Spot crypto ETFs in the U.S. recorded one of their worst weeks. From Jan 26 to 30, 2026, spot Bitcoin ETFs bled $1.49 billion in net outflows.

Author: Sahil Thakur

High attention and emotional sentiment detected.

2nd February 2026 – Spot crypto ETFs in the U.S. recorded one of their worst weeks on record. From January 26 to 30, 2026, spot Bitcoin ETFs bled $1.49 billion in net outflows. Ethereum ETFs followed with $327 million in redemptions. Together, these figures mark a sharp pullback in institutional crypto appetite to close out January.

High Signal Summary For A Quick Glance

Coin Bureau

@coinbureau

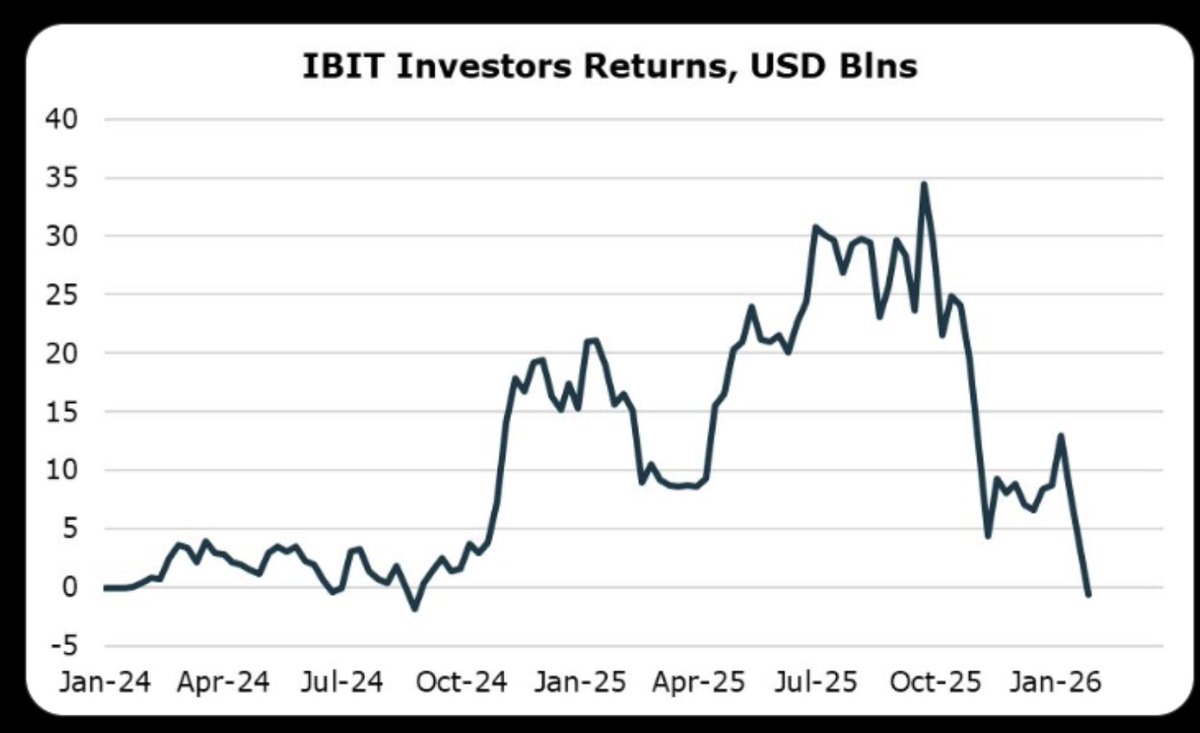

🚨IBIT INVESTORS NOW UNDERWATER According to asset manager Bob Elliott, the average dollar invested in BlackRock’s Bitcoin ETF (IBIT) has turned negative. Bitcoin’s weekend sell-off pushed prices into the mid-$70Ks, tipping IBIT investor returns into the red. https://t.co/eEdfigsznF

