A DEX launches Korean equity perpetual futures with 10x leverage for Hyundai, Samsung, SK Hynix, and KRCOMP onchain trading.

Author: Akshay

January 14, 2026. A major decentralized exchange launched Korean equity perpetual futures, offering onchain trading for Hyundai, Samsung, SK Hynix, and the KRCOMP index with up to 10x leverage. Hyundai Motor ($HYUNDAI), Samsung Electronics ($SAMSUNG), SK Hynix ($SKHYNIX), and the Korean Composite Index ($KRCOMP) are now tradable as synthetic contracts, giving users exposure to these assets without holding the underlying stocks or using traditional brokers. The markets operate 24/7 and integrate seamlessly into the DEX’s existing perpetual framework.

High Signal Summary For A Quick Glance

Tushant Suneja

@tushant_suneja

@Lighter_xyz shipping new markets is the easy part. bootstrapping liquidity is the real test.

We are excited to be the first DEX to offer Korean equity perps! These markets are live at 10X leverage: $HYUNDAI, $SAMSUNG, $SKHYNIX and the $KRCOMP (Korean Composite) index. https://t.co/cJjt9yshDK

02:54 PM·Feb 12, 2026

jayhan88

@BTCThinker88

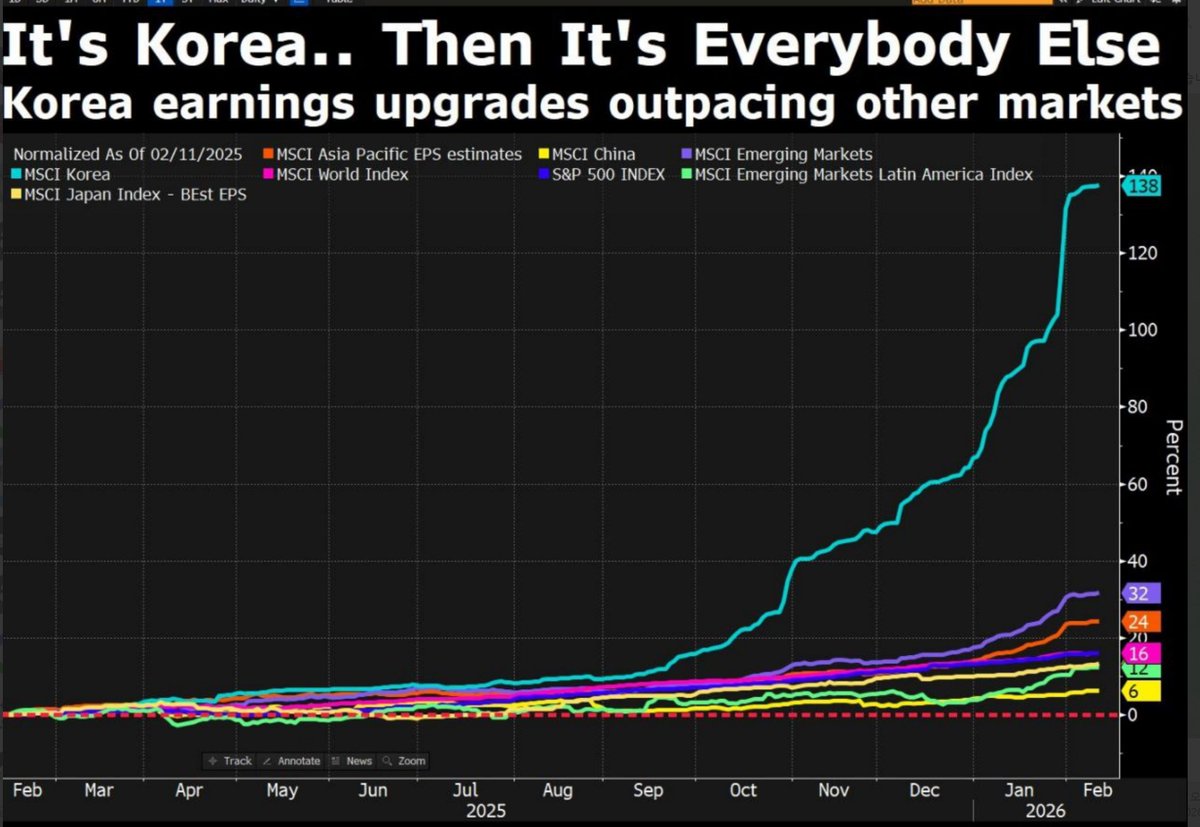

@Lighter_xyz In Korean equities, EPS revisions are notably strong—Korea is outperforming other markets, largely on the back of the memory upcycle. Samsung Electronics and SK Hynix, the dominant players in memory, are driving most of the earnings growth. Meanwhile, Hyundai looks materially https://t.co/YTkvMggvGQ

