WLFI hosted the World Liberty Forum at Mar-a-Lago in Florida. The event was invitation-only and ran as a closed-door, day-long gathering.

Author: Sahil Thakur

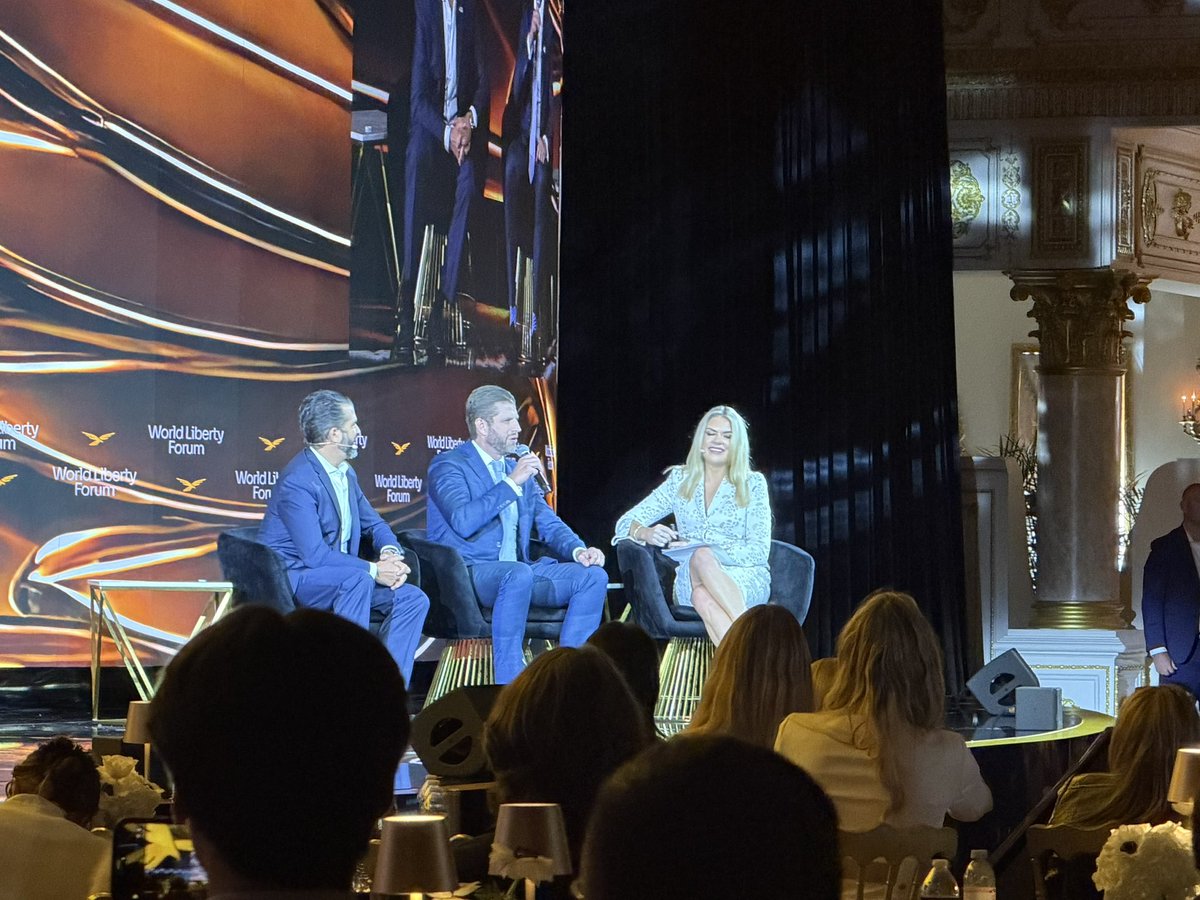

19th February 2026 – World Liberty Financial hosted the World Liberty Forum at Mar-a-Lago in Palm Beach, Florida. The event was invitation-only and ran as a closed-door, day-long gathering. Nearly 400 attendees from finance, tech, government, sports, and media participated.

High Signal Summary For A Quick Glance

Sheldon

@sheldonbitmart

Honored to join the WLFI Summit. Big thanks to @WatcherChase @worldlibertyfi for the invitation. Really enjoyed the conversations and energy in the room. Excited about what’s ahead. https://t.co/XJ0zpQj62K

03:59 AM·Feb 19, 2026

Bilal bin Saqib MBE

@Bilalbinsaqib

Great day at Mar-a-Lago for the World Liberty Forum. Wall Street, crypto, and policymakers all in one room. Goldman Sachs, Nasdaq, Franklin Templeton, Coinbase and others aligned on the future of stablecoins, tokenisation, and financial innovation. https://t.co/JvsQ2sWmCp

03:29 AM·Feb 19, 2026

Hunter $BTC

@iBeatWallStreet

I’ve attended the most important industry conferences around the world for years, and very few rooms genuinely stand above the rest. Today I was invited to attend the World Liberty Forum at @MarALago and by far this event is in a category of its own. Unmatched caliber, https://t.co/JNIiwdnfw2

02:32 AM·Feb 19, 2026

Steady attention without excessive speculation.

