The Netherlands has moved forward with a sweeping reform of its investment tax system with 36% taxes even on unrealized crypto gains.

Author: Sahil Thakur

Steady attention without excessive speculation.

15th February 2026 – The Netherlands has moved forward with a sweeping reform of its investment tax system that directly impacts cryptocurrency holders.

High Signal Summary For A Quick Glance

akaster

@akacryptoster

Even @elonmusk is now posting about the utterly absurd proposal to tax unrealized gains — a measure pushed through with support from @VVD and @DilanYesilgoz that could seriously damage the Dutch economy. Meanwhile, the Dutch media remain strangely silent. Do they not understand https://t.co/18Ow3Ydrqg

04:03 AM·Feb 15, 2026

Michael Oates

@mikey2246

Netherlands implements a 36% unrealized gain tax https://t.co/ecM631uWIn

03:06 PM·Feb 14, 2026

Ðoge MacÐogethy

@DogeMacDogethy

Netherlands has officially committed financial suicide 👀 Every other country embracing #Crypto and the dutch government was like ….. https://t.co/62s9WIKdQU https://t.co/jmMav2H9kH

Netherlands: 36% unrealized gain tax. https://t.co/EWuEgixjzq

02:55 PM·Feb 14, 2026

The Dutch House of Representatives approved the “Actual Return in Box 3 Act” (Wet werkelijk rendement box 3). The reform introduces a flat 36% tax on actual annual returns from savings and investments. The law will take effect on January 1, 2028, if the Dutch Senate grants final approval.

Under the new framework, the Dutch tax authority will calculate returns annually by comparing an asset’s value at the beginning and end of the year. It will then add any income earned, such as dividends or interest.

Key features include:

This system replaces the old Box 3 model, which taxed assumed returns rather than actual performance. The Dutch Supreme Court ruled that system unconstitutional in a series of rulings beginning in 2021. As a result, lawmakers had to redesign the structure.

However, instead of switching to a realized-only system, lawmakers chose to tax annual market value changes.

Crypto investors face unique risks under this structure because of extreme price volatility.

Consider this example:

Year 1

A €100,000 crypto portfolio rises to €140,000.

Unrealized gain: €40,000.

After the €1,800 exemption, taxable gain becomes €38,200.

Tax owed at 36% equals €13,752.

Year 2

The portfolio falls to €60,000.

Loss of €80,000.

The investor pays no tax that year.

However, the €13,752 paid in Year 1 is not refunded.

Year 3

The portfolio recovers to €110,000.

Loss carryforward offsets gains.

No new tax owed.

Even so, the investor already paid tax during Year 1 despite ending below the original starting value.

As a result, critics argue that the system punishes compounding and creates liquidity stress. Investors may have to sell assets in bull markets just to cover tax obligations.

The Dutch government introduced this reform primarily to fix legal and fiscal gaps created by the Supreme Court rulings.

Several factors drove the decision:

Revenue Protection: Delaying reform would cost the treasury an estimated €2.3 billion per year. Lawmakers wanted to plug that hole quickly.

Administrative Simplicity: Officials admitted that taxing realized gains only would take longer to implement. Therefore, they chose unrealized taxation because it is easier to administer by 2028.

Budget Pressures: The government faces broader fiscal strain. By capturing gains in fast-growing sectors such as crypto, the state can secure revenue without waiting for asset sales.

Political Compromise: Even supporting parties acknowledged that taxing unrealized gains is not ideal. However, they described it as a pragmatic solution rather than a perfect one.

The proposal has triggered strong reactions from investors and analysts.

