Space responds to presale controversy, defending its soft cap, refund process, and $SPACE tokenomics after community backlash.

Author: Akshat Thakur

Published On: Thu, 22 Jan 2026 09:58:02 GMT

January 22, 2026 — Space responds to presale controversy after days of mounting criticism surrounding its oversubscribed token sale, refund process, and post-launch communications. The Solana-based leveraged prediction market has publicly rejected allegations of misconduct, arguing that confusion over its funding structure and execution not bad faith drove the backlash.

High Signal Summary For A Quick Glance

Space is a leveraged prediction market built on Solana. It lets users speculate on real-world and crypto-native events such as elections, sports outcomes, and asset prices using leverage of up to 10x. The platform emphasizes non-custodial access, no KYC, fast settlement, and low fees enabled by Solana’s high-throughput infrastructure.

The $SPACE token underpins the ecosystem, supporting governance, staking incentives, and liquidity programs. The project positions itself as the first prediction market to combine leverage and DeFi primitives at scale.

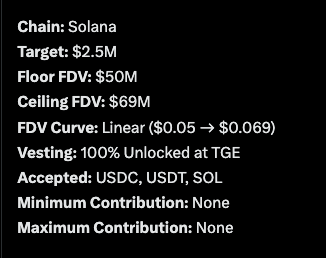

At the center of the backlash is Space’s presale funding target. Critics accused the project of advertising a $2.5 million cap while later accepting significantly more capital, calling the move misleading.

In its response, Space clarified that the $2.5 million figure was a soft cap, intended to represent the minimum funding required to operate sustainably. The team stated that treating it as a hard cap would have left the project with only a short development runway, increasing execution risk.

According to Space, demand exceeded expectations, and oversubscription was permitted to ensure long-term viability. Of the more than $20 million contributed, the team said it allocated $14 million to the project and earmarked approximately $6 million for refunds.

Key milestones in Space’s presale controversy and rollout

Space emerges on Solana positioning itself as the first leveraged prediction market, promoting features such as up to 10x leverage on event outcomes.

Presale launches with a $2.5M target described as a soft cap for operations; strong demand drives significant oversubscription.

Presale ends with more than $20M raised; the team announces plans to refund approximately $6M of excess contributions.

Refunds are processed as Space publishes an X article and hosts a Space audio session responding to claims of misleading caps, selective refunds, and scam allegations.

Community pressure escalates with renewed demands for full refunds; the team defends tokenomics as TGE is expected in late January with no resolution yet.

Refund handling quickly became the most contentious issue. Some contributors claimed smaller investors were denied refunds while larger wallets received them, fueling accusations of favoritism.

Space acknowledged delays in processing refunds but denied any preferential treatment. The team said it handled refunds based on eligibility, timing, and user requests, not wallet size. Space said it executed the address changes at the request of contributors, not insiders.

While defending the process, Space acknowledged that it could have communicated refund details more clearly and confirmed that it scheduled refunds for January 21.

In response to scam accusations, Space said it designed its tokenomics to prioritize long-term sustainability over short-term price action. The team denied any insider dumping or hidden allocations, stating that it structured the $SPACE distribution to support governance participation, liquidity, and ecosystem growth.

The project framed much of the backlash as post-presale volatility-driven FUD, urging the community to “zoom out” and evaluate the platform based on delivery rather than launch-week controversy. The team also held a live Space audio session to address questions directly from the community.

Src: @intodotspace

The dispute highlights structural weaknesses in how teams communicate and execute DeFi presales. Ambiguous soft caps, discretionary refund policies, and reliance on off-chain coordination create opportunities for misunderstanding when teams fail to define expectations precisely.

As leveraged prediction markets grow in relevance, Space’s handling of this controversy may influence how future projects structure disclosures, manage oversubscription, and enforce refund logic. Whether Space can fully restore trust will depend on execution and transparency in the weeks following its TGE.

Real voices. Real reactions.

@intodotspace even if people treat the bullshit "target" as a softcap... unless my math is off, based on your own ceiling fdv, your hard cap should have been no more 3.45m 50m > 69m 0.05 > 0.069 2.5m > 3.45m https://t.co/IRg1ymx5Zp

@intodotspace "But accepting only $2.5M would have funded a few months of operations, not the multi-year runway required to build leveraged prediction market infrastructure at scale." lol, why wasnt that shared upfront?

@intodotspace Great tokenomics and great transparency team 🫡

Our Crypto Talk is committed to unbiased, transparent, and true reporting to the best of our knowledge. This news article aims to provide accurate information in a timely manner. However, we advise the readers to verify facts independently and consult a professional before making any decisions based on the content since our sources could be wrong too. Check our Terms and conditions for more info.

Zebec SuperApp launch: cards, staking, streaming payroll

Steak ’n Shake Introduces Bitcoin Wages for Hourly Workers

Space Responds to Presale Controversy Over $SPACE Soft Cap and Refunds

Neynar Acquires Farcaster in $1B Web3 Social Power Move

Zebec SuperApp launch: cards, staking, streaming payroll

Steak ’n Shake Introduces Bitcoin Wages for Hourly Workers

Space Responds to Presale Controversy Over $SPACE Soft Cap and Refunds

Neynar Acquires Farcaster in $1B Web3 Social Power Move