Arbitrum (ARB), has jumped over 12% in the past 24 hours following its listing on Robinhood, one of the most widely used commission-free trading platforms in the United States.

Author: Sahil Thakur

Written On: Thu, 06 Mar 2025 02:22:24 GMT

Arbitrum (ARB), has jumped over 12% in the past 24 hours following its listing on Robinhood, one of the most widely used commission-free trading platforms in the United States. The listing provides increased exposure for ARB, allowing millions of retail investors to buy and sell the token directly.

Despite the price rally, on-chain activity for Arbitrum remains in decline, raising concerns about whether the price surge is driven by sustained adoption or short-term speculation.

Following the listing, Arbitrum’s market cap reached $1.8 billion, while its 24-hour trading volume spiked to $400 million. The token saw a strong uptick from $0.374 on March 4 to $0.421 the next day, marking a 14.5% increase before slightly stabilizing at $0.419.

Technical indicators suggest that buyers are gaining control, but Arbitrum is still in a downtrend. The Directional Movement Index (DMI) reflects a shift in momentum, with the +DI rising from 13.5 to 29.3 and the -DI falling from 37.3 to 25.2. This shift suggests that buying pressure is increasing while selling pressure is fading.

However, the Average Directional Index (ADX), which measures trend strength, has slightly declined from 30.6 to 28.4, signaling that while the downward trend is weakening, Arbitrum is yet to confirm a full reversal into an uptrend.

Despite the excitement surrounding the Robinhood listing, Arbitrum’s on-chain activity has been steadily declining. The number of 7-day active addresses on the Arbitrum network has dropped significantly from 110,000 in December to approximately 36,400 today.

This decline raises concerns about the long-term sustainability of ARB’s price rally. While the Robinhood listing has fueled short-term speculative interest, the lack of active addresses suggests that real user engagement on the network is waning.

Active addresses are a crucial metric for measuring adoption and network utility. A drop in active users could indicate that despite the price increase, fewer people are actually using Arbitrum’s services. If this trend continues, it could pose challenges for sustaining ARB’s price growth.

The Robinhood listing is seen as a significant milestone for Arbitrum and Ethereum’s layer-2 ecosystem. Mati Greenspan, founder of Quantum Economics, highlighted the importance of this move:

“Arbitrum landing on Robinhood is a huge win for the industry and something that would be completely unheard of just six months ago.”

Greenspan also noted that while many Robinhood users may simply speculate on ARB rather than using it, the increased exposure and liquidity remain a positive development for the community.

Arbitrum’s addition to Robinhood places it alongside major cryptocurrencies like Bitcoin (BTC), Ethereum (ETH), Cardano (ADA), Solana (SOL), and meme coins like Dogecoin (DOGE) and Shiba Inu (SHIB).

Robinhood’s decision to list ARB follows a broader expansion of its crypto offerings. The company reported an 8x increase in crypto trading revenue in Q4 2024, driven by growing demand and competitive pressure from exchanges like Coinbase.

Additionally, the U.S. Securities and Exchange Commission (SEC) recently dropped its investigation into Robinhood’s crypto operations, clearing the company of potential enforcement actions. Dan Gallagher, Robinhood’s Chief Legal Officer, stated:

“We applaud the staff’s decision to close this investigation with no action. Let me be crystal clear – this investigation never should have been opened.”

The SEC probe, launched last spring, focused on whether Robinhood illegally facilitated securities transactions through its crypto platform. With the case now closed, Robinhood has gained regulatory clarity, allowing it to continue expanding its crypto services.

Robinhood listing usually means more exposure for a token, and we’ve already seen ARB’s price jump in response. But does that mean it’s a good buy? That depends.

On one hand, increased accessibility could bring in more retail investors, which might boost liquidity and adoption over time. But let’s be real—most of the price action so far looks like speculation rather than long-term conviction. The fact that Arbitrum’s active addresses are still declining raises some questions about whether this hype is sustainable.

If you’re considering ARB, think about what you’re buying into. If you believe in Ethereum scaling and Arbitrum’s long-term role, this could be a great entry point for a long-term hold. But if you’re just chasing the listing pump, you’re probably late to the party—these things often retrace once the excitement fades.

As always, DYOR (Do Your Own Research), don’t FOMO in, and make decisions based on your own risk appetite.

