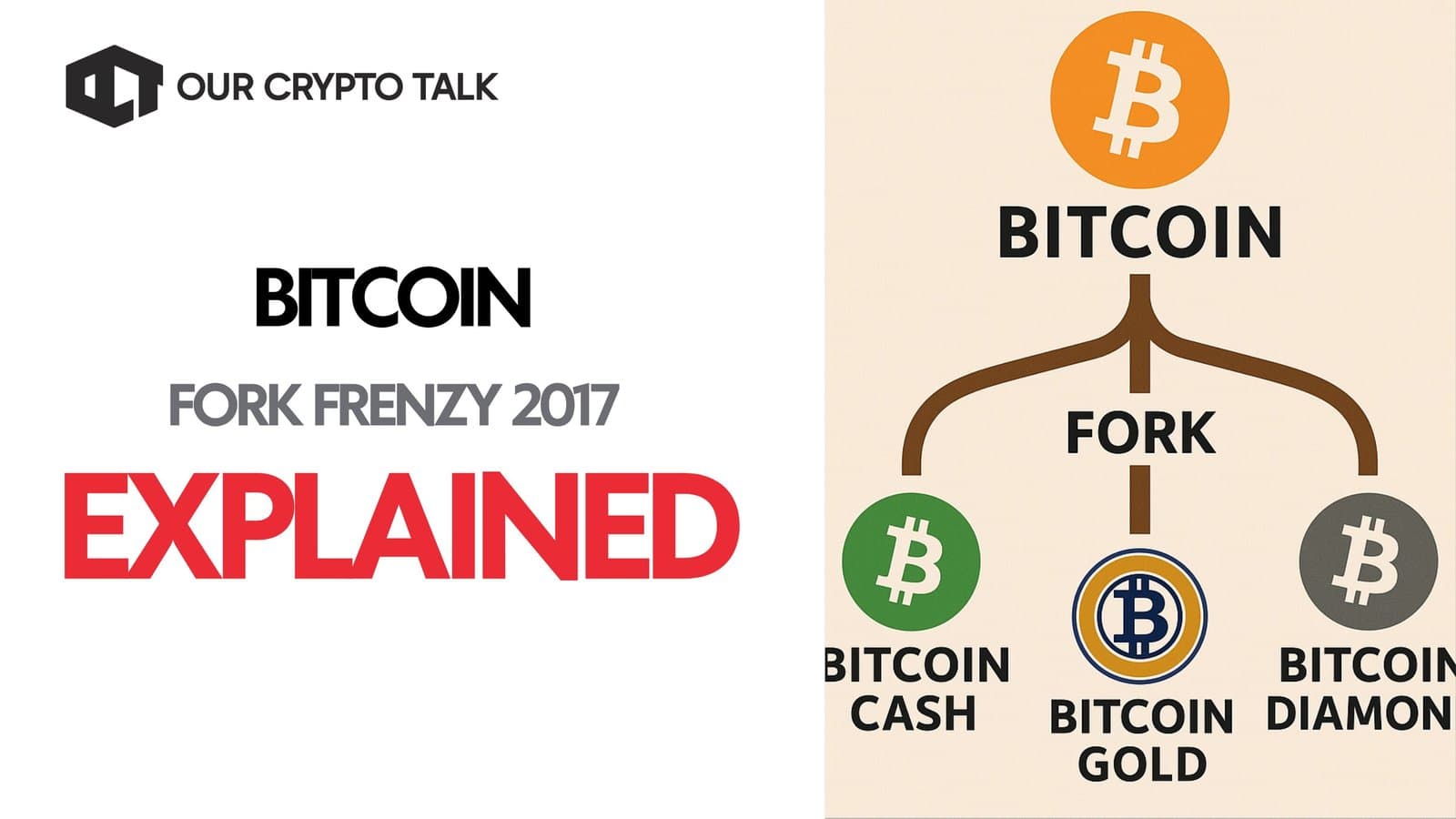

In this article, we explain the Bitcoin Fork Frenzy of 2017 when everyone and their mom created a Bitcoin fork.

Author: Sahil Thakur

In 2017, Bitcoin saw a fork frenzy like none other. People made money, people lost money and the chaotic world of forks was at its peak.

Picture this: it is mid-2017, and you are holding some Bitcoin. One morning, you wake up and realize something strange. Your Bitcoin appears to have duplicated. In addition to your original BTC, you now own an equal amount of a brand-new coin called Bitcoin Cash.

This bizarre event actually happened that summer. To many holders, it felt like a windfall. For example, if you had 5 BTC, you now also had 5 BCH, without having to take any action. Naturally, people rushed to sell these new “fork” coins and lock in quick profits. One early adopter shared how he sold 5 BCH for about 0.2 BTC each. As a result, he earned nearly 1 extra Bitcoin, all without spending a dime.

Consequently, this sparked a frenzy. New forks began popping up rapidly. Dozens of spin-off coins flooded the market. Excitement grew across the crypto community, although it was often mixed with confusion and skepticism.

