Coinbase Global, Inc. published its financial earnings results with the report covering Q4 2025 and the full 2025 fiscal year.

Author: Sahil Thakur

High attention and emotional sentiment detected.

13th February 2026 – Coinbase Global, Inc. published its financial earnings results with the report covering Q4 2025 and the full 2025 fiscal year. Coinbase showed mixed results. It experienced a quarterly loss amid a weak market, but the full year delivered record growth in trading volume and diversified products.

High Signal Summary For A Quick Glance

Mr. Crypto Whale 🐋

@Mrcryptoxwhale

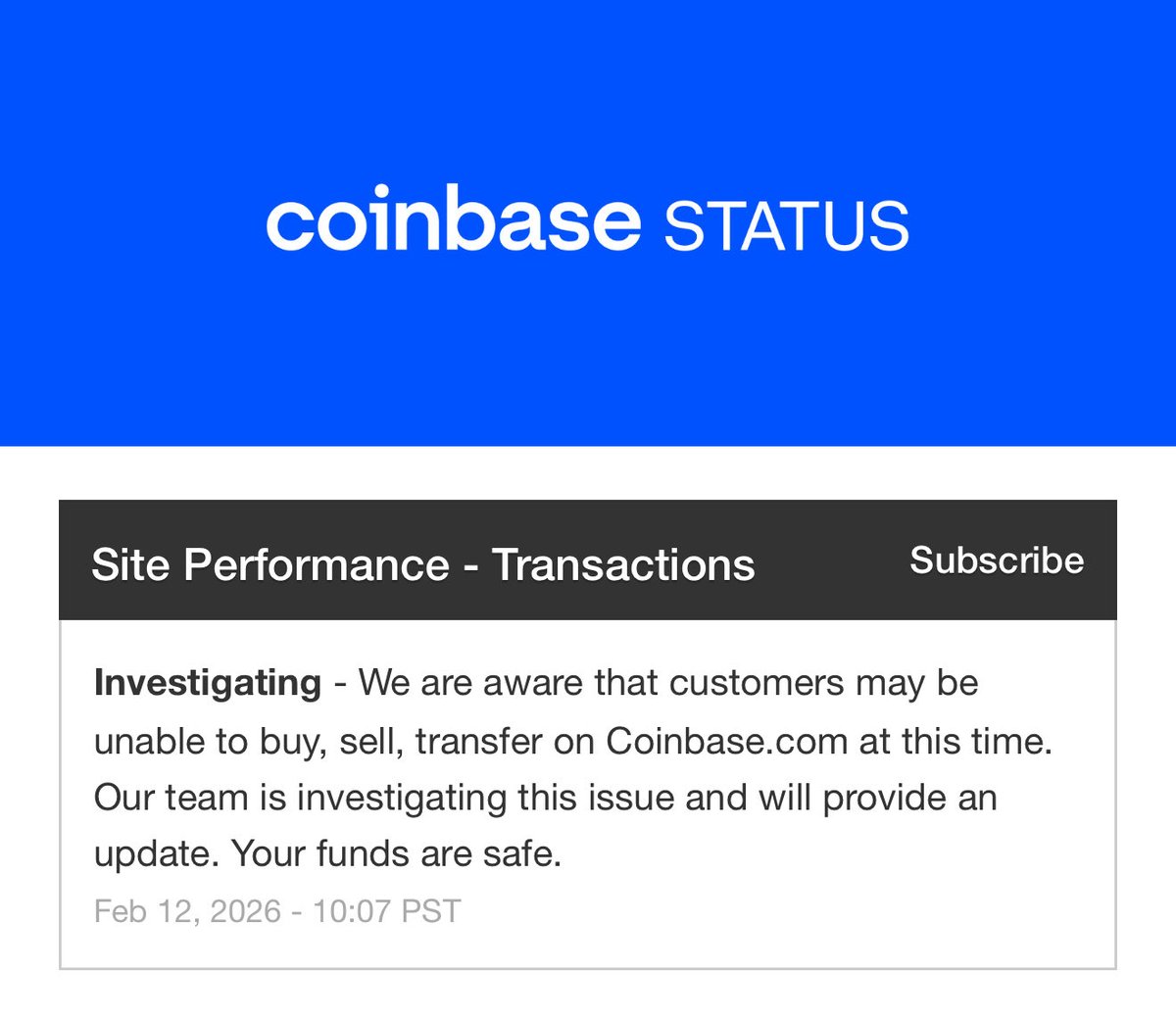

🚨 BREAKING: MASSIVE DISRUPTION REPORTED ON COINBASE USERS ARE CURRENTLY UNABLE TO BUY, SELL, OR TRANSFER CRYPTO AS CORE SERVICES EXPERIENCE OUTAGES. WHAT’S REALLY HAPPENING BEHIND THE SCENES? https://t.co/muFICDPpwh

09:40 PM·Feb 12, 2026

Crypton

@Crypton_on_x

1) what Must be an exciting day for the people working at Coinbase. https://t.co/t2m502yfUi

06:52 PM·Feb 12, 2026

Crypto Bitlord

@crypto_bitlord7

There is absolutely no reason to keep your funds on coinbase. At any moment they can be gone forever. And with the CEO dumping $550m of stock onto your head it’s clear everyone wants an exit. https://t.co/zgFXr5RQGR

06:50 PM·Feb 12, 2026

In Q4, total revenue reached $1.8 billion, down slightly from the previous quarter and down sharply from Q4 2024. Consumer transaction revenue dropped, while institutional transaction revenue rose significantly.

The quarterly net loss resulted mainly from unrealized losses in the crypto investment portfolio and strategic investments. Despite the loss, Coinbase maintained strong cash reserves with more than $11.3 billion in cash and equivalents.

For the full year, Coinbase posted strong gains across several key metrics.

Assets on the platform climbed significantly, up three times over three years. USDC holdings also reached record highs both in Coinbase products and in market capitalization.

Src: Coinbase

Coinbase closed the year with nearly 1 million Coinbase One subscribers, showing steady growth. The company now generates significant revenue from multiple product lines, not just trading fees.

Despite the quarterly slowdown, the broader picture shows increased engagement. Derivatives trading volumes set records. Subscription and stablecoin revenues continue to rise. Coinbase’s strategic expansion into new products added resilience against market cyclicality.

