Trump’s tariff faces a key Supreme Court test as Polymarket signals a 76% chance of it being struck down, with major market and trade impacts.

Author: Kritika Gupta

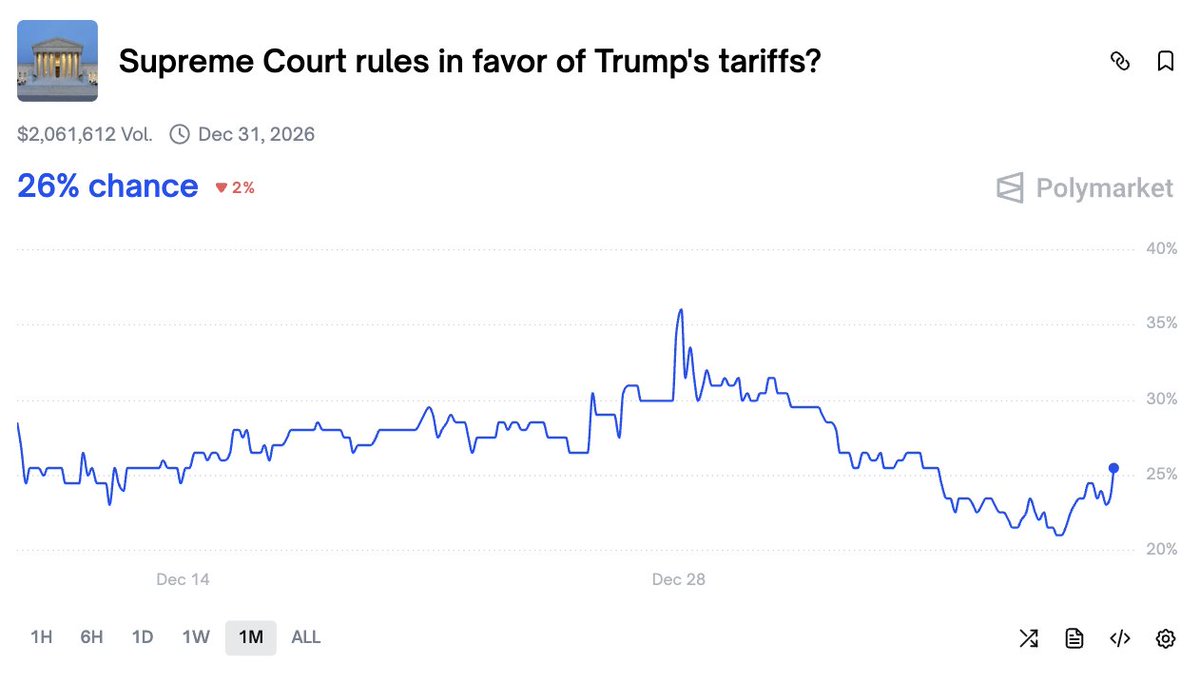

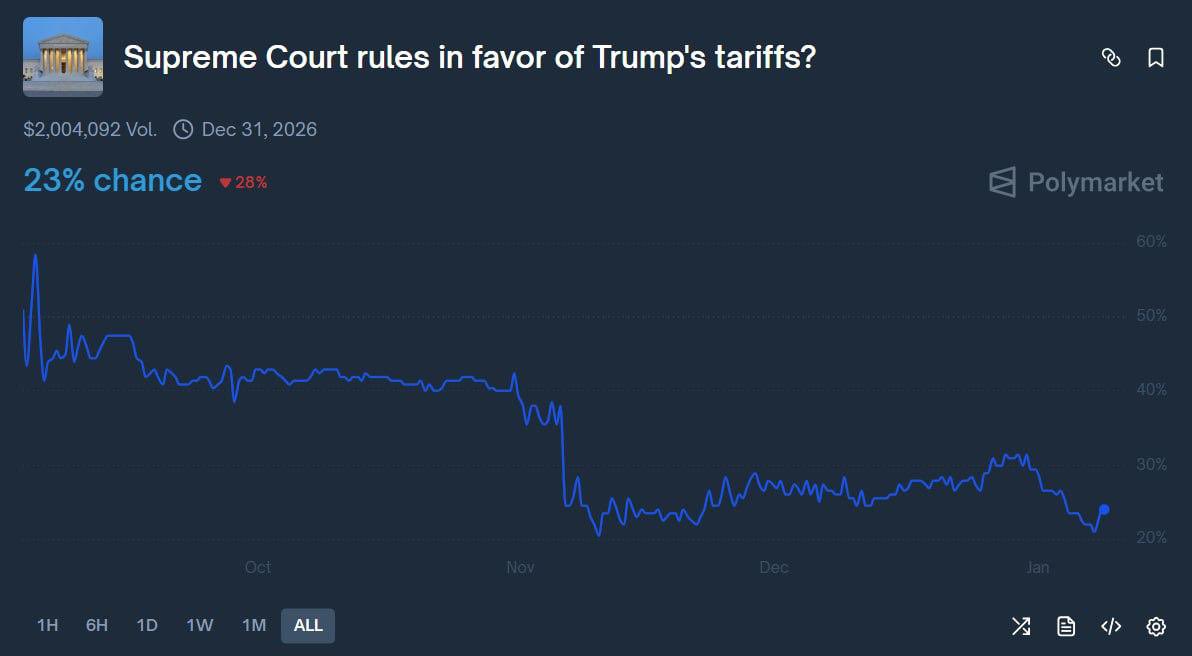

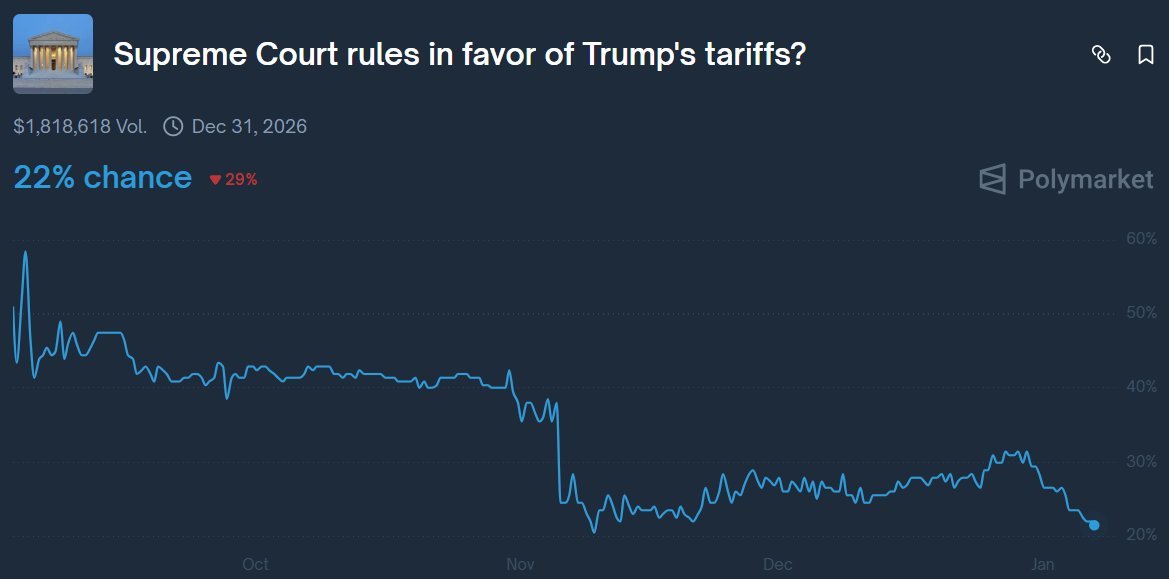

As the U.S. Supreme Court prepares to potentially rule tomorrow on the legality of President Trump’s tariff imposed under the International Emergency Economic Powers Act (IEEPA), prediction markets like Polymarket are pricing in a 76% chance of the measures being struck down. A decision against the administration could trigger massive importer refunds exceeding $133 billion, erase projected $3 trillion in deficit reduction over the next decade, and introduce short-term economic uncertainty—despite alternative tariff tools remaining available to the president. Markets are on edge, with implications for inflation, stocks, and Federal Reserve policy.

The case focuses on President Donald Trump invoking the International Emergency Economic Powers Act to impose sweeping import duties through Trump’s tariff policy. However, lower courts ruled that this use exceeded congressional intent.

CryptoGoos

@cryptogoos

74% chance Trump's tariffs will be declared illegal today... Expect Volatility. 😬 https://t.co/KSylsMwHra

07:03 AM·Jan 9, 2026

Crypto Rover

@cryptorover

BIG WARNING: THE NEXT 24 HOURS COULD BE EXTREMELY VOLATILE FOR MARKETS 🚨 Two major US events are hitting almost back-to-back, and both can quickly change how markets price growth, recession risk, and rate cuts. First: The US Supreme Court tariff ruling. At 10:00 am ET, the https://t.co/13UdNdBswj

04:05 PM·Jan 8, 2026

DTrades

@DTrades98

$SPY $SPX Polymarket predicting 78% chance tariffs are ruled illegal. This could cause the market to pull back hard. I think it would be the $10 ($SPY) or $100 ($SPX) move down to the golden trend line that aligns the best with a drop down. Otherwise, if ruled in favour, we https://t.co/XAhCzii4Sk

08:46 AM·Jan 7, 2026

Despite those rulings, Trump’s tariff remained in effect during appeals, which allowed the dispute to advance to the Supreme Court of the United States. Meanwhile, Polymarket traders assign a 76% chance that the court overturns and more than $2 million in trading volume reinforces investor expectations of a ruling against the administration.

