Aave is caught in a governance fight. The conflict pits the Aave DAO, which is controlled by $AAVE token holders, against Aave Labs,

Author: Sahil Thakur

23rd December 2025 – Aave, the DeFi lending giant, is caught in a serious governance crisis. The conflict pits the Aave DAO, which is controlled by $AAVE token holders, against Aave Labs, the core development company led by founder Stani Kulechov. The issue has exploded into one of the biggest protocol disputes in decentralized finance.

The core disagreements are about who controls Aave’s brand, revenue, and intellectual property. The drama has triggered intense community debate, large token selloffs, and questions about what decentralization truly means.

In early December 2025, Aave Labs integrated CoW Swap into the Aave interface. This was meant to improve swap pricing and MEV protection for users. However, just a few days later, a popular delegate revealed that swap fees from this integration were not going to the DAO. Instead, the revenue was being routed to a private wallet owned by Aave Labs.

This wallet was collecting fees estimated at $200,000 per week, or over $10 million per year. The DAO had no visibility into these funds, and no say in how they were used. The revelation caused an immediate backlash.

On December 12, Marc Zeller, a leading DAO delegate and head of the Aave Chan Initiative, called the move a “stealth privatization” of protocol revenue. According to him, Aave Labs had slowly taken control of key brand assets, revenue sources, and even social media accounts—without DAO approval.

By mid-December, several community members were calling for drastic measures. These included:

VIKTOR

@thedefivillain

Almost a free short all day on $AAVE even after yesterday's large dump No reason for the token to move up in the current market without any kind of resolution and this level of FUD Not sure what it does from here though since we're at round number https://t.co/0iMDWD54YX

10:19 PM·Dec 22, 2025

Aylo

@alpha_pls

I'm just catching up with the evolving AAVE drama. AAVE is now down 20% amid accusations of revenue theft and a rushed 'hostile' governance vote. There are big implications for the future of the token, and all other tokens with equity entities. AAVE has been the clear DeFi https://t.co/CKn9gaIVg8

03:36 PM·Dec 22, 2025

Observe

@obsrvgmi

🚨 @aave is having a full blown civil war And it might be the biggest governance fight defi has ever seen. Heres a clean breakdown 👇 Aave has two sides: – Aave labs → a centralised entity founded by stani – Aave dao → token holders who govern the protocol Now heres what https://t.co/zFnhcN5vSc

01:05 PM·Dec 22, 2025

Aave Labs responded by arguing that the situation was misunderstood. According to the team:

They claimed that maintaining control over the interface, branding, and revenue sources was essential for fast product development. Complete DAO control, they warned, would make Aave slower and less innovative.