Operating expenses were higher than in previous years, reflecting investments in technology, marketing, and growth initiatives.

Even with higher spending, Coinbase delivered adjusted net income of $1.2 billion for the year.

Looking ahead, Coinbase offered cautious guidance for Q1 2026. It expects:

The company emphasized that results will still reflect market conditions and rate environments.

Coinbase shared the results across social platforms, emphasizing long‑term growth. CEO Brian Armstrong reiterated confidence in crypto adoption and Coinbase’s role. He highlighted volume gains, product diversification, and strong balance sheet metrics.

In comments, Armstrong said that crypto is transforming financial services and that Coinbase is positioned to benefit as markets develop. He also stressed that Coinbase stores significant crypto assets and plans to expand offerings like tokenized equities, stablecoin infrastructures, and global derivatives access.

Coinbase’s earnings paint a mixed but constructive picture. The weak Q4 reflects broader market pressure, especially lower trading revenue and unrealized losses on investments. At the same time, full‑year performance shows clear momentum, with diversified revenue streams, high trading volume, and expanded product reach.

Overall, Coinbase faces near‑term volatility, but the company’s strategic investments and growth in market share may support long‑term resilience.

Our Crypto Talk is committed to unbiased, transparent, and true reporting to the best of our knowledge. This news article aims to provide accurate information in a timely manner. However, we advise the readers to verify facts independently and consult a professional before making any decisions based on the content since our sources could be wrong too. Check our Terms and conditions for more info.

Backpack Introduces On-Chain IPOs, Bringing Public Offerings to Solana

Crypto Trader $24M Wrench Attack Theft After Violent Assault

Polygon Launches $1M Gas Rebate to Power Agentic Commerce

Block Street $BSB Airdrop Sparks Backlash After Token Launch

Backpack Introduces On-Chain IPOs, Bringing Public Offerings to Solana

Crypto Trader $24M Wrench Attack Theft After Violent Assault

Polygon Launches $1M Gas Rebate to Power Agentic Commerce

Block Street $BSB Airdrop Sparks Backlash After Token Launch