DOJ emails reveal Jeffrey Epstein Coinbase investment details, raising questions about early crypto funding diligence, and reputational risk.

Author: Kritika Gupta

Steady attention without excessive speculation.

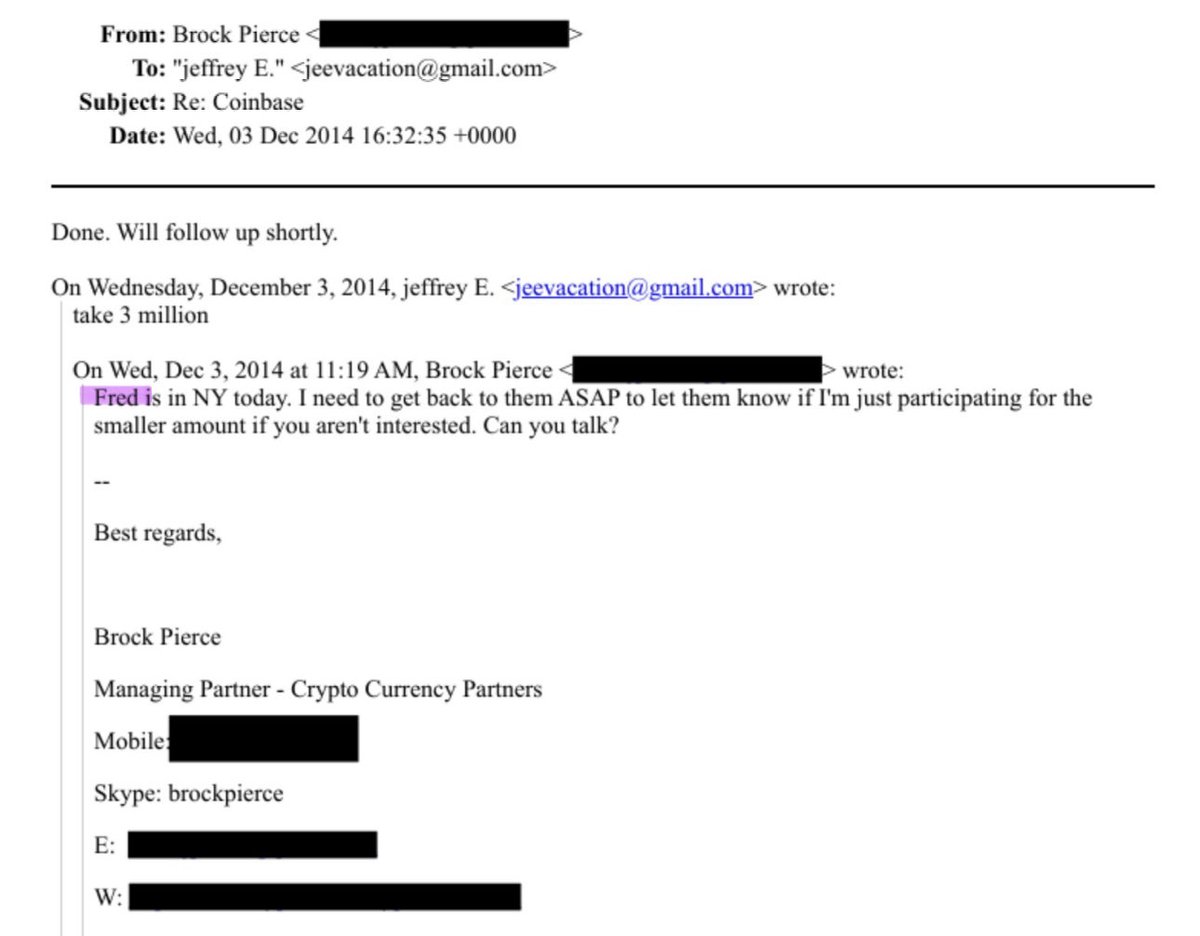

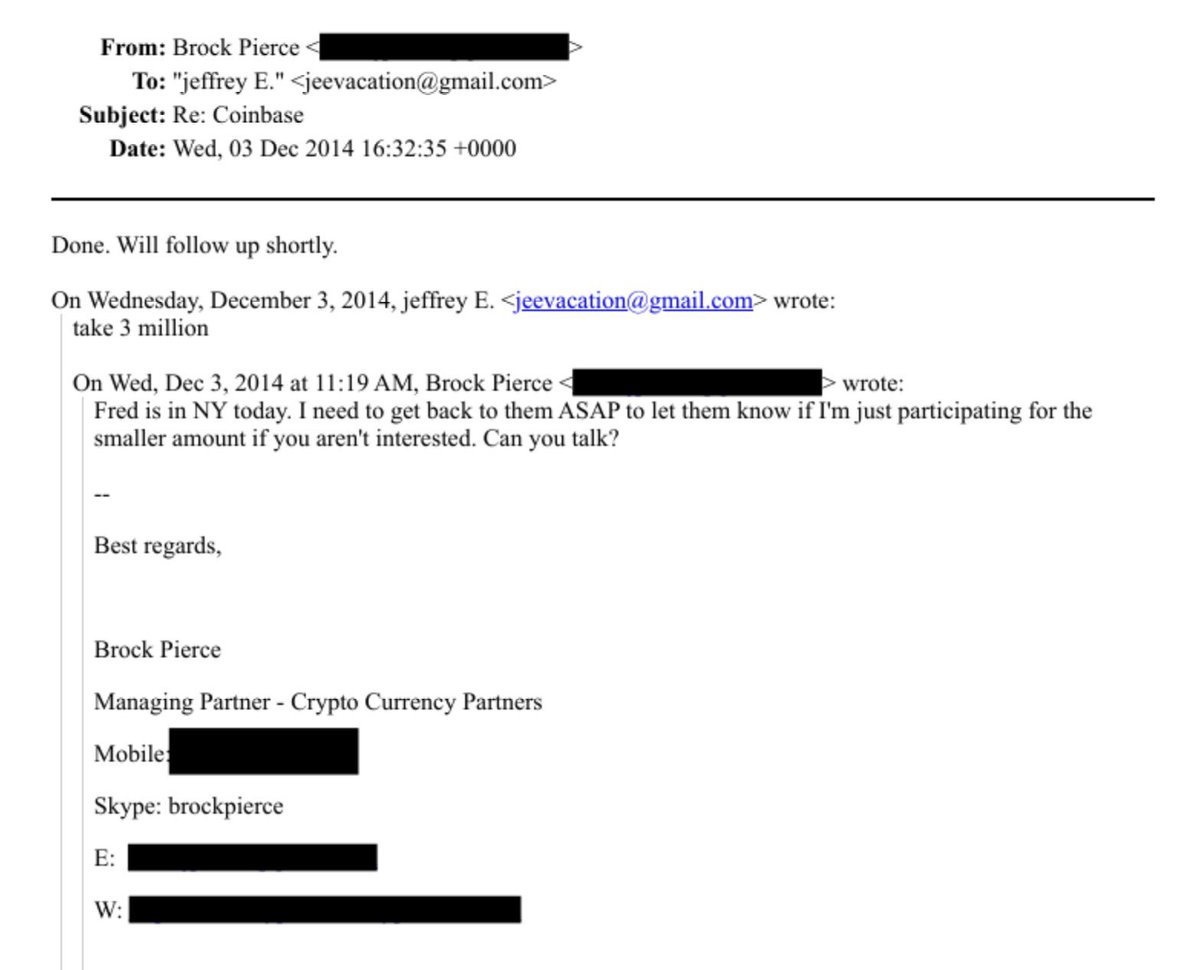

3rd February 2026- The Jeffrey Epstein Coinbase investment story is now trending across crypto circles after newly released U.S. Department of Justice emails revealed Epstein invested $3 million into Coinbase in December 2014, when the exchange was valued at around $400 million. The emails indicate that Tether co-founder Brock Pierce and his venture firm Blockchain Capital helped facilitate the opportunity. They also suggest Coinbase co-founder Fred Ehrsam knew about the deal and supported the arrangement.As a result, this disclosure is now circulating widely across crypto social media and has revived a familiar debate in the industry: how early-stage crypto startups handled fundraising diligence during the sector’s formative years.