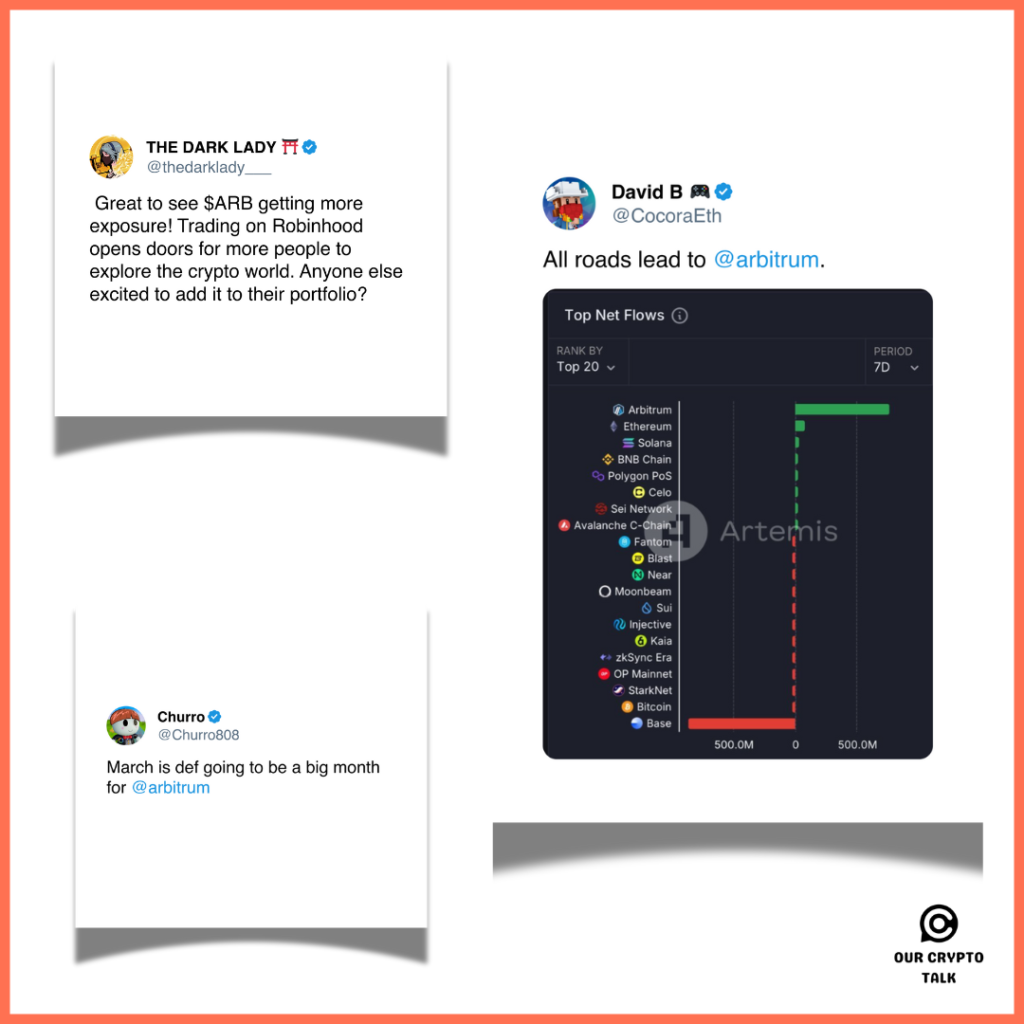

Unsurprisingly, the entire Arbitrum community was excited and happy about the announcement with many believing it could be the game changing catalyst $ARB has needed for a long time.

Real voices. Real reactions.

Add your reaction to this story:

Our Crypto Talk is committed to unbiased, transparent, and true reporting to the best of our knowledge. This news article aims to provide accurate information in a timely manner. However, we advise the readers to verify facts independently and consult a professional before making any decisions based on the content since our sources could be wrong too. Check our Terms and conditions for more info.

Washington’s “Crypto Week” Begins: Three Landmark Bills Could Reshape U.S. Crypto Policy

Pump.fun’s PUMP Token Sale Kicks Off July 12 Amid Hype and Heavy Hedging

Germany Approves Grant to Fund Nuco.Cloud’s AI Layer-2 Blockchain Development

Ethereum to Launch L1 zkEVM in 2026 for Scalability and Privacy

Washington’s “Crypto Week” Begins: Three Landmark Bills Could Reshape U.S. Crypto Policy

Pump.fun’s PUMP Token Sale Kicks Off July 12 Amid Hype and Heavy Hedging

Germany Approves Grant to Fund Nuco.Cloud’s AI Layer-2 Blockchain Development

Ethereum to Launch L1 zkEVM in 2026 for Scalability and Privacy