The SEC is reviewing proposals from CBOE and NYSE Arca to introduce generic listing standards for crypto ETFs.

Author: Sahil Thakur

The U.S. Securities and Exchange Commission (SEC) is reviewing a proposal that could significantly reduce regulatory friction for launching crypto exchange-traded products (ETPs). If adopted, the plan would allow certain cryptocurrency ETFs to list and trade without undergoing individual approval processes, marking a major shift in how digital asset funds come to market.

The proposed rule change, filed by the Cboe BZX Exchange and NYSE Arca, introduces generic listing standards for Commodity-Based Trust Shares. These standards aim to provide a streamlined path for crypto ETFs, especially those meeting defined eligibility criteria, such as trading history on derivatives markets.

Under current regulations, crypto ETF issuers must file a Form 19b-4 with the SEC for every new fund. This starts a lengthy review process that can extend up to 240 days. The new proposal seeks to eliminate that requirement for funds that meet certain baseline standards.

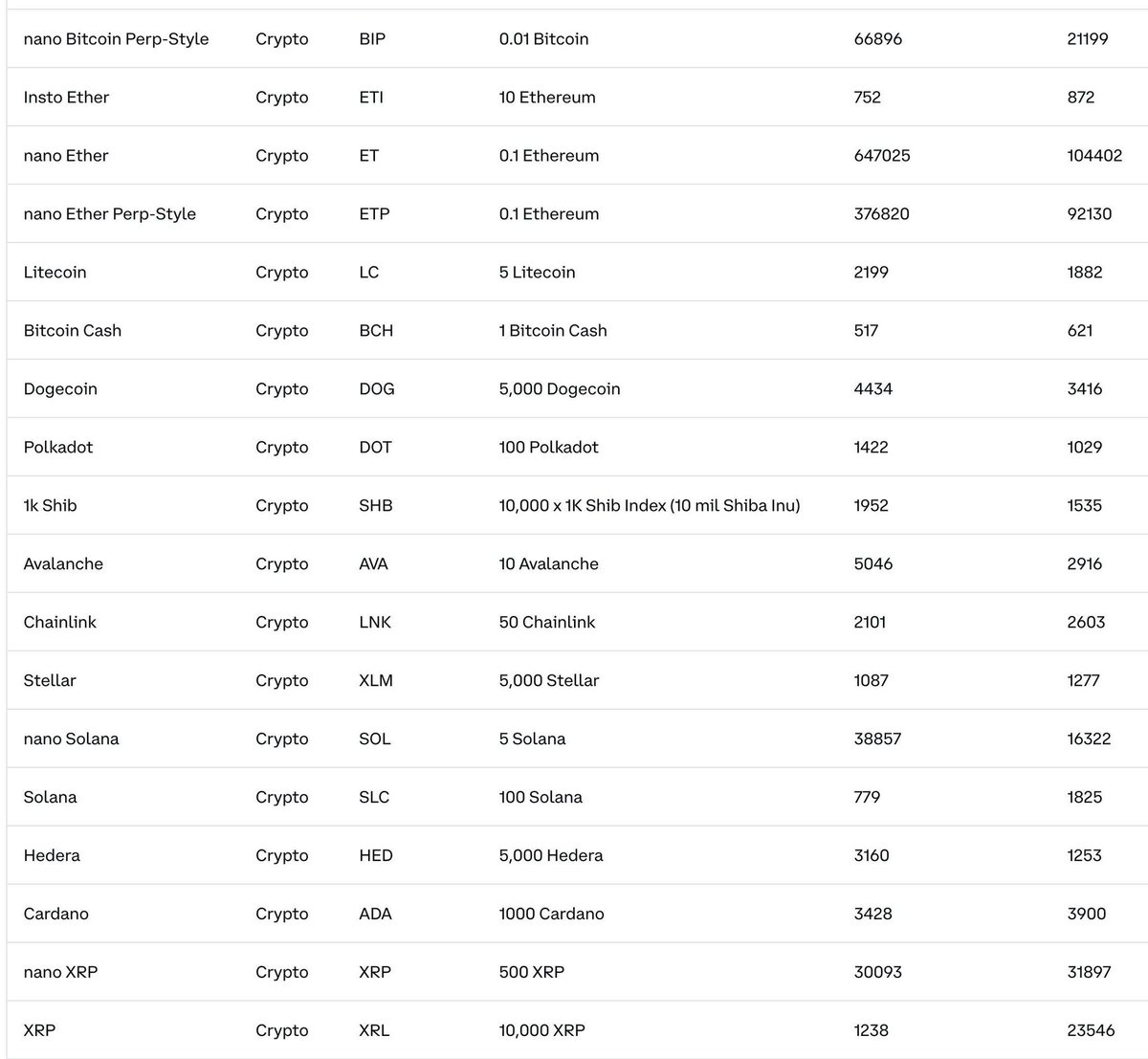

According to the filing, any crypto asset that has been actively traded on Coinbase’s derivatives platform for more than six months could qualify under the new framework. This provision could cover more than a dozen large-cap tokens, including Solana (SOL), XRP, and potentially others like Dogecoin (DOGE), which already have pending ETP applications.

