Forbes released the 11th edition of its Fintech 50 list in 2026 with five crypto companies in the list including hyperliquid, phantom etc.

Author: Sahil Thakur

Steady attention without excessive speculation.

20th February 2026 – Forbes released the 11th edition of its Fintech 50 list in 2026, spotlighting the top 50 private fintech companies reshaping finance through technology. The ranking evaluates firms on revenue growth, innovation, market impact, and leadership strength. Eligible companies must be privately held and either U.S.-based or have significant U.S. operations.

High Signal Summary For A Quick Glance

Phantom

@phantom

We’re beyond excited (and grateful) to be included on @forbes Fintech 50 list this year! This one's for the millions of people who trust and use Phantom. Here’s to more building and shipping 👷♂️🚢 https://t.co/XqQbvKZyRO

Our 11th annual #Fintech50 features companies that continue to innovate and grow rapidly even though industry valuations are decidedly sober compared with those of AI-focused startups, which are the newest darlings of the venture capitalist community. See the 2026 list: https://t.co/6JEVSpooTW

11:12 PM·Feb 19, 2026

Securitize

@Securitize

We're incredibly proud to be back on the @Forbes Fintech 50 for the second year in a row. Thanks to everyone on our team, from the employees to our partners, for making this recognition possible. Tokenize the World. https://t.co/27YDHAIvHv

04:00 PM·Feb 19, 2026

Artemis

@artemis

Hyperliquid just made the Forbes Fintech 50 list. Reported funding: $0. No VC rounds. No mega raises. Just execution. Hyperliquid. https://t.co/H2CbyV5zEY

03:52 PM·Feb 19, 2026

This year’s list reflects a more disciplined funding environment. Fintech investment reached $53 billion over the past year, up from post-crash lows but still far below the 2021 peak. As a result, the 2026 cohort emphasizes profitability, infrastructure, and business-to-business strength.

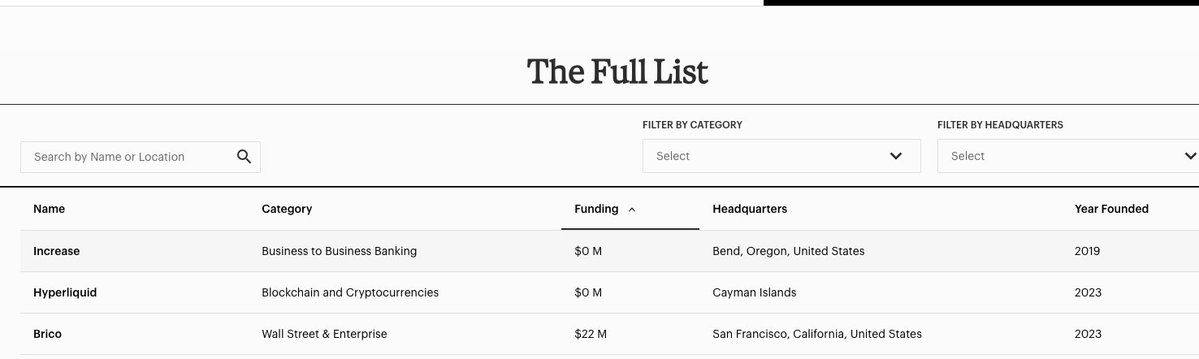

Within that broader landscape, five crypto-native companies secured spots in the Blockchain and Cryptocurrencies category.

Hyperliquid entered the list as one of the fastest-growing decentralized exchanges in the market.

Founded in 2023 by Jeff Yan, a former algorithmic trader at Hudson River Trading, the project operates both as a decentralized exchange and its own specialized Layer 1 blockchain. Unlike many venture-backed crypto startups, Hyperliquid reportedly launched without outside VC funding.

In 2025, it processed $2.95 trillion in trading volume and generated $844 million in revenue. It captured an estimated majority share of decentralized perpetual futures trading. Meanwhile, its HYPE token implied a market capitalization of roughly $7.7 billion as of early 2026.

