Japan’s central bank ( BOJ ) raised interest rates to the highest level since 1995 causing widespread tensions in TradFi and crypto.

Author: Sahil Thakur

19th December 2025 – Japan’s central bank ( BOJ ) raised interest rates to the highest level since 1995. The decision reflects rising inflation pressure and a long shift away from decades of ultra‑loose policy. However, the move also increases risks for growth, borrowing costs, and government debt.

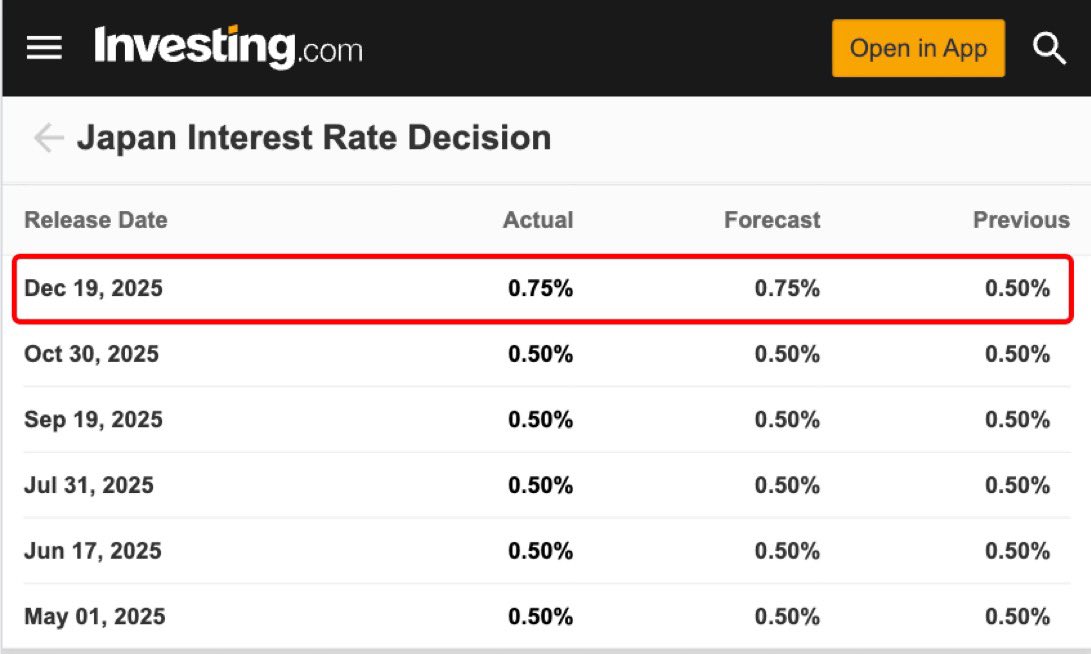

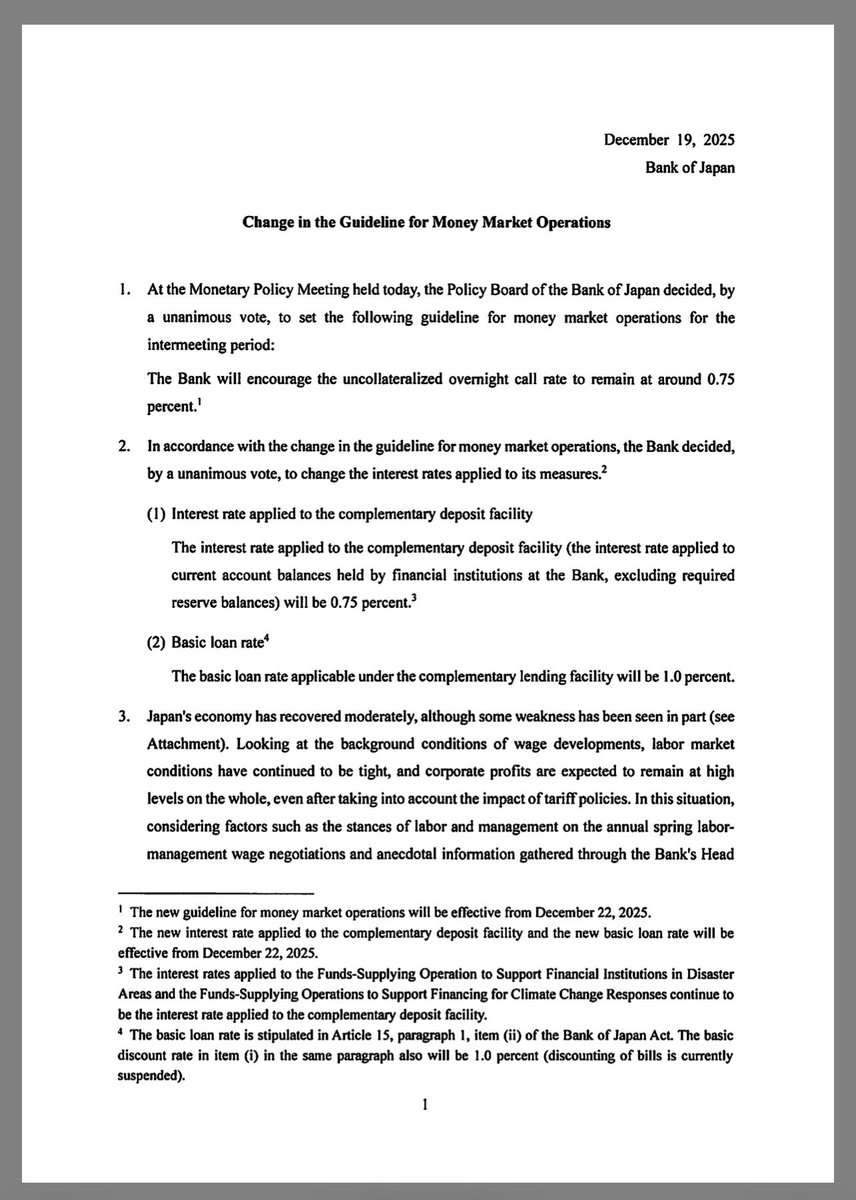

The Bank of Japan lifted its short‑term benchmark rate by 25 basis points to 0.75%. This matches market expectations and pushes rates to a three‑decade high.

The bank said real rates will remain “significantly negative.” It also stressed that financial conditions will stay accommodative to support economic activity.

The decision pushed 10‑year Japanese government bond yields above 2% for the first time since 2006. The yen slipped 0.20% to around 155.79 against the dollar. Japan’s Nikkei 225 gained more than 1% as traders reacted to the policy outlook.

Japan ended its negative interest rate regime last year. Since then, the BOJ has pursued gradual tightening in search of a sustained cycle of rising wages and stable inflation.

Inflation has remained above the 2% target for 44 straight months. Data for November showed consumer prices rising 2.9%. Real wages have continued to fall, creating pressure on household spending power.

Src: Yahoo Finance

Higher rates arrive as Japan’s economy shows renewed weakness. Revised Q3 GDP numbers revealed a 0.6% contraction from the previous quarter, or 2.3% on an annualized basis.

JackTheRippler ©️

@RippleXrpie

🚨BREAKING: The Bank of Japan has raised interest rates to 0.75%, marking the highest rate in 30 years! https://t.co/WrOPofSq9k

04:02 AM·Dec 19, 2025

The Real Remi Relief 🙏✝️💪

@RemiReliefX

🚨Bank Of Japan raise rates 75 points 🚨 https://t.co/QqZe1aXWAZ

03:25 AM·Dec 19, 2025

Crypto Rover

@cryptorover

💥BREAKING: 🇯🇵 Bank of Japan hikes interest rates to 0.75%, highest in 30 years https://t.co/VR1mMUXOp8

03:24 AM·Dec 19, 2025

Even so, the BOJ expects corporate profits to remain strong and wage growth to continue into 2026. It also sees rising odds of hitting its long‑term inflation goal.

