Garrett Jin, a Hong Kong–based crypto trader and controversial industry figure who once celebrated millions in profits during the October crash has been liquidated yesterday.

Author: Sahil Thakur

1st February 2026 – Garrett Jin, a Hong Kong–based crypto trader and controversial industry figure who once celebrated millions in profits during the October crash has been liquidated yesterday.

High Signal Summary For A Quick Glance

Luke Cannon

@lukecannon727

Pour one out for Garrett Jin, the BTC whale who just got fully liquidated on his ETH long Literally zero equity left in his perps account -$128M all-time HLP is currently up $13M after taking over the backstop liquidation & will now have to close the ~$200M long remaining https://t.co/v299Oe4cxd

06:52 PM·Jan 31, 2026

Big Trout ⚫️🦢

@BigTrout300

Garret Jin, one of the most profitable scammers in the space. Committed fraud, stole, scammed. Walked away with $2b+ in assets. This cycle he becomes to "eye of the storm" all the attention in the world. He starts selling spot BTC, spot ETH via Binance in October. Offloading https://t.co/K581B4l3Ys

06:46 PM·Jan 31, 2026

Jin’s career started in traditional finance. He earned an economics degree from Boston University in 2008 and began his career at China Construction Bank. In 2012, he founded Da Yo Trading (HK) and later served as Operations Director at Huobi (now HTX) until 2015. He also co‑founded WaveLabs and GroupFi.

His most notable project was BitForex, a crypto exchange he founded and led as CEO. BitForex abruptly shut down in February 2024 amid allegations that between $56 million and $57 million in customer funds disappeared, widely described as an exit scam. The fallout damaged Jin’s reputation and put him at the center of industry scrutiny.

Despite controversy, Jin remained active in markets. On social media under @GarrettBullish, he shared market insights, macro views, and trading strategies. On-chain analysis linked significant wallets to him, including early movements of tens of thousands of BTC and ENS domains like garrettjin.eth. Jin has repeatedly said some large wallets represent client funds rather than personal assets.

Jin returned to prominence during the October 10, 2025 crash. Minutes before a major announcement by President Donald Trump that a 100% tariff on China would take effect, wallets tied to Jin opened huge short positions on bitcoin and ethereum. Bitcoin quickly collapsed, triggering over $19 billion in liquidations across crypto markets.

Those trades proved lucrative. Estimates placed Jin’s profits from the crash between $140 million and more than $200 million, with roughly $150 million attributed to BTC shorts alone. The timing prompted intense speculation, and some online theories wrongly suggested insider links to political figures. Jin denied any such connections and described the shorts as hedges for client holdings, not personal insider trades.

After October, Jin pivoted to a bullish stance. From late 2025 into early 2026, he built massive leveraged long positions totaling roughly $500 million to $900 million across bitcoin, ethereum, and solana. He publicly argued that ethereum should outperform due to market correlations and potential policy catalysts.

However, markets shifted again. On January 31, 2026, a selloff triggered by concerns over Federal Reserve leadership and political uncertainty prompted widespread deleveraging. Ethereum broke key levels and continued lower.

Src: X (Ash Crypto)

Jin’s biggest long positions, especially in ethereum, were hit hard. His largest ethereum long, once valued between $250M and $700M, was forcibly closed at a loss of roughly $250 million. Over a two‑week stretch, his losses approached $270 million, wiping out most of his October gains.

