Learn how to track crypto whale activity using on-chain data, wallet trackers, and exchange flows to spot big moves and trade smarter.

Author: Arushi Garg

If you have ever seen crypto prices move suddenly and wondered what just happened, you are not alone. Large investors, known as whales, can move the market when they buy or sell big amounts of crypto. Many traders want to follow whale activity, but they feel confused. The tools look complex. The data feels overwhelming. And it is not clear what actually matters.

This guide will show you exactly how to track whale activity in crypto using simple tools. You will learn where to click, what to look at, and how to avoid common mistakes. By the end, you will feel confident checking whale wallets and understanding what their movements mean.

Whale activity in crypto means large transactions made by wallets that hold a big amount of cryptocurrency.

A whale is usually:

When these wallets move millions of dollars worth of Bitcoin or other tokens, it can affect price and market sentiment.

Tracking whale activity means monitoring these large transactions on the blockchain.

When you track whale activity in crypto, you gain insight into market behavior before price moves become obvious.

Here is why it matters:

First, whales often move funds before big market shifts. For example, if large amounts of Bitcoin move to exchanges, it may signal selling pressure. Second, whale accumulation can signal confidence. If large wallets are steadily buying and moving coins off exchanges, it can suggest long-term holding. Third, it helps you avoid emotional trading. Instead of reacting to headlines, you rely on on-chain data.

This does not mean whales are always right. But watching their activity gives you an extra layer of information that most retail traders ignore.

Used correctly, whale tracking helps you:

We will use three beginner-friendly tools:

You can use free versions of all three.

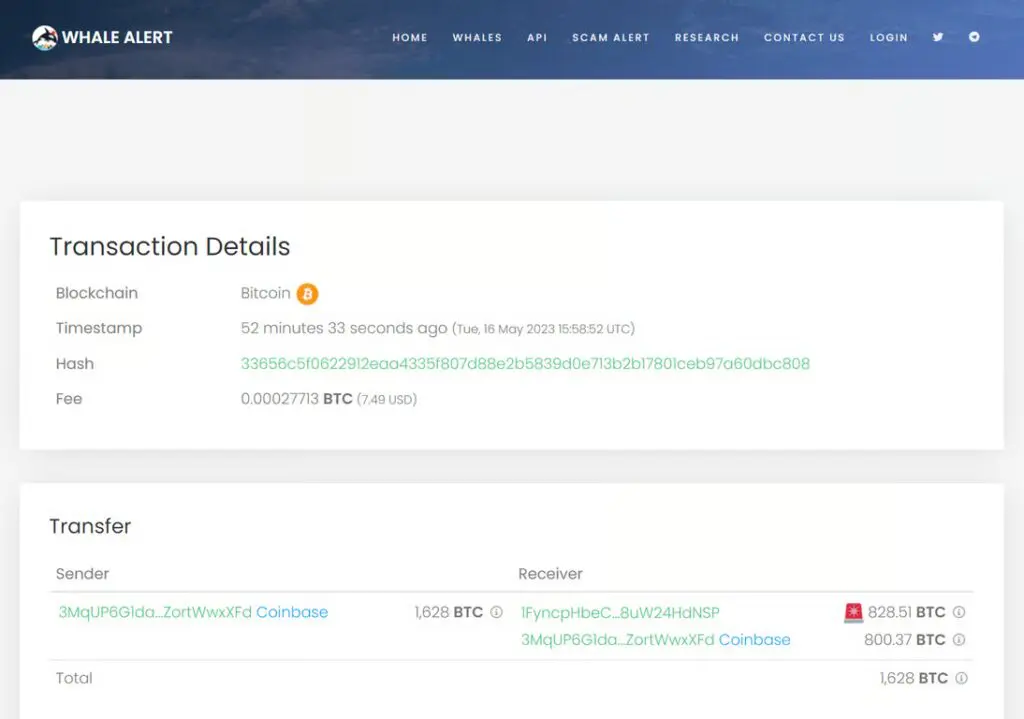

Go to whale-alert.io

On the homepage, you will see recent large transactions.