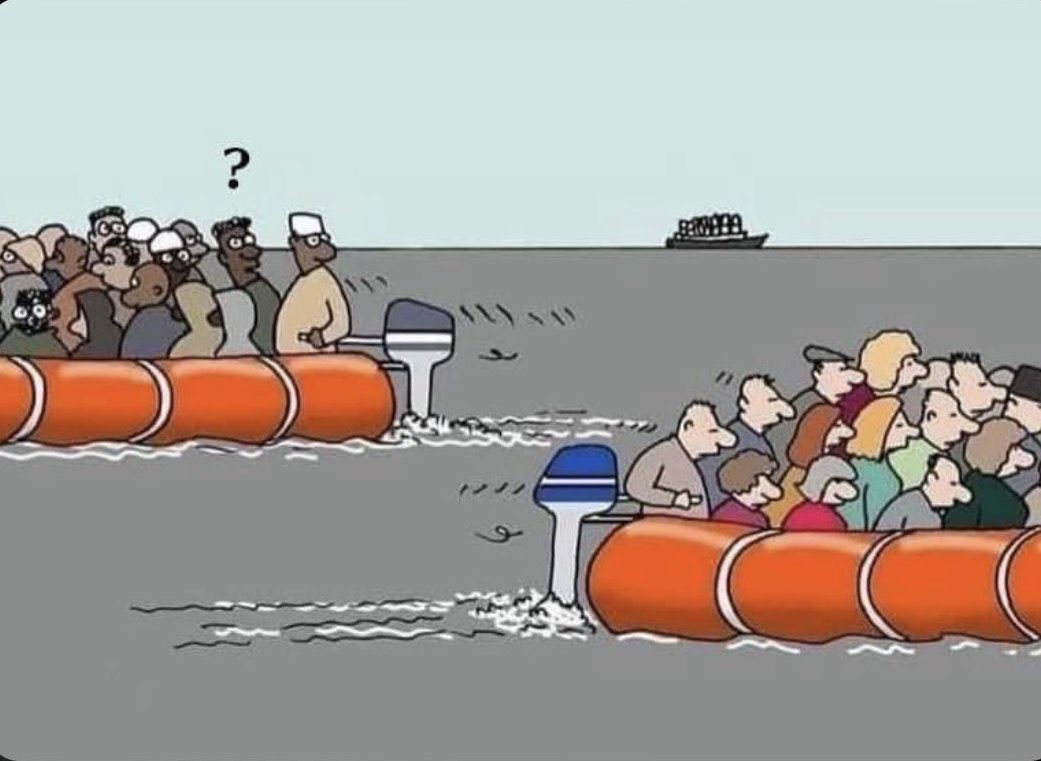

Many argue that the law discourages long-term holding. Others warn it could distort investment behavior and accelerate capital flight to lower-tax jurisdictions such as Singapore, Dubai, or El Salvador.

On social media, critics describe the measure as punitive and damaging to retirement savings. Some investors are already discussing relocation strategies before 2028.

Historical precedents support those fears. Similar wealth taxation efforts in other countries have led to capital outflows and reduced net revenue.

Crypto taxation comparison across major jurisdictions (2026)

If the Senate approves the reform, the Netherlands will become a major test case.

First, the policy could increase short-term selling during bull markets as investors raise cash for tax payments. Second, it may discourage long-term holding strategies. Third, it could accelerate migration of high-net-worth crypto investors.

At the same time, global reporting frameworks are expanding. The OECD’s Crypto-Asset Reporting Framework and the EU’s DAC8 regime will begin cross-border data sharing in 2027. Therefore, moving abroad may not eliminate reporting obligations.

Still, differences in tax treatment will matter.

Several developments now deserve close attention.

The Senate Vote: The Dutch Senate must approve the bill. Rejection or amendments remain possible.

Capital Movement: Watch for signs of investor relocation or restructuring before 2028.

EU Policy Spillover: If the Netherlands implements unrealized crypto taxation successfully, other EU states may study similar models. However, if capital flight accelerates, other countries may avoid it.

Legal Challenges: Investors may challenge the constitutionality of taxing unrealized gains under European human rights frameworks.

Our Crypto Talk is committed to unbiased, transparent, and true reporting to the best of our knowledge. This news article aims to provide accurate information in a timely manner. However, we advise the readers to verify facts independently and consult a professional before making any decisions based on the content since our sources could be wrong too. Check our Terms and conditions for more info.

Netherlands Approves 36% Tax on Unrealized Crypto Gains

Vitalik Buterin Criticizes Prediction Markets as Short-Term Gambling

Amara Exchange Breach Hits $AMARA Token After Launch

Kevin O’Leary Wins $2.8 Million Defamation Case Against BitBoy Crypto

Netherlands Approves 36% Tax on Unrealized Crypto Gains

Vitalik Buterin Criticizes Prediction Markets as Short-Term Gambling

Amara Exchange Breach Hits $AMARA Token After Launch

Kevin O’Leary Wins $2.8 Million Defamation Case Against BitBoy Crypto