Binance SAFU Bitcoin conversion shifts its $1B user protection fund into BTC over 30 days, adding volatility exposure.

Author: Kritika Gupta

30th January 2026- Binance has announced that it will fully convert its roughly $1 billion Secure Asset Fund for Users (SAFU) from stablecoins into Bitcoin over the next 30 days. SAFU is Binance’s user protection reserve, created to cover potential losses from hacks or other security incidents. By shifting the entire fund into BTC, Binance is positioning Bitcoin as the core reserve asset behind its user safety framework during a period of increased market uncertainty.

Binance also stated that it will actively maintain SAFU’s value during the transition and afterward. If market volatility causes the fund’s value to fall below $800 million, Binance will inject additional Bitcoin to bring it back up to the $1 billion threshold.

High Signal Summary For A Quick Glance

Conor Kenny

@conorfkenny

Binance has officially announced it will transition its $1 billion SAFU fund entirely into Bitcoin. The conversion from stablecoins will happen gradually over the next 30 days, signaling massive institutional buy pressure for $BTC throughout February. #Binance #SAFU https://t.co/P6X69dsJy3

12:02 PM·Jan 30, 2026

CryptoDep

@Crypto_Dep

⚡️ @Binance will convert its $1B SAFU fund stablecoin reserves into $BTC Binance has announced its plans to convert its SAFU fund’s $1B stablecoin reserves into #Bitcoin reserves within 30 days. The exchange will also conduct regular rebalancing of the SAFU fund based on https://t.co/sV0NMNoqZi

09:12 AM·Jan 30, 2026

Ash Crypto

@AshCrypto

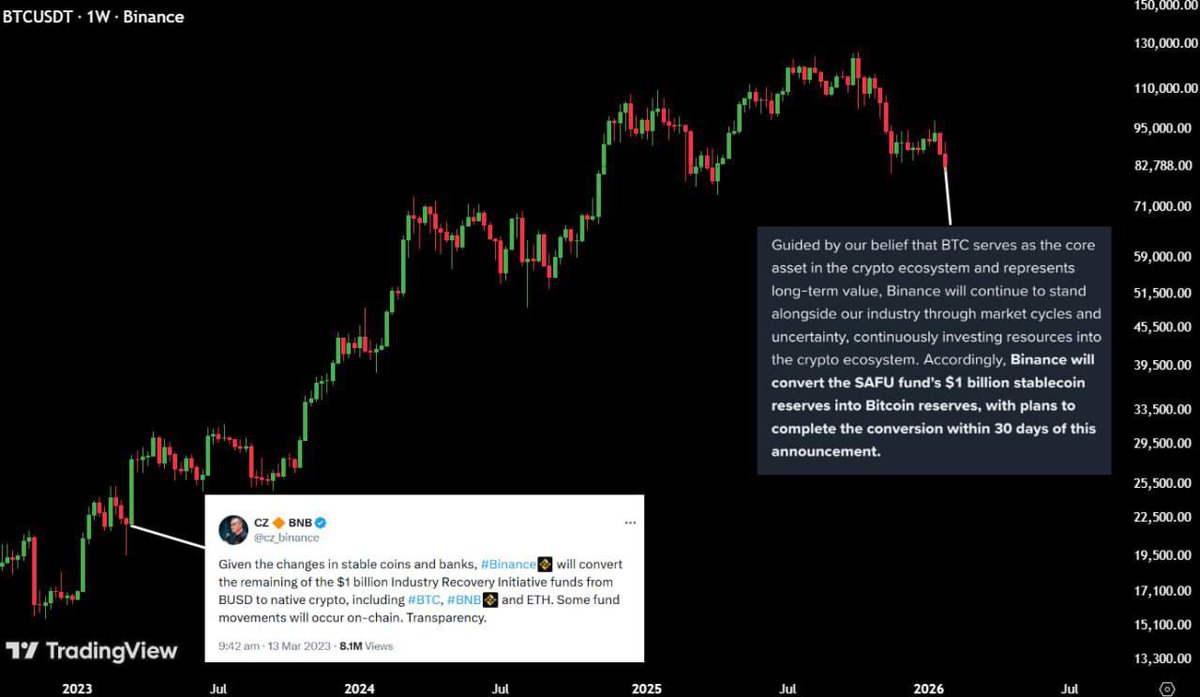

March 2023 - Binance announced conversion of $1 BILLION SAFU FUND into BTC, ETH and BNB. - BTC pumped 250% in a year, ETH pumped 200% and Crypto MCap added $1.8 trillion. January 2026 - Binance has announced to convert $1 BILLION SAFU FUND into Bitcoin. We all know what's https://t.co/wQyQpV7Ym3

