YO Protocol slippage loss wiped out $3.7M on Uniswap V4 after a misrouted swap, raising fresh concerns over DeFi execution and routing risks.

Author: Kritika Gupta

14th January 2026- YO Protocol suffered a major operational failure after a large Uniswap V4 swap executed with extreme slippage. The error wiped out roughly $3.7 million in protocol funds within a single transaction. While no exploit occurred, the incident highlights how routing complexity can amplify risk. The YO Protocol slippage loss now stands as one of the largest execution mistakes of early 2026.

High Signal Summary For A Quick Glance

LIKWID

@likwid_fi

The YO @yield Protocol incident — where ~$3.84M of stkGHO was swapped for just ~$122K USDC — highlights several critical weaknesses in DeFi trade routing and risk controls. At a technical level, the root cause was a failure in execution path safeguards: • Excessively high (or https://t.co/SQfQhxRaPL

07:44 AM·Jan 14, 2026

ilemi

@andrewhong5297

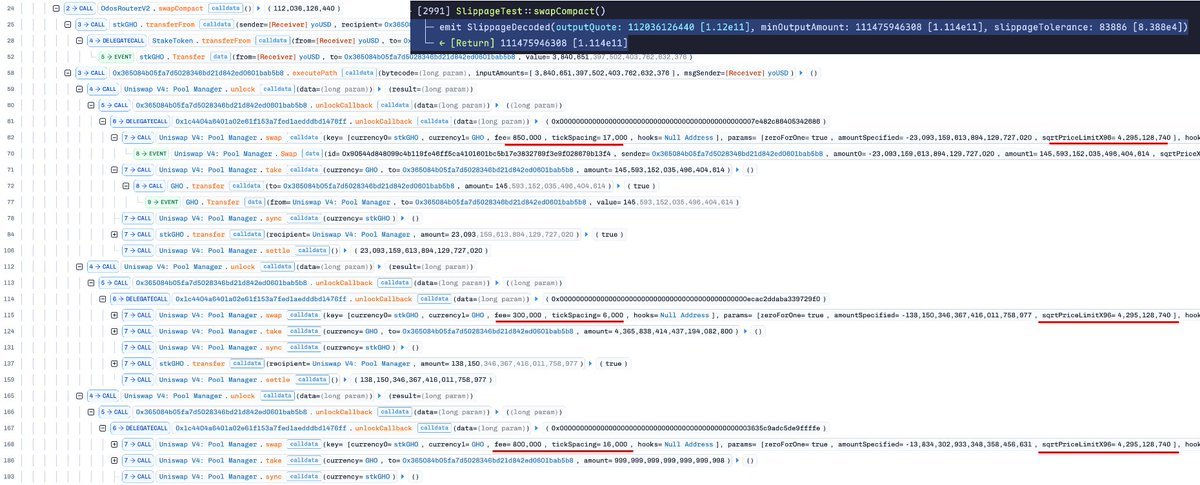

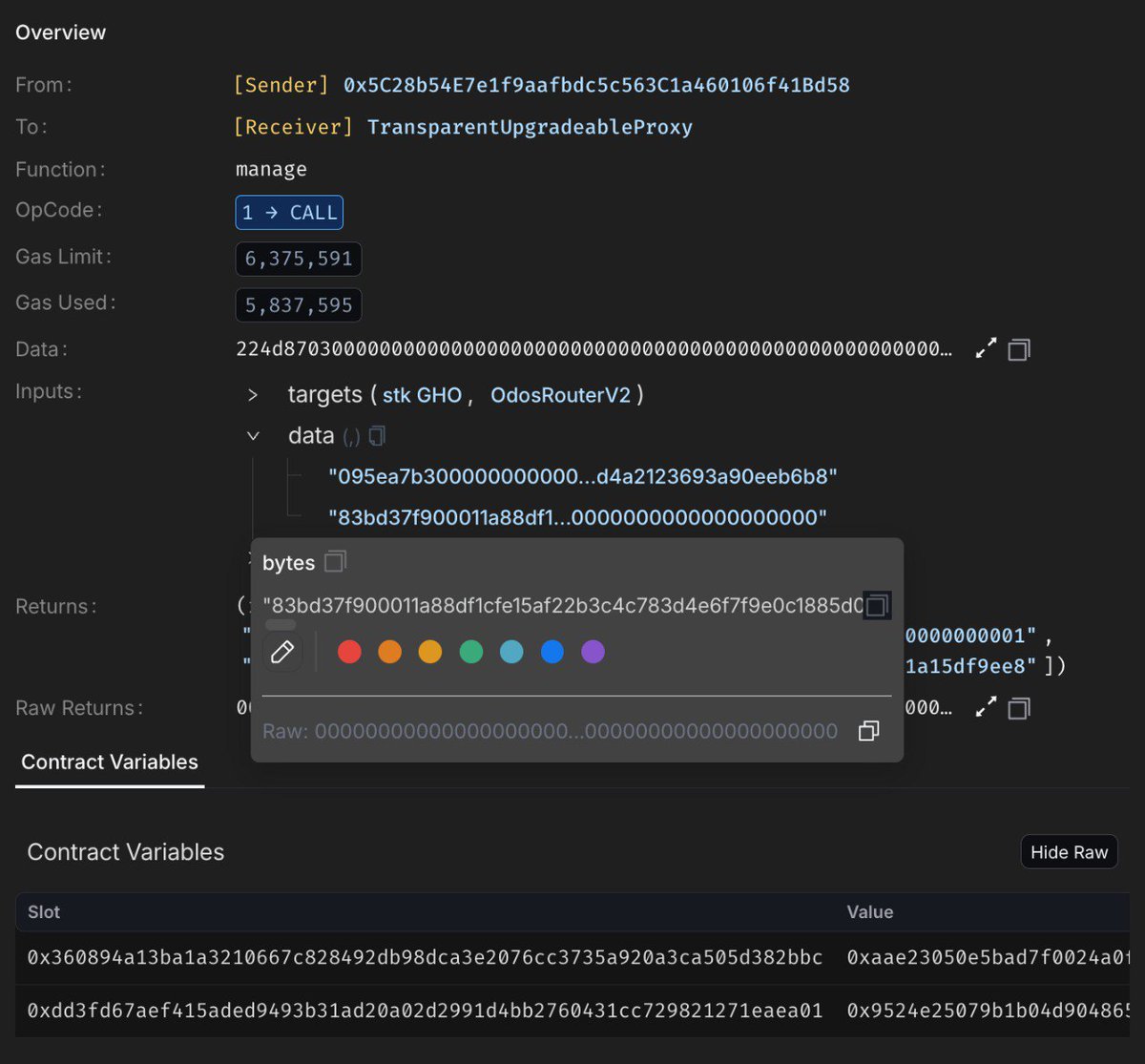

The YO vault used OdosRouterV2 for this operation; it was already quoted at a minimum out of $111,475 USDC in swapCompact, so while there was some minimal slippage, it wasn't the main issue. https://t.co/0Kc5UT01V0 https://t.co/gNtoFBbg1e

YO protocol @yield has lost $3.7 million due to a bad swap of YoUSD. In the following tx YoVault operator executed a swap of $3.84M stkGHO into just ~112k USDC. A Uniswap v4 LP captured the $3.7M difference. https://t.co/VnCvxG3wB4 Several hours later Yo protocol's multisig https://t.co/vL3WEeLibk

05:32 PM·Jan 13, 2026

QuillAudits

@QuillAudits_AI

Today, the Yo Vault operator of YO Protocol (@yield ) executed a large swap of approximately $3.84 million in stkGHO (staked GHO) intended for USDC. Due to an unintended / misconfigured routing through a @Uniswap v4 liquidity pool (likely involving a custom hook or extreme https://t.co/6c9QpPxdBB

11:16 AM·Jan 13, 2026

First, routing choices amplified the damage. According to BlockSec, abnormal execution paths routed the swap through high-fee, thin-liquidity pools, resulting in severe price impact and excessive fee extraction. Independent analysis likewise reached the same conclusion.

Meanwhile, LIKWID described the incident as a failure in execution-path safeguards, noting that excessively high or misconfigured slippage tolerance allowed the trade to proceed instead of reverting.

Crucially, however, it stressed that this was not a smart-contract exploit, but rather a business-logic and risk-management failure at the execution layer. More broadly, similar slippage-driven losses have appeared across DeFi.

