Vooi TGE sees 86% drop post-launch; team addresses technical issues, allocation concerns, and plans for future improvements.

Author: Sahil Thakur

Published On: Wed, 31 Dec 2025 01:43:21 GMT

31st December 2025 – After a rocky token launch and steep price drop, the team behind Vooi has finally addressed community concerns around its TGE, airdrop allocations, and market performance. The statement follows a wave of backlash from users who felt blindsided by the rollout and underwhelmed by their airdrop rewards.

Vooi, a cross-chain perpetual DEX aggregator built on Solana, launched its native token $VOOI on December 17–18, 2025. The event followed a months-long points campaign, with participants grinding trading volumes in hopes of securing sizable airdrops.

Ahead of the TGE, community interest soared. Pre-market trading hinted at prices between $0.30 and $0.75. Polymarket odds suggested a strong chance of hitting a $300M+ FDV within 24 hours. Even the community sale on Cookies Launchpad was oversubscribed by 26x.

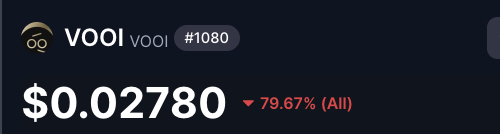

Yet, soon after going live, the token’s price began to fall. Within days, $VOOI dropped from an all-time high of $0.169 to just under $0.03 – an 86% drawdown. While early presale buyers reportedly saw modest gains, most traders and airdrop hunters felt left behind.

Loading chart...

On December 31, the Vooi team issued a statement addressing the TGE fallout. They acknowledged technical issues at launch, including smart contract congestion and limited availability for some regions. According to the team, these problems stemmed from unexpectedly high demand during the claim period.

They also clarified that liquidity was added to exchanges before the claim window began. However, the routing infrastructure struggled to keep up with requests, particularly in parts of Asia. Vooi said it responded by scaling up its backend resources and deploying additional routing tools.

“We are truly sorry,” the team wrote, referring to the technical friction.

Much of the post centered around airdrop allocation transparency, the issue that sparked the loudest community reaction.

According to the team, eligibility was determined based on multiple factors: trading consistency, proof-of-human checks, anti-sybil filters, and behavioral reviews. Many users were disqualified or had their allocations reduced due to farming with multiple accounts or exhibiting wash trading behavior.

Despite these filters, Vooi stated it still allowed partial allocations for users who failed some criteria. Additionally, allocations considered variables like referral contributions, activity in Vooi’s mini-app, and historical trades.

They also noted that Vooi’s own fee structure is often misunderstood. Many participants compared their airdrop returns against total trading fees (including DEX fees), whereas only Vooi-specific fees were relevant to allocation sizes.

The team emphasized that neither it nor its foundation sold tokens post-launch. “All token movements are recorded on-chain,” the statement read.

Despite the explanation, many users remain frustrated. Traders who generated millions in volume claimed to have received just a few dollars in tokens. Others accused Vooi of poor communication, especially around launch timing, and of prioritizing VC and presale allocations over active users.

Accusations of rug-pull behavior have circulated online. Users pointed to Vooi’s market cap collapse — from $112M to under $7M — and a lack of immediate recovery plans like token buybacks. Some also flagged the timing of the airdrop at year-end as a tax burden for U.S.-based participants.

The disappointment mirrors recent post-TGE sentiment seen with other launches like Aster and Solstice.

Looking ahead, Vooi promised to release an updated roadmap and expand $VOOI’s interoperability and use cases. They reiterated their long-term mission of delivering a CEX-grade experience with a decentralized foundation.

“This TGE was only the beginning,” the team said. “We’re committed to transparency and continuous improvement.”

For now, however, $VOOI remains down over 80% from its peak. Whether the project can win back its once-hyped community remains to be seen.

Real voices. Real reactions.

@vooi_io Everyone didn't get a proper allocation. Before tge, I knew it was a rug project because the team said about sibil. team blurred the standards, diverted all the token to their wallets and dumped in market. And then back again, they want to proceed with the second rug. No one

@vooi_io Thank you for making this article. I know alot of people as unhappy with how the airdrop went down. My best tip if this happened to you, is simply move on. I've had my share of disappointments in this space, and holding a grudge leads nowhere. We move forward.

@vooi_io reflection https://t.co/AIGHSDWY7c

Our Crypto Talk is committed to unbiased, transparent, and true reporting to the best of our knowledge. This news article aims to provide accurate information in a timely manner. However, we advise the readers to verify facts independently and consult a professional before making any decisions based on the content since our sources could be wrong too. Check our Terms and conditions for more info.

Haedal Launches Haedal Liquidity, Upgrade On Haevault

Vooi Team Responds After $VOOI Falls 86% Post TGE

Grayscale Files S-1 to Launch First U.S. Bittensor ETP as AI Crypto Gains Momentum

Zebec Network Achieves ISO 20022 Compliance

Haedal Launches Haedal Liquidity, Upgrade On Haevault

Vooi Team Responds After $VOOI Falls 86% Post TGE

Grayscale Files S-1 to Launch First U.S. Bittensor ETP as AI Crypto Gains Momentum

Zebec Network Achieves ISO 20022 Compliance