Paradex rollback follows a Bitcoin price glitch that triggered mass liquidations, forcing the Starknet DEX to halt trading.

Author: Kritika Gupta

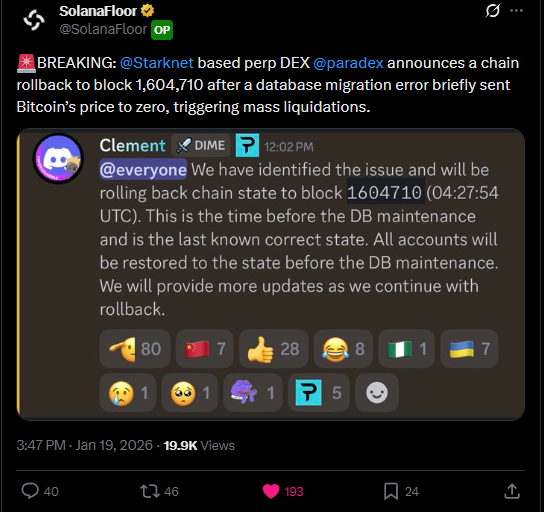

20th January 2026– Paradex, a Starknet-based perpetuals DEX, executed an emergency chain rollback after a critical technical failure briefly priced Bitcoin at $0. The glitch triggered automated liquidations across thousands of leveraged positions, forcing the platform to halt trading and reverse state changes to protect users.

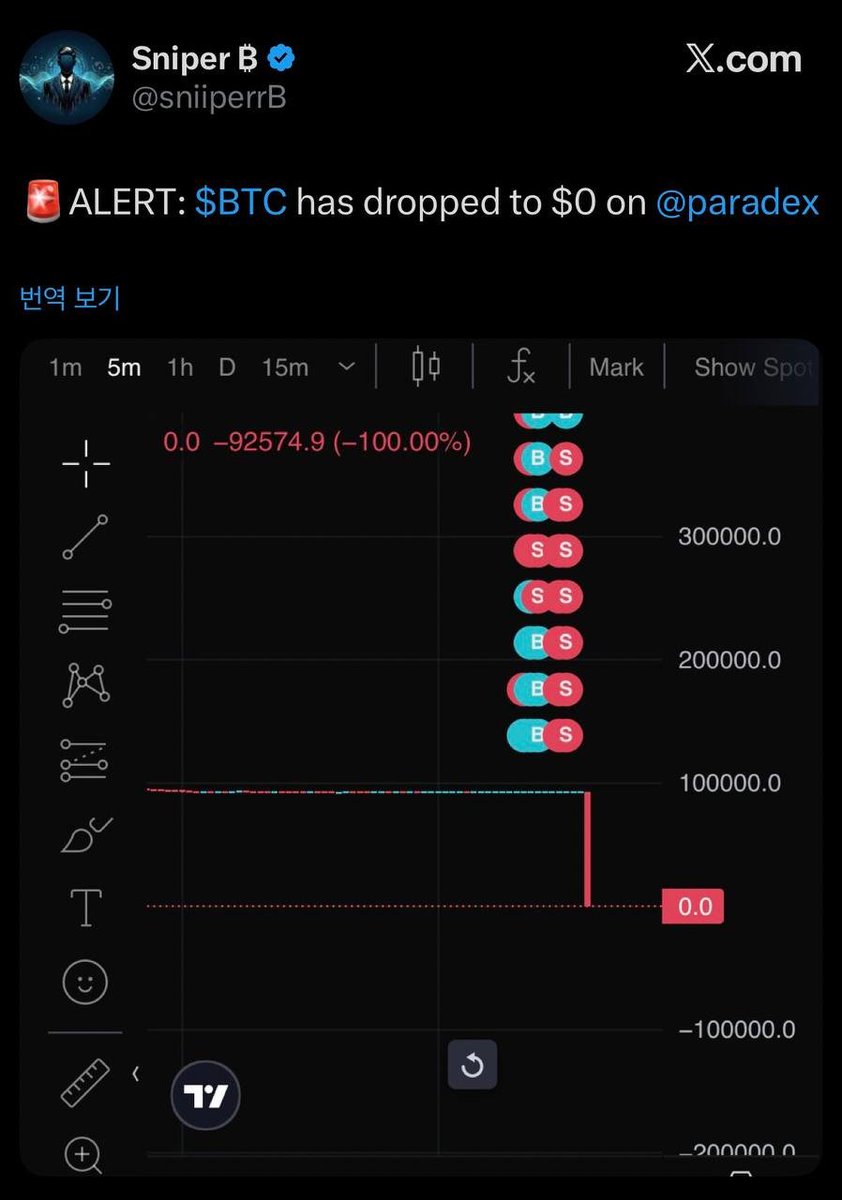

The incident occurred during routine database maintenance. Specifically, a faulty migration script corrupted Paradex’s internal price feeds, causing Bitcoin and potentially other assets such as Ethereum and Solana to register as worthless for a short period. Although the error lasted only minutes, it immediately activated the exchange’s liquidation engine, closing open positions based on the invalid price data.