08:30 PM·Feb 1, 2026

SoSoValue

@SoSoValueCrypto

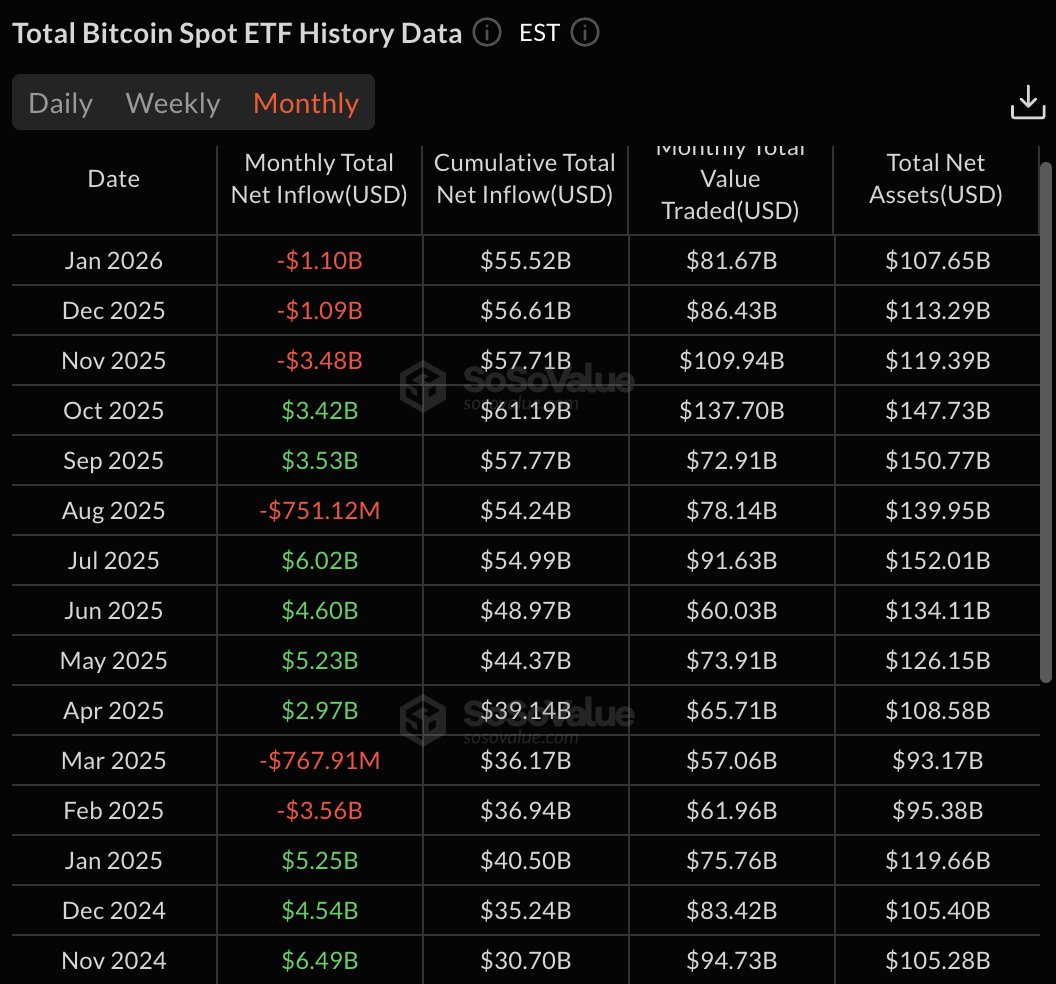

🚨 Market Alert: Gold & Silver Plunge After Historic Highs As geopolitical tensions fuel risk-off sentiment, crypto markets face significant pressure. BTC dropped ~7% to $82,000 — the lowest point of 2026. 📊 Critical ETF Data (via @SoSoValueCrypto ): Jan 2026: -$1.10B outflow https://t.co/h4tr5QrUtk

