MegaETH Stress Test targets 11B transactions in 7 days to prove real-time Ethereum Layer 2 performance for gaming and DeFi.

Author: Kritika Gupta

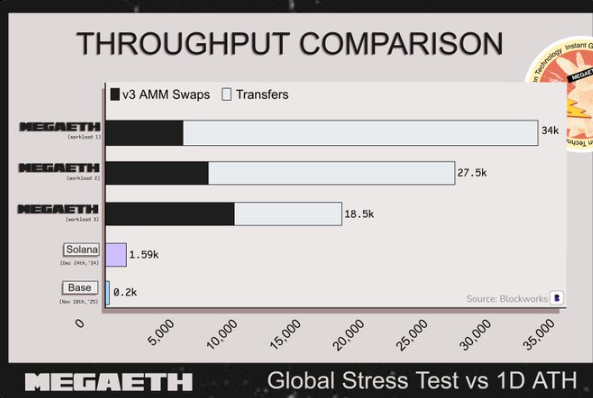

20th January 2026- MegaETH will kick off a seven-day global stress test , opening its mainnet to real users while deliberately pushing the network to its limits. The goal is ambitious: process 11 billion transactions at 15,000–35,000 true transactions per second (TPS), all while maintaining sub-millisecond latency and ultra-low fees.

Unlike closed benchmarks or synthetic load tests, this trial will run live applications especially latency-sensitive gaming and DeFi under extreme, sustained pressure. In short, MegaETH wants to prove it can behave like a “real-time” EVM chain, not just a fast one on paper.

High Signal Summary For A Quick Glance

Whale Factor

@WhaleFactor

MegaETH Launches Global Stress Test — 11 Billion Transactions in 7 Days On January 22, MegaETH is opening the mainnet to users for several latency-sensitive apps, while the chain is under intense sustained load. https://t.co/1JHX3oPBGV

12:20 PM·Jan 20, 2026

RAREMINTS

@raremints_

🔥 $MEGAETH just announced its Global Stress Test. On Jan. 22, the highly-awaited EVM blockchain is opening its mainnet to users for several latency-sensitive apps. The project further announced that the Public Mainnet will proceed a few days after. https://t.co/ueUro9goPd

08:43 AM·Jan 20, 2026

Joestar⭐

@JoestarCrypto

WOW WOW WOW so much info So basically in 3 days MegaETH will run its mainnet Global Stress Test with a sustained 15–35k TPS + your activty on @stompdotgg + @smasherdotfun For info Solana peak was 4.8k TPS (non-vote) If Mega passes this test it’s insane and we’re getting https://t.co/m6EZyxSDxN https://t.co/0kl4ajnVqH

The MegaETH Global Stress Test 11B transactions in 7 days. On Jan 22nd, we’re opening mainnet to users for several latency-sensitive apps while the chain is under intense sustained load. Ultra-low fees. Real-time transactions. Public Mainnet in the days that follow. https://t.co/ZIOZnctCZJ

05:57 PM·Jan 19, 2026

MegaETH traces its origins to 2022. At that time, computer scientist Yilong Li began designing the protocol to address Ethereum’s scaling limits. He drew direct inspiration from Vitalik Buterin’s Endgame vision for Layer 2s.

Momentum picked up in mid-2024. MegaETH closed a $20 million seed round led by Dragonfly Capital, with backing from Buterin and Ethereum co-founder Joseph Lubin. After that, total funding climbed above $80 million. This included a $10 million community fund in December 2024 and a $50 million public token sale in October 2025.

On the technical side, progress moved quickly. MegaETH launched its testnet in March 2025 and reportedly peaked near 47,000 TPS. Later, in December 2025, it released a mainnet beta called “Frontier,” focused on developer onboarding. Meanwhile, ecosystem partnerships such as Ethena’s USDM stablecoin and the MegaMafia incubator pushed the network closer to a large-scale public test.

Crucially, no Ethereum Layer 2 has attempted a user-driven stress test at this scale. In the past, Ethereum mainnet faced heavy load during the 2017 ICO boom and the 2021 NFT surge. However, those events emerged organically and without planning.

By contrast, rollups like Arbitrum and Optimism followed audits and phased launches. They avoided sustained live overloads. Even Ethereum’s 2024 Dencun upgrade boosted throughput indirectly, rather than through a purpose-built stress test like this one.

Key milestones related to the megaETH stress test

Yilong Li begins designing MegaETH to address Ethereum scalability limits, inspired by the Endgame Layer 2 vision.

MegaETH raises a seed round led by Dragonfly Capital, accelerating protocol development and hiring.

A $10M community fund is introduced to support ecosystem growth and early builders.

MegaETH launches its testnet, reportedly peaking near 47,000 TPS under controlled conditions.

A $50M public token sale pushes total funding raised beyond $80M.

The Frontier beta opens to developers, focusing on integrations and tooling readiness.

MegaETH launches a seven-day, user-driven stress test targeting 11 billion transactions.

During the test window, MegaETH will push a heavy mix of ETH transfers and v3 AMM swaps through the Kumbayaprotocol, while real users interact with live apps.

Technically, MegaETH relies on a single sequencer paired with a heterogeneous execution architecture, enabling aggressive parallelization and sub-millisecond block times. Throughout the test, the team says it will publicly surface failures, fixes, and performance data, aiming for transparency rather than a flawless marketing demo.

Several ecosystem projects have already confirmed readiness. For example, Warren, a fully on-chain web hosting platform, plans to go live on Day 1, with deployments already active on testnet.

If MegaETH delivers as advertised, it could become one of the strongest proofs yet that Ethereum can support Web2-class user experiences through L2s. Real-time DeFi, on-chain gaming, and even AI-driven applications would become far more practical without leaving the Ethereum ecosystem.

However, risks remain. Sequencer centralization, long-term decentralization plans, and lingering skepticism around aggressive fundraising could still slow adoption. Market observers also note that strong technical launches do not guarantee immediate token stability past L2 launches.

Our Crypto Talk is committed to unbiased, transparent, and true reporting to the best of our knowledge. This news article aims to provide accurate information in a timely manner. However, we advise the readers to verify facts independently and consult a professional before making any decisions based on the content since our sources could be wrong too. Check our Terms and conditions for more info.

Pump.fun Chat Leaks: Jarett Dunn Releases Telegram Chats

Study From BPI Shows AI Agents Prefer Bitcoin Over Stablecoin

AgentMail x402 Protocol Brings On-Chain Email to AI Agents

Uniswap Wins Full Dismissal of the Scam Token Class Action Lawsuit

Pump.fun Chat Leaks: Jarett Dunn Releases Telegram Chats

Study From BPI Shows AI Agents Prefer Bitcoin Over Stablecoin

AgentMail x402 Protocol Brings On-Chain Email to AI Agents

Uniswap Wins Full Dismissal of the Scam Token Class Action Lawsuit