Superstate Series B funding raises $82.5M to expand SEC-registered tokenized equities, and real-world asset infrastructure.

Author: Kritika Gupta

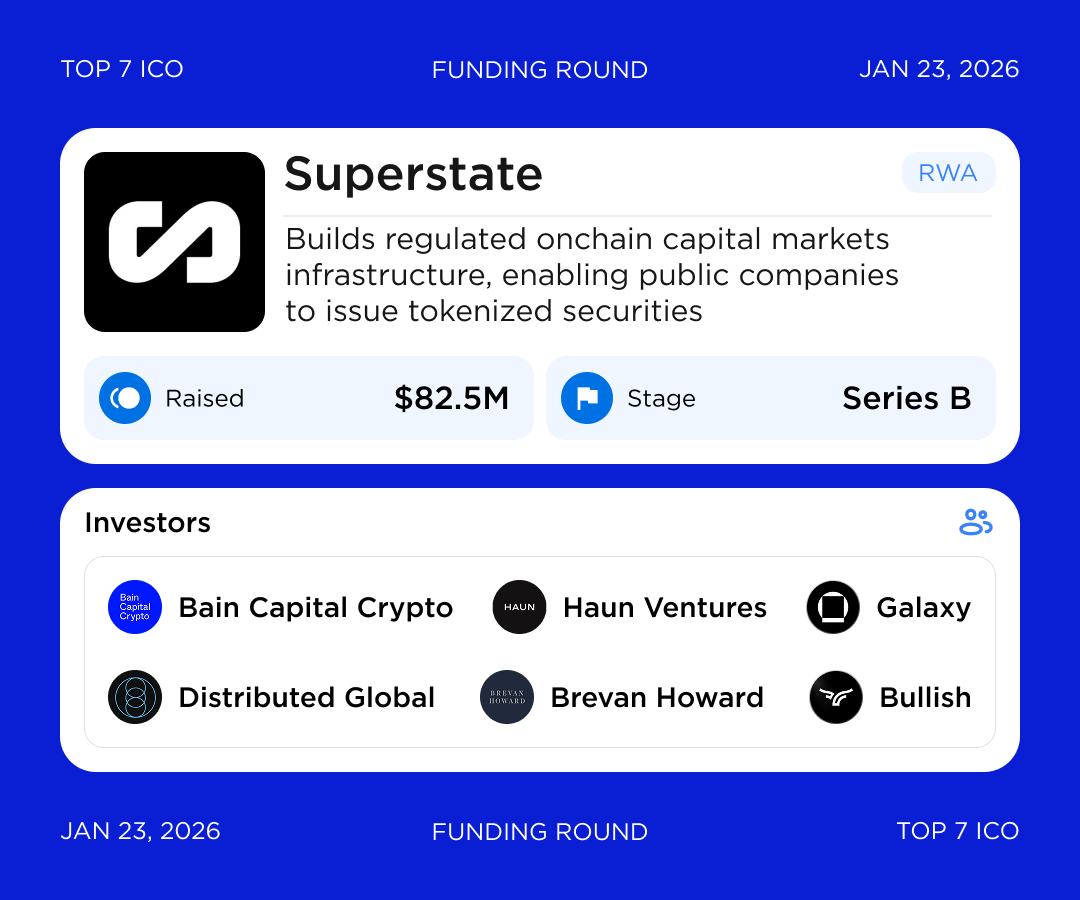

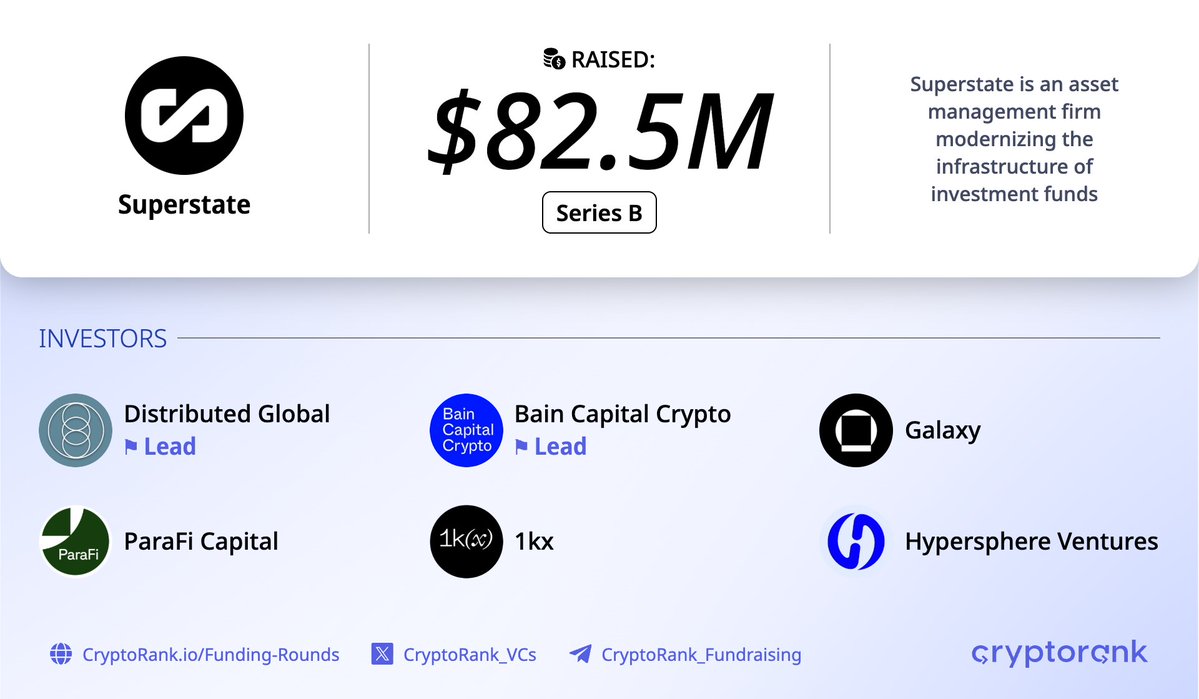

23rd January 2026-Superstate, a regulated fintech firm focused on asset tokenization, has raised $82.5 million in a Series B funding round. Bain Capital Crypto and Distributed Global co-led the raise, with participation from various capitals. As a result, the company is pushing regulated capital markets infrastructure closer to on-chain settlement and composability. Superstate currently manages more than $1.2 billion in tokenized assets, primarily through its USTB and USCC funds, placing it among the largest real-world asset issuers in crypto.