Look at:

If you see something like:

“10,000 BTC transferred to Binance”

That usually means possible selling pressure.

If you see:

“5,000 BTC withdrawn from Coinbase to unknown wallet”

That can indicate accumulation. This is the easiest way to start tracking whale activity in crypto.

If the transaction is on Ethereum or ERC-20 tokens:

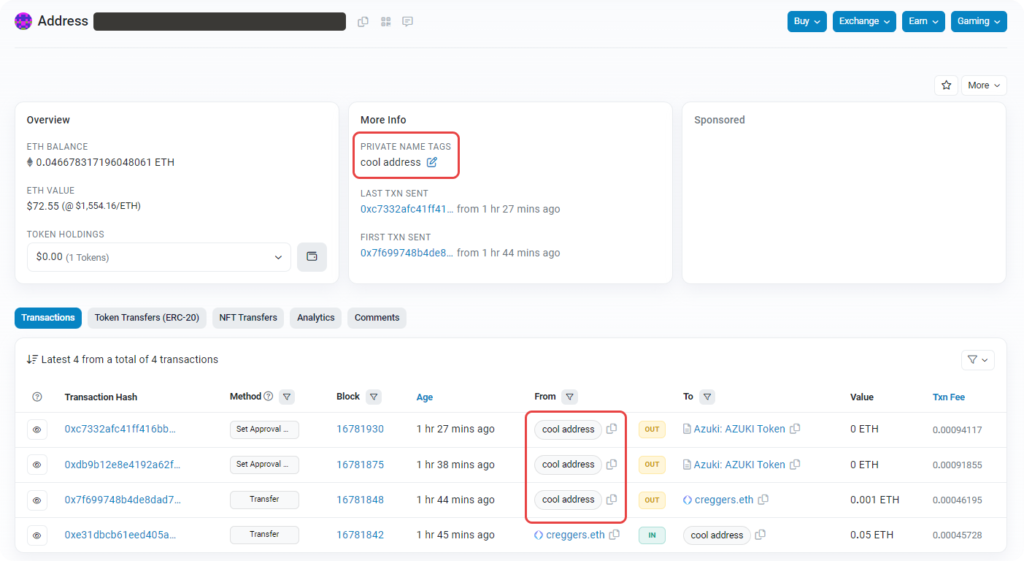

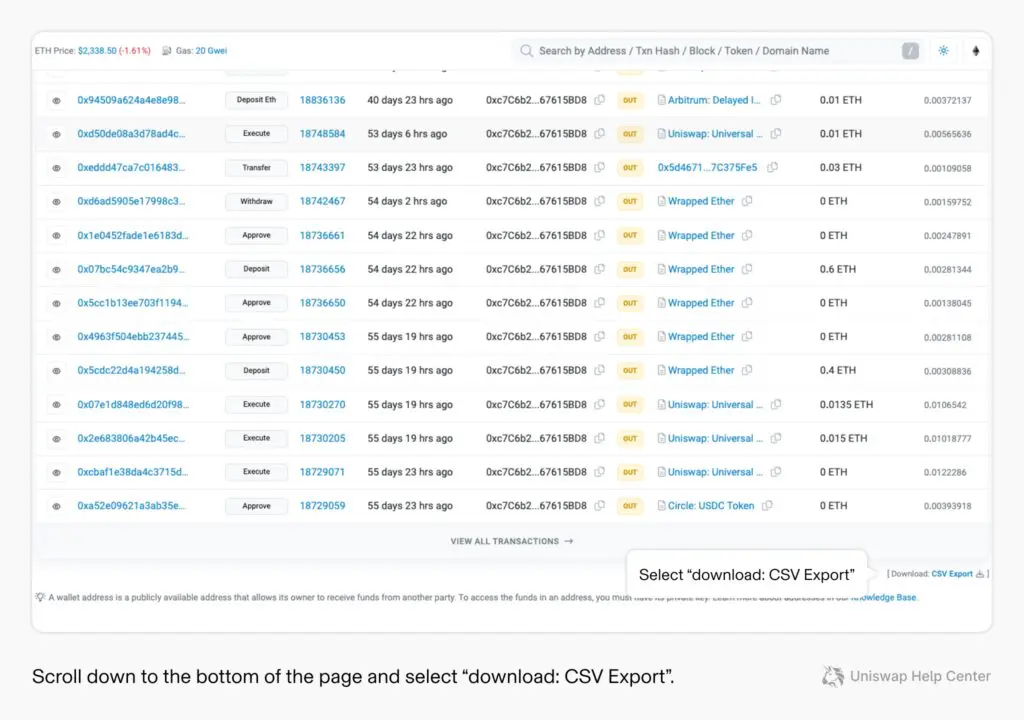

Now you can see:

This helps you answer important questions:

You are now going deeper than surface-level alerts.

