The Ocean Fetch.ai feud intensifies as Binance restricts OCEAN deposits amid legal threats and allegations over $84M in disputed ASI tokens.

Author: Akshat Thakur

October 16, 2025 –The ongoing Ocean Fetch.ai feud has escalated into legal threats, on-chain accusations, and reactions from Binance all centered on roughly 286 million Fetch.ai (FET) tokens valued near $84 million. The dispute stems from the 2024 Artificial Superintelligence (ASI) Alliance, a merger that unified Fetch.ai, Ocean Protocol, and SingularityNET under a shared token structure.

Fetch.ai CEO Humayun Sheikh publicly alleged that Ocean Protocol minted 719 million OCEAN tokens in 2023, later swapping 661 million for 286 million FET during the ASI merger.

He claimed that millions of these tokens were transferred to market-making firms and centralized exchanges without full disclosure. Sheikh compared the move to “a rug pull,” urging exchanges to freeze related wallets and calling for legal redress.

Amid the intensifying Ocean Fetch.ai feud, Binance announced plans to cease ERC-20 OCEAN deposits starting October 20. The exchange said deposits via other supported networks will remain functional, but ERC-20 transactions afterward “will not be credited and may lead to asset loss.”

While Binance did not cite the dispute directly, analysts believe the restriction indicates internal risk assessments given the volume of disputed tokens on . Sheikh interpreted the action as Binance “listening” to community calls for transparency.

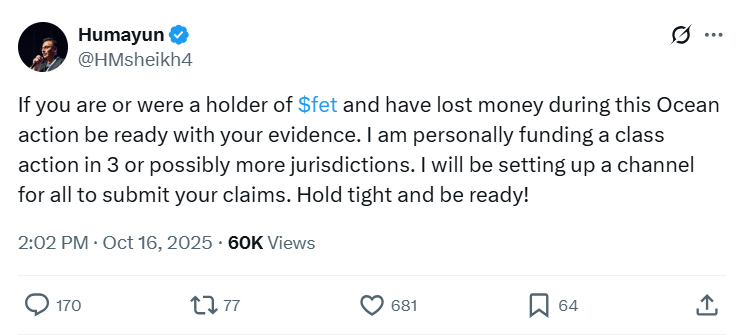

Sheikh vowed to fund class-action lawsuits across multiple jurisdictions and invited FET holders to provide evidence. He named Binance, GSR, and ExaGroup as parties urged to investigate the token transfers.

In contrast, Ocean Protocol denied all allegations, calling them “unfounded claims and harmful rumors.”

Ocean stated that its treasury remains intact and said it had offered to make adjudicator findings public a proposal Sheikh allegedly rejected. The reference to an adjudicator implies that the matter has entered formal legal arbitration under the ASI Alliance merger framework.

The Artificial Superintelligence Alliance was hailed as a unifying framework for decentralized AI projects but has since become a focal point for governance and transparency debates.

Market watchers warn that unresolved infighting could erode investor confidence in AI-linked crypto ecosystems just as adoption accelerates.

Loading chart...

Our Crypto Talk is committed to unbiased, transparent, and true reporting to the best of our knowledge. This news article aims to provide accurate information in a timely manner. However, we advise the readers to verify facts independently and consult a professional before making any decisions based on the content since our sources could be wrong too. Check our Terms and conditions for more info.

Clearpool 2026 Roadmap Focuses on Tokenized Credit

Circle Partners With Polymarket to Upgrade to Native USDC

KvantsAI Confirms $KVAI TGE for 10 February 2026

Fidelity Launches FIDD Stablecoin With 1:1 Minting on Ethereum

Clearpool 2026 Roadmap Focuses on Tokenized Credit

Circle Partners With Polymarket to Upgrade to Native USDC

KvantsAI Confirms $KVAI TGE for 10 February 2026

Fidelity Launches FIDD Stablecoin With 1:1 Minting on Ethereum