Ethereum gas fees have dropped to around $0.01, marking a major shift in network efficiency and reshaping the debate around scalability.

Author: Chirag Sharma

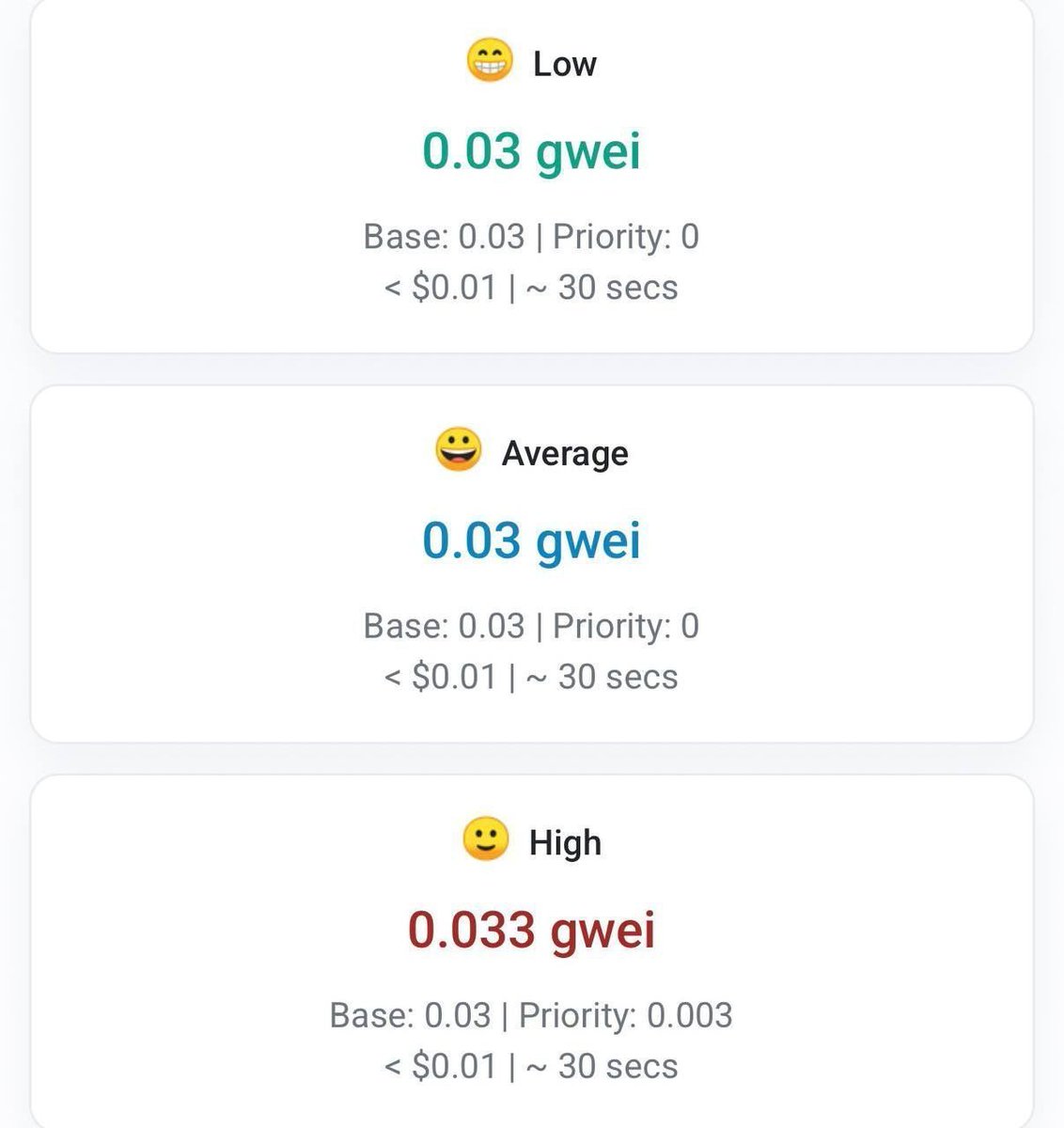

January 18., 2026 For the first time in nearly five years, gas fees on Ethereum have dropped below one cent. Gas prices are hovering near 0.035 Gwei, with priority fees effectively at zero across all speed tiers. In practical terms, this means ETH transfers and ERC-20 swaps are settling for pennies, while even complex actions like NFT mints or DEX trades now cost just a few cents.