High Signal Summary For A Quick Glance

Jacob King

@JacobKinge

BREAKING: Bitcoin has FLASH-CRASHED to $0 on Paradex, a decentralized crypto exchange. The exchange claims its due to a database migration glitch during maintenance. The crash triggered mass liquidations of leveraged long positions, a platform outage, and forced a chain rollback https://t.co/DTuFZqAJfH

08:57 PM·Jan 19, 2026

enes.hl

@enesonchain

This is the perp dex youre farming, Paradex. DEX rolling back chain state ? A DEX ROLLING BACK ? Send it to ZERO. Hyperliquid. https://t.co/7YusHlqQmG

03:02 PM·Jan 19, 2026

NB🇵🇱

@norbertbodziony

so @paradex is rolling back state i wonder if this was programming bug or just insider bailout https://t.co/IeQYKiQWmZ

02:39 PM·Jan 19, 2026

Paradex relies on automated pricing and liquidation logic to power its zero-fee perpetuals trading on Starknet. During the scheduled migration, engineers unintentionally altered live pricing data instead of isolating it from production systems. As a result, the platform displayed Bitcoin at $0, an impossible valuation that liquidation algorithms interpreted as a total market collapse.

Once the team identified the issue, Paradex immediately paused trading to prevent further damage. Shortly afterward, the exchange announced a full rollback to block 1,604,710, the last verified stable state before the migration began. This rollback reversed all erroneous trades and liquidations caused by the glitch.

While rare, rollback events continue to raise difficult questions about decentralization and finality in crypto markets. In late 2025, Flow faced intense backlash after reversing blocks following a $3.9 million exploit, undoing not only malicious transactions but also legitimate activity. Earlier precedents include the 2020 BitMEX flash crash and earlier mainnet bugs on other chains, all of which damaged user confidence.

Consequently, Paradex’s decision reignites debate over how much centralized control is acceptable during emergencies. Although users avoided losses, critics argue that the ability to roll back state undermines the trustless guarantees typically associated with decentralized exchanges.

Relative positioning against past rollback and market disruption events

Following roughly eight hours of downtime, Paradex restored operations and confirmed that all user accounts returned to their pre-incident state. Importantly, the team reported that no funds were permanently lost. Through Discord and social media updates, Paradex emphasized that user balances were safe and that the rollback fully neutralized the impact of the faulty price feeds.

In addition, the exchange committed to a post-mortem review. According to the team, future upgrades may include stricter separation between maintenance processes and live trading systems, as well as stronger safeguards around price feed integrity.

In the short term, sentiment around Paradex remains divided. On one hand, users credit the team for fast action, transparent communication, and full account restoration. On the other hand, the incident highlights structural risks in automated liquidation systems and operational dependencies that can still fail despite decentralization narratives.

Looking ahead, Paradex now faces pressure to harden its infrastructure. Multi-oracle validation, isolated testing environments, and clearly defined emergency controls will likely become expectations rather than optional upgrades. If the exchange delivers these improvements quickly and transparently, it can preserve its position in the competitive Starknet perpetuals market.

Our Crypto Talk is committed to unbiased, transparent, and true reporting to the best of our knowledge. This news article aims to provide accurate information in a timely manner. However, we advise the readers to verify facts independently and consult a professional before making any decisions based on the content since our sources could be wrong too. Check our Terms and conditions for more info.

Step Finance ShutDown After $40M Hack Ends Solana Era

Project 0 Upgrades Add PT Tokens and Multi-Venue Collateral

Austria Halts KuCoin EU Expansion Over Compliance Gaps

Fluid Protocol Sets Up Legal Foundation While DAO Keeps Full Control

Step Finance ShutDown After $40M Hack Ends Solana Era

Project 0 Upgrades Add PT Tokens and Multi-Venue Collateral

Austria Halts KuCoin EU Expansion Over Compliance Gaps

Fluid Protocol Sets Up Legal Foundation While DAO Keeps Full Control