DOJ documents reveal that Jeffrey Epstein discussed Gary Gensler in a handful of emails in May 2018 related to digital currencies.

Author: Sahil Thakur

High attention and emotional sentiment detected.

17th Feb 2026 – Newly released U.S. Department of Justice documents reveal that Jeffrey Epstein discussed Gary Gensler in a handful of emails in May 2018 related to digital currencies.

Importantly, there is no evidence of any pre-2026 public connection between Epstein and Gensler beyond these emails. There are no records of direct correspondence between the two, no confirmed meeting, no financial ties, and no proof of collaboration.

High Signal Summary For A Quick Glance

wEeZiE {X}🕵🏻♂️

@NerdNationUnbox

So Gary Gensler met Epstein confirmed #sicko https://t.co/b0dm8rQQ9j

03:23 AM·Feb 17, 2026

Cowboy.X

@cowboycrypto313

Here is definitive proof that Gary Gensler was meeting with Epstein while he was at MIT prior to becoming SEC Chair. Both screen shots from May 5-6, 2018. Epstein to Larry Summers: “Gary Gensler coming earlier dont know him wants to talk digital currencies. Views?” Epstein https://t.co/ZWMbEkVq2Y

03:49 AM·Feb 16, 2026

ᙢinus ᙡells

@MinusWells

🚨CONFIRMED: Gary Gensler motivation for continuing the SEC Lawsuit confirmed in #EpsteinFiles #Epstein $XRP #Ripple #XRP https://t.co/Hh2jaAcsdq

