Find the best way to store crypto with our guide on top wallets. Protect your assets by choosing the right wallet for security and convenience.

Author: Chirag Sharma

Crypto offers financial freedom, but they also come with unique challenges, particularly when it comes to storage. The key to owning crypto lies in owning your private keys. “Not your keys, not your crypto”. This control over your assets is what sets crypto apart from traditional banking. However, knowing the best way to store your crypto can make all the difference in securing your investments.

When you hold your private keys, you are in complete control of your crypto. This means no third party can access your funds without your permission. But, with great power comes great responsibility. Securing your keys becomes your sole duty, and losing them could mean losing access to your assets forever. This is why choosing the right storage method is crucial.

For most people, wallets are the best option for storing crypto. Wallets come in various forms—hardware, software, and paper—each offering different levels of security and convenience. However, if you regularly trade crypto, constantly transferring assets between a wallet and an exchange can be cumbersome and costly. In such cases, you may need to trust exchanges with your assets. But doing so requires a clear understanding of the risks involved.

We mentioned two of the best storage options in our previous article on 10 Must Have Crypto Tools

Now let’s explore more :

When considering the best way to store crypto, wallets are often the first choice for many users. Wallets allow you to store your private keys securely, giving you complete control over your assets. Unlike exchanges, where the platform holds your keys, wallets ensure that you alone can access your funds. This level of security is essential in the crypto world, where hacking and theft are constant threats.

Wallets come in different types, each suited to different needs. Hardware wallets, like Ledger and Trezor, are physical devices that store your private keys offline. This makes them highly secure, as they are not vulnerable to online attacks. Hardware wallets are best for long-term storage and large amounts of crypto, as they offer robust protection against hacking.

Software wallets, on the other hand, are applications you can install on your computer or smartphone. These wallets provide easy access to your funds, making them ideal for everyday use hence considered a best way to store crypto. However, because they are connected to the internet, they are more susceptible to hacking than hardware wallets. To mitigate this , it’s crucial to use strong passwords and enable two-factor authentication.

Paper wallets involve printing your private keys on a piece of paper. This method is completely offline, making it immune to online attacks. However, the risk lies in the physical nature of the paper wallet—if you lose or damage the paper, you lose access to your crypto. For this reason, it’s important to store paper wallets in a secure, waterproof, and fireproof location.

No matter which type of wallet you choose, securing your private keys should always be a top priority. Without securing keys there in no best way to store crypto. This includes creating backups of your keys and storing them in a safe location. For hardware and software wallets, this typically involves writing down a recovery phrase—usually 12 or 24 words—that can be used to restore access to your wallet if the device is lost or damaged.

It’s also essential to keep your wallet software up to date. Developers regularly release updates to patch security vulnerabilities and improve functionality. By keeping your wallet software current, you reduce the risk of being exploited by hackers.

Finally, consider using multi-signature (multi-sig) wallets, which require multiple private keys to authorize a transaction. This adds an extra layer of security, as a hacker would need access to all the keys to steal your funds.

While wallets provide the highest level of security for your crypto assets, they may not be the most practical solution for everyone, especially active traders. Storing crypto on exchanges is often seen as a necessary compromise, offering convenience and accessibility at the cost of some security. However, it’s important to understand the risks and benefits of using exchanges to store your assets and how to mitigate potential threats.

Exchanges like Binance, Coinbase, and Kraken allow users to trade a wide variety of cryptocurrencies quickly and efficiently. For traders who frequently buy and sell, keeping funds on an exchange makes sense. It eliminates the need to transfer assets back and forth from a wallet, which can be time-consuming and incur transaction fees. The immediate accessibility of funds on exchanges enables traders to capitalize on market opportunities in real-time, which is critical in the fast-paced world of cryptocurrency.

Another advantage of storing crypto on exchanges is the liquidity they provide. Large exchanges typically have substantial trading volumes, making it easier to execute trades at favorable prices. Additionally, exchanges often offer advanced trading tools, such as stop-loss orders and margin trading, which can enhance trading strategies.

Despite their convenience, exchanges come with significant risks. The most obvious danger is the threat of hacking. Since exchanges store large amounts of cryptocurrency in centralized locations, they are prime targets for cyberattacks. History has seen numerous high-profile exchange hacks, where millions of dollars worth of crypto were stolen. When you store your assets on an exchange, you trust the platform to secure your funds, but unfortunately, security breaches can and do happen.

Another risk is the potential for exchange insolvency or regulatory action. If an exchange goes bankrupt or is shut down by authorities, users may lose access to their funds. Even if the exchange is not hacked or shut down, it could face liquidity issues, leading to delays in withdrawals or other problems that can impact your ability to access your assets.