At the same time, as Uniswap V4–style architectures, hooks, and fragmented liquidity environments become more common, execution risk increases when safeguards fail.

Historically, market reactions to such incidents remain brief. Accordingly, security firms and market observers note that these events usually cause short-lived TVL dips, followed by recovery once funds are reimbursed or controls are tightened.

How the $3.7M YO Protocol loss fits into past slippage and execution failures

The incident occurred amid a broader rebound in DeFi sentiment in early 2026. Crypto markets remain in a risk-on phase, supported by ETF inflows and renewed institutional interest. Bitcoin trades near $95,000, while Ethereum hovers around $3,300. Total DeFi TVL continues to rise as capital rotates back into yield strategies and on-chain trading.

Despite this, the loss accounts for only a small share of overall DeFi liquidity. Importantly, markets showed no signs of systemic stress or cascading liquidations. GHO held steady near its $1 peg, and related tokens and DeFi indices avoided major price disruptions.

In contrast, social reactions remain mixed. On one hand, some users criticized operational oversight and questioned trust in the vaults. On the other, others emphasized the speed of mitigation. Overall, coverage frames the event as an isolated execution error rather than a structural flaw, noting it stemmed from business-logic risk management rather than a smart contract exploit.

In such incidents, recovery depends on quick action to restore confidence. Teams often use treasury funds to cover losses, helping limit panic and broader fallout.

Additionally, some protocols also seek on-chain, cooperative solutions, asking counterparties to return most of the captured value while keeping a small portion as an incentive.

However, prevention matters more than reimbursement. Protocols need stronger execution controls, including avoiding low-liquidity pools, setting hard limits on price impact, and tightening routing rules for large trades.

Our Crypto Talk is committed to unbiased, transparent, and true reporting to the best of our knowledge. This news article aims to provide accurate information in a timely manner. However, we advise the readers to verify facts independently and consult a professional before making any decisions based on the content since our sources could be wrong too. Check our Terms and conditions for more info.