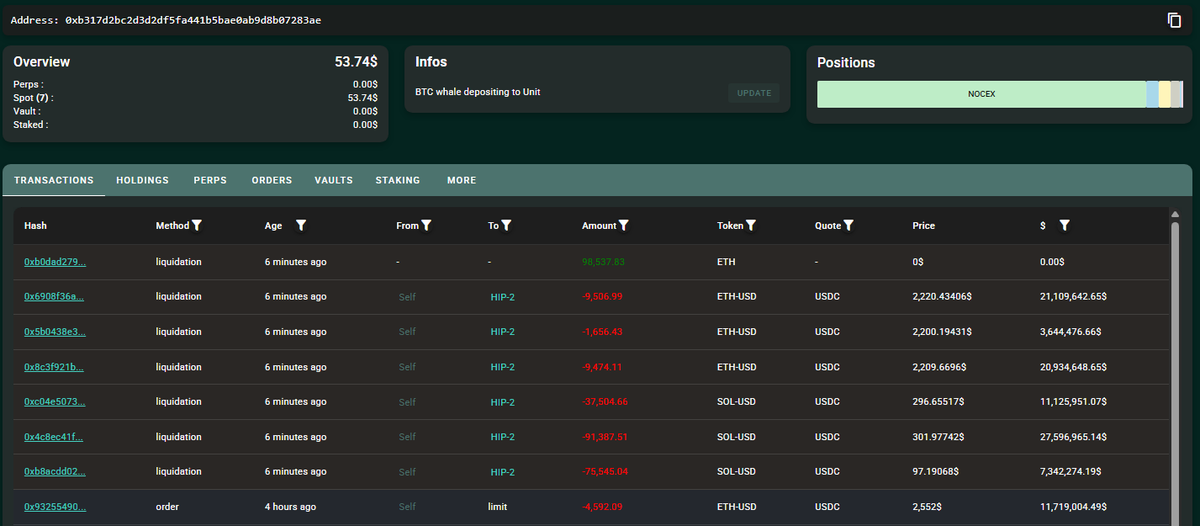

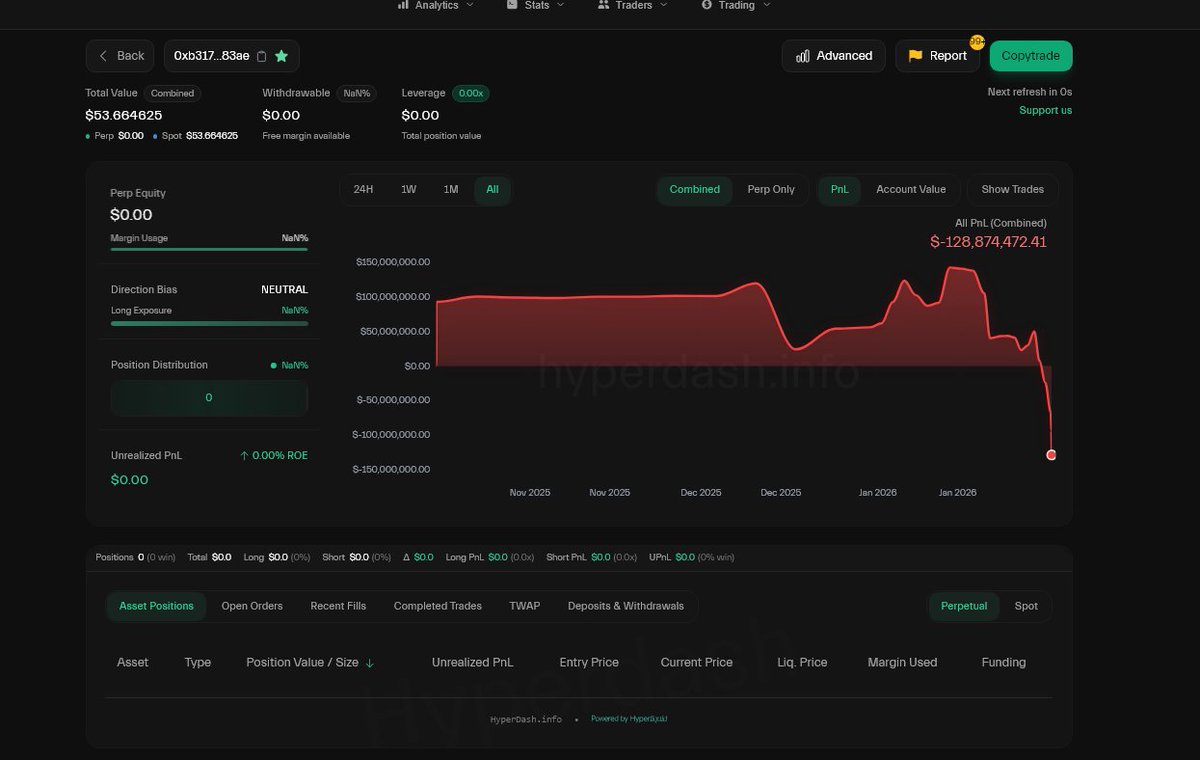

By the end of the liquidations, Jin’s Hyperliquid account shrank to just $53. Onchain records suggest his lifetime profit‑and‑loss on the platform dipped into negative territory, exceeding $128 million in net realized losses. Hyperliquid captured about $15 million through the liquidation process itself.

The market reaction was swift. Traders and commentators presented Jin’s ordeal as a stark lesson on the risks of leveraged trading, even for whales. Some described his story as a cautionary tale on timing, leverage, and market unpredictability.

Today, Garrett Jin’s journey underscores crypto’s extreme volatility. In a span of months, he moved from one of the most profitable trades of the cycle to one of the most visible losses. The episode reinforces a simple truth for traders: leverage can magnify gains, but it can also magnify losses.

Our Crypto Talk is committed to unbiased, transparent, and true reporting to the best of our knowledge. This news article aims to provide accurate information in a timely manner. However, we advise the readers to verify facts independently and consult a professional before making any decisions based on the content since our sources could be wrong too. Check our Terms and conditions for more info.

Lista Credit Goes Live Bringing Collateral Free Borrowing to DeFi

Aave Surpasses $1 Trillion in Cumulative Loans

Meteora Insider Allegations: Co-Founder Denies Trading Claims

STBU Token Exploit Mints 56M Tokens on Arbitrum

Lista Credit Goes Live Bringing Collateral Free Borrowing to DeFi

Aave Surpasses $1 Trillion in Cumulative Loans

Meteora Insider Allegations: Co-Founder Denies Trading Claims

STBU Token Exploit Mints 56M Tokens on Arbitrum