Explore the dynamics of the crypto bull run, driven by Bitcoin cycles, global liquidity, and key economic factors.

Author: Chirag Sharma

Published On: Wed, 28 Aug 2024 13:06:23 GMT

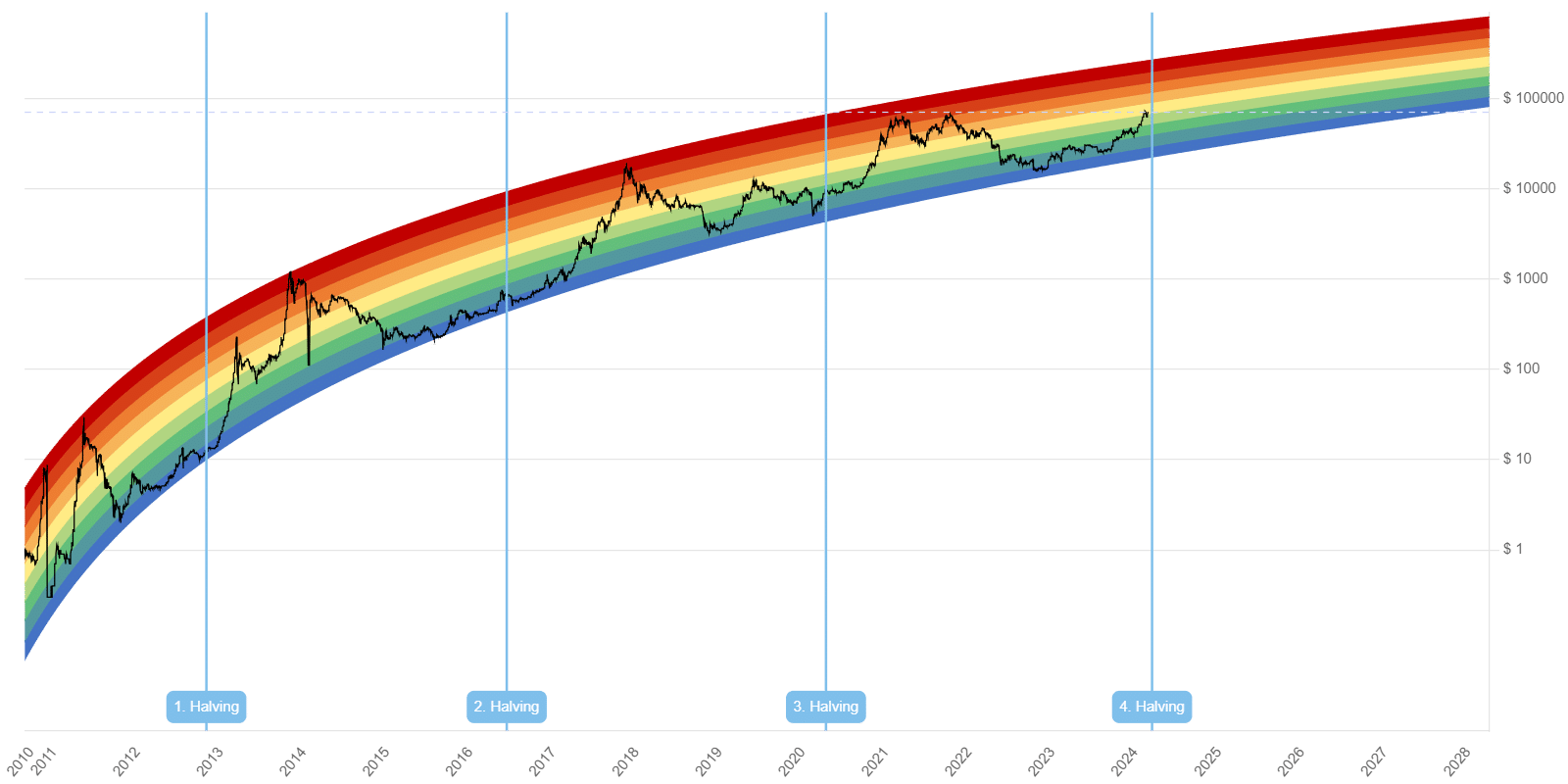

Today, I want to delve into one of the most debated topics in the crypto community : cycles in the crypto bull run. This concept has long been a cornerstone of Bitcoin analysis, with many enthusiasts swearing by the predictable patterns that Bitcoin is said to follow. However, as we approach the 2024 cycle, it’s becoming increasingly clear that these cycles may not be as reliable as once thought. Despite what many of us insist, I believe we are witnessing the beginning of a new phase, one where traditional cycle theories may no longer apply.

