BitMine Ethereum staking surges as Tom Lee’s firm stakes $341M more ETH, lifting total staked holdings to 2.33M ETH worth nearly $7B.

Author: Kritika Gupta

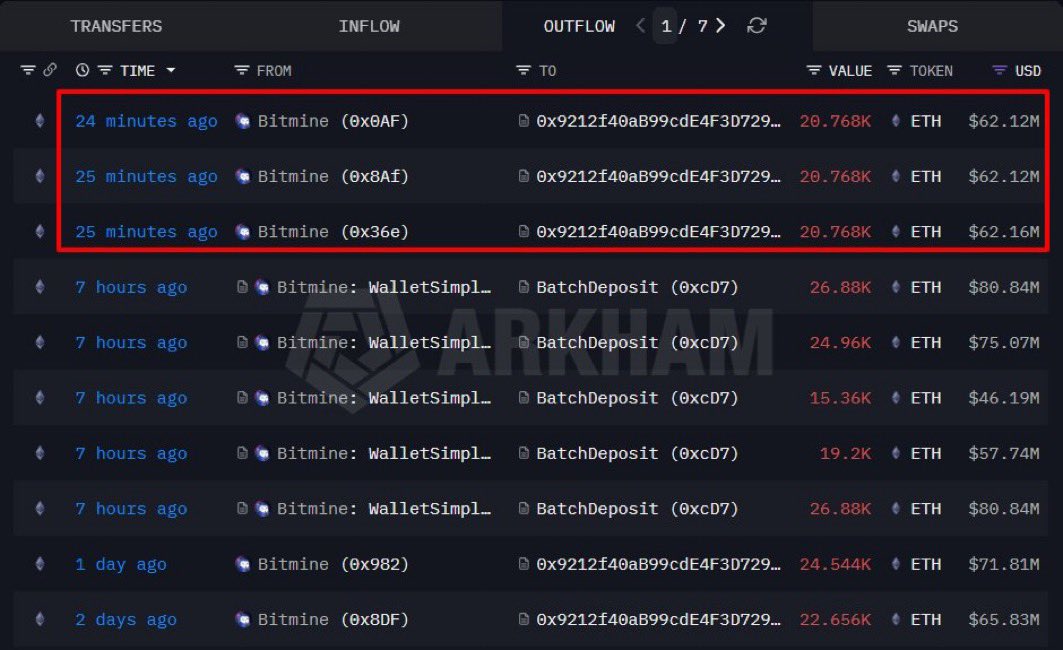

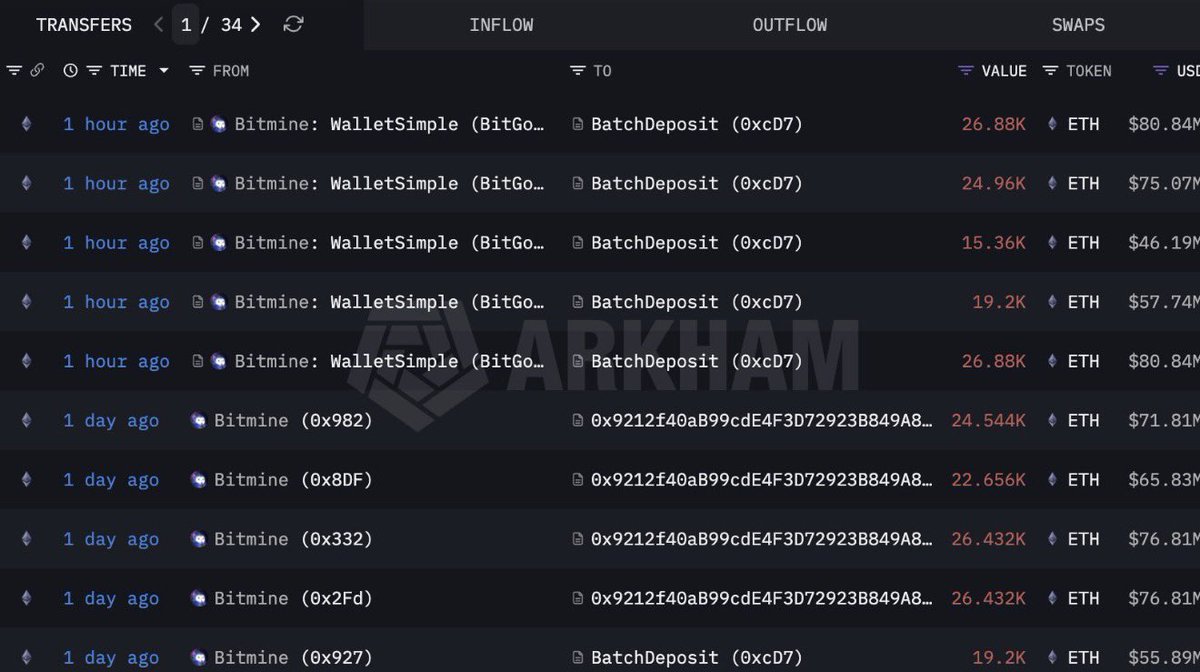

28th January 2026- BitMine Ethereum staking is accelerating again as BitMine, the crypto investment firm led by Fundstrat’s Tom Lee, staked an additional 113,280 ETH, valued at roughly $340.7 million. As a result, the firm’s total staked Ethereum now stands at 2.33 million ETH, worth about $7 billion.