10:27 AM·Feb 1, 2026

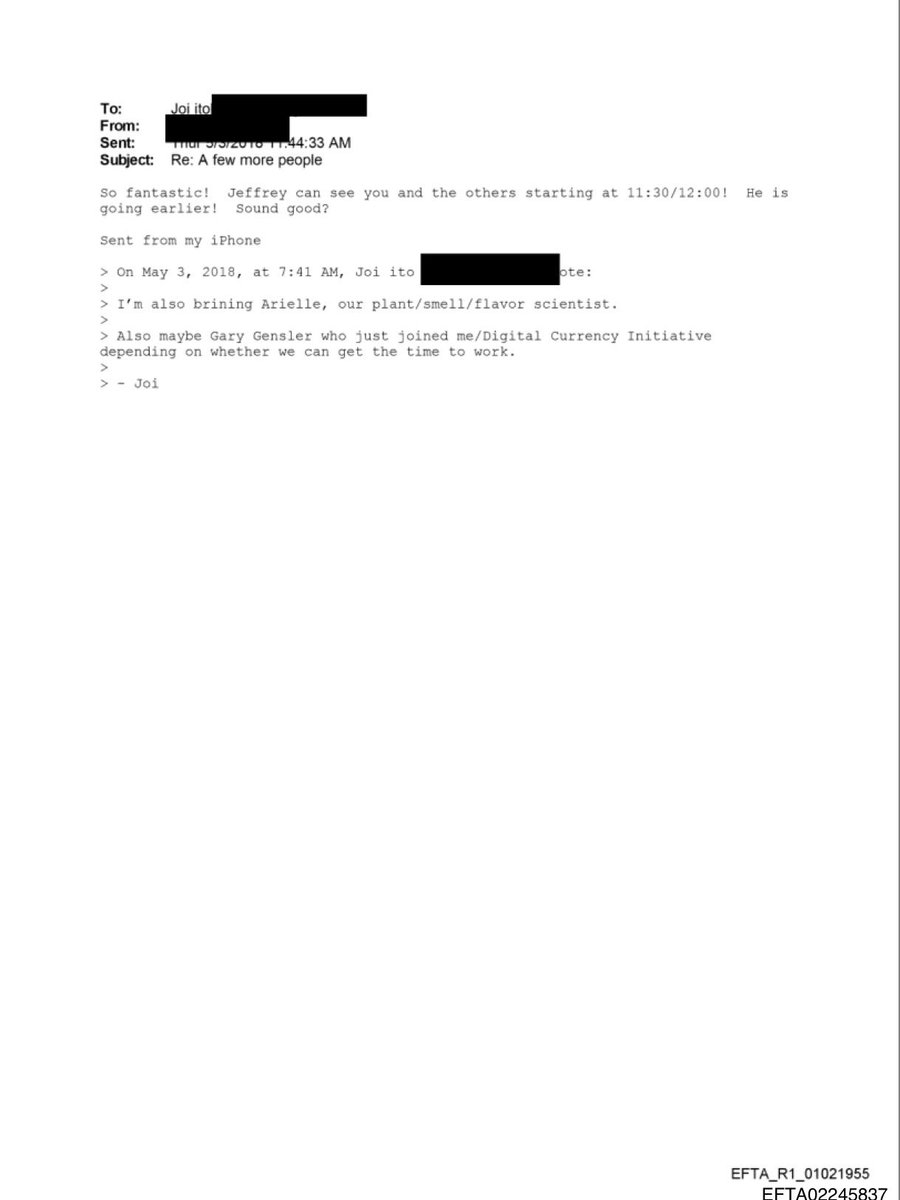

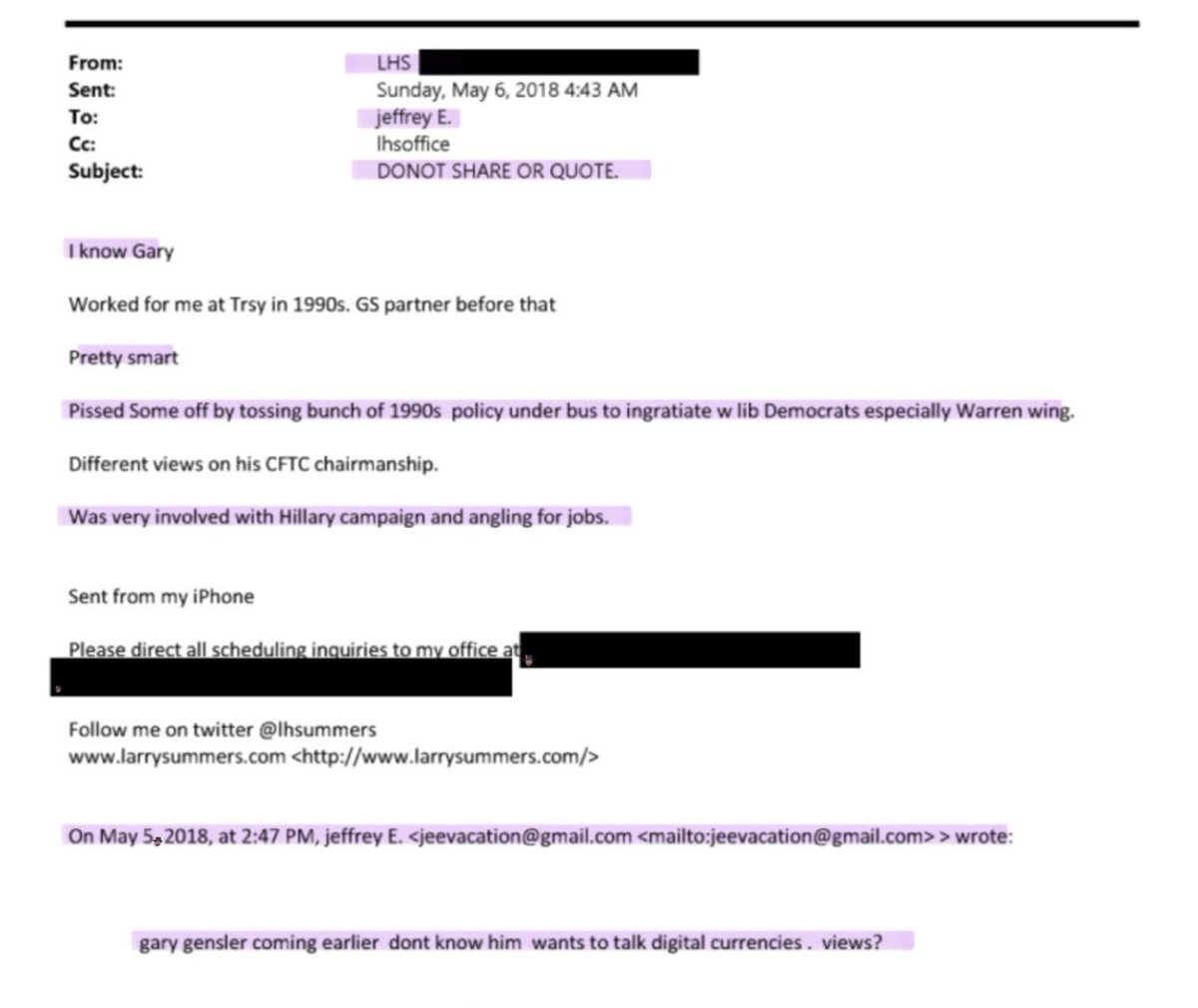

The key exchange occurred in early May 2018 between Epstein and former U.S. Treasury Secretary Lawrence Summers.

In one email, Epstein wrote to Summers that “Gary Gensler [is] coming earlier… wants to talk digital currencies.” Another version of the message included a note marked “DO NOT SHARE OR QUOTE.” Summers replied that he knew Gensler from their time at the Treasury Department in the 1990s and described him as “pretty smart.”

Two days later, Epstein followed up with additional commentary about Gensler. He referenced Gensler’s prior Treasury role, his time at Goldman Sachs, and his tenure as CFTC chair. He also commented on Gensler’s political positioning during the Hillary Clinton campaign.

In a separate message, Epstein wrote that he “would be with Gary Gensler on crypto tomorrow.” However, the documents do not independently confirm whether that meeting actually took place.

At the time, Gensler had joined MIT Sloan School of Management and was teaching a course titled “Blockchain and Money.” The emails place him within academic and policy discussions around cryptocurrency, but they do not establish a formal relationship with Epstein.

Src: X (Aaron Day)

Despite speculation online, the documents do not show:

Gensler later served as SEC Chair from 2021 to 2025 and led an aggressive regulatory crackdown on the crypto industry. However, the released files contain no evidence linking his regulatory decisions to Epstein.

While the Gensler emails are limited, the documents reinforce that Epstein had deep interest in cryptocurrency and digital asset policy well before his death in 2019.

Between 2002 and 2017, Epstein donated roughly $850,000 to MIT, including over $500,000 to the MIT Media Lab. Some of that funding supported the Digital Currency Initiative, which helped fund Bitcoin Core developers after the Bitcoin Foundation’s collapse.