In the following sections, we will explore how the Bitcoin–Bitcoin Cash split unfolded. We will also examine the wave of copycat forks that followed, the clever strategies some holders used to benefit, and the key takeaways from this chaotic yet pivotal moment in crypto history.

The story officially began on August 1, 2017. At that point, a group of users and miners decided to create a new version of Bitcoin. They had grown frustrated over disagreements about how to scale the network. To resolve the conflict, they initiated what is known as a hard fork. This resulted in two separate chains: one that continued as Bitcoin (BTC) and another that became Bitcoin Cash (BCH).

As a result of the split, every Bitcoin holder at the time received the same number of BCH. The media quickly compared the event to a stock split or a surprise dividend. For instance, Reuters quoted an expert who explained it like this: “You go to sleep with 100 bitcoins and wake up in the morning with 100 bitcoins plus 100 ‘Bitcoin Cash,’ a new token.”

For investors, this presented an unexpected opportunity. Suddenly, they held two independent assets. Unlike a test coin or a joke token, Bitcoin Cash launched with real market value. Within days, BCH was trading for several hundred dollars per coin. Therefore, those with large BTC balances found themselves holding a sizable amount of new value.

Many chose to sell their BCH immediately. They either bought more BTC or converted the proceeds into cash. As highlighted earlier, selling 5 BCH at around 0.2 BTC each could result in a full Bitcoin of added value. This possibility led to widespread excitement.

An ad by Bitcoin Cash in 2017

However, not everyone celebrated. Some critics argued that this looked like money created from nothing.

In fact, even major exchanges raised concerns. BitMEX, for example, initially refused to list BCH. One executive openly criticized the fork for introducing what seemed like unearned value into the market.

Nevertheless, the fork had happened. Bitcoin Cash existed, and its supporters made their case. They claimed it was a better version of Bitcoin because it supported larger blocks and faster transaction speeds. On the other hand, Bitcoin loyalists continued supporting the original chain.

Throughout the following months, both sides argued passionately. Yet one simple truth became clear: those who controlled their private keys had a major advantage. They could access and manage their new assets without relying on third parties.

What few realized at the time was that this event marked only the beginning. The frenzy of Bitcoin forks had just begun.

After the successful launch of Bitcoin Cash and the large windfall it gave to Bitcoin holders, others quickly wanted to copy the idea. By late 2017, the crypto world entered a true fork frenzy. Developers and opportunists began cloning Bitcoin’s code to release new spin-off coins. Each project claimed to offer some kind of improvement over Bitcoin. More importantly, most copied the same approach of rewarding existing Bitcoin holders with new coins on a one-to-one basis.

In other words, anyone who held Bitcoin during these events could claim an equal number of new forked coins. It felt like a constant series of airdrops or bonuses landing in people’s wallets every few weeks. However, the value of these new coins dropped quickly as the number of forks kept rising.

Several notable forks appeared during this period:

These examples represent only a small portion of what was happening. Many other forks appeared during the same period. Projects with names such as Bitcoin Silver, Bitcoin Uranium, Bitcoin Clashic, and Bitcoin X tried to capture attention. Others were pure jokes, like Bitcoin Pizza or even “Bitcoin My Little Pony.” One report estimated that at least fourteen Bitcoin forks launched in December 2017 alone. Most promised something new but were really just clones with slightly different branding.

As more forks entered the market, their value and credibility quickly declined. Bitcoin Cash had strong support and liquidity, while Bitcoin Gold and Diamond had niche communities. However, the majority of later forks failed to gain traction. Many became inactive or disappeared entirely.

Later studies found that out of dozens of Bitcoin forks created between 2017 and 2018, only a few achieved real trading volume or consistent usage. Over time, the so-called free money became smaller and harder to convert into profit. Even so, for those paying attention, there was still some incentive to claim whatever value these new tokens offered, provided the process was done safely.

A clear lesson emerged from the fork frenzy: “Not your keys, not your coins.” In other words, only those who controlled their own private keys could reliably access the new forked coins. If your Bitcoin sat on an exchange or in a custodial wallet, you had to wait and hope that the platform would support the fork. Some never did.

For instance, when Bitcoin Cash launched, several major exchanges, including Coinbase, BitMEX, and Bitstamp, initially chose not to support it. As a result, their users could not access their “free” BCH right away. Coinbase eventually distributed the coins, but only months later. On the other hand, anyone using a non-custodial wallet with control over private keys could immediately access their BCH. No permission or delay was required.

This pattern repeated with nearly every new fork. Each time, exchanges made individual decisions about whether to recognize the forked coin. Many lesser-known forks never appeared on major platforms at all. Therefore, self-custody remained the only guaranteed way to benefit from every fork. If you held your BTC in a personal wallet, you automatically had access to the forked coins. All you needed was the know-how to claim them.

This approach gave individual users more power. However, it also meant taking on more responsibility. Claiming these coins often required technical steps, and mistakes could be costly. Some users rushed in, trying to cash out quickly, only to lose coins through careless handling of their private keys. In many cases, “free money” became lost money.

