Aztec Network, a privacy-focused Layer 2 built on Ethereum, launched its AZTEC token but the price faced immediate drop.

Author: Sahil Thakur

Steady attention without excessive speculation.

12th February 2026 – Aztec Network, a privacy-focused Layer 2 built on Ethereum, launched its AZTEC token but the price faced immediate drop. The launch followed years of development and a unique token sale structure, but the token faced immediate selling pressure and criticism from the community.

High Signal Summary For A Quick Glance

Maran

@MaransCrypto

how to raise $159,300,000, run, and come back to rug the case of aztec - bring privacy to Ethereum - raised $2.1m in seed round - raised $17m from paradigm - raised $100m from a16z - these were traditional vc funding rounds first project launch and failure - launched zk. https://t.co/Rjf3cHpLdB

02:23 PM·Feb 11, 2026

Amin🇮🇷🇮🇱

@0xAminMAD

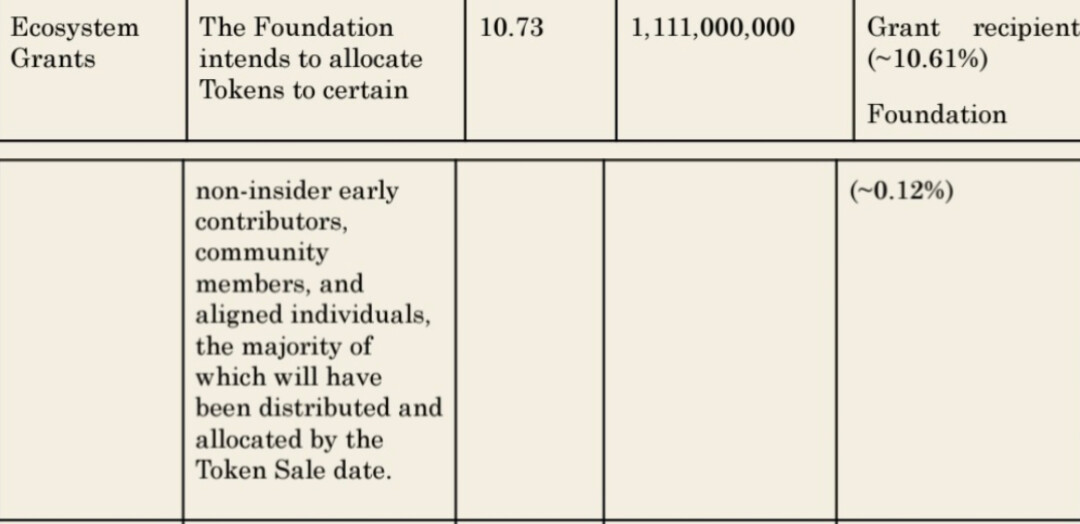

One mysterious thing about $Aztec tokenomics 10% grants for non-insider early contributors (devs & builders like human tech bridge, dashtec, and other early projects on Aztec), community members (not us!), aligned individuals (family & friends) It is fully unlocked at tge! And https://t.co/hdiK6J2ChY

11:42 AM·Feb 11, 2026

Morsy

@morsyxbt

gm, Aztec is live in binance perp markets at $0.02 cp was $0.047 - sale participants are at 50% loss first zama public sale rekted users, now $AZTEC these cash-grab icos are ruining this space i didn't participate in this trash though, hbu ? https://t.co/tgC4CDK0ri

05:04 AM·Feb 11, 2026

Aztec Network uses zero-knowledge proofs to enable privacy-preserving transactions while staying compatible with Ethereum. The team introduced programmability to privacy, allowing developers to build apps with opt-in confidentiality.

The project originated in 2018, raised between $119 million and $178 million in funding, and released several key products. These included Aztec Connect in 2022 (later sunset), a public testnet in May 2025, and the Ignition mainnet in November 2025. The mainnet launched as a decentralized, operatorless L2, with staking activated in advance of the token sale.

Aztec’s token sale began on November 13, 2025. It used Uniswap Labs’ Continuous Clearing Auction (CCA) format, designed to enable fair, on-chain price discovery. This was the first major test of the CCA model in the wild.

The sale offered 1.547 billion AZTEC tokens—about 15% of total supply—and targeted community distribution. Participants included ETH stakers, zk.money users, and Uniswap traders. Over 300,000 addresses were whitelisted. The team raised over 19,000 ETH (around $61 million) from more than 16,000 users.

The sale’s starting valuation was $350 million FDV, roughly 75% below Aztec’s last funding round. A post-sale liquidity pool on Uniswap v4 was seeded with 4,234 ETH, locked for at least 90 days.