High Signal Summary For A Quick Glance

TOP 7 ICO | Crypto Market Briefs

@top7ico

Superstate raises $82.5M in a Series B Round The round was led by @BainCapCrypto and Distributed Global, with participation from @HaunVentures, @BHDigitalAssets, @galaxyhq, Sentinel Global, @Bullish, @hypersphere_, @flowdesk_co, @1kxnetwork, @intersection, @paraficapital, and https://t.co/eV06ddh7ZK https://t.co/xnes2DWx5y

1/ We’re proud to announce an $82.5M Series B, led by @BainCapCrypto and Distributed Global, with participation from @HaunVentures, Brevan Howard Digital, @galaxyhq, Sentinel Global, @Bullish, @hypersphere_, and @flowdesk_co alongside our existing investors. https://t.co/k25Vwn7pI5

07:45 AM·Jan 23, 2026

CoinMarketCap

@CoinMarketCap

LATEST: 💰 Tokenization startup Superstate has raised $82.5 million in Series B funding to expand its platform for issuing SEC-registered equities on the Ethereum and Solana blockchains. https://t.co/x7R7DZFFWX

05:04 AM·Jan 23, 2026

Fundraising Digest

@CryptoRank_VCs

Superstate $82.5M Series B Round⚡️ 📑 About: @SuperstateInc is an asset management firm modernizing the infrastructure of investment funds 🤝 Investors: Distributed Global (Lead), Bain Capital Crypto (Lead), Galaxy, ParaFi Capital, 1kx, and Hypersphere Ventures https://t.co/i1qNnavqll

06:47 PM·Jan 22, 2026

Superstate’s Series B follows rapid growth in institutional demand for tokenized financial products. Founded in 2023, the firm operates as a regulated investment adviser and an SEC-registered transfer agent. This structure allows it to issue compliant, blockchain-based securities rather than synthetic or wrapper products.

Its flagship funds highlight this approach. USTB holds more than $750 million in assets, while USCC exceeds $425 million. These funds demonstrate how tokenized securities can remain compliant while integrating with DeFi systems for settlement, custody, and composability.

Earlier funding rounds set the foundation for this expansion. In June 2023, Superstate raised a $4 million seed round led by ParaFi, Cumberland, and 1kx. Later that year, in November 2023, the company closed a $14 million Series A co-led by Distributed Global and CoinFund, with participation from Galaxy, Breyer Capital, Arrington Capital, and others. Those rounds funded regulatory approvals, early product development, and initial fund launches.

Following the Series A, market response across crypto and fintech was broadly positive. Coverage framed Superstate as proof that regulated tokenization could move beyond experimentation. Consequently, investor interest in RWAs accelerated, creating favorable conditions for the larger Superstate Series B funding announced this week.

Key milestones related to Superstate Series B funding

Superstate launches as a regulated investment adviser and SEC-registered transfer agent, focusing on compliant on-chain securities.

The company raises a $4 million seed round led by ParaFi, Cumberland, and 1kx to fund early regulatory and product development.

Superstate closes a $14 million Series A co-led by Distributed Global and CoinFund, enabling initial fund launches and infrastructure buildout.

USTB and USCC grow to more than $1.2 billion in combined AUM, validating demand for compliant real-world asset tokenization.

Superstate announces $82.5 million in Series B funding, co-led by Bain Capital Crypto and Distributed Global.

Superstate plans to scale its on-chain securities platform and expand issuance for regulated tokenized assets.

Superstate plans to use the Series B capital to scale its Opening Bell platform. This product enables public companies to issue and manage tokenized shares directly on Ethereum and Solana. Importantly, Opening Bell also supports follow-on capital raises through Direct Issuance Programs, which allow companies to raise capital on-chain while maintaining regulatory compliance.

The platform focuses on real-time ownership tracking, faster settlement cycles, and seamless integration with DeFi infrastructure. Alongside product development, Superstate will expand its team, strengthen regulatory and compliance systems, and launch additional tokenized private and public funds designed for institutional investors.

This funding round highlights the accelerating momentum behind real-world asset tokenization. By moving regulated securities onto public blockchains, firms like Superstate challenge traditional market structures that rely on multiple intermediaries, limited trading hours, and slow settlement.

Industry analysts increasingly view tokenized equities as a potential long-term evolution of capital markets. Features such as 24/7 settlement, global accessibility, and programmable ownership could significantly reshape how assets are issued and traded. As a result, institutional adoption of blockchain-native securities may continue to grow.

However, challenges remain. Regulatory coordination across jurisdictions, interoperability between blockchains, and integration with existing market infrastructure will determine how quickly this model scales. Even so, the Superstate Series B funding positions the company as a leading infrastructure provider in the shift toward compliant, on-chain capital markets.

Our Crypto Talk is committed to unbiased, transparent, and true reporting to the best of our knowledge. This news article aims to provide accurate information in a timely manner. However, we advise the readers to verify facts independently and consult a professional before making any decisions based on the content since our sources could be wrong too. Check our Terms and conditions for more info.