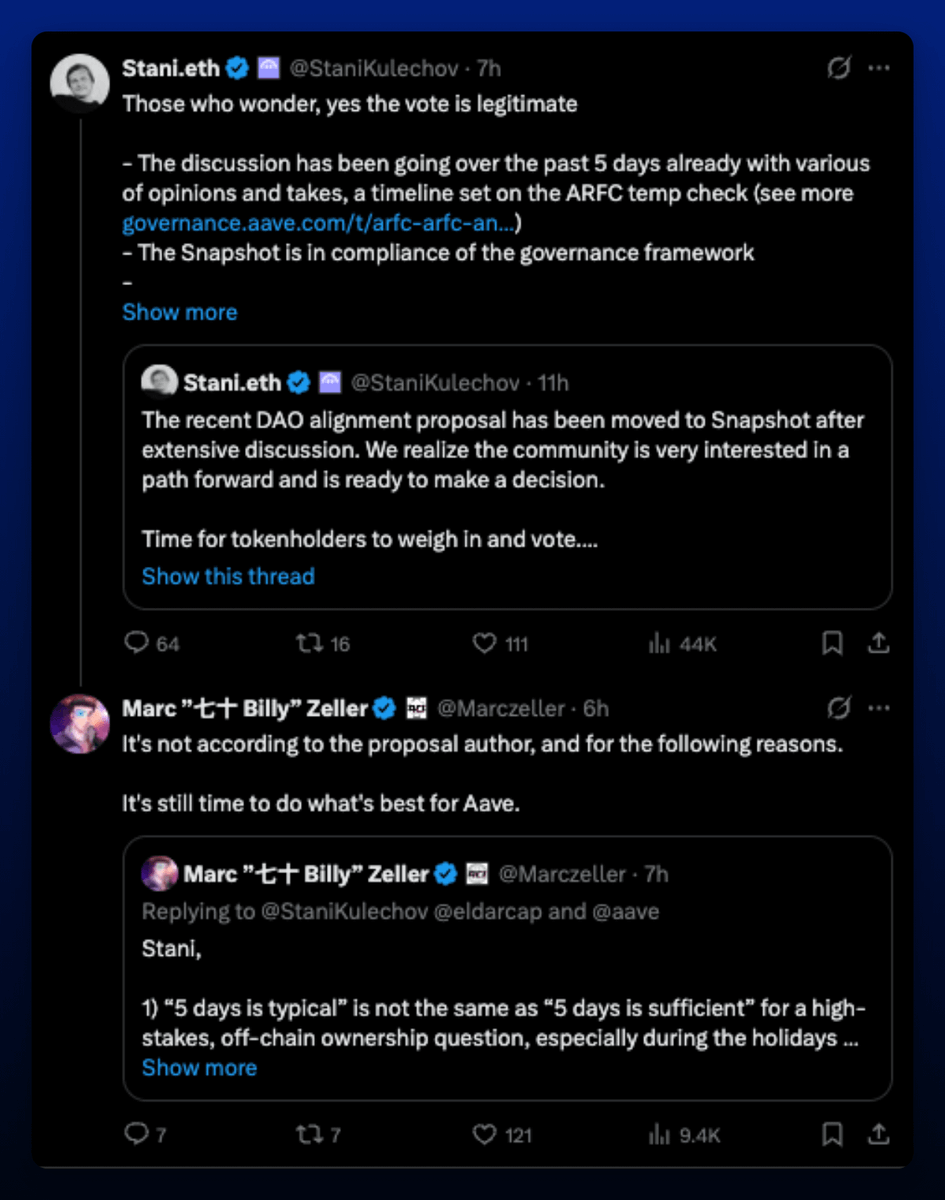

In an attempt to resolve the conflict, Aave Labs initiated a Snapshot vote on December 23. The proposal would grant AAVE token holders official ownership of Aave’s brand assets, including the name, logo, domains, and social media handles.

However, the vote caused even more controversy.

The proposal was based on a draft by Ernesto Boado, former CTO of Aave Labs. But Boado claimed he never approved the final version and had not agreed to a vote yet. He called the move “disgraceful” and asked the community to abstain from voting.

Marc Zeller also criticized the timing. He said the vote was rushed during the holiday season and that new delegates with fresh voting power were being used to influence the outcome.

The controversy has already affected the $AAVE token. On December 22, the token price fell by 11%, dropping from around $180 to $160. Trading volume spiked as panic set in.

Adding to the selloff, a major whale dumped 230,000 $AAVE tokens, worth around $37.6 million. The sale was split between stETH and WBTC, worsening the market pressure.

Despite this, Aave remains a dominant player in DeFi. The protocol still generates more than $140 million in annual revenue and controls roughly 87% of the DeFi lending market.

Loading chart...

This situation is more than just a dispute over fees. It raises fundamental questions about how DeFi protocols operate.

The Aave community is now debating these questions openly. Some members are pushing for a fully DAO-controlled model. Others believe the protocol needs a strong central team to remain competitive.

This is not the first time a protocol has faced these issues. Similar debates have occurred in other DAOs like Uniswap. But Aave’s scale and market share make this fight especially important.

Src: X (JoestarCrypto)

The Snapshot vote is live. Early numbers show that it may not pass, but results are still coming in.

Meanwhile, discussions continue on social media and governance forums. Some users propose new votes to reclaim revenue or brand rights. Others suggest mediation between Aave Labs and DAO leaders.

In the background, Aave Labs continues building. Aave V4 and the Horizon mobile app are still in development, though critics worry that their revenues could also bypass the DAO.

Our Crypto Talk is committed to unbiased, transparent, and true reporting to the best of our knowledge. This news article aims to provide accurate information in a timely manner. However, we advise the readers to verify facts independently and consult a professional before making any decisions based on the content since our sources could be wrong too. Check our Terms and conditions for more info.