Rain, a company building stablecoin payment infrastructure for enterprises, has raised $250 million in a Series C funding round.

Author: Sahil Thakur

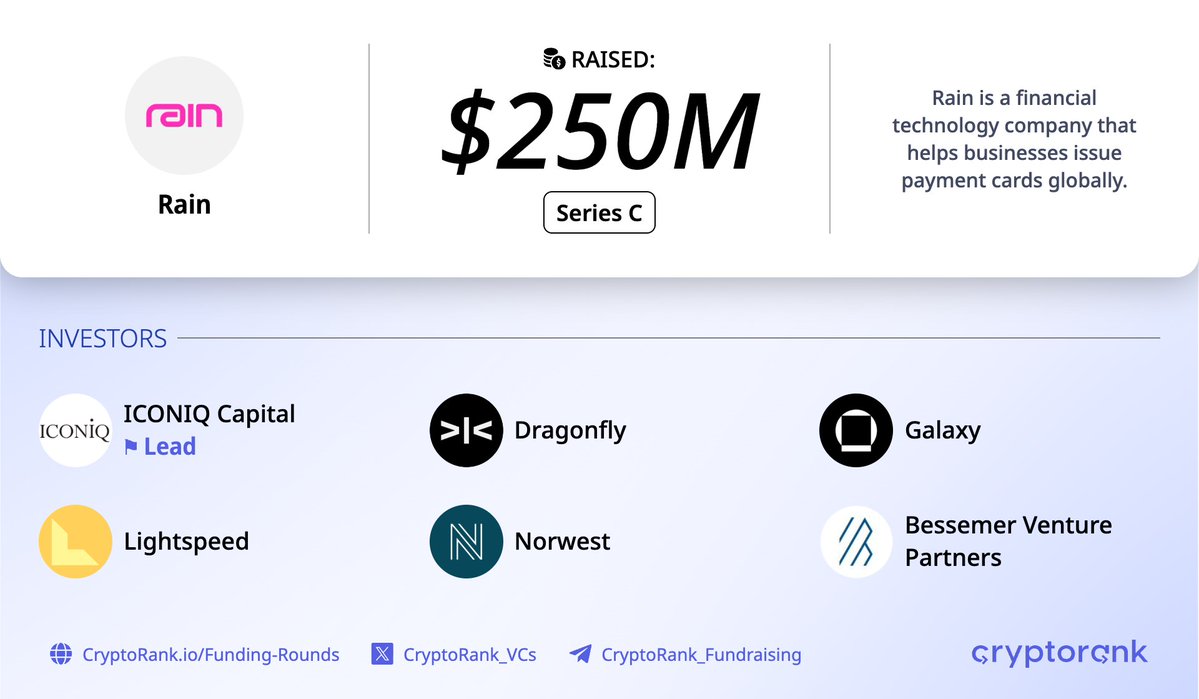

10th January 2026 – Rain, a company building stablecoin payment infrastructure for enterprises, has raised $250 million in a Series C funding round. The round values the company at $1.95 billion.

This latest raise comes just four months after its Series B and ten months after its Series A. In total, Rain has now raised over $338 million. The pace of fundraising reflects growing interest in stablecoin-based payments from institutional investors.

High Signal Summary For A Quick Glance

Nik

@NikMilanovic

MONSTER Series C news this morning @raincards starts off the year with a $250M Series C led by @ICONIQCapital, only 4 months after its August Series B, at a $1.95B valuation. A 17x increase in valuation over just 10 months. Rain provides the infrastructure for enterprises to https://t.co/Iyc3ant67i

12:54 PM·Jan 9, 2026

Marcel van Oost

@oost_marcel

Rain just closed a $250 Million Series C, valuing the company at $1.95 Billion, up 17x in just 10 months 🤯 The round brings Rain's total funding to over $338M. A few other signals worth paying attention to: • $3B+ in annualized transaction volume • 200+ enterprise partners https://t.co/TtLQJp7gRY

12:45 PM·Jan 9, 2026

Fundraising Digest

@CryptoRank_VCs

Rain $250M Series C Round⚡️ 📑 About: @raincards is a financial technology company that helps businesses issue payment cards globally. 🤝 Investors: ICONIQ Capital (Lead), Dragonfly, Galaxy, Lightspeed, Norwest, and Bessemer Venture Partners 🏷 Valuation: $1.95B https://t.co/JtimLuqoLF

12:23 PM·Jan 9, 2026

Rain helps businesses integrate stablecoins into their payment systems. Its platform lets companies issue cards, create wallets, process payouts, and convert fiat to stablecoins. It is designed to offer a user experience similar to traditional payment tools.