Some people are now calling for an accelerated cycle, where Bitcoin’s price revisits its previous all-time high and even sets a new record shortly after the halving event. This is something that has never happened before, and it challenges the conventional wisdom that Bitcoin follows a strict four-year cycle. In recent weeks, we’ve seen Bitcoin dip to around $53,000, only to bounce back, leaving many wondering what’s next. The community is split, with some saying the cycle is over, others believing it’s just starting, and still others claiming we are in a super cycle. Clearly, the old notion of Bitcoin cycles is being put to the test, and it’s time we reconsider how we analyze these patterns.

The concept of the Bitcoin cycle has always been linked to the four-year halving event, where the reward for mining new blocks is halved, reducing the supply of new Bitcoin entering the market. This event has historically led to significant price increases, as the reduced supply and continued demand drive up the value. However, the 2024 cycle is showing signs that things might be different this time around.

It’s no longer sufficient to rely solely on the halving event to predict Bitcoin’s price movements. The global economy, changes in monetary policy, and the behavior of large institutional investors all play crucial roles in shaping the market. In particular, two key factors have caught my attention: the M2 money supply and the Federal Reserve’s interest rate decisions. These factors are influencing not just Bitcoin, but all risk-on assets, including stocks and other cryptocurrencies.

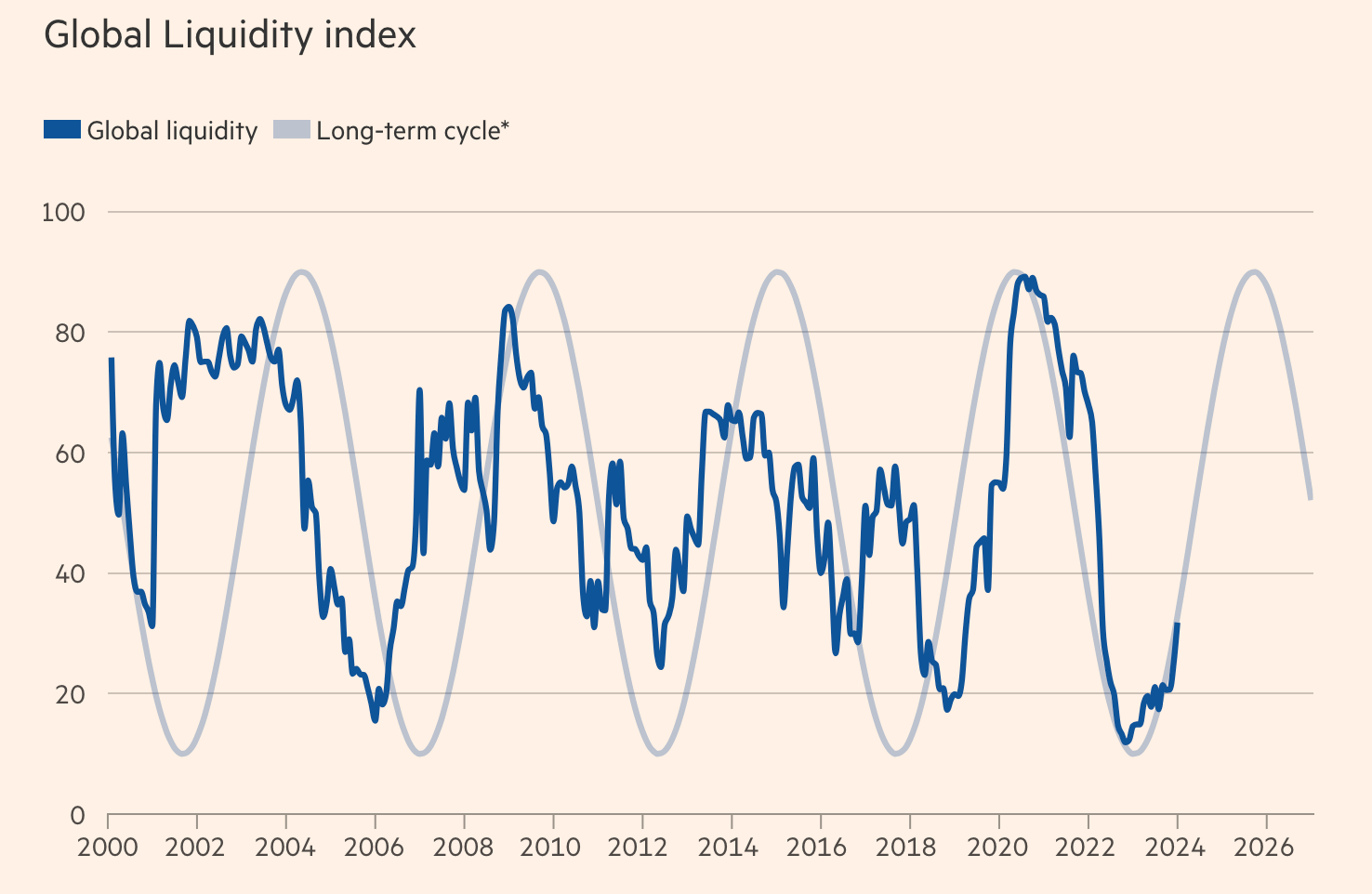

Another interesting aspect is the global liquidity cycle, which tends to last around 65 months, not exactly aligning with the traditional four-year Bitcoin cycle. This larger liquidity cycle has shown to be a more reliable indicator of market trends, providing a clearer picture of when major price movements are likely to occur. As we approach the next 12 to 18 months, it’s essential to consider these broader economic forces when trying to predict Bitcoin’s future.

