Omnipair Solana launches beta with oracle-free lending, enabling borrowing against memecoins while improving DeFi capital efficiency.

Author: Kritika Gupta

High attention and emotional sentiment detected.

17th February 2026- Omnipair has officially launched its beta version on Solana at omnipair.fi, introducing a new lending automated market maker that allows users to borrow against memecoins and illiquid tokens. Unlike traditional lending protocols, Omnipair does not rely on external price oracles. Instead, it integrates swaps, lending, and leverage into unified liquidity pools. As a result, the protocol reduces oracle manipulation risk and improves capital efficiency.

MetaDAO and Colosseum support Omnipair’s development, and MetaDAO contributes its futarchy-based governance model. This governance system uses market mechanisms instead of traditional voting to guide ecosystem decisions.

High Signal Summary For A Quick Glance

jussy

@jussy_world

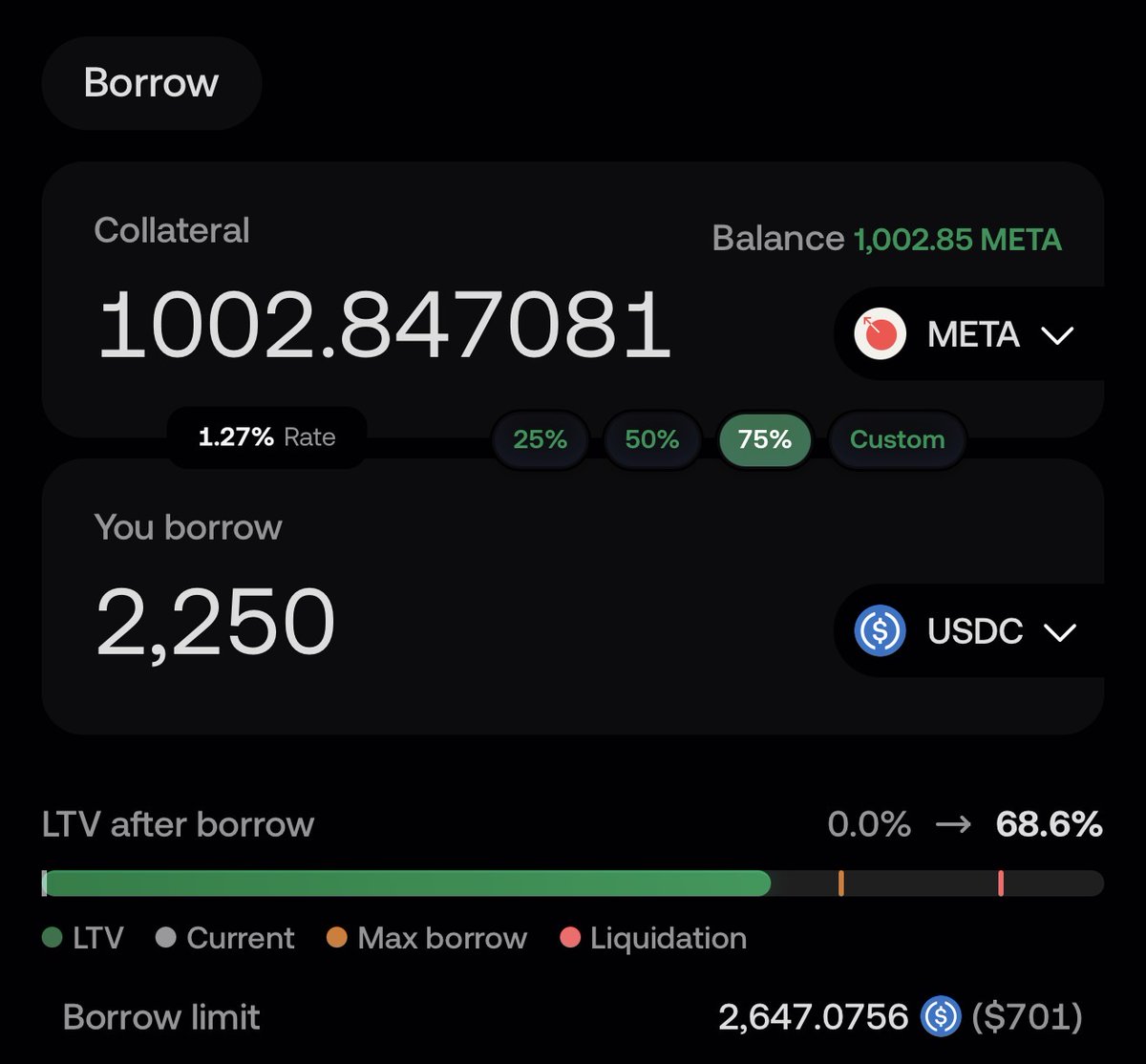

Well, @solana should be proud of this launch You can borrow against almost any token, even memecoins Including tokens most lending markets would never touch @omnipair built a next-gen lending AMM For example, I can borrow against $META paying only 1.3% Incredible tech https://t.co/TiIYDNygTL

12:13 PM·Feb 17, 2026

Solana’s rapid growth has created strong demand for more flexible lending infrastructure. The network’s fast transaction speeds and low fees have attracted a large number of new tokens, especially memecoins and long-tail assets. However, traditional protocols such as Aave and Compound often avoid these assets due to oracle dependency and risk management limitations.

MetaDAO developed Omnipair to address this gap. MetaDAO operates as a Solana launchpad that uses futarchy, which allows markets to determine funding outcomes based on economic incentives. This approach improves capital allocation efficiency and reduces governance manipulation risk.

Previous MetaDAO launches demonstrated strong but volatile performance. Several projects achieved significant returns after launch, while others experienced rapid corrections. Nevertheless, MetaDAO proved that permissionless, market-driven capital formation can succeed on Solana. Therefore, Omnipair builds on this model to deliver a more flexible lending system.

Relative positioning against past updates or peers