08:30 AM·Jan 30, 2026

Eric Balchunas

@EricBalchunas

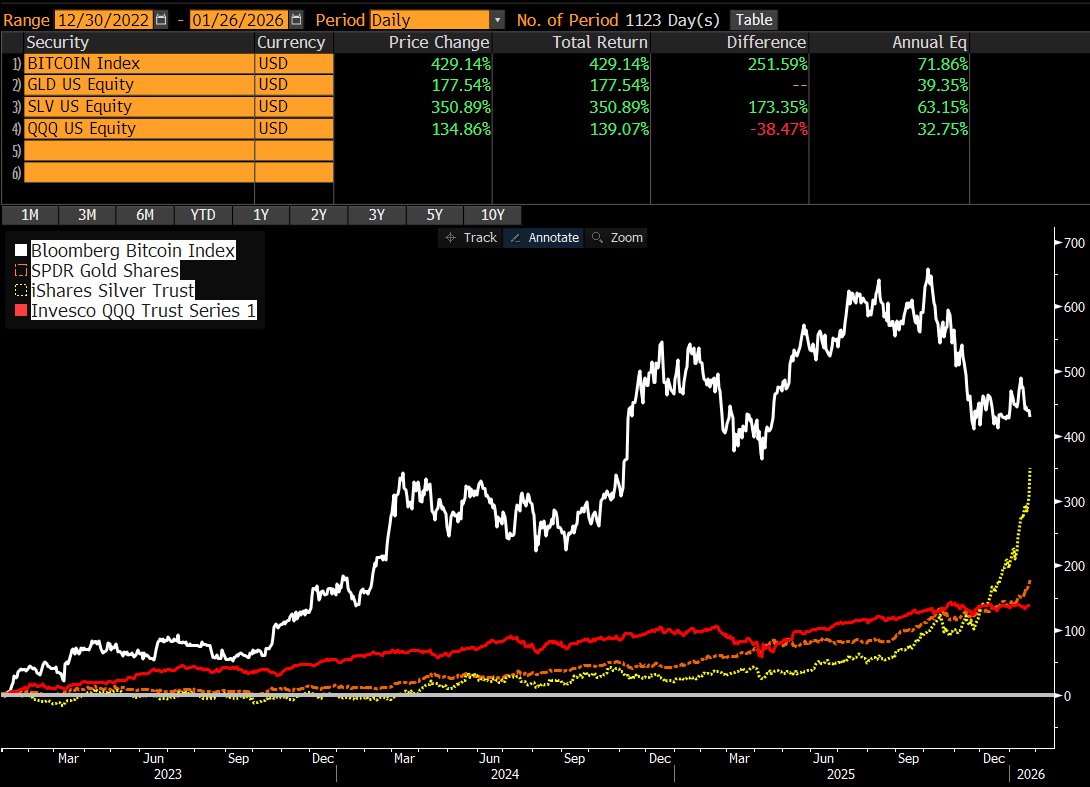

The dread I see from bitcoiners (and the football spiking from the haters) is very short-sighted to me given that since 2022 (right before the BlackRock ETF filing) Bitcoin is up 429%, gold 177%, Silver 350%, QQQ 140%. In other words bitcoin spanked everything so bad in '23 and https://t.co/SPNB9RTdzv

11:11 PM·Jan 27, 2026

Bitcoin ETFs lost nearly $1.5B in just five trading days. This alone accounted for 93% of the month’s $1.6B net outflow, making it one of the worst months since spot ETFs launched.

The pain peaked on January 29, with a single-day outflow of $817.8 million, mostly during a steep BTC price drop below $85,000. Market volatility, macro uncertainty, and declining BTC sentiment likely drove the redemptions.

Loading chart...

BlackRock’s IBIT ETF was hit the hardest. Over the five-day span, IBIT saw $947.2 million in outflows, equivalent to roughly 11,170 BTC sold.

This sell-off came mainly on Jan 29 and 30, when BTC broke below key support levels and retail panic intensified. Combined with other issuer flows, the data suggests a short-term institutional retreat.

Bitcoin spot ETF flows: past vs current trend

Ethereum ETFs mirrored the Bitcoin trend. From Jan 26 to 30, $327.1 million exited Ethereum spot ETFs, the worst weekly performance in months.

Outflows peaked on January 30, when $252.9 million was withdrawn in a single day.

Loading chart...

BlackRock’s ETHA ETF saw $264 million in outflows over the week. This translated into a net sell-off of approximately 94,995 ETH.

The biggest exits came on Jan 30, with ETH down sharply after breaking below $2,500. IBIT’s and ETHA’s twin outflows show that even heavyweight issuers weren’t immune to investor jitters.

Ethereum spot ETF flows: past vs current trend

Next, focus on whether ETF outflows continue or stabilize as February begins. If redemptions slow, it would signal that institutions are done de-risking and may start rebuilding positions. However, another week of heavy withdrawals would confirm a broader shift away from crypto exposure.

At the same time, watch BlackRock’s behavior closely. IBIT and ETHA selling has driven much of the pressure. If flows flip back to neutral or positive, market sentiment could recover quickly. On the other hand, continued selling from the largest issuers would likely cap any near-term rallies.

Macro signals also remain critical. Federal Reserve messaging, Senate confirmation drama around Kevin Warsh, and government shutdown risks could all add volatility. Any hint of rate cuts or liquidity support would likely ease pressure on both Bitcoin and Ethereum.

Finally, monitor price reaction around key technical levels. Bitcoin holding above the low $80,000 range and Ethereum defending the $2,500 area would suggest forced selling is largely finished. A clean breakdown, however, could trigger another round of ETF-driven liquidations and extend the correction.

Our Crypto Talk is committed to unbiased, transparent, and true reporting to the best of our knowledge. This news article aims to provide accurate information in a timely manner. However, we advise the readers to verify facts independently and consult a professional before making any decisions based on the content since our sources could be wrong too. Check our Terms and conditions for more info.

CrowdWalrus Goes Live Introducing Crowdfunding to Sui

MegPrimePay Token launching on 26th Feb On Uniswap & Coinbase DEX

BBRL Polygon Launch: Banco Braza Expands BRL Stablecoin

U.S. Senate Launches Investigation Into Binance Crypto Transfers

CrowdWalrus Goes Live Introducing Crowdfunding to Sui

MegPrimePay Token launching on 26th Feb On Uniswap & Coinbase DEX

BBRL Polygon Launch: Banco Braza Expands BRL Stablecoin

U.S. Senate Launches Investigation Into Binance Crypto Transfers