Notably, this staked amount represents around 55% of the firm’s total ETH position, showing that BitMine is not only accumulating Ethereum but also actively locking a large portion into Ethereum’s proof of stake system.At the same time, Ethereum’s price is trading near $3,000, which makes this move stand out as a major institutional commitment during a relatively mixed market environment.

High Signal Summary For A Quick Glance

BitMine’s latest staking move reflects a strategy built around yield and long-term conviction. With BitMine Ethereum staking, the firm earns passive yield while maintaining exposure to Ethereum’s upside.

First, Ethereum staking continues to offer steady yield, with estimated annual rewards near 3% to 5% depending on network conditions. Since institutions increasingly favor strategies that generate passive returns, staking has become a more attractive option than simply holding ETH idle.

Second, Tom Lee has maintained a consistently bullish view on crypto assets, especially during consolidation phases. Since Ethereum shifted to proof of stake in 2022 through The Merge, institutional strategies like BitMine’s have expanded. This has happened mainly because staking combines long-term exposure with ongoing yield.

Additionally, BitMine has followed this staking approach repeatedly in recent weeks and months, which signals a deliberate accumulation campaign instead of a one-off bet.

For example, just one day earlier, the firm reportedly staked 184,960 ETH worth around $538 million, raising holdings to about 2.13 million ETH. In addition, other recent activity includes a $45 million ETH addition last week and another 209,504 ETH stake that helped push totals toward $6.5 billion.

Key milestones related to this development

Ethereum shifts from proof of work to proof of stake, making staking a core network mechanism.

The firm continues staking large ETH tranches, signaling a structured accumulation strategy.

BitMine adds roughly $45 million worth of Ethereum, expanding its allocation.

BitMine stakes another major tranche, bringing holdings to around 2.13 million ETH.

BitMine stakes an additional 113,280 ETH, accelerating its yield-focused Ethereum strategy.

BitMine’s total staked Ethereum reaches around 2.33 million ETH, valued near $7 billion.

BitMine’s staking spree strengthens a key narrative: Ethereum is evolving into an institutional yield asset, not just a speculative token. Because staking locks ETH, BitMine’s approach may also contribute to a reduction in circulating supply. This in turn can support long-term price strength if demand remains stable or rises.

Furthermore, BitMine’s staking helps support Ethereum’s security model by contributing to validator operations, which reinforces Ethereum’s credibility as the dominant smart contract chain.

However, there is also a structural concern. If too much ETH concentrates in the hands of a small number of institutions, the ecosystem could face centralization risks. Even though staking itself supports network operations, large ownership concentration can still raise governance and liquidity concerns over time.

Looking ahead, BitMine Ethereum staking could expand further if Ethereum upgrades improve scalability and reduce fees, since those improvements would strengthen the long-term investment case.

Moreover, the market may increasingly interpret BitMine’s repeated staking behavior as a sign that institutions now treat Ethereum as a strategic core holding. Tom Lee has also previously projected strong long-term upside for ETH, tying future growth to DeFi expansion, Web3 adoption, NFTs, and broader on-chain economic activity.

Our Crypto Talk is committed to unbiased, transparent, and true reporting to the best of our knowledge. This news article aims to provide accurate information in a timely manner. However, we advise the readers to verify facts independently and consult a professional before making any decisions based on the content since our sources could be wrong too. Check our Terms and conditions for more info.

BMNR Bullz

@BMNRBullz

UPDATE Tom Lee and BitMine just doubled down on Ethereum staking. 🔹 Added 62,304 ETH 🔹 $186.4M in fresh capital 🔹 2.33M ETH staked 🔹 $6.96B locked on Ethereum If BitMine’s ETH is fully staked, potential yield could reach ~$400M per year, or over $1M per day. This is https://t.co/lGDQCv4hWv https://t.co/Z3oPDzfSmm

JUST IN BitMine just staked another massive batch of 113,280 ETH 🔹 Total value: $340 million 🔹 Total staked: 2,332,051 ETH 🔹 Now over 50% of their ETH holdings $ETH $BMNR https://t.co/KK3NxIDB19 https://t.co/B9Hu7DUHg9

09:53 AM·Jan 28, 2026

Kodi (BMNR) 📌

@SweatyKodi

Bitmine just staked another huge batch of 113,280 Ethereum!!! Total cost: $340 million Total staked: 2,332,051 ETH That’s more than half their current holdings! $ETH / $BMNR https://t.co/vwfIXNz0s2

05:23 AM·Jan 28, 2026

Broke Doomer🔺

@im_BrokeDoomer

BitMine committed another $341M to ETH staking. Total staked now sits at 2.33M ETH worth roughly $7B. More than half of their ETH is locked and earning. You don’t do that if you’re bearish. You do that when you’re building conviction for next few years. https://t.co/bvwop3hvIN

05:15 AM·Jan 28, 2026

BitMine Stakes $341M in Ethereum Taking The Total to $7B

Meshpay Hits $1B Valuation After $75M Series C Funding

Wallchain and HeyElsa Reach Resolution After Rewards Dispute

Citrea Mainnet Launch Brings DeFi Execution to Bitcoin

BitMine Stakes $341M in Ethereum Taking The Total to $7B

Meshpay Hits $1B Valuation After $75M Series C Funding

Wallchain and HeyElsa Reach Resolution After Rewards Dispute

Citrea Mainnet Launch Brings DeFi Execution to Bitcoin