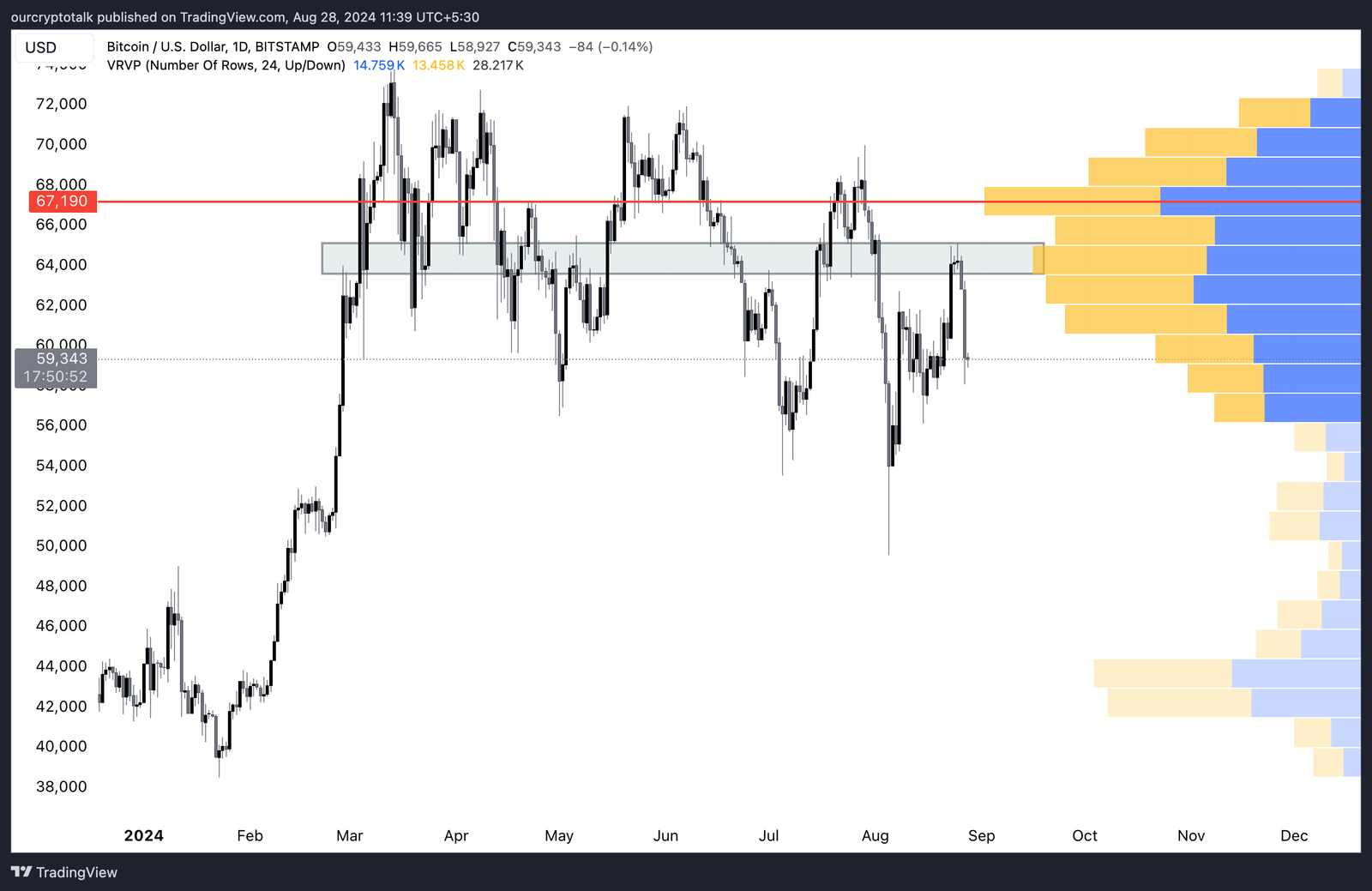

Currently, Bitcoin is facing a significant resistance zone at the $67,000 level, which was previously at $66,000 just a month ago. This level is marked by a strong concentration of selling interest, creating a barrier to any upward momentum. If Bitcoin had managed to break above $65,000, this resistance would have come into play. The next crucial area for traders is the recent high around $65,000, where the price briefly touched before dipping to its current level around $59,000.

At the moment, Bitcoin is hovering just above $59,000, close to the lower boundary of a high-volume zone, considered a ‘safe zone’ by many investors. On the downside, a break below $56,000 needs a quick recovery within 1-2 days to prevent triggering bearish sentiment. Historically, quick rebounds have occurred when the price dropped to the $50,000-$53,000 range, but a slower recovery could erode investor confidence. For a bullish breakout, the $69,000 level is crucial; breaking and holding this level for at least a week would confirm a major upward move.

We’ve recently seen it close back above the 21-week exponential moving average (EMA), which is a positive sign for continued upward momentum. Additionally, Bitcoin has managed to bounce back above the 200-day EMA after briefly dipping below it, signaling a potential resumption of the uptrend. Right now its just hovering around the 200 EMA and needs to close above it for further upside actions. We have covered the importance of this level during the last dip and you can check it out here

Bitcoin would either continue to chop around until the Federal Open Market Committee (FOMC) meeting in September, or we would see a sharp recovery if the Federal Reserve intervened. Fortunately, the latter scenario played out, and Bitcoin has shown remarkable resilience, even surpassing my expectations for a recovery.

