Robinhood has officially secured a spot in the S&P 500, while Strategy was left out during the September 2025 rebalancing.

Author: Sahil Thakur

Published On: Sun, 07 Sep 2025 06:27:50 GMT

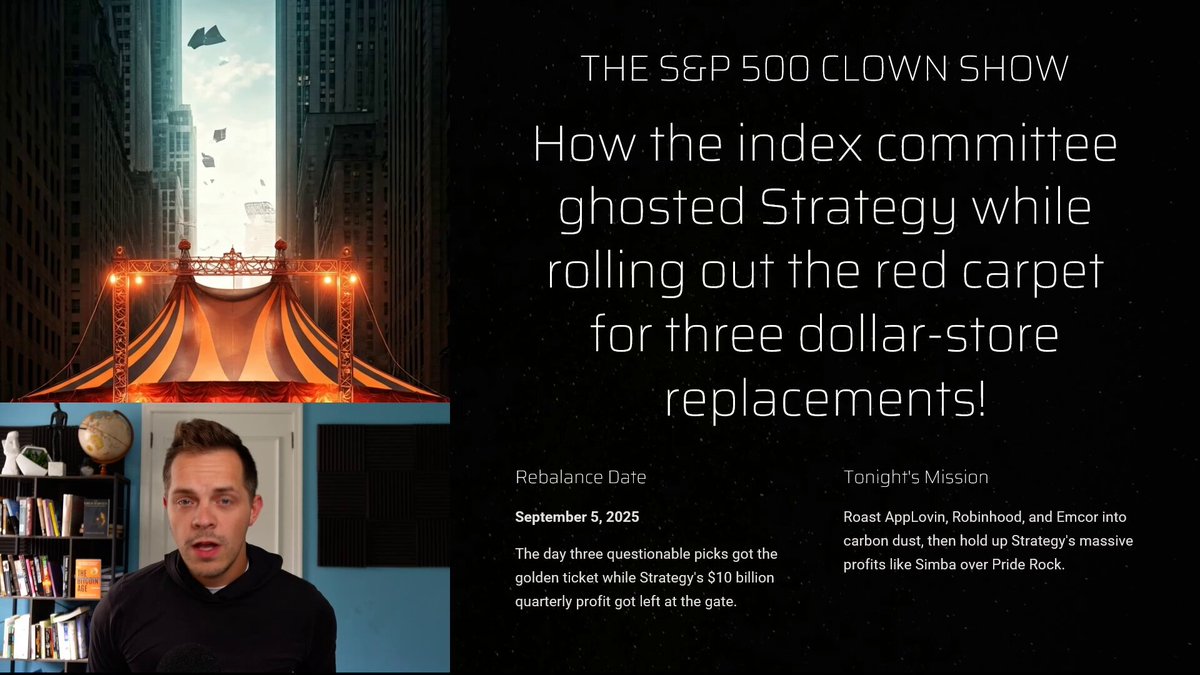

Robinhood has officially secured a spot in the S&P 500, while MicroStrategy, now rebranded as Strategy was left out during the September 2025 rebalancing. This outcome surprised many, especially since Strategy met most technical requirements for inclusion.

To qualify for the S&P 500, companies must meet specific benchmarks. These include a U.S. listing, a market cap above $8.2 billion, at least 50% public float, strong liquidity, and consistent profitability over the past four quarters. Strategy checked all these boxes. Its market capitalization stands near $96 billion. In Q2 2025 alone, the firm reported $10 billion in net income and $14 billion in operating income, thanks largely to new fair-value accounting rules that apply to its Bitcoin holdings.

Despite meeting the criteria, the S&P Dow Jones Indices committee chose Robinhood, AppLovin, and Emcor Group instead. The decision stemmed from one core issue: earnings volatility.

Although Strategy has massive holdings – 636,505 $BTC valued at nearly $70 billion, its financial results swing wildly due to crypto price fluctuations. The committee prefers companies with steady earnings and diversified business models. Vincent Van Code, a market analyst, pointed out that Strategy’s quarterly earnings often fluctuate due to unrealized Bitcoin gains and losses. This instability likely hurt its case.

As a result, Strategy lost out on a major opportunity. Had it been included, index-tracking funds could have injected $10 to $16 billion into its stock. That would have not only boosted MSTR shares but also helped bring Bitcoin closer to mainstream financial adoption.

Robinhood, on the other hand, took full advantage of its opportunity. The company replaced Caesars Entertainment in the index. The market responded immediately – Robinhood’s stock jumped 7% in after-hours trading. For investors, the move confirmed that fintech remains a central theme in the evolving financial landscape.

Robinhood’s inclusion brings tangible benefits. Index funds and ETFs tracking the S&P 500 must now hold HOOD shares, generating automatic demand and liquidity. This isn’t just a stock price story. It also reflects the platform’s growing role in democratizing finance, especially in crypto and commission-free trading.

Strategy’s exclusion highlights the cautious stance that traditional indices still hold toward crypto-heavy businesses. Even though Coinbase and Block made it in previously, Strategy’s Bitcoin-first model may require further evolution. Unless it diversifies beyond Bitcoin or finds a way to deliver consistent earnings, Strategy may struggle to gain mainstream financial acceptance.

This move could also dampen hopes among Bitcoin advocates who expected index inclusion to serve as a credibility boost for the asset class. Instead, the market saw a reminder: volatility still matters.

For Strategy, the path forward may require some changes. The company could expand its software segment or refine its Bitcoin strategy to reduce earnings swings. More importantly, this episode shows that even as crypto gains popularity, traditional gatekeepers still demand financial predictability.

For Robinhood, the inclusion offers more than a short-term stock bump. It signals a level of institutional trust that may attract long-term capital. But with that trust comes scrutiny. Investors will now closely watch Robinhood’s earnings consistency, user growth, and ability to manage regulatory risks.

In the end, this S&P 500 rebalancing revealed two clear messages: fintech is maturing into the mainstream, while crypto-native firms still face a higher bar for acceptance.

Real voices. Real reactions.

🚨STRATEGY MISSES S&P 500 - TOTAL CLOWN SHOW DESTROYED!🚨 This is an OUTRAGE. The S&P committee is a TOTAL JOKE. REPOST THIS TO SEND THESE CLOWNS A MESSAGE. Strategy (MSTR) just got ghosted by the S&P 500 while a loot-box ad pusher, a meme-stock pawn shop, and an HVAC https://t.co/VJb9rB19DR

Strategy didn't get listed in the S&P 500!?! https://t.co/wA7Ll1zCjd

Our Crypto Talk is committed to unbiased, transparent, and true reporting to the best of our knowledge. This news article aims to provide accurate information in a timely manner. However, we advise the readers to verify facts independently and consult a professional before making any decisions based on the content since our sources could be wrong too. Check our Terms and conditions for more info.

NYSE Approves Bitwise Solana Staking ETF For Tuesday

MYX Integrates Chainlink For Permissionless Perpetual Trading

Bybit Enables Native USDC Transfers on Hedera Network

Clearpool X-Pool Launch Promises 8–15% Stablecoin Yields

NYSE Approves Bitwise Solana Staking ETF For Tuesday

MYX Integrates Chainlink For Permissionless Perpetual Trading

Bybit Enables Native USDC Transfers on Hedera Network

Clearpool X-Pool Launch Promises 8–15% Stablecoin Yields