High Signal Summary For A Quick Glance

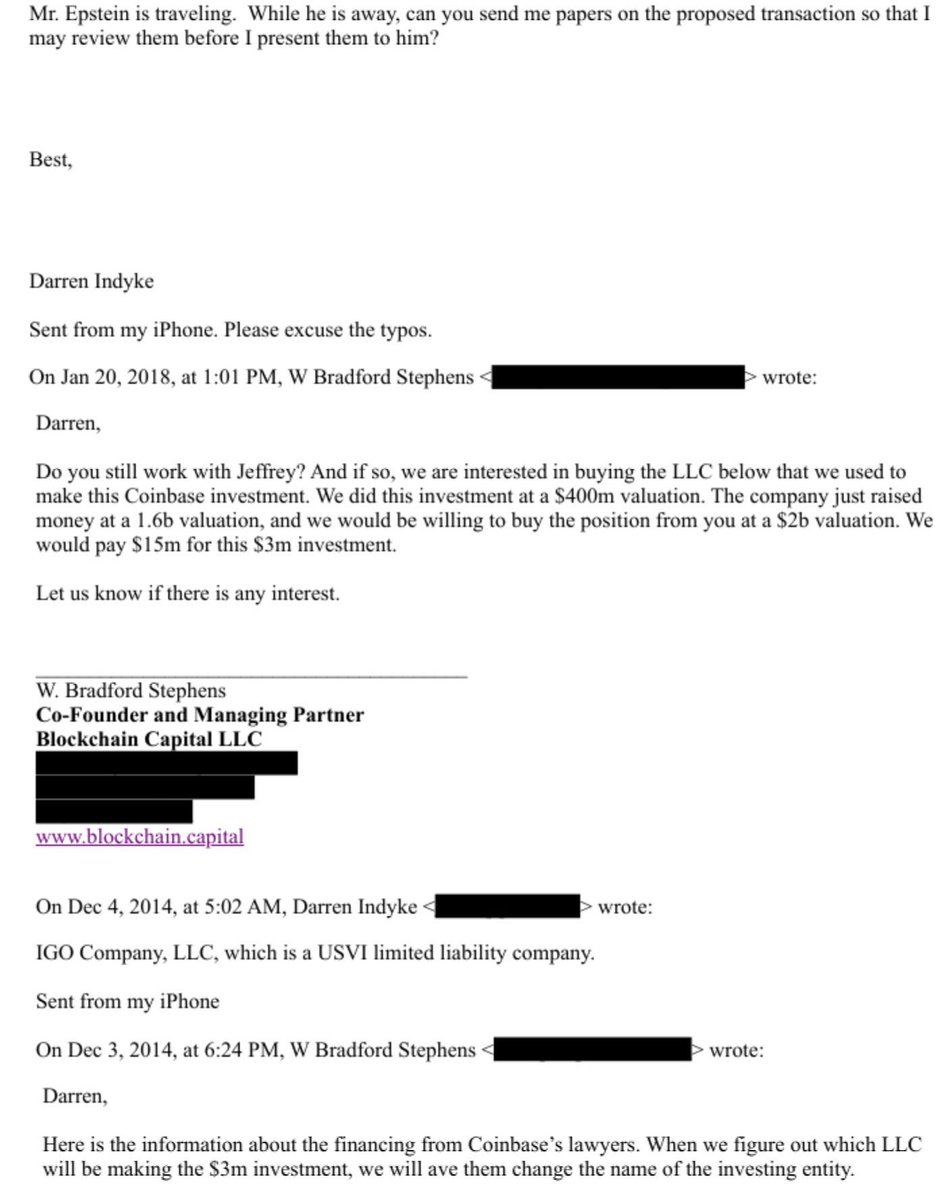

The disclosure comes from a newly released set of DOJ emails tied to ongoing reviews of Epstein’s financial networks and activity. According to the information described in the emails, Brock Pierce introduced Epstein to the Coinbase Series C funding opportunity. Epstein then invested through his entity, IGO Company LLC.

Epstein had long-standing ties across elite circles in politics, science, and technology. In prior reporting and document releases, Epstein appeared in connection with several major tech figures, including LinkedIn co-founder Reid Hoffman and Microsoft co-founder Bill Gates, often around meetings, introductions, and investment-related discussions.

Historically, Epstein-linked revelations have created short-term reputational shockwaves for people and institutions mentioned in documents. In many cases, affected firms saw limited and temporary market turbulence, especially when disclosures did not indicate operational misconduct or criminal wrongdoing. Crypto markets have followed the same pattern in prior scandals, often reacting emotionally first and then stabilizing if the story does not evolve into legal action.

