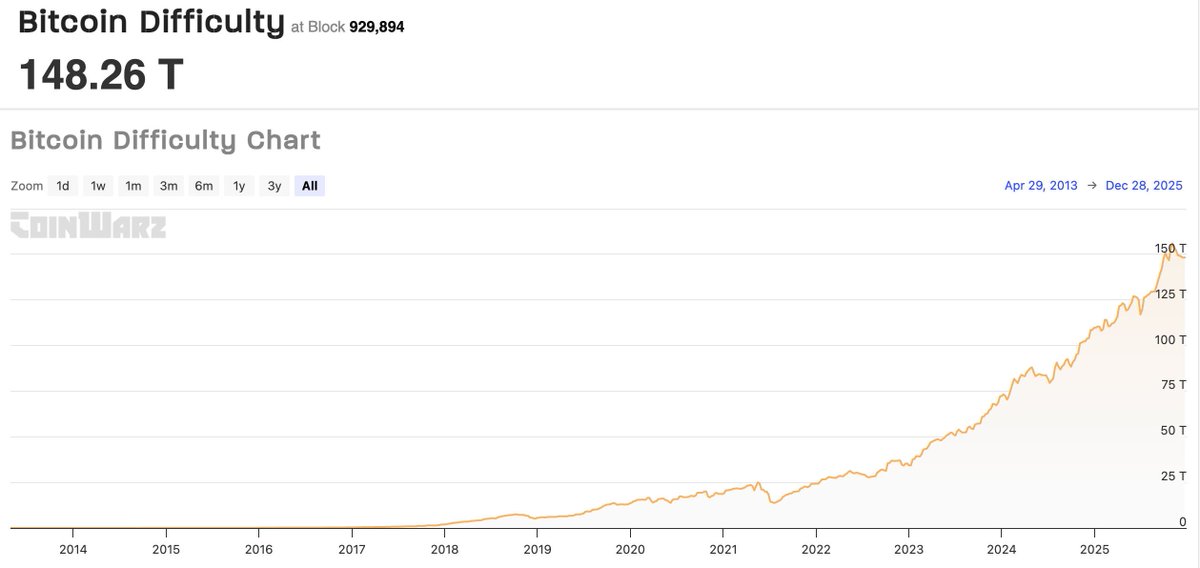

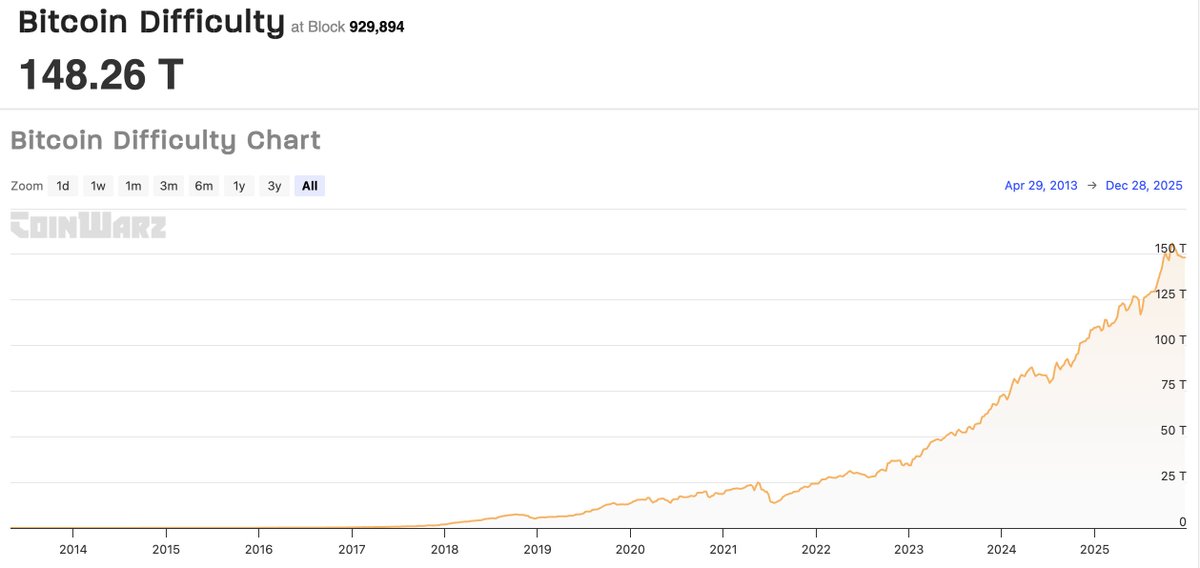

Bitcoin mining difficulty hit a record 148.2 trillion in 2025, with projections pointing to further increases in early 2026.

Author: Akshat Thakur

December 29, 2025 — Bitcoin mining difficulty reached a record high in its final 2025 adjustment, climbing to 148.2 trillion. Network projections indicate another increase to nearly 149 trillion on January 8, 2026, reflecting sustained hashrate growth.

Bitcoin relies on a difficulty adjustment mechanism to keep block production close to one block every ten minutes. When miners add more computational power, the protocol raises difficulty to maintain this target. Over time, advances in hardware efficiency and higher participation have driven exponential hashrate growth.

As a result, difficulty levels have climbed steadily across market cycles. The 2025 adjustments reflect continued miner investment despite price volatility. This process underpins Bitcoin’s long-term security model.

Bitcoin’s final difficulty adjustment of 2025 pushed the metric to 148.2 trillion. Network data projects another increase to roughly 149 trillion on January 8, 2026, at block height 931,392. Average block times fell to approximately 9.95 minutes, slightly faster than the protocol target.

That acceleration triggered the upward recalibration. Bitcoin recalculates difficulty every 2,016 blocks, or roughly every two weeks. This automatic mechanism prevents sustained deviations in block production.

crypto.news

@cryptodotnews

LATEST: Bitcoin mining difficulty reached 148.2 trillion in its final 2025 adjustment and is projected to rise further to 149 trillion on January 8, 2026. https://t.co/SLZhWS9g3b

09:02 AM·Dec 29, 2025

Cointelegraph

@Cointelegraph

⚡️ LATEST: Bitcoin mining difficulty reached 148.2 trillion in its final 2025 adjustment and is projected to rise further to 149 trillion on January 8, 2026. https://t.co/qpnohXrzel

