AVAX Spot ETF debuts on Nasdaq with zero net inflows, signaling cautious investor sentiment and limited appetite for ETF exposure.

Author: Kritika Gupta

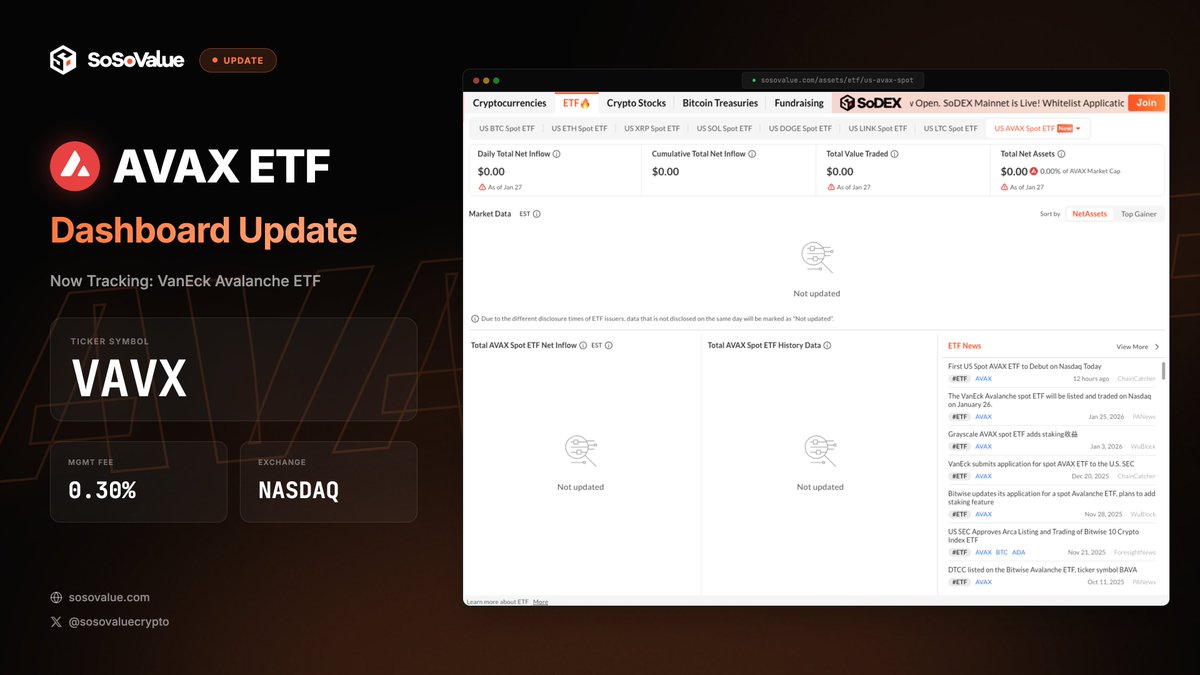

27th January 2026– Avalanche ETF (VAVX), the first U.S. spot exchange-traded fund designed to offer direct exposure to Avalanche’s native token AVAX, officially launched on Nasdaq on January 26, 2026. However, the debut drew a muted response. The fund recorded no net inflows on its first day, even though it generated roughly $330,000 in trading volume and ended the session with a net asset value (NAV) of $2.41 million.

This quiet launch matters because it shows how cautious investors remain toward altcoins right now. Even with expanding crypto ETF access in the U.S., market participants continue to concentrate capital in the most established assets.

High Signal Summary For A Quick Glance

Coin Bureau

@coinbureau

🚨LATEST: AVAX SPOT ETF DEBUTS ON NASDAQ WITH ZERO NET INFLOWS The first U.S. Avalanche spot ETF, VanEck’s $VAVX, began trading on Nasdaq but recorded no net inflows on Day 1 – posting $330K in volume and a $2.41M NAV. https://t.co/o0cnA6fckk

05:15 AM·Jan 27, 2026

SoSoValue

@SoSoValueCrypto

The SoSoValue AVAX ETF dashboard now tracks the VanEck Avalanche ETF (VAVX), the first US AVAX spot ETF, officially listed on NASDAQ. @avax @vaneck_us Key Details: - Ticker: VAVX - Exchange: NASDAQ - Mgmt Fee: 0.30% - Supports cash/in-kind creation & redemption - Staking enabled https://t.co/zMbCwODbhQ

