Uniswap has surged nearly 14% in the past week and 100 million UNI tokens burn after their governance proposal passed.

Author: Sahil Thakur

29th December 2025 – Uniswap has surged nearly 14% in the past week after the voting for the 100 million UNI tokens burn. The move eventually removed nearly $596 million worth of tokens from circulation. This action followed the successful passage of the UNIfication proposal, which aims to reshape how the protocol captures value.

The governance vote passed with overwhelming support. Over 125 million UNI tokens backed the proposal, while only 742 opposed it. The turnout far exceeded the required 40 million quorum. Voting began on December 19 and ended two days later.

Key figures in the DeFi space supported the proposal. These included Kain Warwick from Synthetix, Jesse Walden of Variant Fund, and former Uniswap Labs engineer Ian Lapham. Their endorsements helped boost confidence in the proposal’s direction.

After the vote, Uniswap implemented a two-day governance delay. The burn took place once that period ended.

The market reacted quickly. UNI jumped 19 percent as voting began. After the burn, the token added another 6 percent. It traded between $5.89 and $6.35 over the following 24 hours. Market capitalization and trading volume also rose.

With the burn complete, UNI’s dropped to about 730 million tokens. The total supply remains at 1 billion.

MarcoV

@marcov_91

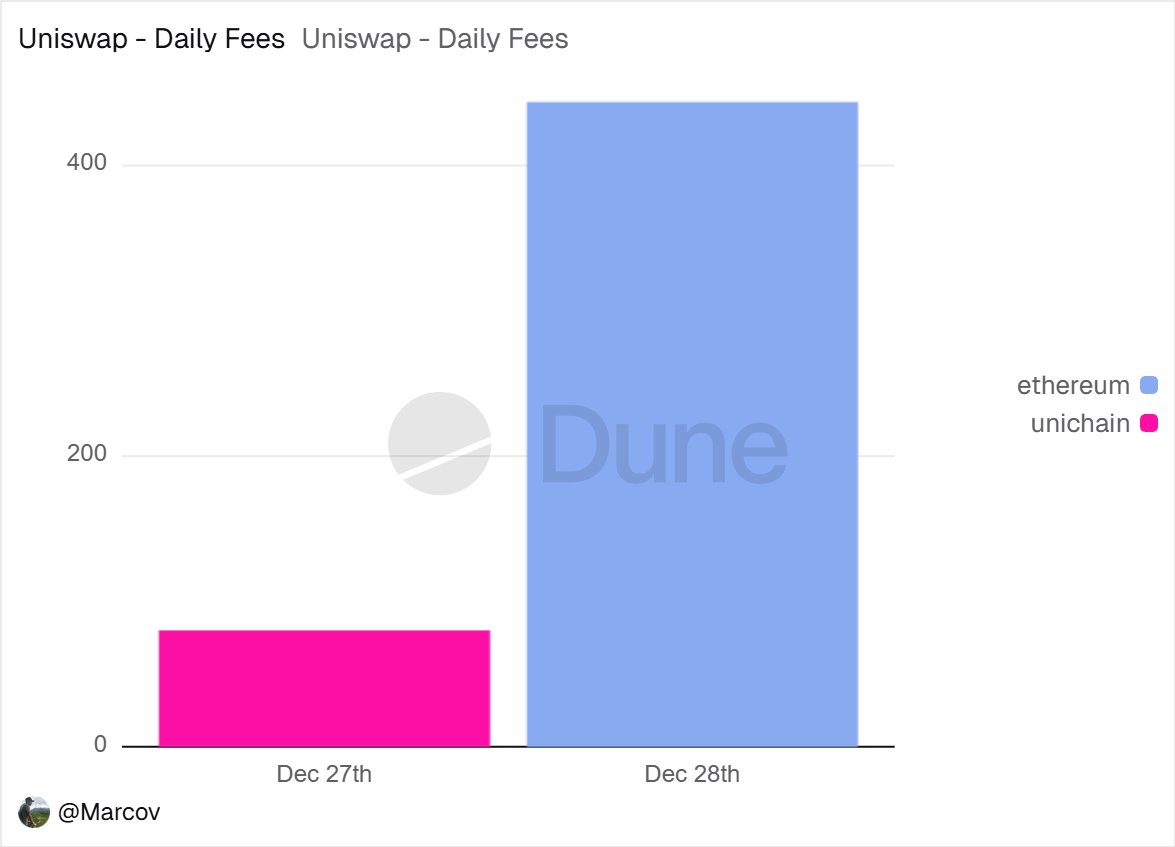

Build a dashboard tracking Uniswap protocol fees & UNI burns post-UNIfication 🦄 Current statistics: 💰Ethereum Fees: $444 🪙Unichain Fees: $80 ❤️🔥100M UNI retroactive burn executed 🔗https://t.co/ApAr5n2GeK @Dune @Uniswap https://t.co/AZWT4iOsBi

10:06 PM·Dec 28, 2025

MANDO CT 🇮🇪 🇦🇪 🇬🇧

@XMaximist

Uniswap has officially burned 100 million UNI following the community’s approval of a fee-burning governance proposal. This move reduces circulating supply and reinforces long-term value alignment for the protocol and its holders. https://t.co/Y302dSASFv

02:02 PM·Dec 28, 2025

⭕️La_Crrypt💰₿

@Ola_Crrypt

when I saw Uniswap burnt 100M UNI ($600M+), I was honestly wowed $600M erased on purpose, almost PumpFun lifetime revenue gone in one click first question I asked myself was why burn in the is present market? then I checked deeper, this wasn’t a team decision every https://t.co/olluQrOD4y

09:56 AM·Dec 28, 2025

Loading chart...

