Tether has added 8,888 BTC in Q4 2025, according to a recent update from CEO Paolo Ardoino, strengthening its Bitcoin position.

Author: Sahil Thakur

1st January 2026 – Tether has significantly boosted its Bitcoin holdings, adding 8,888.8888888 BTC in Q4 2025, according to a recent update from CEO Paolo Ardoino. On-chain data indicates that the stablecoin issuer accumulated roughly 9,850 BTC in total during the quarter, amounting to about $876 million at current prices.

Part of the buying included a withdrawal of 961 BTC, worth around $97.18 million from Bitfinex on November 7, 2025. A larger transfer of 8,888.8 BTC followed on January 1, 2026, bringing the total to nearly 9,850 BTC for the quarter.

This BTC now sits in Tether’s primary Bitcoin reserve address. The address holds 96,185 BTC, valued at approximately $8.42 billion. It ranks as the fifth-largest known Bitcoin wallet globally. The size of the holding highlights Tether’s increasingly aggressive treasury strategy focused on .

Perception 🌐

@BTCPerception

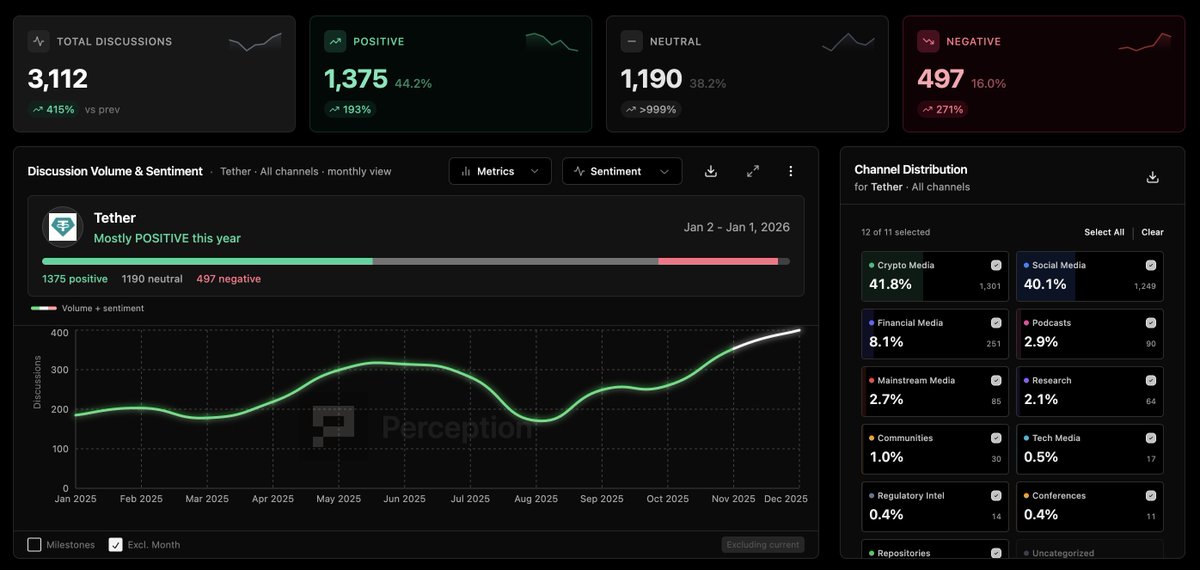

@paoloardoino Public perception of Tether: Mostly positive sentiment across the year. 16% of the discussions were negative vs 44% positive. https://t.co/1wk3ltZr4w

Tether acquired 8,888.8888888 BTC in Q4 2025. https://t.co/vMh1uzv1wO

01:44 AM·Jan 1, 2026

JulbyJuli.eth

@JulbyJuli

@paoloardoino @saylor That’s why we had 88.888,88? 888K incoming? https://t.co/ZzW56XBlah

88.888,88 looks beautiful https://t.co/jfT3hGLvrl

10:57 PM·Dec 31, 2025

Pookie

@PookieTrader

@paoloardoino I hope your avg cost is better than saylor’s

Tether acquired 8,888.8888888 BTC in Q4 2025. https://t.co/vMh1uzv1wO

09:54 PM·Dec 31, 2025

Tether has repeatedly positioned Bitcoin as a long-term reserve asset. Rather than short-term trading, the firm uses excess profits to build exposure to BTC. The growing balance reflects this philosophy. It also shows confidence in Bitcoin as a strategic hedge.

Alongside the BTC accumulation, Tether also minted significant new USDT volumes in recent weeks. This included a $1 billion issuance on the TRON network, suggesting a strong outlook for liquidity demand on exchanges and payment rails.

Notably, USDT is seeing broader usage beyond trading. Data shows increasing adoption for remittances and smaller peer-to-peer payments. Analysts argue this shift reinforces Tether’s role as a global digital dollar rather than just a market-making tool.

Tether’s recent investments go beyond token issuance. The firm is backing payment infrastructure companies, particularly those building on the Bitcoin Lightning Network. These moves aim to bring both Bitcoin and USDT closer to real-world settlement use cases.

Tether issues USDT, the largest dollar-pegged stablecoin, and it manages a large pool of assets to support it. Most of Tether’s reserves sit in U.S. Treasury bills and other highly liquid government securities. The company also holds cash and money-market funds so it can meet redemptions quickly.

Tether has expanded into alternative assets as well. It owns significant amounts of bitcoin and gold, which it presents as diversification and protection against economic shocks. It also allocates smaller portions of its reserves to secured loans and other higher-risk investments.

Beyond its reserves, Tether invests profits into technology and infrastructure projects. These include payments companies, bitcoin mining operations, and emerging tech ventures. Through these moves, Tether aims to grow beyond a pure stablecoin issuer and become a broader financial and technology player.

Supporters point to the size of Tether’s reserves and its heavy use of Treasuries. Critics worry about transparency and the exposure to volatile assets. Either way, the makeup of Tether’s holdings now influences both crypto markets and traditional finance.

Src: Arkham

The combination of growing Bitcoin reserves and broader USDT utility paints a clear picture. Tether is positioning itself for scale. It is reinforcing its balance sheet with BTC while expanding USDT’s relevance across both centralized exchanges and decentralized payment systems.

Together, these developments mark a strong close to 2025 and set the stage for deeper integration of Tether’s products into the global crypto economy.

Our Crypto Talk is committed to unbiased, transparent, and true reporting to the best of our knowledge. This news article aims to provide accurate information in a timely manner. However, we advise the readers to verify facts independently and consult a professional before making any decisions based on the content since our sources could be wrong too. Check our Terms and conditions for more info.

Quantoz, A Project On Algorand Becomes Direct Visa Principal Member

Hyperliquid, Phantom, Securitize Make Forbes Fintech 50 List

Base Shifts to In-House Stack, Reducing Reliance on OP Stack

Nexus Labs Launch USDX Stablecoin Backed by US Treasuries

Quantoz, A Project On Algorand Becomes Direct Visa Principal Member

Hyperliquid, Phantom, Securitize Make Forbes Fintech 50 List

Base Shifts to In-House Stack, Reducing Reliance on OP Stack

Nexus Labs Launch USDX Stablecoin Backed by US Treasuries