Reports surfaced that the U.S. Marshals Service, under the DOJ sold roughly 57.55 Bitcoin forfeited by the co-founders of Samourai Wallet.

Author: Sahil Thakur

6th January 2026 – Reports surfaced that the U.S. Marshals Service (USMS), under the DOJ , sold roughly 57.55 Bitcoin forfeited by the co-founders of Samourai Wallet. These assets came from Keonne Rodriguez and William Lonergan Hill, who pleaded guilty to operating an unlicensed money-transmitting business.

However, blockchain data presents a more complicated picture. While the funds did move into Coinbase Prime custody, there’s no on-chain evidence confirming an actual sale. This raises fresh questions about whether the DOJ violated Executive Order 14233, which prohibits the liquidation of forfeited Bitcoin designated for the U.S. Strategic Bitcoin Reserve.

On November 3, 2025, 57.553 BTC moved from an address linked to Samourai Wallet forfeitures into a Coinbase Prime wallet. Shortly after, internally swept the funds to a different deposit address. These movements align with Coinbase’s routine custodial behavior.

Senator Cynthia Lummis

@SenLummis

Why is the U.S. gov still liquidating bitcoin when @POTUS explicitly directed these assets be preserved for our Strategic Bitcoin Reserve? We can’t afford to squander these strategic assets while other nations are accumulating bitcoin. I’m deeply concerned about this report. https://t.co/XW5WxsfliA

🚨NEW: It seems that the SDNY/DOJ has sold the bitcoin that the Samourai devs paid it as part of their plea deal even though Executive Order 14233 mandates that forfeited bitcoin be held in the U.S.’s Strategic Bitcoin Reserve. And this wasn’t the first time in the Samourai case

01:54 AM·Jan 6, 2026

Crypto Rover

@cryptorover

💥BREAKING: 🇺🇸 DOJ seems to have violated President Trump's Strategic Bitcoin Reserve executive order by selling forfeited $BTC. That was not the promise! https://t.co/EdkG8cUNFf

01:46 AM·Jan 6, 2026

While the original deposit wallet now holds a zero balance, this alone does not indicate a sale. Coinbase frequently consolidates funds for internal accounting and custody. The BTC in question now resides within Coinbase’s broader Prime infrastructure. This cluster contains thousands of addresses used for storage, settlement, and liquidity.

Thus far, none of the blockchain activity shows the Bitcoin leaving Coinbase’s infrastructure or fragmenting into outputs that would suggest a trade execution. The transfer sequence follows typical custodial patterns and does not support the claim of liquidation.

Src: X (Crypto Rover)

Because Coinbase Prime handles conversions from BTC to USD off-chain, any actual sale would leave no trace on the blockchain. That means only off-chain records—such as DOJ documentation, court orders, or execution confirmations—can verify whether a sale occurred.