Forbes highlighted its ability to deliver centralized-exchange speed while remaining fully onchain.

Phantom, the San Francisco-based crypto wallet founded in 2021, also made its debut on the list.

Originally known as a Solana-focused wallet, Phantom has expanded into a broader multi-chain consumer platform. It now supports 22 million active users globally.

In 2025, the company reported $320 million in revenue, up from $200 million the prior year. It also moved beyond basic wallet functionality. Phantom introduced fiat on-ramps, debit card products, and integrations with platforms like Hyperliquid and Kalshi.

The shift positions Phantom as a hybrid between self-custody wallet and mainstream fintech app.

Securitize returned to the Fintech 50 for the second consecutive year.

Founded in 2017 and based in Miami, the company specializes in tokenizing real-world assets. It provides infrastructure for issuing, trading, and administering tokenized securities.

To date, Securitize has tokenized more than $4 billion in assets across over 100 issuances. It works with major asset managers including BlackRock, Apollo, BNY, Hamilton Lane, KKR, and VanEck.

In 2025, revenue surged to $69 million, up from $18 million in 2024. The company also played a central role in BlackRock’s BUIDL tokenized Treasury fund. Additionally, it announced plans for a SPAC merger backed by Cantor Fitzgerald, potentially making it the first pure-play tokenization firm to go public.

Its repeat appearance underscores growing institutional demand for regulated blockchain infrastructure.

Polymarket, a blockchain-based prediction market platform, also joined the list.

Founded in 2020 and based in New York, Polymarket allows users to trade on political, economic, and sports outcomes. In 2025, the platform processed over $30 billion in trading volume, driven largely by election-related markets.

The company reached a $9 billion valuation in late 2025. It also regained regulatory traction after securing CFTC approval to resume U.S. operations following a previous halt.

CEO Shayne Coplan, 27, became one of the youngest self-made billionaires during the company’s rise.

Forbes recognized Polymarket’s transformation from niche crypto experiment to mainstream forecasting infrastructure.

Ledn, a Bitcoin-backed lending platform founded in 2018, completed the crypto cohort.

The company allows users to borrow U.S. dollars against Bitcoin collateral without selling their BTC holdings. Notably, Ledn survived the previous crypto lending crisis that wiped out several centralized competitors.

In 2025, Ledn originated more than $1 billion in loans. It operates in over 100 countries and uses AI-powered underwriting to speed approvals.

Its inclusion signals a renewed focus on sustainable digital-asset lending rather than speculative yield products.

The 2026 crypto selections reflect a clear pattern.

First, the emphasis has shifted toward institutional infrastructure and regulated frameworks. Second, companies with real revenue and strong product-market fit now dominate. Third, tokenization, wallets-as-platforms, and sustainable lending models have replaced the earlier cycle’s speculative DeFi themes.

While retail hype remains muted compared to 2021, crypto firms on the list demonstrate strong institutional momentum.

Overall, the 2026 Forbes Fintech 50 signals that crypto’s role within fintech is evolving. The focus now centers on infrastructure, compliance, and integration with traditional finance rather than purely speculative growth.

Our Crypto Talk is committed to unbiased, transparent, and true reporting to the best of our knowledge. This news article aims to provide accurate information in a timely manner. However, we advise the readers to verify facts independently and consult a professional before making any decisions based on the content since our sources could be wrong too. Check our Terms and conditions for more info.

ZRO Single Token Model Confirmed Across Ecosystem

Quantoz, A Project On Algorand Becomes Direct Visa Principal Member

Hyperliquid, Phantom, Securitize Make Forbes Fintech 50 List

Base Shifts to In-House Stack, Reducing Reliance on OP Stack

ZRO Single Token Model Confirmed Across Ecosystem

Quantoz, A Project On Algorand Becomes Direct Visa Principal Member

Hyperliquid, Phantom, Securitize Make Forbes Fintech 50 List

Base Shifts to In-House Stack, Reducing Reliance on OP Stack

$29.41