Hyperliquid HYPE unstaking distribution of 1.2M tokens on January 6 sparks sell pressure concerns and volatility risks across DeFi markets.

Author: Akshat Thakur

December 28, 2025 — Hyperliquid HYPE Unstaking Distribution confirmed that 1.2 million HYPE tokens will exit staking on January 6. The announcement has triggered debate over potential sell pressure and short-term market volatility.

Hyperliquid operates a high-performance blockchain optimized for perpetual futures trading with verifiable execution. The protocol runs on a BFT proof-of-stake architecture that emphasizes decentralization and onchain transparency. Hyperliquid records all trades and state changes directly onchain, distinguishing itself from centralized exchanges.

The platform aims to deliver institutional-grade performance while maintaining trust-minimized guarantees. Within this ecosystem, the HYPE token supports staking incentives, ecosystem rewards, and network participation. As adoption grows, token distribution events increasingly influence market perception.

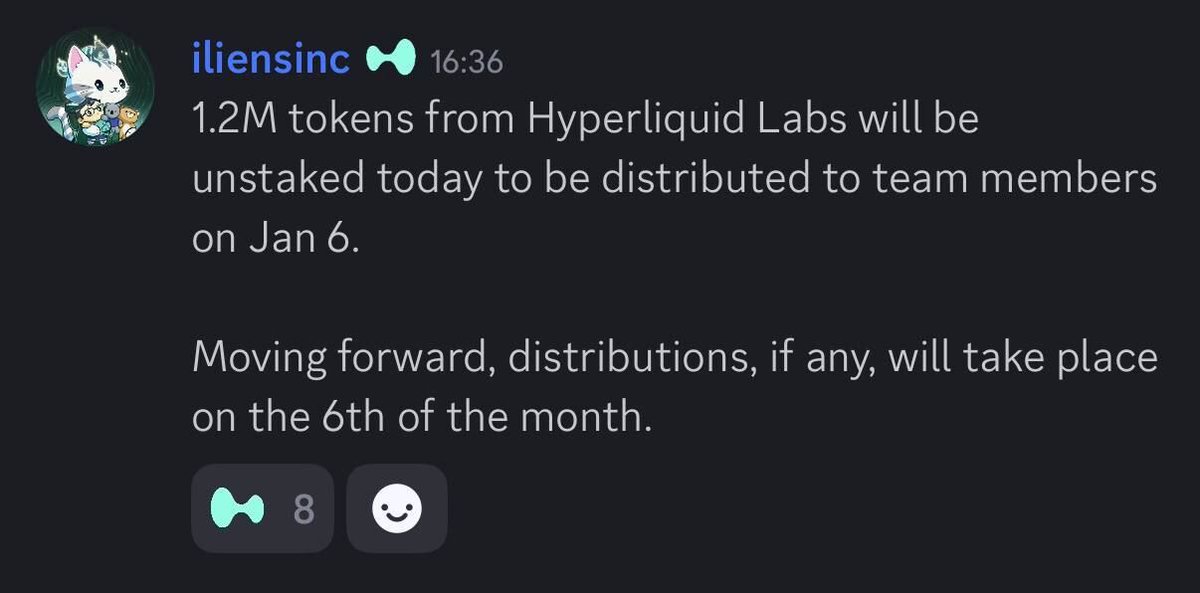

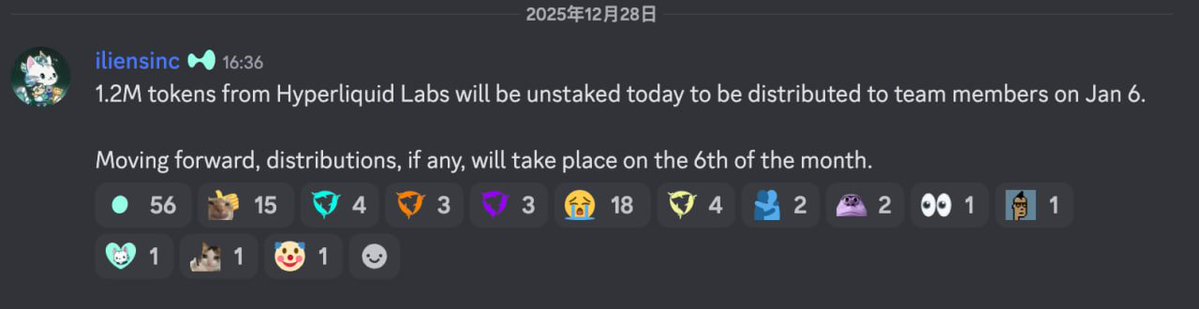

The Hyperliquid HYPE Unstaking Distribution surfaced on December 28, 2025, after it was reported that 1.2 million HYPE tokens will unstake for distribution on January 6. The disclosure immediately drew attention across crypto social channels. Traders highlighted that unstaking distributions often precede selling activity as recipients gain liquidity.

Cointelegraph

@Cointelegraph

🚨 HUGE: 1.2M $HYPE tokens are being unstaked for distribution on January 6th. https://t.co/Aenjo9G55G

05:00 PM·Dec 28, 2025

Wu Blockchain

@WuBlockchain

Hyperliquid cofounder iliensinc announced on Discord that 1.2M tokens from Hyperliquid Labs will be unstaked today to be distributed to team members on Jan 6. Moving forward, distributions, if any, will take place on the 6th of the month. https://t.co/x2plM9InDg https://t.co/zuwwOviqaU

04:21 PM·Dec 28, 2025

DEGEN NEWS

@DegenerateNews

NEW: HYPERLIQUID TEAM SAYS “1.2M TOKENS FROM HYPERLIQUID LABS WILL BE UNSTAKED TODAY TO BE DISTRIBUTED TO TEAM MEMBERS ON JAN 6” - “MOVING FORWARD, DISTRIBUTIONS, IF ANY, WILL TAKE PLACE ON THE 6TH OF THE MONTH” SOURCE: https://t.co/5MUkm6pQuX https://t.co/ftGZDfVFW5