However, the BOJ forecasts that core inflation will slow to below 2% between April and September 2026 as food inflation cools and government support programs take effect.

The move carries risks for Japan’s financial stability. Bond yields are already at multi‑year highs, increasing borrowing costs for the world’s most indebted major economy. Japan’s debt‑to‑GDP ratio stands near 230%, the highest globally.

A stronger yen could help ease the cost‑of‑living crisis, but recent currency trends have leaned bearish. The yen has traded between 154 and 157 per dollar since November, falling more than 2.5% since Prime Minister Sanae Takaichi took office.

Economists expect another rate hike by mid‑2026 that could take policy to 1%. However, forecasts vary widely. BOJ Governor Kazuo Ueda recently said estimating the terminal rate remains difficult. Current projections place it between 1% and 2.5%.

Oxford Economics analyst Shigeto Nagai warned that another hike may cause friction with Takaichi if inflation falls smoothly toward 2% in early 2026. The prime minister previously opposed higher rates, but analysts believe she accepted this move due to yen weakness and mounting cost‑of‑living pressure.

In November, Japan approved a 21.3 trillion yen ($135.5 billion) stimulus plan to support consumers and revive growth. The challenge now shifts to delivering stability, managing inflation, and navigating a slower economy during a rate‑hiking cycle not seen in 30 years.

Our Crypto Talk is committed to unbiased, transparent, and true reporting to the best of our knowledge. This news article aims to provide accurate information in a timely manner. However, we advise the readers to verify facts independently and consult a professional before making any decisions based on the content since our sources could be wrong too. Check our Terms and conditions for more info.

Grvt Partners with Aave to Turn Idle Margin into Yield and Unveils 2026 Roadmap

Fabric Protocol $ROBO Token Launches on Virtuals

Tether Drops $200M Into Whop to Expand Stablecoin Payments

Zano Launches MCP For AI Tool Integration

Grvt Partners with Aave to Turn Idle Margin into Yield and Unveils 2026 Roadmap

Fabric Protocol $ROBO Token Launches on Virtuals

Tether Drops $200M Into Whop to Expand Stablecoin Payments

Zano Launches MCP For AI Tool Integration