Key milestones related to this development

Jeffrey Epstein invests $3 million into Coinbase at an estimated ~$400M valuation, reportedly via IGO Company LLC.

Emails reportedly show Brock Pierce and Blockchain Capital help introduce the Coinbase funding round to Epstein.

Coinbase expands rapidly as crypto adoption grows and institutional interest begins forming.

Epstein reportedly sells 50% of his stake for nearly $15 million, demonstrating the gains from early crypto venture positions.

Epstein-related disclosures expand public attention to his financial networks across tech and finance.

The DOJ emails reportedly show that Epstein did not invest through Blockchain Capital’s venture fund. Instead, Epstein invested directly via his LLC after Pierce initiated the conversation and connected him to the round.

The emails also indicate involvement or awareness at the executive level. Specifically, the reporting claims Fred Ehrsam expressed interest in meeting Epstein after the investment. That detail matters because it suggests the relationship was not accidental or hidden from leadership.

The investment later generated significant gains. Epstein reportedly sold half of his stake in 2018 for nearly $15 million and kept the remaining position. This outcome highlights how early crypto venture allocations produced massive returns, even when the capital source later became reputationally toxic.

The update rapidly trended on X, with users expressing shock and demanding accountability and transparency about Coinbase’s early funding history. Many commenters framed the Jeffrey Epstein Coinbase investment as evidence that early crypto venture funding lacked meaningful ethical screening.

From a business perspective, the reputational impact matters. Coinbase has repeatedly positioned itself as the compliance-forward face of U.S. crypto. Consequently, renewed headlines about the Jeffrey Epstein Coinbase investment can place pressure on Coinbase’s public image, even if the investment itself did not violate laws at the time.

Industry observers also expect renewed attention on venture funding standards. Regulators already scrutinize crypto for governance failures and weak controls. Consequently, high-profile revelations about early funding sources can strengthen calls for stricter compliance expectations around investor onboarding, enhanced reputational screening, and clearer disclosure standards.

Our Crypto Talk is committed to unbiased, transparent, and true reporting to the best of our knowledge. This news article aims to provide accurate information in a timely manner. However, we advise the readers to verify facts independently and consult a professional before making any decisions based on the content since our sources could be wrong too. Check our Terms and conditions for more info.

Cowboy.X

@cowboycrypto313

So when Brock Pierce is chatting with Epstein about Coinbase, he mentions, “Fred is in NY”. That’s Fred Ehrsam Co-Founder of Coinbase who started Paradigm with Matt Huang. Matt was the head crypto partner at Sequoia Capital which is HEAVILY tied to the Chinese Communist Party. https://t.co/DrFMfxZ8yT

04:09 AM·Feb 3, 2026

Aaron Day

@AaronRDay

Jeffrey Epstein invested $3 million in Coinbase in 2014, it appears. BTW, Epstein doesn’t invest in his own name. He invested in Blockstream through Digital Garage and funded Bitcoin core devs through MIT. I am now guessing that he might have invested through Brock Pierce’s https://t.co/3NYPsATsnr

01:28 AM·Feb 3, 2026

Chad Steingraber

@ChadSteingraber

It shouldn’t be a surprise at this point that Epstein was investing and influencing Coinbase as an early supporter. What makes perfect sense now looking back is why Coinbase was refusing to list XRP on its platform. https://t.co/MQJQ8o3CW4 https://t.co/HmUGMRQeMA

Pretty wild to get direct confirmation. It’s even wilder to know that the direct original source for the persecution of Ripple and XRP came from Epstein, funneled into the Democrat party. https://t.co/8zUc8zQCNU https://t.co/Ctf78m6sRI

01:02 AM·Feb 3, 2026

The DOJ releases a new batch of emails that reportedly exposes the Jeffrey Epstein Coinbase investment, triggering renewed debate on due diligence.

Vultisig Launches Plugin Marketplace for OnChain Automation

CZ Fires Back at 4 Funny FUDs and Limits Comments on X

Ripple-Backed $280M Diamond Tokenization Hits XRPL

DOJ Emails Reveal Jeffrey Epstein ($3M) Coinbase Investment

Vultisig Launches Plugin Marketplace for OnChain Automation

CZ Fires Back at 4 Funny FUDs and Limits Comments on X

Ripple-Backed $280M Diamond Tokenization Hits XRPL

DOJ Emails Reveal Jeffrey Epstein ($3M) Coinbase Investment