04:00 AM·Dec 29, 2025

Dynamic Nexus Crypto

@dnexuscrypto

Bitcoin’s mining difficulty experienced a modest increase in its final adjustment of 2025, with projections indicating another rise in January 2026, reflecting ongoing network hash rate dynamics. @Bitcoin #MiningDifficulty #DynamicNexus #DynamicNexusCrypto By Dynamic Nexus © https://t.co/C0HZ23J9f0

08:04 PM·Dec 28, 2025

Higher mining difficulty directly raises the computational and energy requirements for block rewards. Large-scale operations with access to cheap power and advanced hardware benefit from economies of scale. Smaller or less efficient miners face tighter margins as difficulty climbs.

This dynamic has fueled ongoing debates around mining centralization. At the same time, rising difficulty signals confidence among miners willing to deploy capital. Profitability now depends increasingly on operational efficiency rather than raw hashrate alone.

Bitcoin’s rising difficulty strengthens resistance against 51% attacks and double-spend attempts. However, sustained increases also concentrate mining power among well-capitalized operators. Energy consumption remains a parallel concern as difficulty tracks hashrate expansion.

Future efficiency gains in ASIC hardware may offset some cost pressures. Despite these challenges, continued difficulty growth signals network resilience. As long as miners compete for block rewards, Bitcoin’s security model remains intact.

Our Crypto Talk is committed to unbiased, transparent, and true reporting to the best of our knowledge. This news article aims to provide accurate information in a timely manner. However, we advise the readers to verify facts independently and consult a professional before making any decisions based on the content since our sources could be wrong too. Check our Terms and conditions for more info.