Crypto trader James Wynn shuts down X after a reported 99% nine-figure loss in latest trade.

Author: Sahil Thakur

Published On: Sun, 13 Jul 2025 05:23:46 GMT

James Wynn, a crypto trader who gained fame and notoriety for placing high-leverage bets worth hundreds of millions of dollars, has vanished from the public eye after what appears to be a complete financial wipeout.

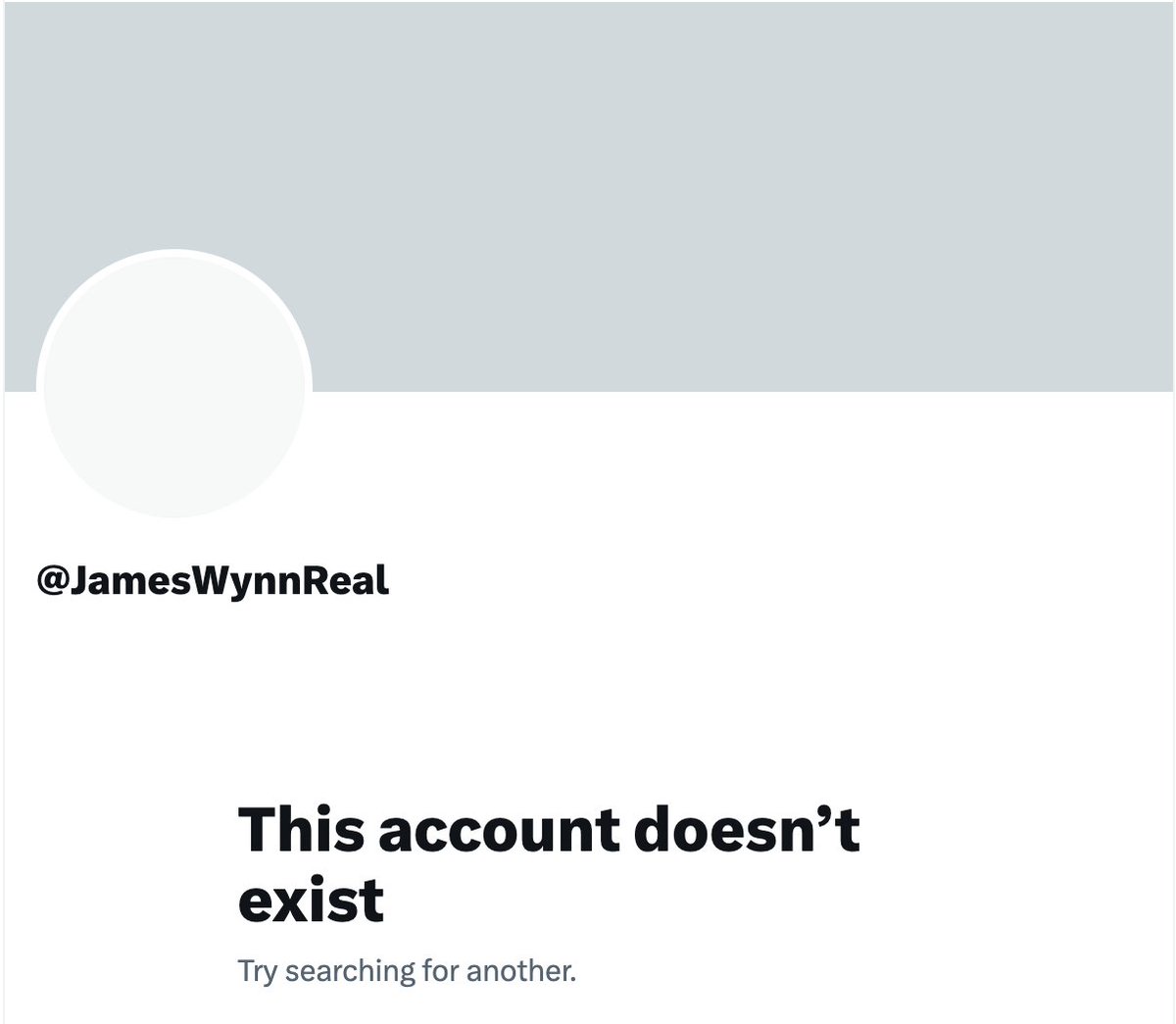

Wynn’s X (formerly Twitter) profile, @JamesWynnReal, was deactivated this week. The handle now displays the standard “This account doesn’t exist” message. Before disappearing, Wynn quietly updated his bio to just one word: “broke.”