Uniswap Labs confirmed that protocol fees are now active. These fees apply to Uniswap v2 and selected v3 pools on the Ethereum mainnet. At the same time, interface fees were set to zero. This means users interacting with Uniswap’s front-end do not face additional charges.

Revenue collected from Unichain will also contribute to future UNI burns. However, these funds will first cover data and infrastructure costs tied to Layer 1 and Optimism.

Future fee integrations will require separate governance votes. These may include pools on Layer 2 networks, Uniswap v4, and services like UniswapX.

The protocol uses different fee models depending on the version. In v2, governance can turn fees on or off across all pools at once. A portion of the 0.3 percent fee, specifically 0.05 percent, now goes to the protocol. Liquidity providers still receive the remaining 0.25 percent.

Uniswap v3 offers more flexibility. Governance can enable fees on specific pools. For lower-fee pools charging between 0.01 and 0.05 percent, the protocol receives one-quarter of LP fees. For higher-fee pools, ranging from 0.30 to 1.00 percent, the protocol receives one-sixth. This system encourages more balanced participation while still supporting long-term sustainability.

The Uniswap Foundation announced a new Growth Budget. It will allocate 20 million UNI to support development across the ecosystem. This includes grants and funding for protocol contributors.

Foundation leaders said developer support will continue. They emphasized that growth and innovation remain top priorities, even after a large portion of the treasury has been burned.

Our Crypto Talk is committed to unbiased, transparent, and true reporting to the best of our knowledge. This news article aims to provide accurate information in a timely manner. However, we advise the readers to verify facts independently and consult a professional before making any decisions based on the content since our sources could be wrong too. Check our Terms and conditions for more info.

Base Shifts to In-House Stack, Reducing Reliance on OP Stack

Nexus Labs Launch USDX Stablecoin Backed by US Treasuries

EDENA Launches World’s First Autonomic Financial OS

World Liberty Financial Tokenization Enters RWA Market

Base Shifts to In-House Stack, Reducing Reliance on OP Stack

Nexus Labs Launch USDX Stablecoin Backed by US Treasuries

EDENA Launches World’s First Autonomic Financial OS

World Liberty Financial Tokenization Enters RWA Market