Hyperliquid trading volume hits $2.6T, surpassing Coinbase as onchain perpetuals accelerate and decentralized derivatives reshape markets.

Author: Kritika Gupta

High attention and emotional sentiment detected.

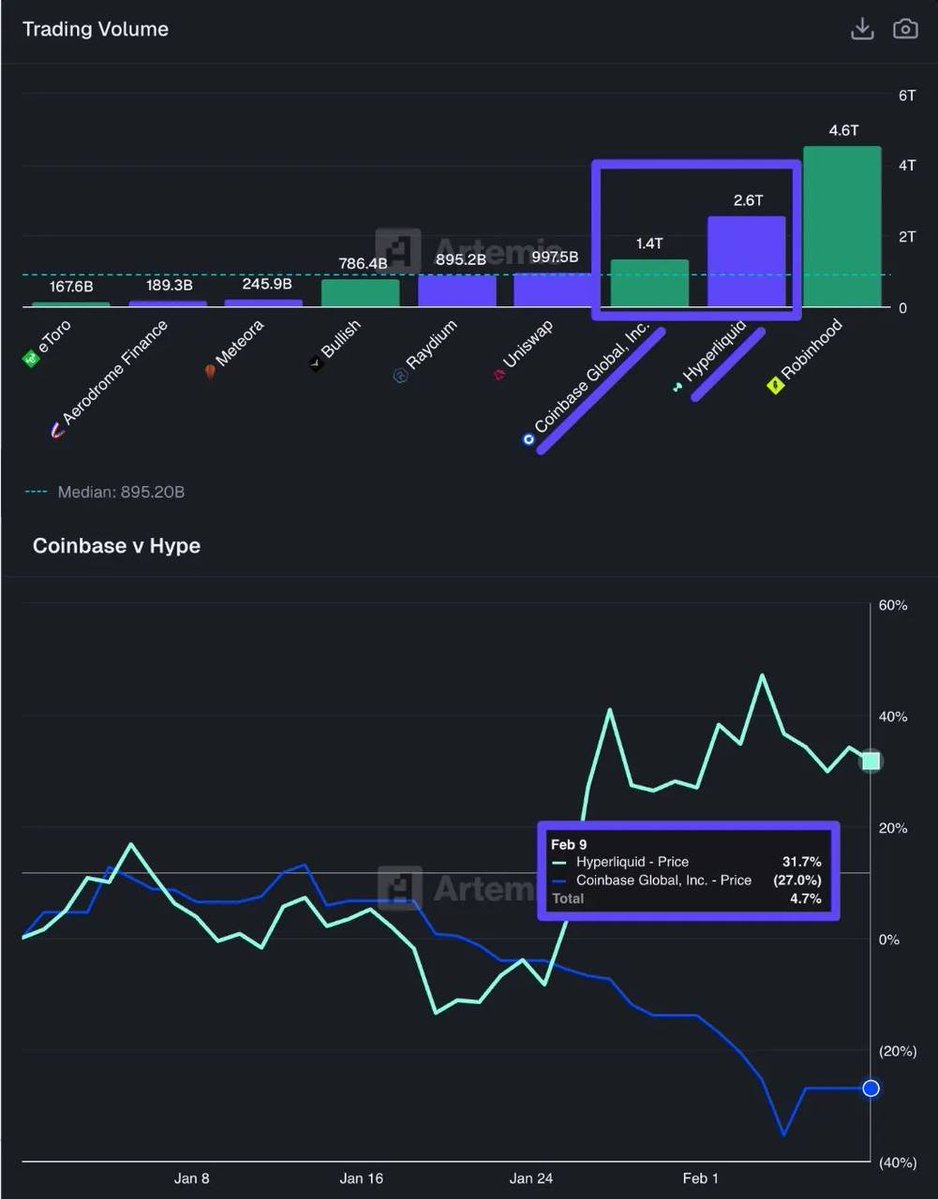

10th February 2026- Hyperliquid has overtaken Coinbase in year-to-date notional trading volume. According to fresh data from analytics firm Artemis, Hyperliquid processed $2.6 trillion in volume so far this year, compared with Coinbase’s $1.4 trillion. This marks a rare moment where a fully onchain derivatives platform outpaces one of the largest centralized exchanges in the industry.