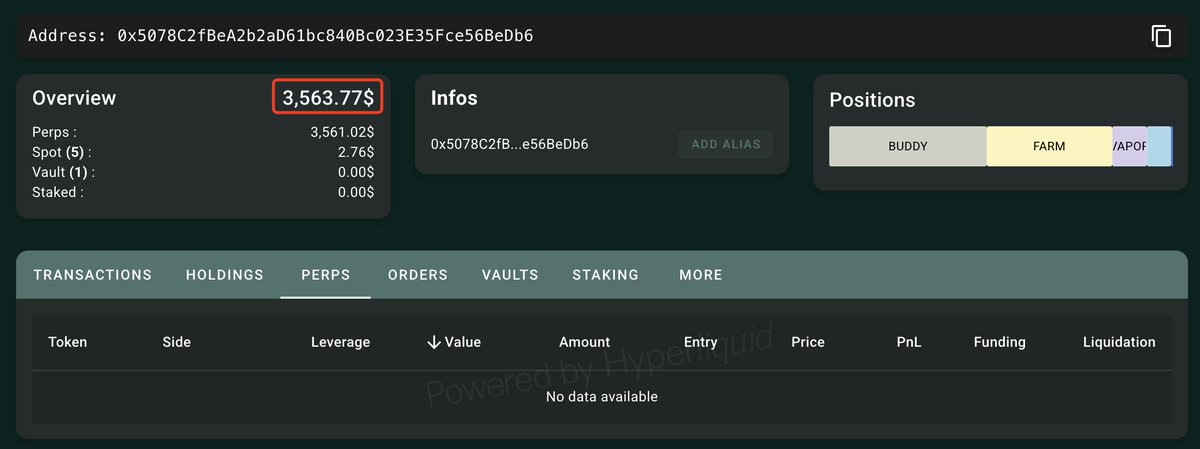

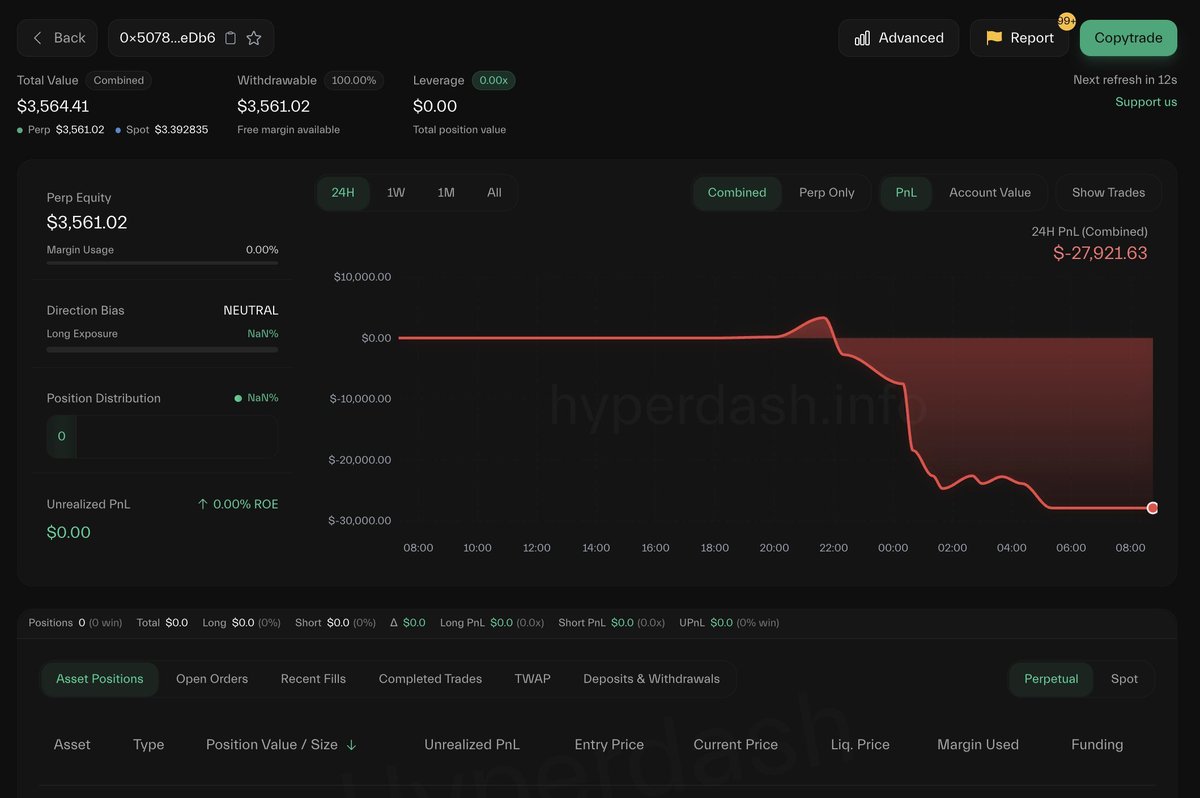

The silence comes after months of increasingly reckless trading behavior that drew both attention and concern from across the crypto community. On-chain data now paints a stark picture: wallets linked to Wynn show a total balance of just $10,176, according to blockchain analytics platforms Arkham Intelligence and Hypurrscan.

Wynn became a fixture in crypto trading circles for placing massive, leveraged positions on the decentralized perpetuals platform Hyperliquid. His trades were often contrarian, risky, and public. The scale of his exposure shocked even seasoned market participants, but his conviction, or perhaps stubbornness, earned him a cult following.

In May 2025, Wynn entered a long position on Bitcoin worth $100 million, effectively betting that BTC would rise above $105,000. When the price dipped below that mark, the position was liquidated, wiping out 949 BTC – nearly the entire position — in a single move.

Rather than retreat, Wynn doubled down.

He opened another $100 million BTC position shortly after the first liquidation. In a now-deleted post, Wynn accused market makers of deliberately pushing prices to liquidate his trades. He claimed that these “targeted liquidations” were an effort to flush him out of the market.

In response, Wynn issued a public appeal for help, asking the crypto community for donations to keep him trading. At least 24 wallet addresses sent funds to support him, according to on-chain records. Wynn later said he liquidated 240 BTC — worth roughly $25 million at the time — to “lower the liquidation price” of the remaining position and give himself more breathing room.

Despite these efforts, Wynn was liquidated again. Over 99% of the $100 million in that second trade evaporated within weeks. His wallets now hold only a fraction of that amount.

Wynn had long acknowledged that his strategy lacked traditional safeguards. In a post just before his first major loss, he wrote:

“I do not follow proper risk management, nor do I claim to be a professional; if anything, I claim to be lucky. I’m effectively gambling, and I stand to lose everything. I strongly advise people against what I’m doing.”