High Signal Summary For A Quick Glance

Smart Money Crypto

@HugotoCrypto

🚨 ETHEREUM IST DAS NEUE SOLANA Krypto Twitter feiert: "Ethereum ist das neue Solana!" 2.8 Millionen Transaktionen pro Tag – All-Time High. Gas Fees bei 0.033 gwei. Praktisch kostenlos. Zur Einordnung: Während der PEPE-Season 2023 haben wir $40-50 pro Transaktion gezahlt. https://t.co/EOY0TySPP2

03:48 PM·Jan 18, 2026

Syminweb3

@Syminweb3

Zero Gas, Full Confidence Gas fees are the silent tax of blockchain, quietly eroding profits, limiting strategies, and intimidating newcomers. On Ethereum or BSC, users juggle swap fees, routing fees, and unpredictable gas spikes. One sudden congestion event, and your well-laid https://t.co/ON9ecyAHZg

03:12 PM·Jan 18, 2026

For users, the impact is immediate. Everyday transactions feel frictionless again. For developers, Ethereum has quietly regained an edge as a cost-efficient execution layer rather than an expensive settlement chain. However, there is a trade-off. Lower gas fees also mean lower ETH burn under EIP-1559, raising fresh questions about long-term value capture for the asset itself.

This fee collapse is not accidental. It is the cumulative result of several scaling decisions finally compounding.

The Fusaka upgrade in December 2025 increased the gas limit from 45 million to 60 million, materially expanding throughput without compromising security. Before that, Dencun (2024) introduced data blobs, pushing large volumes of activity to Layer 2s, while Pectra (May 2025) optimized execution and prepared Ethereum for stateless clients.

At the same time, Layer 2 networks such as Base, Arbitrum, and Optimism now handle a significant share of transaction volume. Much of the fee revenue that once burned ETH is instead captured by sequencers. That shift explains why fees can stay low even as usage rises.

Macro factors also play a role for Ethereum gas fees. Post-2025 market cooling, ETF outflows, and tax-related selling reduced speculative congestion. Yet developer activity has not slowed. In fact, some Layer 2s now process millions of transactions per day, highlighting a network that is scaling through efficiency rather than demand destruction.

Comparison with previous Ethereum upgrades and similar scaling approaches from competitors

Several milestones will determine whether this low-fee era persists. Mid-2026 is expected to bring the Glamsterdam upgrade, focused on parallel execution and expanded blob capacity. February’s All-Core Devs calls will also signal near-term priorities. Votes around validator reward structures, EIP implementations, and zkEVM security upgrades are expected in Q2. Vitalik Buterin’s roadmap also targets privacy layers and quantum-resistant infrastructure by late 2026. Watch for a rebound in ETF inflows post-tax season and confirmation that low fees are not masking validator centralization risks. Reduced ETH burn remains a long-term concern. A sudden surge in activity without corresponding upgrades could push fees higher again. Conversely, a smooth Glamsterdam rollout may lock in Ethereum’s position as both scalable and affordable.

Our Crypto Talk is committed to unbiased, transparent, and true reporting to the best of our knowledge. This news article aims to provide accurate information in a timely manner. However, we advise the readers to verify facts independently and consult a professional before making any decisions based on the content since our sources could be wrong too. Check our Terms and conditions for more info.

Study From BPI Shows AI Agents Prefer Bitcoin Over Stablecoin

AgentMail x402 Protocol Brings On-Chain Email to AI Agents

Uniswap Wins Full Dismissal of the Scam Token Class Action Lawsuit

Ice Open Network Launches $ION Trading on PancakeSwap

Study From BPI Shows AI Agents Prefer Bitcoin Over Stablecoin

AgentMail x402 Protocol Brings On-Chain Email to AI Agents

Uniswap Wins Full Dismissal of the Scam Token Class Action Lawsuit

Ice Open Network Launches $ION Trading on PancakeSwap