If you choose to store crypto on an exchange, it’s crucial to follow best practices to minimize risks. First, only keep the amount of crypto on an exchange that you need for active trading. Store the rest in a more secure wallet. Second, use exchanges that have a strong reputation for security, including features like two-factor authentication (2FA), withdrawal whitelist, and cold storage for the majority of user funds.

Additionally, regularly monitor your account and withdraw any profits to a secure wallet. Staying informed about the security measures and financial health of the exchange you use is also vital. While no exchange can be completely risk-free, taking these precautions can help protect your assets while still allowing you to trade effectively.

For those who prioritize security over convenience, cold storage is often considered the best way to store crypto. Cold storage involves keeping your private keys completely offline, away from the internet and potential cyber threats. This method is ideal for long-term holders who don’t need regular access to their funds and are focused on protecting their assets from hacking and other risks associated with online storage.

Cold storage refers to the practice of keeping private keys on a device or medium that is not connected to the internet. This can include hardware wallets, paper wallets, and even air-gapped computers. By keeping the private keys offline, cold storage eliminates the risk of online hacks, phishing attacks, and malware that could compromise your assets.

One of the most popular forms of cold storage is hardware wallets. These devices store your private keys on a physical device that remains offline except when you connect it to a computer to make a transaction. Even then, the transaction is signed on the device itself, keeping your private keys secure from potential threats. Hardware wallets like Ledger and Trezor are designed with robust security features, making them a preferred choice for long-term storage.

The primary benefit of cold storage is the high level of security it provides. Since your private keys are never exposed to the internet, they are immune to most forms of hacking. This makes cold storage an excellent choice for those holding significant amounts of cryptocurrency or who plan to hold their assets for an extended period.

However, cold storage also has its drawbacks. The most notable is the lack of accessibility. If you need to access your funds quickly, cold storage can be cumbersome, requiring multiple steps to move your assets online before you can make a transaction. Additionally, if you lose your cold storage device or the recovery phrase, you could permanently lose access to your funds. Therefore, it’s crucial to securely store backup copies of your recovery phrase in a safe location.

Cold storage is best suited for long-term holders who don’t need frequent access to their funds. If you’re planning to hold your crypto for years or even decades, cold storage offers peace of mind by significantly reducing the risk of theft. It’s also a good option for storing large amounts of cryptocurrency, where the security of your assets is more important than the convenience of quick access.

When it comes to storing crypto securely, selecting the right wallet is crucial. Below, we explore seven of the best wallets, both hardware and software, that offer robust features for protecting your assets. Each wallet ensures that you have the best way to store crypto while maintaining control over your private keys.

The Tangem Wallet offers an innovative approach to cold storage, presenting itself as a physical

card (similar to a credit or contactless card) with a secure chip embedded inside. Its key feature

is the elimination of the seed phrase, removing a major attack vector and risk of user error.

Access to your funds is achieved by tapping the card against your smartphone’s NFC reader,

blending the maximum security of a hardware wallet with incredible ease of use. It supports a

wide range of major crypto assets and is a modern, user-friendly option for anyone looking for

the best way to store their cryptocurrency securely.

Ledger Nano X is a top-rated hardware wallet, offering the highest level of security for storing crypto offline. This device stores your private keys on a physical device, keeping them safe from online threats. Ledger Nano X supports over 1,500 cryptocurrencies and features Bluetooth connectivity, allowing you to manage your assets through a mobile app. For those who prioritize security and want the best way to store crypto long-term, Ledger Nano X is an excellent option.

Trezor Model T is another leading hardware wallet, known for its advanced security features and user-friendly design. This wallet keeps your private keys offline, providing robust protection against hacking and malware. Trezor Model T supports a wide range of cryptocurrencies and includes a touch screen for easy navigation. As one of the best ways to store crypto, Trezor Model T is ideal for users who need maximum security for their assets.

Confused between which wallet to choose from these two?