Polymarket has become a real-time sentiment gauge for political and legal outcomes. In this case, traders assign only a 24% chance that the court upholds the tariffs. That imbalance shows strong confidence that the Supreme Court will strike down Trump tariffs outcome will prevail.

Importantly, traders factor in recent oral arguments from November 2025. They also weighed prior rulings that questioned the scope of emergency powers. Together, these signals push odds sharply toward invalidation.

A ruling against the tariffs could force refunds exceeding $133.5 billion already collected from importers. As a result, federal finances would face immediate strain. At the same time, budget projections would lose nearly $3 trillion in expected deficit reduction over the next decade.

Supporters argue tariffs boosted domestic manufacturing and pressured trade partners like China. Critics counter that they raised consumer prices and input costs. Therefore, the decision could reset inflation dynamics and alter supply chain planning.

Markets already price in volatility. Equity traders watch indexes like the S&P 500 for sudden swings. Bond markets also react as inflation expectations shift. Meanwhile, some investors see refund payments as short-term liquidity injections.

At the same time, rate traders reassess policy paths at the Federal Reserve. If tariffs disappear, import costs may fall. That scenario could support earlier rate cuts. Still, uncertainty remains high ahead of the ruling.

Even if the court strikes trump’s tariff down, presidents retain other tools. Trump could pursue Section 232 tariffs or seek congressional backing for narrower measures. However, those routes take longer and face tighter limits.

Over time, removing duties could cool inflation and support broader equity participation beyond tech. Yet, it may also widen trade deficits and invite retaliation. Consequently, policy debates will likely continue well beyond the ruling.

Our Crypto Talk is committed to unbiased, transparent, and true reporting to the best of our knowledge. This news article aims to provide accurate information in a timely manner. However, we advise the readers to verify facts independently and consult a professional before making any decisions based on the content since our sources could be wrong too. Check our Terms and conditions for more info.