World Liberty Financial, the Trump family-backed crypto project, organized the forum. Donald Trump Jr., Eric Trump, Zach Witkoff, and Alex Witkoff led the event. The central theme focused on the future of the U.S. dollar, stablecoins, tokenized real-world assets, DeFi-TradFi integration, AI in finance, and cross-border payments.

Meanwhile, the $WLFI token rallied sharply. It surged between 10% and 22% on the day, outperforming both Bitcoin and Ethereum amid event-driven hype.

Loading chart...

WLFI announced its first flagship real-world asset initiative. It partnered with DarGlobal and Securitize to tokenize loan revenue interests in the Trump International Hotel & Resort in the Maldives.

The project includes around 100 luxury beach and overwater villas. Completion is targeted for 2030. Accredited investors can access fixed yields, revenue streams, and potential profit exposure through compliant private placements under Regulation D and Regulation S.

Tokens will launch on public blockchains. Additionally, WLFI plans to integrate them into its lending markets as potential collateral.

Eric Trump framed the move as opening elite real estate access to blockchain-based capital markets. The announcement marks WLFI’s formal entry into scalable and compliant real estate tokenization.

WLFI also unveiled a partnership with Apex Group, a $3.5 trillion asset servicing firm.

Apex plans to pilot and integrate WLFI’s USD1 stablecoin across subscriptions, distributions, redemptions, and settlement processes. As a result, WLFI aims to position USD1 as a regulated settlement layer inside traditional financial infrastructure.

Executives described the partnership as an inflection point. The goal is clear: bring stablecoin rails into institutional workflows.

WLFI positioned USD1 as an institutional-grade digital dollar. The team highlighted real-time on-chain proof-of-reserves powered by Chainlink.

Initially, WLFI plans to focus on U.S.-Mexico remittance corridors. Over time, it aims to expand into up to 40 currency corridors. In parallel, the company teased a broader World Liberty Forex or World Swap platform.

The vision centers on low-fee remittances, on-chain settlements, and eventually AI-agent commerce. Zach Witkoff described the effort as modernizing the dollar to preserve its global dominance in a digital and AI-driven economy.

Although non-WLFI speakers did not launch new products, the policy tone was strong.

Multiple attendees urged swift passage of the CLARITY Act, a U.S. digital asset market structure bill. Supporters want it passed within 90 days, potentially by April. The bill aims to clarify SEC and CFTC jurisdiction and unlock institutional participation.

Speakers emphasized that stablecoins pegged to the U.S. dollar could drive global dollarization. In their view, this would increase Treasury demand and reinforce U.S. financial leadership.

Eric Trump argued that crypto adoption remains in its early innings. He described the industry as being at the “starting line” and predicted rapid acceleration. He also reiterated his long-term bullish outlook on Bitcoin.

Donald Trump Jr. criticized the traditional banking system. He called USD1 an upgraded version of the dollar. According to him, private innovation can modernize what legacy institutions failed to evolve.

Witkoff stressed compliance and transparency. He framed WLFI as a collaborative effort with institutions rather than a disruptive outsider.

Solomon acknowledged owning a small amount of Bitcoin. He signaled that institutional adoption is accelerating in 2026. He also emphasized the need for regulatory clarity to sustain growth.

Nasdaq CEO Adena Friedman and NYSE President Lynn Martin highlighted tokenization, AI-driven trading infrastructure, and stablecoin integration. They argued that modernizing capital markets is essential for U.S. leadership.

Senator Bernie Moreno voiced strong support for regulatory clarity and stablecoin expansion. CFTC Chairman Michael Selig emphasized balanced innovation and risk management.

Coinbase CEO Brian Armstrong criticized banking lobby resistance to stablecoin rewards. He called for forward-looking regulation instead of protectionism.

The forum painted an aggressive but institution-friendly roadmap.

First, WLFI wants to scale real estate tokenization beyond the Maldives project. It plans to integrate RWAs into lending markets and governance structures.

Second, USD1 aims to become core settlement infrastructure. WLFI sees stablecoins as foundational rails for payments, remittances, and tokenized asset markets.

Third, WLFI positions itself as a bridge between DeFi and TradFi. The $WLFI token powers governance, while partnerships bring credibility and distribution.

Finally, the broader macro narrative centers on U.S. leadership. Attendees framed regulatory clarity as essential to prevent innovation flight overseas.

The World Liberty Forum served as a high-profile showcase of crypto and institutional convergence under Trump-family branding.

Markets reacted immediately, with $WLFI surging on the day. However, the long-term success of the strategy will depend on execution, regulatory outcomes, and sustained institutional participation.

Our Crypto Talk is committed to unbiased, transparent, and true reporting to the best of our knowledge. This news article aims to provide accurate information in a timely manner. However, we advise the readers to verify facts independently and consult a professional before making any decisions based on the content since our sources could be wrong too. Check our Terms and conditions for more info.

EDENA Launches World’s First Autonomic Financial OS

World Liberty Financial Tokenization Enters RWA Market

World Liberty Forum 2026: Pushes Stablecoins and RWAs

Encrypt V2 Launch Enables Private Cross-Chain Bridging

EDENA Launches World’s First Autonomic Financial OS

World Liberty Financial Tokenization Enters RWA Market

World Liberty Forum 2026: Pushes Stablecoins and RWAs

Encrypt V2 Launch Enables Private Cross-Chain Bridging