03:44 PM·Dec 28, 2025

Several community members warned that the unlock could introduce short-term downside pressure. Others suggested that volatility could create tactical trading opportunities. The announcement framed January 6 as a critical liquidity event for HYPE markets.

Market participants quickly split into opposing camps following the announcement. Some traders described the distribution as fresh exit liquidity, cautioning holders to prepare for potential downside. Others emphasized that not all unstaked tokens translate into immediate selling.

Comments across social platforms reflected heightened anticipation rather than panic. The discourse underscored how unlock narratives often amplify sentiment-driven volatility. In DeFi markets, perception frequently moves prices ahead of actual flows.

The Hyperliquid HYPE Unstaking Distribution highlights a recurring challenge across DeFi: managing token liquidity events without destabilizing markets. Unlocks often create asymmetric risk, as traders price in selling before it occurs. Projects that communicate clearly and structure distributions carefully tend to reduce shock.

In contrast, poorly managed unlocks can damage confidence even if fundamentals remain intact. As perps trading becomes more competitive, perception around token supply dynamics matters as much as usage metrics. This event reinforces why unlock schedules remain a key risk factor for DeFi investors.

Our Crypto Talk is committed to unbiased, transparent, and true reporting to the best of our knowledge. This news article aims to provide accurate information in a timely manner. However, we advise the readers to verify facts independently and consult a professional before making any decisions based on the content since our sources could be wrong too. Check our Terms and conditions for more info.

Base Shifts to In-House Stack, Reducing Reliance on OP Stack

Nexus Labs Launch USDX Stablecoin Backed by US Treasuries

EDENA Launches World’s First Autonomic Financial OS

World Liberty Financial Tokenization Enters RWA Market

Base Shifts to In-House Stack, Reducing Reliance on OP Stack

Nexus Labs Launch USDX Stablecoin Backed by US Treasuries

EDENA Launches World’s First Autonomic Financial OS

World Liberty Financial Tokenization Enters RWA Market