Nate Geraci, president of NovaDius Wealth and a noted ETF analyst, called the proposal “a very important submission.” He added that if approved, it would spare issuers from seeking SEC clearance for each new crypto ETF provided they meet the defined conditions.

CryptosRus

@CryptosR_Us

🚨 NEW: 🇺🇸The SEC has released “Listing Standards” for crypto ETPs via latest exchange filing– any token with over 6 months of futures trading on @coinbase derivatives appearing likely for approval. According to Eric Balchunas, September or October timing expected for multiple https://t.co/p2g2ycPBwA

12:43 AM·Jul 31, 2025

The first test cases for this streamlined approval process could be Solana and XRP. Solana’s ETP application is facing an October 10 deadline for SEC decision-making, while XRP’s deadline trails shortly after.

Legal experts like Greg Xethalis suggest that both could benefit from the new listing standards if adopted in time. In-kind creation and redemption models—already approved for spot Bitcoin and Ethereum ETFs are expected to feature prominently in these next-generation ETPs. Solana ETPs may also include staking features under this framework.

The SEC is now in the comment phase, which is likely to conclude 21 days after the proposed rule is published in the Federal Register. Final decisions could follow within 60 days, depending on the pace of review and any further amendments.

NYSE Arca’s filing mirrors Cboe’s proposal, signaling a coordinated industry push for regulatory modernization. Both exchanges argue that the new standards will reduce time and cost burdens for issuers while enhancing market competition and investor access.

A spokesperson for Cboe noted that the proposed rules do not yet include a quantitative threshold, such as minimum asset size, but amendments to include such measures are expected post-approval.

“The Exchange believes that the proposed generic listing standards… would promote market competition among issuers of such products, to the benefit of the investing public,” NYSE Arca wrote in its submission.

The regulatory environment has shifted significantly in 2025 under President Donald Trump’s administration. Earlier this month, the White House released a 168-page policy paper through its Working Group on Digital Assets, advocating for clearer rules and reduced red tape.

Legislation like the GENIUS Act, now law, sets comprehensive guidelines for stablecoin issuance and reserves. The House of Representatives also passed the CLARITY Act and the CBDC Anti-Surveillance State Act, both awaiting Senate review after the August recess.

Together, these initiatives reflect a broader government strategy to integrate digital assets into the traditional financial system while curbing regulatory overreach.

The SEC has recently approved in-kind redemptions and expanded options limits for Bitcoin and Ethereum ETFs. These changes align crypto funds more closely with traditional ETF structures and improve market access for institutional investors.

If the new generic listing standards are adopted, they could become the foundation for a new era in crypto fund issuance, accelerating approvals and encouraging broader adoption. With dozens of ETP applications pending, the industry is watching closely for the Commission’s next move.

| Fund / Product | Type | YTD Return (2025) | Notes |

|---|---|---|---|

| iShares Bitcoin Trust (IBIT) | Spot Bitcoin ETF | +25.3% | Very tight tracking, massive inflows |

| Ninepoint Crypto & AI Leaders ETF | Hybrid Crypto/AI | –8.3% (as of May) | Volatile, rebounded in June |

| European Physical Bitcoin ETPs | Crypto ETPs | +1.4% to +2.0% | Modest YTD gains vs 2024 boom |

| ProShares BITO | Futures-based ETF | Futures-tracking | Lower alignment to spot BTC |

| GBTC (Grayscale Bitcoin Trust) | Legacy Trust | N/A (outflows) | Legacy structure losing assets |

| Amplify BLOK / other crypto stock ETFs | Equity-basket ETF | Varies | Indirect exposure to crypto equities |

Our Crypto Talk is committed to unbiased, transparent, and true reporting to the best of our knowledge. This news article aims to provide accurate information in a timely manner. However, we advise the readers to verify facts independently and consult a professional before making any decisions based on the content since our sources could be wrong too. Check our Terms and conditions for more info.