WLFI rebounded 9% after World Liberty Financial burned 47 million tokens and blacklisted Justin Sun 's wallet, aiming to stabilize prices.

Author: Sahil Thakur

World Liberty Financial ( WLFI ), the Trump-backed crypto project, saw a 9% rebound after two major developments: a 47 million token burn and the blacklisting the wallet of Justin Sun. These events came just days after WLFI’s public trading launch was met with heavy sell pressure and a steep 31% drop.

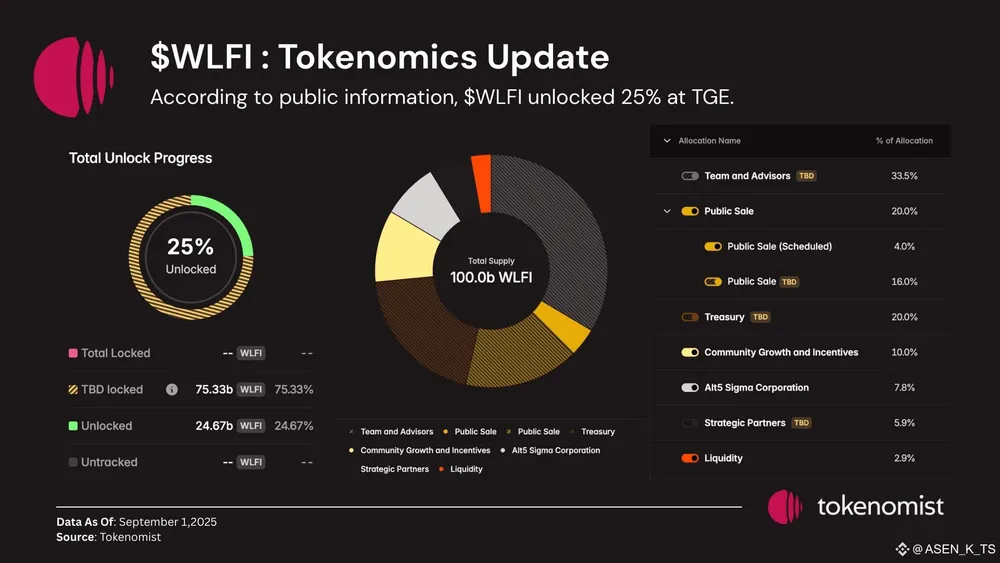

On September 2, WLFI permanently removed 47 million tokens, about 0.19% of its circulating supply through a multi-signature burn agreement. The goal was to reduce supply and support price stability following the volatile debut. Currently, around 700 million WLFI tokens are in circulation, with over 24.6 billion unlocked from the original 100 billion total supply.

The burn was approved by a community governance vote, where 133 participants backed the supply-tightening proposal. While official voting procedures are still pending, the team has indicated plans for ongoing buyback and burn programs funded by protocol fees.

Token burns are a common deflationary mechanism in crypto markets. Some academic research shows that supply reductions exceeding 5% annually can drive price appreciation of 15–20% in favorable conditions.

Src: Tokenomist

Separately, on-chain data from Arkham and Nansen revealed that Justin Sun’s wallet was blacklisted by the WLFI project after a 50 million token transfer to exchange HTX, a move worth roughly $9 million. The action immediately triggered speculation that the project was limiting sell-side pressure during the fragile post-launch phase.

Sun later clarified on X that the transfers were routine tests, not intended for sale. He reiterated his long-term commitment to the WLFI ecosystem, stating, “We have no plans to sell our unlocked tokens anytime soon.”

A spokesperson confirmed that Sun and the WLFI team remain in active discussions regarding the situation.

<<-chart-{world-liberty-financial}->>

Analysts suggest these events highlight the growing tension between celebrity-led projects and institutional-grade expectations. Kevin Rusher of RAAC commented, “Market maturity hinges more on institutional adoption than hype. Retail investors must be cautious about short-term narratives.”

Despite initial turbulence, the WLFI team appears focused on long-term strategies involving supply control and ecosystem growth.

Our Crypto Talk is committed to unbiased, transparent, and true reporting to the best of our knowledge. This news article aims to provide accurate information in a timely manner. However, we advise the readers to verify facts independently and consult a professional before making any decisions based on the content since our sources could be wrong too. Check our Terms and conditions for more info.