Loading chart...

Omnipair’s core innovation is its Generalized Automated Market Maker engine. This system combines trading, lending, and leverage into a single liquidity pool. Users can create pools instantly by selecting token pairs and configuring parameters such as swap fees, loan-to-value ratios, and volatility smoothing settings.

Most importantly, Omnipair eliminates external price oracles. Instead, it calculates asset pricing using market activity within the liquidity pool. The protocol uses a time-weighted exponential moving average to reduce volatility manipulation. As a result, it removes a major attack vector that has historically affected DeFi protocols.

The protocol also supports leverage through looping strategies. Users deposit collateral, borrow assets, and reinvest repeatedly. The maximum leverage depends on the collateral factor, which adjusts based on market conditions.

Additionally, Omnipair isolates risk at the pool level. Each pool operates independently, which prevents systemic risk from spreading across the protocol. The open-source design also improves transparency and security.

Omnipair could significantly expand lending access on Solana. It allows traders to borrow against assets that traditional protocols exclude. As a result, it unlocks liquidity for memecoins, emerging tokens, and other long-tail assets.

Removing oracle dependency improves security and reliability. Oracle exploits have caused major losses across DeFi. Therefore, Omnipair’s market-driven pricing model strengthens protocol resilience.

Unified liquidity pools also improve efficiency. Liquidity providers earn multiple revenue streams, while traders gain easier access to leverage. Consequently, Omnipair could increase Solana’s total value locked if adoption grows.

Overall, Omnipair introduces a new model for decentralized lending. By removing oracle reliance and enabling permissionless markets, the protocol strengthens Solana’s position as a leading DeFi ecosystem.

Our Crypto Talk is committed to unbiased, transparent, and true reporting to the best of our knowledge. This news article aims to provide accurate information in a timely manner. However, we advise the readers to verify facts independently and consult a professional before making any decisions based on the content since our sources could be wrong too. Check our Terms and conditions for more info.