02:32 AM·Jan 27, 2026

BSCN

@BSCNews

🚨UPDATE: FIRST-EVER AVAX ETF GOES LIVE ON NASDAQ The $AVAX Spot ETF, powered by @vaneck_us is now live on @Nasdaq under the ticker VAVX It becomes the first and currently the only U.S.-listed ETP focused on providing investors with exposure to the price return and potential https://t.co/tvvndzq0y1

03:16 PM·Jan 26, 2026

VanEck’s VAVX ETF launch followed a broader wave of regulatory progress and rising crypto ETF activity. VanEck filed for the Avalanche spot ETF in late 2025 and submitted multiple amendments before it ultimately reached approval. The product tracks the MarketVector Avalanche Benchmark Rate and aims to provide direct exposure to AVAX, while also positioning itself to potentially incorporate staking rewards.

At the same time, the AVAX Spot ETF entered the market during a period when investors still hesitate to deploy capital into smaller or more volatile crypto exposures. This matters because similar patterns have appeared before. For example, spot Ethereum ETFs launched in July 2024 with more than $1 billion in trading volume on day one but recorded only around $106 million in net inflows, reflecting early caution.

In contrast, Bitcoin spot ETFs launched in January 2024 with massive demand and recorded $4.66 billion in day-one trading volume, alongside inflows exceeding $655 million. That strong start helped fuel a price rally and accelerated institutional adoption. Ethereum’s experience looked different because initial trading coincided with profit-taking and short-term volatility, although inflows grew later as markets adjusted.

Key milestones related to this development

Launch sees strong demand, with $4.66B in day-one trading volume and $655M+ in inflows, accelerating institutional adoption.

Trading volume exceeds $1B on day one, but net inflows remain limited at around $106M, reflecting early investor hesitation.

VanEck submits the initial Avalanche spot ETF application in the U.S., beginning the formal regulatory review process.

VanEck updates filings through several amendments as regulators review structure, custody setup, and benchmark tracking.

VanEck’s VAVX becomes the first U.S. spot ETF for Avalanche, tracking the MarketVector Avalanche Benchmark Rate with potential staking positioning.

The temporary sponsor fee waiver ends, after which the ETF applies a 0.20% sponsor fee going forward.

VAVX posting zero net inflows on its first day highlights how selective investors remain, even when the product structure includes incentives like fee waivers. Traders still rotated capital, as shown by the trading volume, but institutions and long-term allocators did not commit fresh net capital on day one.

This dynamic reinforces a key takeaway: institutions currently prefer Bitcoin and Ethereum exposure, while they treat altcoin ETFs as higher-risk entries. In the current macro environment, investors still weigh uncertainties such as economic volatility, geopolitical pressure, and shifting market liquidity. As a result, many participants prioritize “proven” crypto allocations instead of adding fresh exposure to newer or less established assets.

For Avalanche specifically, this debut does not signal rejection of the ecosystem, but it does signal that accessibility alone does not guarantee demand. Instead, capital flows tend to follow sentiment and conviction. Therefore, VAVX’s subdued start may delay expectations of immediate institutional rotation into AVAX.

VAVX’s long-term performance will likely depend on two major variables: Avalanche’s ecosystem growth and overall market conditions. The ETF improves institutional access to AVAX, which strengthens the infrastructure for potential future adoption. However, the market still needs stronger risk appetite before capital meaningfully rotates into altcoin-focused products at scale.

Over time, incentives such as staking-related rewards and fee reductions could attract inflows, particularly if broader sentiment shifts bullish. Additionally, if Avalanche delivers stronger network activity, adoption growth, or ecosystem milestones, institutions may gain more confidence in using VAVX as a regulated exposure route.

Our Crypto Talk is committed to unbiased, transparent, and true reporting to the best of our knowledge. This news article aims to provide accurate information in a timely manner. However, we advise the readers to verify facts independently and consult a professional before making any decisions based on the content since our sources could be wrong too. Check our Terms and conditions for more info.