We are excited to be the first DEX to offer Korean equity perps! These markets are live at 10X leverage: $HYUNDAI, $SAMSUNG, $SKHYNIX and the $KRCOMP (Korean Composite) index. https://t.co/cJjt9yshDK

09:50 PM·Feb 11, 2026

Rich

@iwantlambo

@Lighter_xyz hyundai, samsung are huge rly hard to invest in these via normal tradfi in US so lighter adding this is insane if they add a few more like hynix it will be game over

We are excited to be the first DEX to offer Korean equity perps! These markets are live at 10X leverage: $HYUNDAI, $SAMSUNG, $SKHYNIX and the $KRCOMP (Korean Composite) index. https://t.co/cJjt9yshDK

08:47 PM·Feb 11, 2026

Lighter DEX launched Korean equity perpetual futures as part of DeFi’s move into real world assets. Traders can now access leveraged positions on Hyundai, Samsung, SK Hynix, and the Kospi index without traditional brokerages. The launch follows growing interest in South Korea’s tech and EV sectors, while Lighter’s Optimism based platform offers low cost, fast, on chain exposure.

The move was partly expected as DeFi expands into tokenized equities, but Lighter claiming the “first DEX” for Korean perps was a surprise. No prior teasers were made, though Crypto Twitter buzzed about undervalued Korean tech stocks. Early engagement was high, but trading volumes remain modest, showing adoption is still developing.

Timeline: Lighter DEX from Mainnet Launch to Korean Equity Perps

Lighter DEX launches on Optimism with zero-fee perpetual trading powered by zk-proofs for verifiable order matching and liquidations, reaching billions in daily volume during invite-only access.

The $LIT token generation event distributes 25% of supply to the community, enabling revenue sharing with 50% of supply allocated to ecosystem growth and buybacks.

Lighter expands into real-world assets with leveraged U.S. equity perpetual contracts on mainnet, marking its entry into tokenized TradFi exposure.

Staking for $LIT goes live, granting gated access to internal liquidity providers and funding rate rebates for participants.

Lighter becomes the first DEX to launch on-chain Korean stock perpetuals at 10x leverage, including $HYUNDAI, $SAMSUNG, $SKHYNIX, and the $KRCOMP index.

Planned infrastructure upgrades include EVM scalability improvements and shared collateral mechanisms across exchanges, alongside potential expansion into FX, commodities, options, and prediction markets.

The ongoing points farming campaign concludes, with remaining community token allocations reserved for future incentive programs.

Korean equity perps on a DEX are new, but similar launches have occurred. Perpetual Protocol added equity synths in 2021, boosting $PERP, drawing positive Crypto Twitter attention, inspiring copycat DEXes, and increasing DeFi TVL. GMX added tokenized equities in 2022–2023, driving $GMX momentum, low fee narratives, and institutional interest.

Hyperliquid expanded to equity contracts in 2024, generating massive volumes and $HYPE gains. Reactions highlighted tokenized RWAs and TradFi DeFi bridges, while systemic effects included fee-driven capital rotation, Layer 2 improvements, and liquidity fragmentation, showing both growth potential and risks.

Comparison of Korean equity perps launch vs. prior U.S. stock perps rollout

After Lighter DEX launched Korean equity perps for $HYUNDAI, $SAMSUNG, $SKHYNIX, and $KRCOMP at 10x leverage on February 11, 2026, investors should watch adoption, liquidity, and ecosystem integration. Additionally, updates in Q1 2026 and the March 24 end of the $LIT points program will signal demand and retention. Furthermore, early trading volumes, funding rates, and aggregator integrations will show how the markets are performing and impacting DeFi.

Governance and roadmap milestones matter as well. Lighter’s revenue-sharing model for $LIT holders could evolve through DAO proposals. Expansions to additional Korean or global equities and multi chain margin features could drive growth. Positive shifts may come from market volatility or oracle partnerships, while technical issues, low adoption, or regulatory action by the Korean FSC could slow momentum and affect token performance.

Our Crypto Talk is committed to unbiased, transparent, and true reporting to the best of our knowledge. This news article aims to provide accurate information in a timely manner. However, we advise the readers to verify facts independently and consult a professional before making any decisions based on the content since our sources could be wrong too. Check our Terms and conditions for more info.

Hibachi Partners with Arc for On-Chain FX Trading

ETHZilla Makes History With Launch of Tokenized Jet Engine Asset

Binance France CEO Targeted in Armed Home Invasion

Polymarket Launches 5-Minute Bitcoin Price Markets to Boost High-Frequency Trading

Hibachi Partners with Arc for On-Chain FX Trading

ETHZilla Makes History With Launch of Tokenized Jet Engine Asset

Binance France CEO Targeted in Armed Home Invasion

Polymarket Launches 5-Minute Bitcoin Price Markets to Boost High-Frequency Trading