While some admired his honesty, others criticized what they saw as irresponsible behavior, especially given the attention his trades received. Newer traders may have mistaken his activity for success, despite repeated losses.

Wynn’s disappearance from social media marks a sharp turn in a story that had been unfolding in public view. For months, the trader posted frequently about his trades, wins, and losses. Now, all that remains is a deleted account, a single word — “broke”, and empty wallets.

His story has become a case study in the dangers of high-leverage trading in crypto, where even small price swings can wipe out entire positions. It also serves as a cautionary tale about trading in public: the pressure to perform, the temptation to double down, and the blurred lines between performance and spectacle.

Wynn’s case underscores a broader point: in a market driven by volatility, speed, and social hype, proper risk management isn’t optional, it’s essential.

Long-term investors and veteran traders have pointed to Wynn’s losses as a reminder of why short-term speculation, especially with borrowed funds, can be catastrophic. “This is exactly why we HODL,” one Bitcoin maxi wrote in response to the news.

Real voices. Real reactions.

James Wynn(@JamesWynnReal) has deactivated his X account! What happened? Did he blow up completely? All his wallets and Hyperliquid balance combined are down to just $10,176. https://t.co/FX6sISVWOh https://t.co/snkLcUUgXb https://t.co/bkkxOpo7hZ

James Wynn the final liquidation Moment of silence for a guy who was up $100M before he lost it all ✋️ https://t.co/aIR8I4pZGG

He made $100,000,000 in unrealized profit. Lost everything. Begged for donations to avoid liquidation. Today his account got suspended. The downfall of James Wynn 🧵 (1/9) https://t.co/lMFKIiuc1V

Our Crypto Talk is committed to unbiased, transparent, and true reporting to the best of our knowledge. This news article aims to provide accurate information in a timely manner. However, we advise the readers to verify facts independently and consult a professional before making any decisions based on the content since our sources could be wrong too. Check our Terms and conditions for more info.