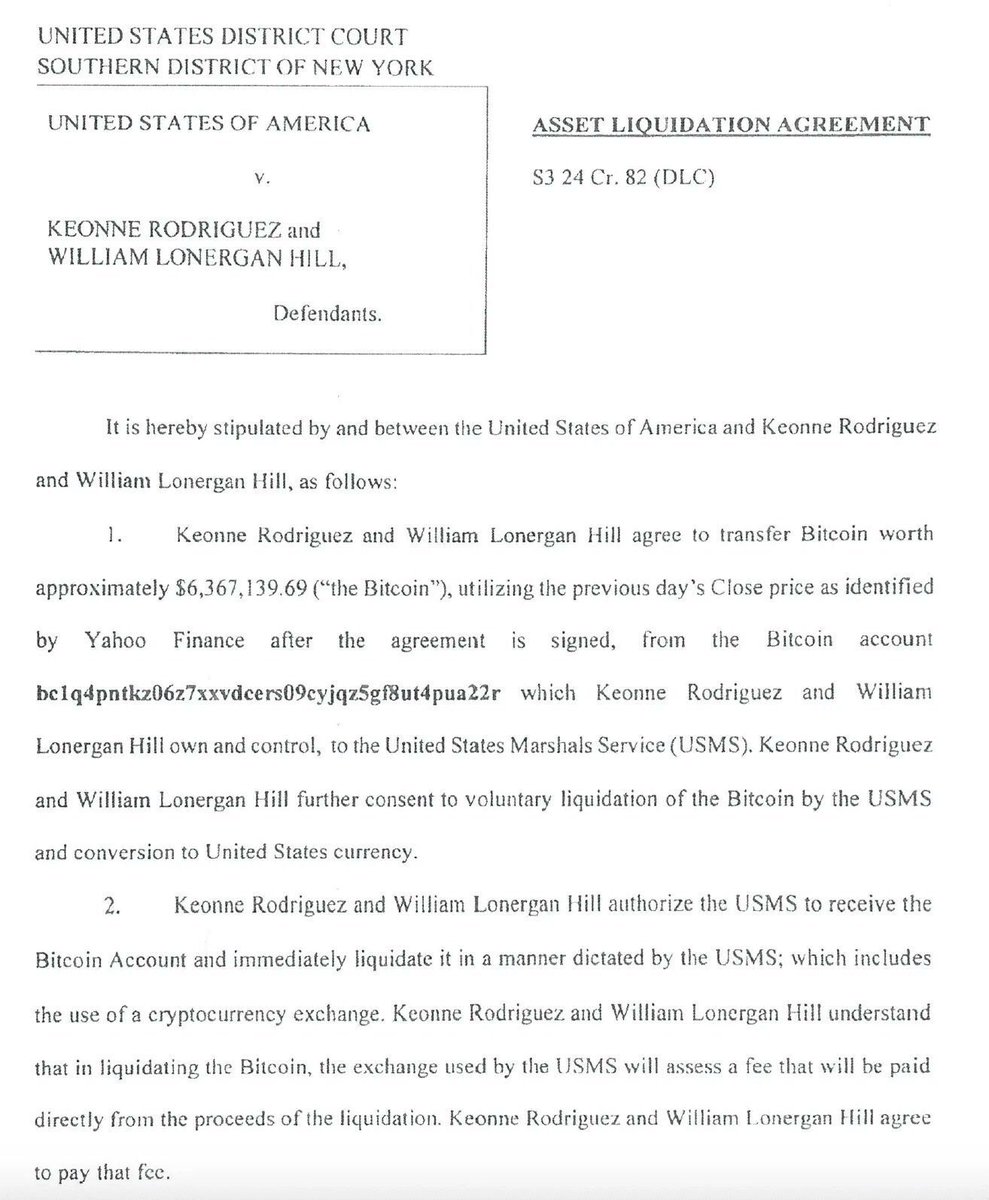

A recently surfaced “Asset Liquidation Agreement” shows that Rodriguez and Hill agreed to forfeit exactly 57.553 BTC, worth over $6.3 million at the time. The document was signed by Assistant U.S. Attorney Cecilia Vogel on November 3. However, the Bitcoin appears to have gone directly to Coinbase Prime, bypassing traditional USMS custody.

While this adds weight to claims of a sale, it still does not prove one occurred. Off-chain actions remain unverified without official confirmation.

Signed by President Trump, Executive Order 14233 mandates that all Bitcoin acquired through federal asset forfeiture be retained as part of the U.S. Strategic Bitcoin Reserve. It specifically prohibits agencies from selling these assets unless they meet strict conditions—none of which appear relevant in this case.

Legal experts point to several statutes that support this interpretation. For example, 18 U.S. Code § 982 and related forfeiture laws govern the handling of seized property but do not require liquidation. The Executive Order treats forfeited crypto as “Government BTC,” which agencies must retain unless directed otherwise by the Attorney General.

So, if the DOJ sold the BTC without such approval, it may have violated this order. Whether the Bitcoin ever entered Treasury Reserve accounts, as required, is also unclear due to a lack of documentation.

The case raises broader concerns about how the Southern District of New York (SDNY) handles crypto prosecutions. Known informally as the “Sovereign District of New York,” SDNY often operates with a high degree of autonomy.

This isn’t the first time SDNY has pushed ahead despite federal policy guidance. Prosecutors continued the Samourai Wallet case even after DOJ leadership signaled a shift in stance. In April 2025, Deputy Attorney General Todd Blanche issued a memo stating that DOJ would stop targeting privacy wallets and other noncustodial crypto tools based solely on user activity. SDNY ignored that memo.

When defense attorneys learned that FinCEN officials viewed Samourai as a noncustodial service—one that likely didn’t qualify as a money transmitter—they still saw the case move forward. Facing long odds and harsh sentencing, both Rodriguez and Hill eventually took plea deals.

Senator Cynthia Lummis voiced strong concern following reports of the Samourai Wallet Bitcoin potentially being sold by U.S. authorities. In a public statement, she questioned why the federal government continues to liquidate seized Bitcoin despite President Trump’s Executive Order explicitly mandating its retention in the Strategic Bitcoin Reserve. Lummis warned that offloading these digital assets undermines U.S. strategic interests, especially as other nations actively accumulate Bitcoin. She called the situation deeply troubling and urged immediate oversight.

As it stands, the blockchain does not confirm that the forfeited BTC was sold. All activity appears consistent with custodial operations inside Coinbase Prime. However, without access to court filings or execution logs, one cannot rule out an off-chain sale.

If the DOJ did liquidate the Bitcoin without proper authority, it may have directly violated Executive Order 14233. Whether this marks another instance of the SDNY acting outside federal directives remains an open question.

Until more evidence surfaces, the answer lies not on-chain, but in documents the public can’t yet see.

Our Crypto Talk is committed to unbiased, transparent, and true reporting to the best of our knowledge. This news article aims to provide accurate information in a timely manner. However, we advise the readers to verify facts independently and consult a professional before making any decisions based on the content since our sources could be wrong too. Check our Terms and conditions for more info.

ZachXBT Criticizes Phantom For Address Poisoning

Agentic Finance Acquisition: ProCap To Acquire CFO Silvia

Grant Cardone Lists Golden Beach Mansion for 700 Bitcoin

Japan Nikkei hits 56,000, sparks Bitcoin to $72,000 and gold past $5,000

ZachXBT Criticizes Phantom For Address Poisoning

Agentic Finance Acquisition: ProCap To Acquire CFO Silvia

Grant Cardone Lists Golden Beach Mansion for 700 Bitcoin

Japan Nikkei hits 56,000, sparks Bitcoin to $72,000 and gold past $5,000