The process of claiming forked coins followed a general pattern. When a fork happened, it created a snapshot of the Bitcoin blockchain. Your BTC balance at that moment gave you a matching balance on the new fork’s chain. To access those coins, you usually needed two things: a wallet that supported the fork and the private key linked to your BTC at the time of the snapshot.

However, using your private key in unverified software is extremely risky. Over time, experienced users developed a safer, step-by-step method:

By following these steps, users greatly reduced the risks involved. Although the process could be tedious, it became worthwhile for those focused on increasing their Bitcoin holdings. By the end of 2017, many technically skilled Bitcoin users had turned coin-claiming into a regular routine. Fork after fork, they squeezed as much value as possible from their original BTC stash.

However, this gold rush also attracted scammers. As excitement grew and newcomers flooded in, so did fraud. The environment became fertile ground for fake wallets, phishing attempts, and misleading instructions. Caution and technical understanding became essential to avoid turning opportunity into loss.

As excitement over “free” fork coins spread, scammers took full advantage. Phishing sites, fake wallets, and malware began appearing, all designed to steal users’ private keys. One of the most notorious examples involved the Bitcoin Gold wallet scam.

Bitcoin Gold (BTG) launched in October 2017. Like other forks, it required users to use a specific wallet or tool to claim their new coins. During that time, a fake website called MyBTGWallet appeared. It posed as a legitimate web wallet for Bitcoin Gold. For a short period, it even managed to get a link placed on the official Bitcoin Gold website. This gave it a false sense of credibility.

As a result, many users visited the fake site and entered their private keys or recovery phrases. Their funds were stolen almost instantly. In one especially damaging scam, the operators of MyBTGWallet stole over $3.3 million in cryptocurrency. Victims not only lost their Bitcoin Gold, but in many cases, their original Bitcoin and other assets vanished as well. One user shared how he followed the link from the official BTG site and later discovered that both his BTC and BTG were gone.

After discovering the fraud, the Bitcoin Gold team apologized. They reminded users never to reuse private keys online and repeated an important rule: never enter your key or recovery phrase on random websites. In a public statement, the developers said it was never truly safe to input private keys into any online tool. They also strongly advised users to move their coins to a new wallet before attempting to claim forked tokens.

Unfortunately, for those who had already fallen for the scam, this advice arrived too late. Similar tactics appeared around other forks. Fake Bitcoin Diamond websites and phishing emails tricked people into giving up their keys. Many users, acting in haste, lost everything they had.

The lesson was clear. A fork may offer free coins, but claiming them without caution could lead to major losses. Greed and impatience often opened the door to scams. Over time, experienced users learned to approach new forks and airdrops with extreme care. They verified tools, followed best practices, and, when uncertain, chose not to engage at all.

By early 2018, the Bitcoin fork craze had largely come to an end. The flood of copycat coins slowed as it became clear that most had no meaningful use or community. Aside from Bitcoin Cash, which remained one of the top cryptocurrencies by market value, most other Bitcoin-themed forks faded away.

Coins like Bitcoin Gold and Bitcoin Diamond technically still exist. However, they hold only a fraction of Bitcoin’s value and have very little adoption. For example, at one point, BTG was worth only $7, and BCD just a few dollars. In contrast, Bitcoin traded for tens of thousands. Many fork coins were removed from exchanges or simply vanished.

In total, over 50 Bitcoin fork coins appeared during the frenzy. Yet, only about nine of them continued to see any real trading activity. Among those, only a few – such as Bitcoin Cash, Bitcoin SV, Bitcoin Gold, and Bitcoin Diamond, maintained a visible presence or developer support.

Looking back, the windfalls of 2017 were a rare event. Each new fork delivered less value and came with greater risks. Those who sold early often made the most profit. Meanwhile, others who believed the hype around “the next Bitcoin” often saw prices surge briefly, then crash. The market grew wiser. Investors began demanding real utility and community support before assigning value to new forked coins.

By the end of 2018, the fork frenzy had faded. Attention shifted to other trends like ICOs, DeFi, and later, NFTs. The fork rush became a fascinating but cautionary chapter in crypto’s history.

First, self-custody is essential. Holding your own keys means full control over your assets. It also means you qualify for forks and airdrops. Those who left their Bitcoin on exchanges during the frenzy missed out on thousands of dollars in potential gains. However, self-custody also brings responsibility. It requires careful attention to security.

Users learned the importance of moving funds before using private keys in new software. They became wary of too-good-to-be-true offers and made sure to verify sources. These habits continue to matter today.

Second, the forks taught that copying Bitcoin’s code does not guarantee success. Real value comes from community support, ongoing development, and actual use. Bitcoin Cash found a niche and survived. Most others did not.

Lastly, the fork frenzy highlighted both the creativity and the chaos in crypto. From serious debates about scaling to bizarre projects like Bitcoin Uranium or Bitcoin Pizza, the ecosystem saw it all. Some people gained wealth. Others gained wisdom. A few, unfortunately, lost everything to scams.

One truth still stands strong: always hold your own keys, and always keep them secure. That way, when the next opportunity arises, whether a fork or something new – you are ready to act on your own terms, with experience as your guide.