08:51 AM·Jan 30, 2026

This decision comes amid heightened scrutiny around exchange behavior, reserve transparency, and stablecoin reliability. Community criticism has increased in recent weeks, and some observers have tied recent volatility to Binance’s influence. Cathie Wood of ARK Invest recently pointed to Binance-related activity as a contributing factor in a deleveraging cycle.

Binance framed the SAFU conversion as part of a broader industry-building approach and emphasised Bitcoin’s long-term role as a store of value. It also indirectly highlighted the risks stablecoins face, including regulatory pressure and occasional events.

Binance has executed similar treasury shifts before like SAFU Fund. In March 2023, the exchange converted $1 billion previously held in BUSD into a basket including Bitcoin, Ethereum, and BNB, following the U.S. banking crisis that shook confidence across markets. Later, in April 2024, Binance shifted SAFU assets entirely into USDC to prioritize stability. This latest move reverses that approach and leans into Bitcoin instead.

Key milestones related to this development

Binance launches the Secure Asset Fund for Users (SAFU) to strengthen user protection and build trust after growing security concerns across exchanges.

Binance converts roughly $1B from BUSD into Bitcoin, Ethereum, and BNB, positioning crypto assets as reserve hedges during U.S. banking crisis volatility.

Binance reallocates SAFU reserves entirely into USDC to prioritize stability and lower volatility exposure in user protection funds.

Market turbulence grows and community criticism rises, with influential voices highlighting Binance’s impact on broader crypto deleveraging events and reserve narratives.

Binance confirms it will fully convert the ~$1B SAFU fund from stablecoins into Bitcoin, reinforcing BTC as the core reserve asset for user security.

Binance executes the stablecoin-to-BTC conversion in stages across 30 days to reduce price impact and avoid sudden liquidity shocks.

If SAFU valuation falls below $800M due to BTC volatility, Binance injects additional Bitcoin to restore the reserve back to its $1B target.

This conversion could support Bitcoin sentiment because a $1 billion shift into BTC increases demand and reinforces BTC’s role as the market’s primary reserve asset. Binance plans to execute purchases gradually, which reduces the risk of sudden market disruption, yet it still introduces a major buyer into the market over a 30-day period. As a result, traders may interpret this as an exchange-driven tailwind for BTC.

At the same time, holding SAFU fully in Bitcoin increases volatility exposure. Unlike stablecoin reserves, Bitcoin reserves can drop rapidly in value during sharp sell-offs, which could force Binance to top up SAFU more frequently if BTC price declines. Therefore, the strategy strengthens BTC alignment but increases the need for active reserve management.

More broadly, Binance is sending a message that the industry is increasingly treating Bitcoin as a treasury-grade asset, not just a speculative token. This could influence other platforms and institutions to reconsider stablecoin-heavy reserve models.

Binance said users can verify SAFU on-chain through its public wallet address, supporting transparency around the reserve. The exchange also stated it will rebalance and audit the fund regularly to maintain the $1 billion target. Binance is positioning this move as a continuation of its security posture since SAFU’s creation in 2018.

Looking forward, a Bitcoin-only SAFU model could set a precedent for exchange safety funds across the market. It may boost confidence among Bitcoin supporters and reinforce BTC dominance in institutional narratives. However, it also increases reliance on Bitcoin price stability at a time when volatility remains a core feature of the crypto cycle.

Our Crypto Talk is committed to unbiased, transparent, and true reporting to the best of our knowledge. This news article aims to provide accurate information in a timely manner. However, we advise the readers to verify facts independently and consult a professional before making any decisions based on the content since our sources could be wrong too. Check our Terms and conditions for more info.