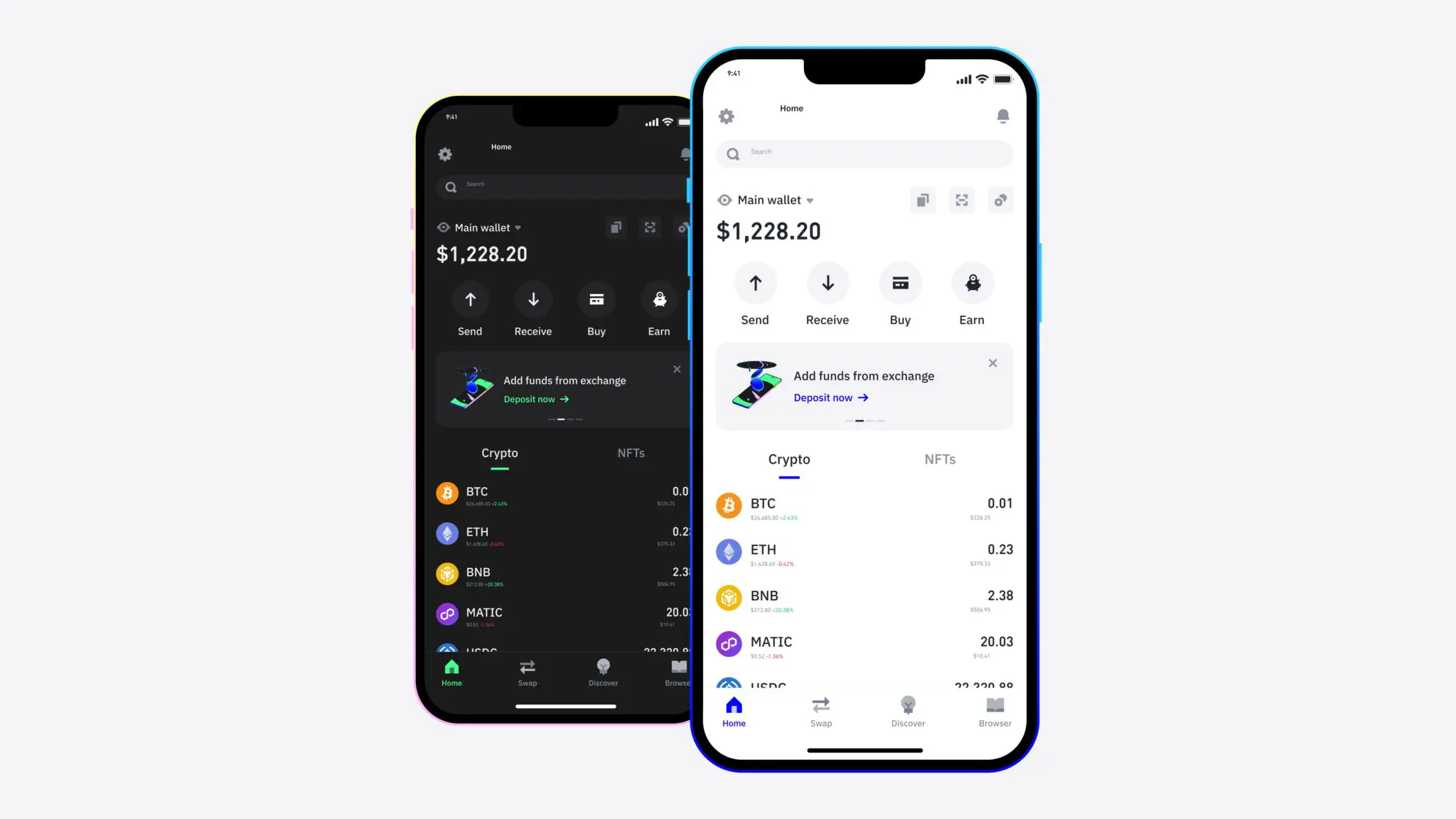

Trust Wallet is a popular software wallet known for its user-friendly interface and wide range of supported cryptocurrencies. As a mobile app, it allows users to manage their crypto on the go. Trust Wallet also provides a built-in decentralized exchange (DEX) and Web3 browser, enabling users to interact with decentralized applications (dApps) directly from the wallet. With its strong security features and ease of use, Trust Wallet is often considered one of the best ways to store crypto for both beginners and experienced users.