At the same time, market performance has diverged sharply. Hyperliquid’s native token, HYPE, is up 31.7% year to date, while Coinbase stock (COIN) has declined 27.0%. As a result, the performance gap between the two now approaches 59%. Together, these figures highlight both a shift in trader activity and a change in investor expectations around where crypto trading growth may occur.

High Signal Summary For A Quick Glance

CryptOpus

@ImCryptOpus

💎💎💎💎💎 #Hyperliquid Quietly Overtakes Coinbase! The decentralized exchange #Hyperliquid is outperforming public giant #Coinbase across key metrics. Total #trading volume on #Hyperliquid has reached $2.6 trillion, compared to $1.4 trillion on Coinbase. Market #performance https://t.co/DF6FAMKTE3

09:33 AM·Feb 10, 2026

Shawn

@ShawnCT_

Traditional centralized giant @coinbase is being phased out by the market. Many people still haven’t realized that @HyperliquidX is more than just a Perp DEX. It is redefining how trading works and gradually stripping traditional centralized giants of their edge. https://t.co/PAu7pKe0hC

06:30 AM·Feb 10, 2026

Hyperliquid launched in 2023, shortly after the collapse of FTX reshaped trader priorities around custody, transparency, and platform risk. From the beginning, the team focused on building a fully onchain central limit order book on a custom Layer 1 blockchain. They introduced HyperBFT consensus to deliver sub-second finality and high throughput. As a result, Hyperliquid offers execution quality similar to centralized exchanges, while still preserving self-custody and onchain settlement.

Next, adoption accelerated through a points-based incentive program that culminated in a major airdrop in November 2024. At the time, Hyperliquid distributed over $1 billion worth of HYPE tokens to tens of thousands of users. Importantly, Hyperliquid trading volume remained elevated even after incentives normalized, signaling durable demand rather than short-term farming.

In 2025, Hyperliquid expanded further with the rollout of HyperEVM, which turned the platform into a broader ecosystem rather than a single trading venue. This expansion attracted developers, liquidity, and new use cases. Meanwhile, external conditions supported growth. Regulatory pressure on centralized exchanges increased, market volatility favored perpetual contracts, and traders sought efficient, permissionless alternatives.

Relative positioning against past updates or peers

Following the Artemis data release, discussion spread quickly across crypto media and social platforms. Observers emphasized not just headline volume figures, but also execution quality, liquidity depth, and sustained user activity. Consequently, sentiment has continued shifting away from legacy exchange brands toward high-performance onchain platforms.

Moreover, HYPE’s strength during a broader market slowdown has reinforced this narrative. In contrast, COIN’s decline reflects concerns around regulatory exposure, slower trading volumes, and margin pressure. Together, these trends suggest that investors increasingly favor decentralized trading infrastructure over traditional exchange models.

Looking ahead, Hyperliquid’s milestone points to a broader transition in crypto markets. Derivatives and perpetuals trading, long dominated by centralized exchanges, are steadily moving onchain. For Coinbase, this shift arrives amid regulatory challenges and the need to diversify revenue beyond transaction fees. While Coinbase retains advantages in compliance, custody, and institutional services, competition from decentralized platforms is intensifying.

For Hyperliquid, the achievement opens the door to deeper integrations, new asset classes, and further ecosystem expansion through HyperEVM. However, risks remain, including evolving DeFi regulation, competition from other high-performance chains, and the challenge of maintaining security and uptime at scale.

Our Crypto Talk is committed to unbiased, transparent, and true reporting to the best of our knowledge. This news article aims to provide accurate information in a timely manner. However, we advise the readers to verify facts independently and consult a professional before making any decisions based on the content since our sources could be wrong too. Check our Terms and conditions for more info.

Jump Trading Takes Equity Stakes in Kalshi and Polymarket

Hyperliquid Tops Coinbase With $2.6T in Onchain Trading Volume

MrBeast Enters Fintech With $1B Step Acquisition

Grant Cardone Lists Golden Beach Mansion for 700 Bitcoin

Jump Trading Takes Equity Stakes in Kalshi and Polymarket

Hyperliquid Tops Coinbase With $2.6T in Onchain Trading Volume

MrBeast Enters Fintech With $1B Step Acquisition

Grant Cardone Lists Golden Beach Mansion for 700 Bitcoin