One of the most significant developments influencing the current crypto bull run is the Federal Reserve’s recent pivot in monetary policy. At the Jackson Hole symposium, policymakers, including Federal Reserve Chair Jerome Powell, indicated that the time has come to shift from rate hikes to rate cuts. This announcement has sent shockwaves through the financial markets, leading to rallies in stocks, risk-on assets, and of course, Bitcoin.

( Source and complete demonstration )

This policy shift marks a critical moment in the ongoing crypto bull run. Over the past year, we’ve speculated about when the Federal Reserve would transition from raising interest rates to cutting them. Now, it’s confirmed that rate cuts are on the horizon, with the first expected at the FOMC meeting on September 18th. This move is likely to provide a significant boost to Bitcoin and other cryptocurrencies, as lower interest rates generally lead to increased liquidity and higher asset prices.

The global liquidity cycle, which I mentioned earlier, also plays a vital role in this context. This cycle, which lasts approximately 65 months, has historically aligned with major market turning points, including Bitcoin’s previous bull runs. As we enter the next phase of this cycle, we can expect increased liquidity to flow into the markets, further fueling the current crypto bull run. This broader economic context, combined with the Federal Reserve’s actions, suggests that we could see Bitcoin testing its previous all-time high of $71,000 in the coming weeks.

Liquidity is the lifeblood of any market, and in the context of a crypto bull run, it becomes even more critical. The global liquidity cycle that we discussed earlier is a key factor that many analysts overlook when trying to predict Bitcoin’s future price. This cycle is influenced by various factors, including central bank policies, global economic conditions, and investor sentiment.

As we’ve seen in the past, periods of high liquidity often correspond with significant price increases in Bitcoin and other cryptocurrencies. This is because increased liquidity leads to more money flowing into the market, driving up prices. Conversely, when liquidity dries up, we typically see market corrections or even prolonged bear markets.