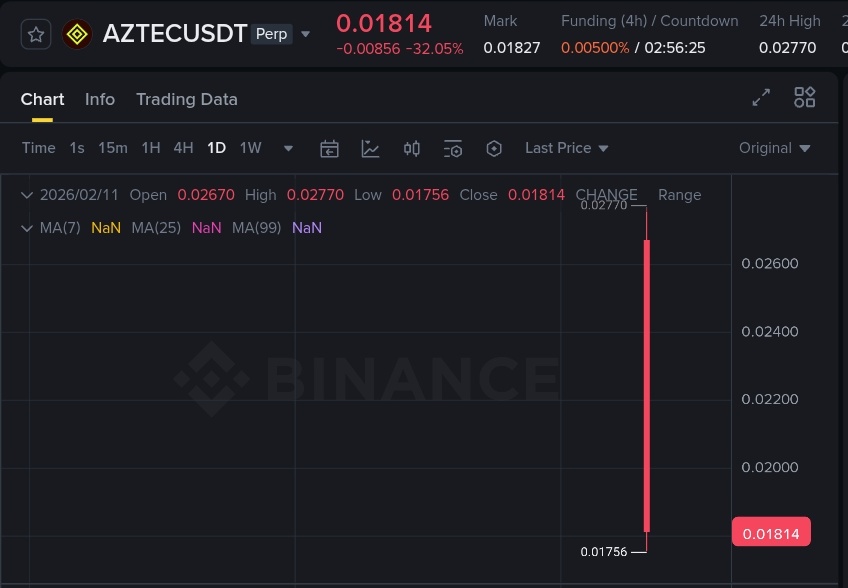

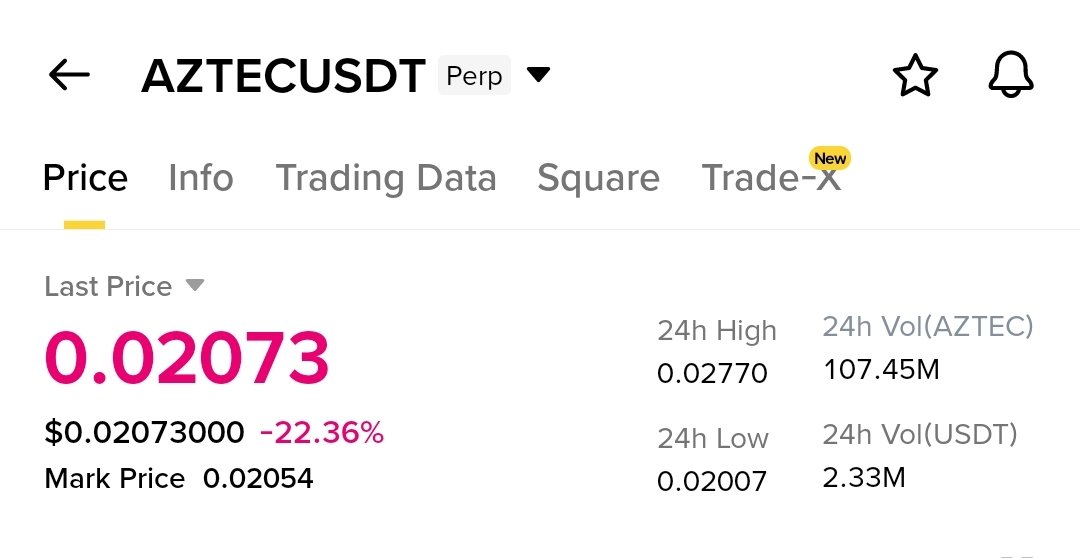

The token went live on February 11–12, 2026, with an initial listing price near $0.0188. Despite a brief spike to around $0.0473, the price quickly dropped over 60% within hours, settling back at ~$0.018. At that level, the market cap stood at about $53 million, with FDV around $189 million.

This steep drop created frustration among both community buyers and presale participants.

Loading chart...

Several factors contributed to the crash:

Aztec token launch compared with recent Layer 2 peers

The reaction from the crypto community was mixed but leaned negative. Many users accused the project of prioritizing VCs over loyal contributors. Some saw the CCA and sale structure as an over-engineered way to extract value while offering few benefits to retail buyers.

Others argued that the decision not to airdrop tokens to testnet participants or long-time users undermined trust. Comparisons were drawn to projects like Arbitrum and Uniswap, which had successful airdrop-based launches that encouraged loyalty.

On social media, some labeled the sale as exploitative or “VC cashout theater.” Others pointed to the declining price and restrictive lockups as signs that secondary buyers lacked reason to hold long term.

Despite the price crash, the Aztec team continues to promote the project as a long-term, privacy-first Layer 2. They’ve committed to decentralization from launch and believe their zero-knowledge technology and Noir developer tooling position them well for future growth.

Legal backing from Latham & Watkins and a structured mainnet rollout reflect serious planning. However, the community backlash presents a major challenge. Rebuilding trust will depend on how the team addresses concerns about token distribution, ecosystem incentives, and roadmap execution.

As of February 12, 2026, the token remains volatile. Traders and community members are watching closely for shifts in liquidity, early whale activity, and any new updates from the team.

Our Crypto Talk is committed to unbiased, transparent, and true reporting to the best of our knowledge. This news article aims to provide accurate information in a timely manner. However, we advise the readers to verify facts independently and consult a professional before making any decisions based on the content since our sources could be wrong too. Check our Terms and conditions for more info.

$0.02