Financial records also confirm that Epstein invested approximately $3 million in Coinbase in 2014 through an LLC structure. He also invested in Blockstream and communicated with early Bitcoin developers, venture capitalists, and crypto researchers.

In 2016, emails show Epstein proposing a Sharia-compliant digital currency modeled on Bitcoin. He also claimed to have spoken with “Bitcoin founders,” although those claims remain unverified.

Separate 2014 communications within Epstein-linked investment circles discussed Ripple and Stellar as competitive threats to Bitcoin-focused infrastructure. Some individuals in the XRP community have pointed to those older tensions, along with the 2018 Gensler references and Epstein’s MIT funding, to suggest bias in the SEC’s 2020 lawsuit against Ripple.

However, there is no documented evidence tying Epstein to the SEC’s enforcement strategy. Epstein died in 2019, before the Ripple lawsuit began. Additionally, under Gensler’s leadership, the SEC pursued enforcement actions across multiple crypto entities, not exclusively Ripple.

The newly released files confirm that:

However, the documents do not demonstrate any direct partnership, influence, or coordinated action between Epstein and Gensler.

Our Crypto Talk is committed to unbiased, transparent, and true reporting to the best of our knowledge. This news article aims to provide accurate information in a timely manner. However, we advise the readers to verify facts independently and consult a professional before making any decisions based on the content since our sources could be wrong too. Check our Terms and conditions for more info.

Lighter LLP Upgrade Boosts Liquidity for RWA Markets

Nexo Relaunches US Crypto Services After Regulatory Exit

Nicki Minaj Announced as Key Speaker for Trump-Backed WLF 2026

Jeffery Epstein Tried To Get In Touch With Gary Gensler

Lighter LLP Upgrade Boosts Liquidity for RWA Markets

Nexo Relaunches US Crypto Services After Regulatory Exit

Nicki Minaj Announced as Key Speaker for Trump-Backed WLF 2026

Jeffery Epstein Tried To Get In Touch With Gary Gensler