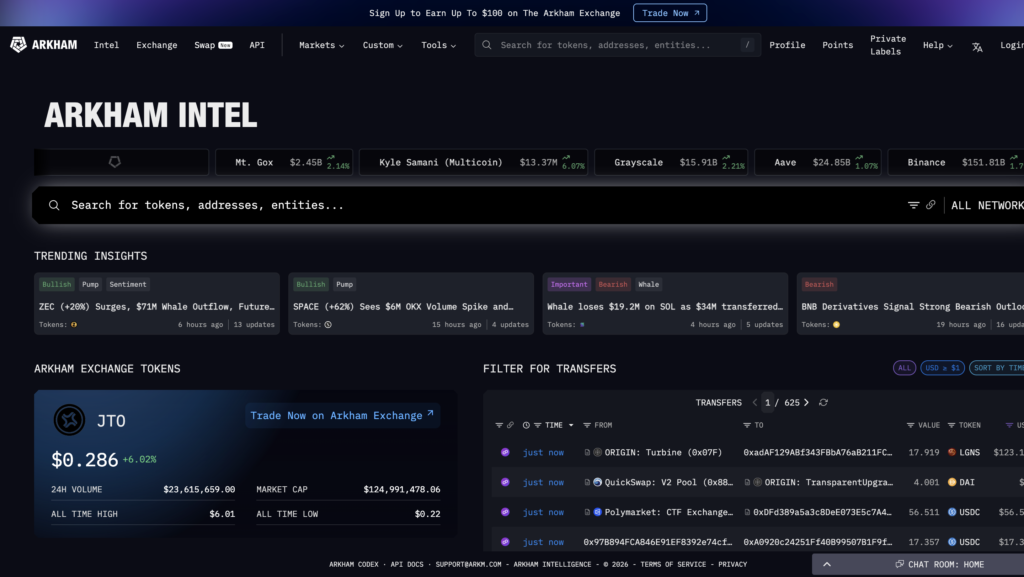

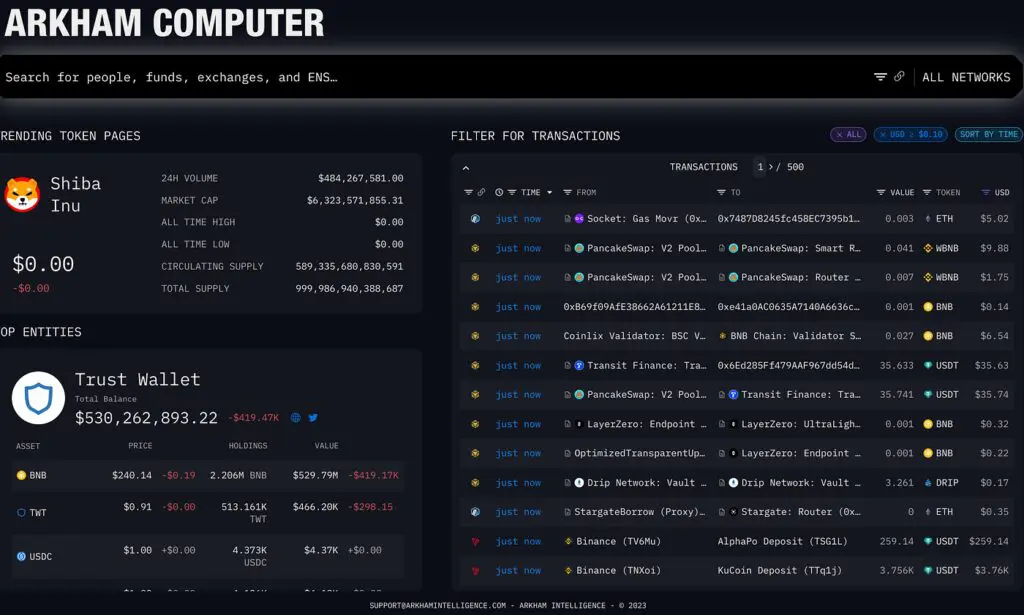

Go to arkhamintelligence.com

Search for a wallet address.

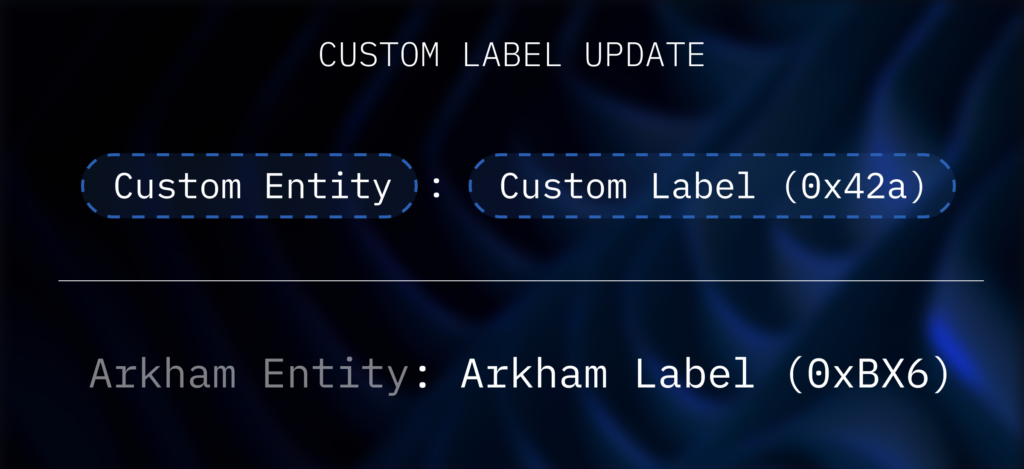

Check if it is labeled as:

Arkham helps you understand who may be behind the wallet.

This adds context. A transfer from Binance to Binance is internal. That is different from a fund sending tokens to Coinbase.

Context matters when you track whale activity in crypto.

Tracking whale activity in crypto becomes powerful when you approach it with patience and structure. Many beginners jump from one alert to another and end up confused. The goal is not to react fast. The goal is to observe smartly.

Here are the best practices to follow.

One large transaction does not tell the full story. Whales often move funds between their own wallets. What matters is repetition. If you see consistent transfers to exchanges over several days, that pattern is more meaningful than a single movement.

Instead of monitoring random alerts, choose a few large wallets and follow them regularly. Watch how they behave during market dips and rallies. Over time, you will notice patterns in how certain whales operate.

Large inflows to exchanges can suggest potential selling pressure. Large outflows can suggest accumulation. Checking this data once a day is enough. You do not need to monitor it every hour.

Set notifications on platforms like Whale Alert or Arkham. This saves time and reduces emotional trading. You stay informed without staring at charts all day.

Write down what happened and how the market reacted. For example, note when a whale moved funds before a price drop. Over time, your notes become your personal data advantage.

Exchanges frequently move funds internally. Stablecoin transfers are common and not always bullish or bearish. Always check the source and destination before drawing conclusions.

Do not rely only on whale activity in crypto. Use it alongside volume analysis, support and resistance levels, and broader market sentiment. Whale data works best as confirmation, not as a standalone signal.