Peter Thiel dumps ETHZilla stake after treasury collapse, ETH sales, and pivot to tokenized jet engine assets.

Author: Akshat Thakur

February 18, 2026 — Peter Thiel dumps ETHZilla stake following a sharp decline in the firm’s crypto treasury strategy and a broader collapse in its share price. A recent SEC filing confirmed that Thiel and Founders Fund fully exited their 7.5% position in the Ethereum-focused treasury company. The move matters as ETHZilla’s model built on holding large amounts of Ether, unraveled amid market downturns, raising questions about corporate crypto treasury strategies and institutional confidence in volatile digital assets.

High Signal Summary For A Quick Glance

Coin Medium

@Thecoinmedium

🚨 NEW: A recent SEC filing indicates that Peter Thiel has fully stepped away from his position in ETHZilla https://t.co/MuZorkqWJf

12:56 PM·Feb 18, 2026

Coin Bureau

@coinbureau

🚨 BREAKING: Peter Thiel exits $ETH treasury firm ETHZilla, selling his entire stake. A new SEC filing shows the billionaire investor and his Founders Fund FULLY SOLD their stake in the company. https://t.co/iXCSCrwXrT

06:38 AM·Feb 18, 2026

Watcher.Guru

@WatcherGuru

JUST IN: Billionaire Peter Thiel fully exits Ethereum treasury firm ETHZilla, sells entire stake. https://t.co/GIX1IIHQzJ

06:28 AM·Feb 18, 2026

ETHZilla, formerly known as 180 Life Sciences, rebranded in 2025 to build a corporate treasury centered on Ethereum. The company raised approximately $425 million to accumulate ETH, positioning itself as a public-market proxy for Ethereum exposure. At its peak, the strategy attracted high-profile investors including Peter Thiel’s Founders Fund, which acquired a 7.5% stake.

The firm’s stock surged during the 2025 Ethereum rally as institutional interest in crypto treasuries increased. However, ETHZilla’s balance sheet remained heavily exposed to ETH price volatility. As Ethereum declined significantly from its 2025 highs, the company faced liquidity pressure and mounting debt obligations.

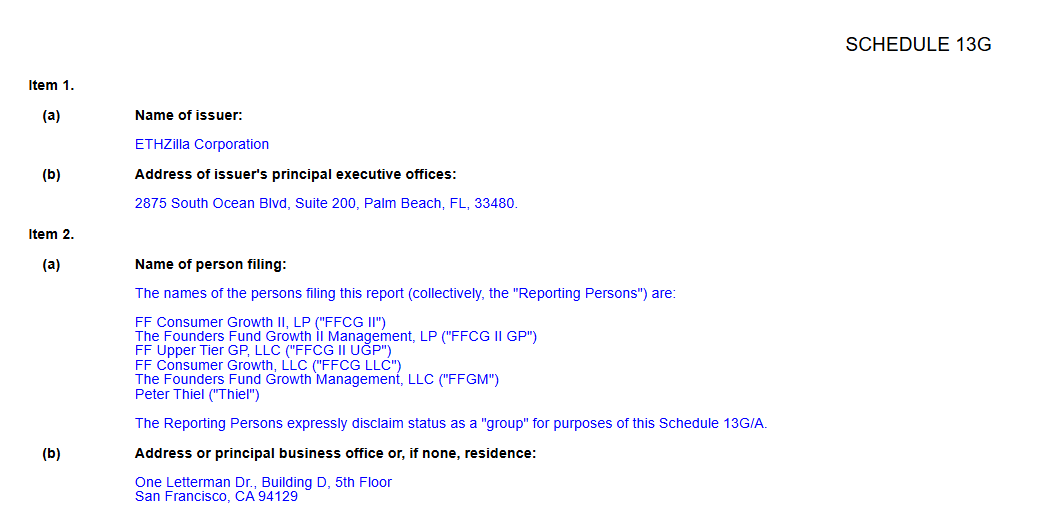

Peter Thiel dumps ETHZilla stake according to a Schedule 13G amendment filed with the U.S. Securities and Exchange Commission. The filing showed Thiel-linked entities reduced their holdings from over 11 million shares to zero by the end of 2025.

The disclosure triggered a drop in ETHZilla’s stock price during after-hours trading. The sale likely locked in significant losses given the firm’s share price decline from over $100 in 2025 to under $3 by early 2026.

The exit marks a reversal from Thiel’s earlier support for ETHZilla’s treasury model and signals a shift in institutional appetite for single-asset crypto treasury strategies.

Key milestones in ETHZilla’s pivot, treasury strategy, and shift toward real-world asset tokenization

ETHZilla completes a $425 million private placement, pivots from pharmaceuticals to an Ether treasury strategy, and sees its stock surge. Peter Thiel’s Founders Fund discloses a 7.5% stake.

ETHZilla sells 24,291 ETH for $74.5 million at an average price of $3,068.69, addressing liquidity needs during a broader crypto market downturn.

Peter Thiel and Founders Fund fully divest their 7.5% stake in ETHZilla, marking a significant shift in institutional backing.

ETHZilla reveals plans to tokenize a portfolio of home loans on a Layer 2 network, expanding into real-world asset infrastructure.

The company acquires two commercial jet engines valued at $12.2 million for tokenization, accelerating its transition toward RWA-backed assets.

An SEC filing confirms Founders Fund’s full divestment, triggering a more than 5% drop in ETHZilla stock during after-hours trading.

News of the exit spreads widely, with ETHZ stock collapsing to $3.50—down 97% from its 2025 peak—as community scrutiny intensifies.

The company’s crypto treasury came under pressure as Ethereum prices declined roughly 60% from their 2025 peak levels. ETHZilla sold tens of millions of dollars worth of ETH to repay outstanding debt obligations, weakening its balance sheet further.

The forced sales increased market pressure and reduced investor confidence in the firm’s strategy. Analysts described the approach as overly concentrated and lacking hedging mechanisms.

As the stock fell more than 90% from its highs, ETHZilla’s treasury model came under scrutiny as an example of the risks associated with corporate exposure to volatile digital assets.

Following the treasury collapse, ETHZilla announced a pivot toward tokenized real-world assets, including jet engine lease financing structured on blockchain infrastructure. The move was presented as a diversification strategy beyond pure crypto exposure.

Market reaction to the pivot has been mixed, with some observers viewing it as an attempt to stabilize operations while others questioned its long-term viability. The absence of continued backing from early investors has added to skepticism around the transition.

The shift reflects a broader trend of crypto-adjacent firms exploring tokenized asset models as a hedge against digital asset volatility.

Our Crypto Talk is committed to unbiased, transparent, and true reporting to the best of our knowledge. This news article aims to provide accurate information in a timely manner. However, we advise the readers to verify facts independently and consult a professional before making any decisions based on the content since our sources could be wrong too. Check our Terms and conditions for more info.

Encrypt V2 Launch Enables Private Cross-Chain Bridging

Peter Thiel Dumps ETHZilla Stake After Crypto Treasury Collapse

Zora Expands to Solana with Launch of Real-Time Attention Markets

Dragonfly Fund IV Closes at $650M Amid Crypto Bear Market

Encrypt V2 Launch Enables Private Cross-Chain Bridging

Peter Thiel Dumps ETHZilla Stake After Crypto Treasury Collapse

Zora Expands to Solana with Launch of Real-Time Attention Markets

Dragonfly Fund IV Closes at $650M Amid Crypto Bear Market