Bitcoin has crashed by more than $2000 below the $93k levels as news of the US-EU tariff war escalating continues.

Author: Sahil Thakur

19th January 2026 – Bitcoin has crashed by more than $2000 below the $93k levels as news of the US-EU tariff war escalating continues.

High Signal Summary For A Quick Glance

Crypto Rover

@cryptorover

🚨CRASH: Bitcoin dumps below $94,000 after 🇺🇸 US futures open. https://t.co/HE2AhAArVi

11:49 PM·Jan 18, 2026

Henry Bolton OBE 🇬🇧

@_HenryBolton

President Trump is inviting a trade war with Europe. Here is my “Tariffs for beginners guide” for him - Lesson 1: 1) The EU operates a common external tariff. You cannot selectively tariff Denmark, France, or Germany without de facto tariffing the EU as a whole, unless you

06:38 PM·Jan 17, 2026

Justin Wolfers

@JustinWolfers

New tariff just dropped. Americans set to pay an additional 10% tax on all goods from Germany, the UK, France, the Netherlands, Sweden, Norway, Denmark, and Finland. It starts in two weeks, rising to 25% by June. (Aside: A trade war with one EU member is a trade war with the https://t.co/RX3wP0f1fL

05:26 PM·Jan 17, 2026

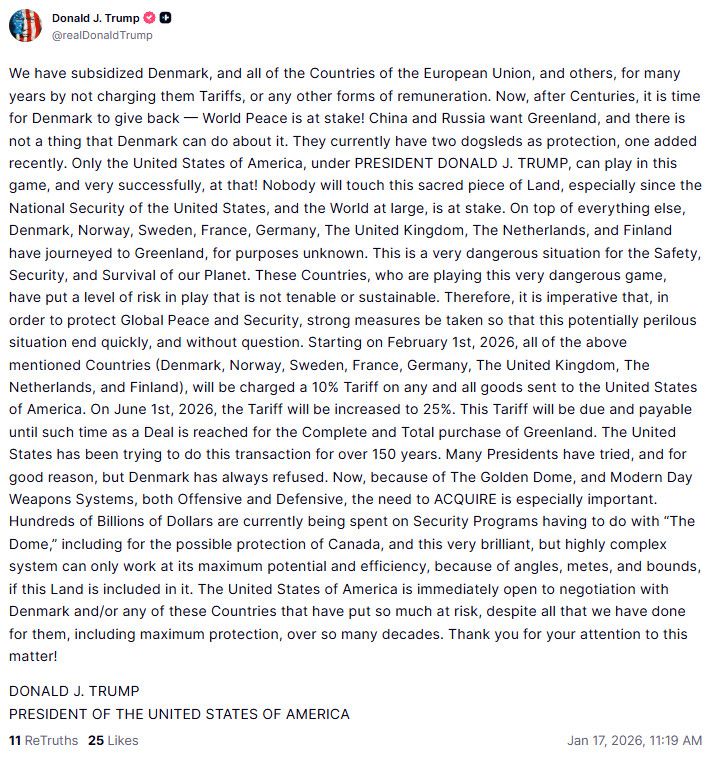

U.S. President Donald Trump announced that he would impose a 10% tariff on all goods imported from eight European countries -Denmark, Norway, Sweden, France, Germany, the United Kingdom, the Netherlands, and Finland starting February 1. He plans to raise the tariff to 25% by June 1, 2026. These tariffs will stay in place until the U.S. secures a deal for the “complete and total purchase” of Greenland, an autonomous territory of Denmark.

This bold move comes after these countries opposed Trump’s renewed push to buy Greenland. Some even sent military contingents to the island in support of Denmark. Trump claims the tariffs are vital for U.S. national security, citing Arctic competition with Russia and China. However, critics quickly labeled the tactic as coercive blackmail against NATO allies.

The proposed tariffs threaten up to $1.2 trillion in annual U.S.-EU trade. Sectors such as agriculture, tech, and manufacturing could see disruptions. European leaders responded immediately. French President Emmanuel Macron and U.K. Prime Minister Keir Starmer condemned the tariffs as “unacceptable” and “completely wrong.” They warned of a “dangerous downward spiral” in U.S.-EU relations. Meanwhile, bipartisan U.S. lawmakers also criticized the plan for straining vital alliances.

In Denmark and Greenland, protests erupted. Citizens voiced strong opposition to any idea of U.S. ownership of the island.

Loading chart...

On January 18, the EU convened an emergency meeting of ambassadors. Leaders agreed to explore diplomacy but also started preparing countermeasures. A summit on January 22 will finalize strategy.

Possible responses include:

The EU’s message is clear: it will defend its sovereignty and economic integrity. European Council President Antonio Costa affirmed the bloc’s readiness to act “against any form of coercion.”

Markets reacted swiftly. The euro and British pound weakened against the dollar, reflecting investor concern over increased volatility.

These growing trade tensions are shaking the crypto market. Investors are now wary of rising inflation and uncertain Fed policy. As a result, Bitcoin (BTC) and other digital assets have come under pressure.

On January 13, BTC briefly dropped below $93,000. This followed two key events: the passage of the U.S. CLARITY Act (a controversial crypto regulation bill) and early tariff threats aimed at Canada, Mexico, and China. The fall marked a 6–10% dip from recent highs near $97,000. However, Bitcoin rebounded to trade around $95,000 as of January 18.

Short-term, analysts see more volatility ahead. If EU counter-tariffs activate, liquidity could sweep BTC below $90,000. Still, some view Bitcoin as a hedge. If Trump’s aggressive policies inflate the deficit or weaken the dollar, BTC could push above $100,000 long-term.

Stablecoin inflows and options trading have helped stabilize the market. But if tensions escalate into a full-blown trade war, expect broader corrections across altcoins like Ethereum and XRP.

All eyes are now on the EU summit on January 22, where leaders will finalize their retaliatory strategy against Trump’s tariff threat.

If diplomacy stalls, expect the €93B counter-tariff package and Anti-Coercion Instrument (ACI) to move into action by early February.

This could spark a full-blown U.S.–EU trade war, rattling global markets and pushing Bitcoin into higher volatility zones. Additionally, any statements from the Federal Reserve, ECB, or crypto-heavy regions reacting to macro instability could shift narratives fast. Traders should monitor key dates: Feb 1 (tariffs begin), Feb 6 (EU retaliation deadline), and mid-Feb CPI/FOMC signals for added impact.

Our Crypto Talk is committed to unbiased, transparent, and true reporting to the best of our knowledge. This news article aims to provide accurate information in a timely manner. However, we advise the readers to verify facts independently and consult a professional before making any decisions based on the content since our sources could be wrong too. Check our Terms and conditions for more info.

ZachXBT Criticizes Phantom For Address Poisoning

Agentic Finance Acquisition: ProCap To Acquire CFO Silvia

Grant Cardone Lists Golden Beach Mansion for 700 Bitcoin

Japan Nikkei hits 56,000, sparks Bitcoin to $72,000 and gold past $5,000

ZachXBT Criticizes Phantom For Address Poisoning

Agentic Finance Acquisition: ProCap To Acquire CFO Silvia

Grant Cardone Lists Golden Beach Mansion for 700 Bitcoin

Japan Nikkei hits 56,000, sparks Bitcoin to $72,000 and gold past $5,000