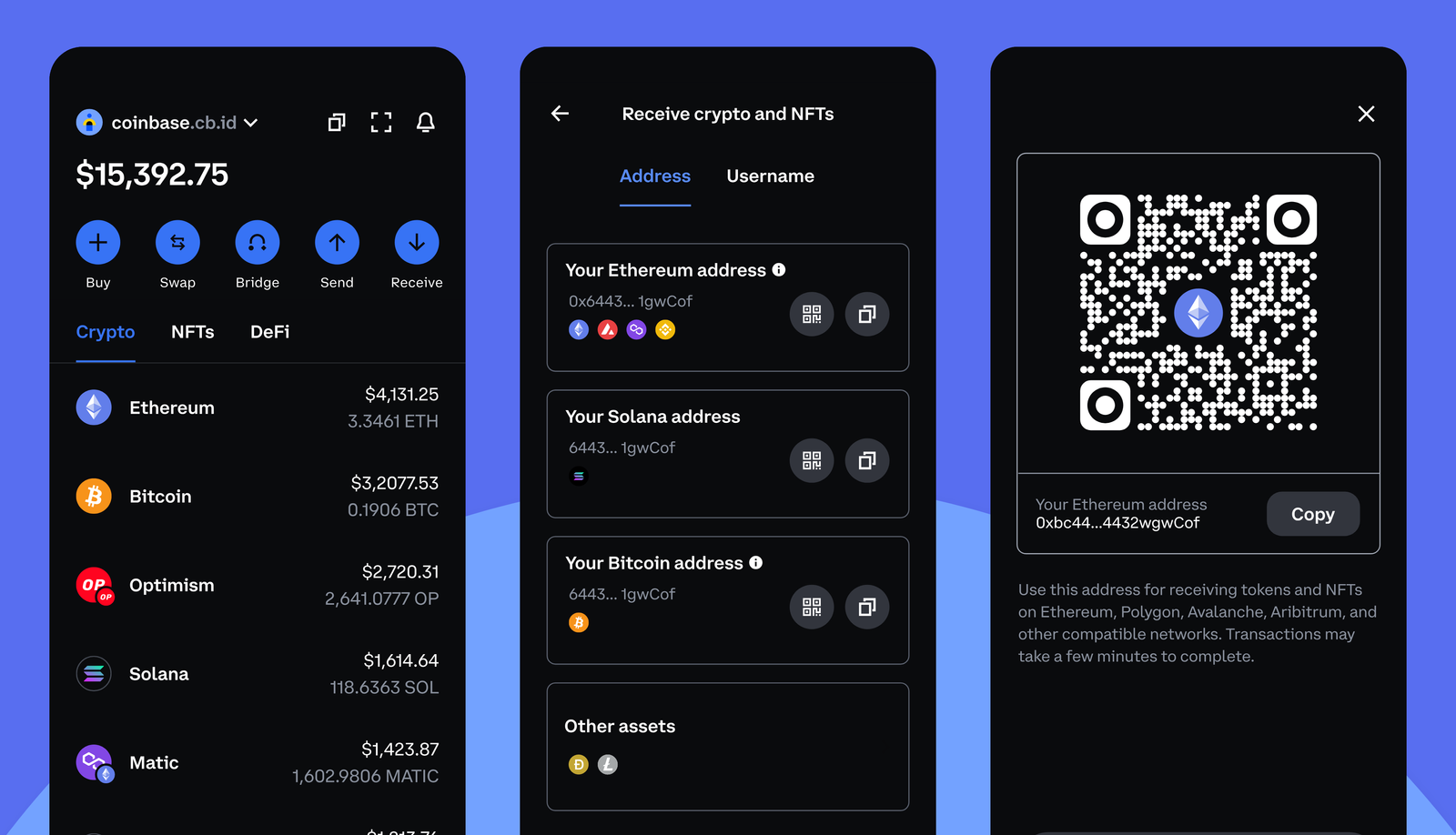

Coinbase Wallet offers another excellent option for securely storing crypto. Unlike the Coinbase exchange, this wallet gives users complete control over their private keys, ensuring that your assets are safe from third-party access. Coinbase Wallet supports a broad array of cryptocurrencies and includes an intuitive interface for managing your portfolio. It also integrates with decentralized applications, making it versatile and convenient. For those looking for the best way to store crypto with accessibility and security, Coinbase Wallet is a strong choice.

MetaMask is a widely used software wallet, especially popular among Ethereum and DeFi users. This browser extension allows you to manage your crypto directly from your web browser, making it highly accessible for daily use. MetaMask also supports interaction with decentralized applications, providing flexibility for DeFi enthusiasts. While MetaMask offers a convenient way to store and access crypto, it’s important to follow security best practices to ensure your assets remain safe.

Exodus is a software wallet that offers a seamless user experience, with support for multiple cryptocurrencies and an integrated exchange feature. This wallet is available on both desktop and mobile, allowing users to manage their crypto assets easily. Exodus also provides an intuitive interface and a built-in portfolio tracker, making it a great choice for users who want the best way to store crypto while monitoring their investments.

Mycelium is a well-established software wallet known for its advanced features and strong security. This mobile wallet supports Bitcoin and a few other cryptocurrencies, offering a range of options for managing your assets. Mycelium also includes integration with hardware wallets like Ledger and Trezor, providing additional layers of security. For those looking for a reliable and secure way to store crypto, Mycelium is a top contender.

Choosing the best way to store crypto is vital for protecting your digital assets. This guide covers the importance of owning your private keys, the limitations of keeping crypto on exchanges, and reviews seven top wallet options—both hardware and software—to help you secure your investments.

In the ever-evolving world of cryptocurrency, ensuring the security of your digital assets should be a top priority. Understanding the importance of controlling your private keys cannot be overstated. The best way to