So far, Rain has processed more than $3 billion in annual transactions. It works with over 200 partners, including Western Union, Nuvei, and KAST. Its infrastructure reaches a potential user base of over 2.5 billion people.

Rain was founded in 2021 by Farooq Malik and Charles Naut to solve a core problem in digital assets: making stablecoins usable in everyday finance. The company built a platform that connects stablecoins with traditional payment systems so enterprises can issue cards, run wallets, and handle payouts with familiar user experiences.

Early on, Rain secured a Series A round in March 2025 led by Norwest Venture Partners, raising $24.5 million to scale its compliant infrastructure and global payment rails. Only a few months later, in August 2025, Rain followed up with a $58 million Series B round led by Sapphire Ventures. That raise, which brought total funding to about $88.5 million, reflected strong enterprise demand for its stablecoin-powered payment stack and helped Rain expand into Europe, the Middle East, Africa, and Asia-Pacific markets.

How Rain’s funding rounds evolved over time

The round was led by ICONIQ. Other investors included Sapphire Ventures, Dragonfly, Bessemer Venture Partners, Galaxy Ventures, FirstMark, Lightspeed, Norwest, and Endeavor Catalyst.

ICONIQ’s Kamran Zaki said Rain’s technology and regulatory approach make it a strong contender to lead enterprise adoption of tokenized payments.

Rain says the new capital will support its global expansion. The company plans to grow across North America, South America, Europe, Asia, and Africa. It also wants to help partners scale quickly in regions with growing interest in stablecoins.

Part of the funds will go toward improving Rain’s payments platform. The company also plans to make strategic acquisitions and build new features that simplify stablecoin usage for both businesses and consumers.

Rain’s CEO, Farooq Malik, said the company is still early in its journey. Over the past year, it has seen a 30x increase in active cards and a 38x increase in annualized payment volume.

The funding gives Rain more room to expand and strengthen its position. It aims to bring stablecoins to the mainstream, not by replacing traditional systems, but by improving them.

Going forward, keep an eye on how Rain uses its fresh capital to enter new regions and deepen enterprise adoption of stablecoin rails. Expansion into key markets across North America, South America, Europe, Asia, and Africa could unlock more real-world use cases and bring stablecoin payments closer to mainstream finance.

Also look for strategic acquisitions that boost Rain’s capabilities and new product launches designed to simplify stablecoin integration for partners. Finally, regulatory clarity in major jurisdictions will be important because it will shape enterprise comfort with stablecoins and help determine how quickly Rain’s infrastructure is adopted globally

Our Crypto Talk is committed to unbiased, transparent, and true reporting to the best of our knowledge. This news article aims to provide accurate information in a timely manner. However, we advise the readers to verify facts independently and consult a professional before making any decisions based on the content since our sources could be wrong too. Check our Terms and conditions for more info.

YZi Labs Alleges Undisclosed Ownership by 10X Capital in CEA Industries

Grvt Partners with Aave to Turn Idle Margin into Yield and Unveils 2026 Roadmap

Fabric Protocol $ROBO Token Launches on Virtuals

Tether Drops $200M Into Whop to Expand Stablecoin Payments

YZi Labs Alleges Undisclosed Ownership by 10X Capital in CEA Industries

Grvt Partners with Aave to Turn Idle Margin into Yield and Unveils 2026 Roadmap

Fabric Protocol $ROBO Token Launches on Virtuals

Tether Drops $200M Into Whop to Expand Stablecoin Payments