Given the current trajectory of the global liquidity cycle and the Federal Reserve’s impending rate cuts, we are likely entering a period of increased liquidity. This bodes well for the ongoing crypto bull run, as it suggests that there will be plenty of capital available to push Bitcoin to new highs.

While liquidity is a crucial factor, it’s also important to consider the role of external factors in driving the current crypto bull run. Events such as regulatory changes, technological advancements, and geopolitical developments can all have a significant impact on the market.

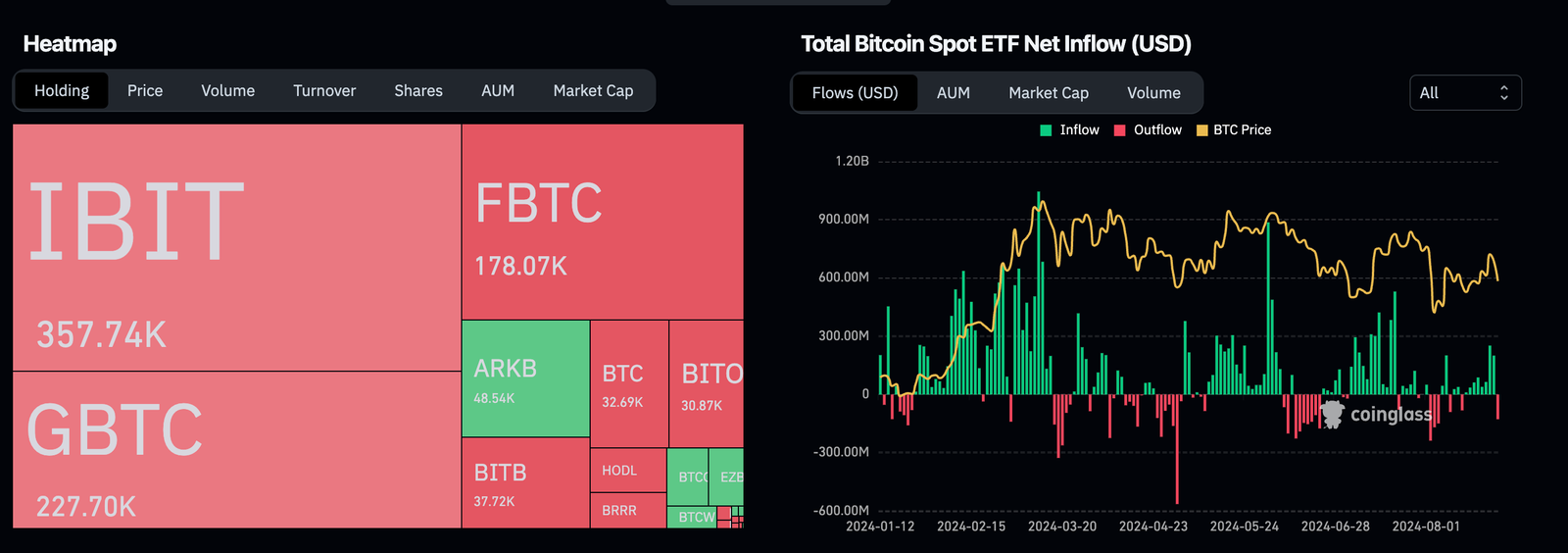

For example, the recent approval of Bitcoin ETFs in several countries has provided a significant boost to the market. These financial products make it easier for institutional investors to gain exposure to Bitcoin, leading to increased demand and higher prices. Similarly, advancements in blockchain technology, such as the development of layer 2 solutions, are making Bitcoin more scalable and attractive to a broader audience.

On the geopolitical front, we’ve seen how events like the ongoing conflict in Eastern Europe and tensions in other regions can drive investors towards Bitcoin as a safe-haven asset. These external factors, combined with the underlying market dynamics, are creating a perfect storm for the ongoing crypto bull run.

In conclusion, as we navigate the complexities of the upcoming Bitcoin cycle, it’s clear that traditional models may not fully apply to the evolving market dynamics. While the Bitcoin halving remains a significant event, the global liquidity cycle and Federal Reserve policies play an equally crucial role in shaping the trajectory of the crypto market. The recent developments, particularly the anticipated rate cuts by the Fed, suggest a promising outlook for Bitcoin and the broader crypto market.

All the opinions in this article are that of the author and in no way are financial advice. Our Crypto Talk and the author always suggest you do your own research in crypto and to never take anything as financial advice that you read on the internet. Check our Terms and conditions for more info.