Strategy Bitcoin crash survival stress test shows the company could repay debt even in extreme BTC declines.

Author: Kritika Gupta

High attention and emotional sentiment detected.

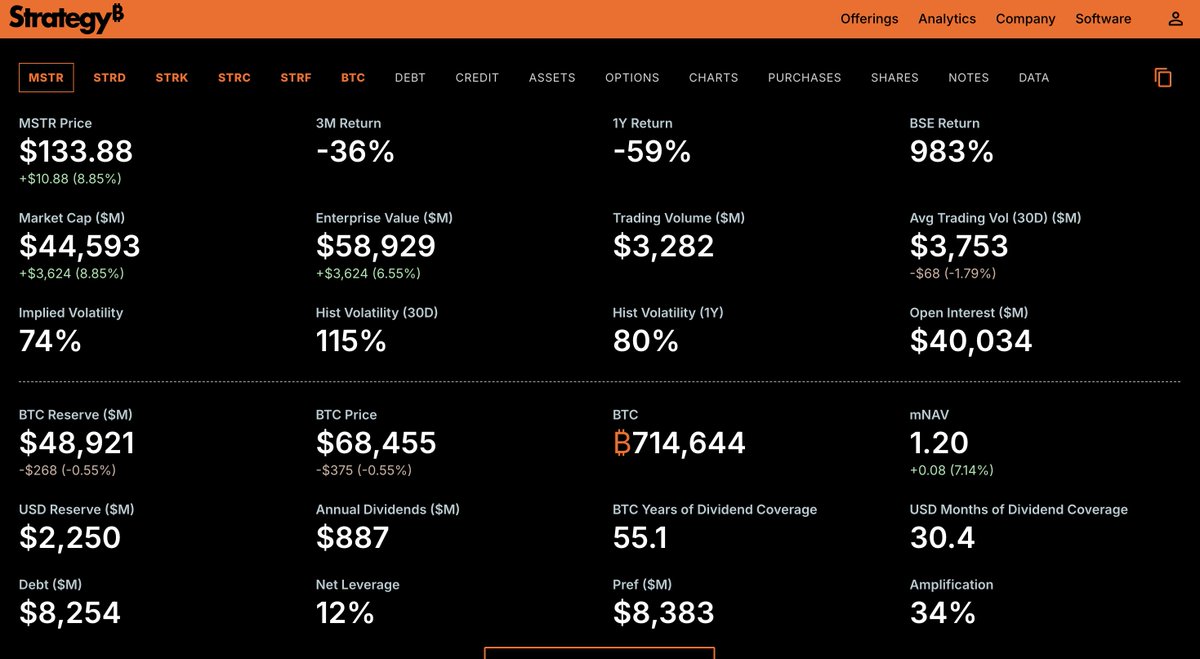

16th February 2026- The Strategy Bitcoin crash survival plan has become a major topic of discussion after the company confirmed it could withstand an extreme Bitcoin decline to $8,000 while still fully covering its debt. This scenario represents an 88% drop from current price levels near $68,000 to $69,000. Importantly, the company stated it would not need to sell any Bitcoin to meet its financial obligations, which reinforces confidence in its long-term treasury strategy.

This statement comes at a time when investors remain cautious about leveraged Bitcoin treasury strategies. Strategy’s reassurance aims to demonstrate that its balance sheet remains resilient even under extreme stress conditions.

High Signal Summary For A Quick Glance

YashasEdu

@YashasEdu

So @saylor didn't build a company. He has built a one-way door for Bitcoin. Most people look at Strategy and see leveraged $BTC bet and they miss what's actually happening here 👇 The debt structure is the product. ➤ Borrowed $3B and pays zero interest on it ➤ Zero Bitcoin https://t.co/NsE605pZnP https://t.co/6GdAsDGud9

Strategy can withstand a drawdown in $BTC price to $8K and still have sufficient assets to fully cover our debt. https://t.co/vrw4z4Ex9q

06:59 AM·Feb 16, 2026

The renewed focus on the Strategy Bitcoin crash survival model follows the company’s fourth-quarter 2025 earnings report, which revealed a $17.4 billion unrealized loss. This loss occurred after Bitcoin fell sharply from more than $126,000 in October 2025 to around $69,000 by year-end. Consequently, concerns resurfaced regarding the company’s leveraged Bitcoin accumulation strategy.

Strategy, formerly known as MicroStrategy, rebranded in 2025 to reflect its transformation into a Bitcoin treasury-focused company. However, this is not the first time the company has faced scrutiny. During the 2022 bear market, Bitcoin dropped below $16,000, which triggered fears that Strategy might be forced to sell its holdings or face financial distress.

Despite those fears, the company maintained its Bitcoin position. As Bitcoin recovered during 2023 and 2024, Strategy’s stock rebounded strongly and gained more than 1,000% from its lowest levels. This recovery reinforced confidence among supporters, although critics continue to warn about risks associated with leverage.

Key milestones related to this development

The company makes its first Bitcoin purchase, marking its shift toward using Bitcoin as a primary treasury reserve asset.

Strategy expands its Bitcoin holdings rapidly through cash reserves and debt financing, becoming the largest corporate Bitcoin holder.

Bitcoin falls below $16,000, triggering market concerns about Strategy’s leverage.

Bitcoin rebounds strongly reinforcing investor confidence in its long-term treasury strategy.

The company officially rebrands to emphasize its identity as a Bitcoin treasury company.

The surge significantly increases the value of Strategy’s holdings, strengthening its balance sheet and treasury valuation.

Bitcoin declines to around $69,000, resulting in a $17.4 billion unrealized loss and renewed investor concerns about leverage risk.

The company announces it can fully cover debt obligations without selling Bitcoin, even in an extreme 88% crash scenario.

Strategy currently holds 714,644 Bitcoin, acquired at an average cost of approximately $76,056 per coin. This represents a total investment of about $54.4 billion. At current market prices near $69,000, these holdings are valued at roughly $49 billion.

However, in a crash scenario where Bitcoin falls to $8,000, the value of Strategy’s holdings would decline to about $5.7 billion. This amount closely aligns with the company’s estimated $6 billion in net debt. As a result, Strategy states it would still have sufficient asset value to cover its debt without liquidating Bitcoin, although shareholder equity would be nearly eliminated.

Furthermore, Strategy holds approximately $2.5 billion in cash reserves. These funds allow the company to cover operating costs and interest payments for more than two years without needing to sell Bitcoin or raise additional capital.

The Strategy Bitcoin crash survival assurance has reassured many investors about the durability of its treasury model. Strategy’s stock rose about 9% following the announcement, which reflects renewed market confidence. Additionally, the company’s ability to withstand extreme downside scenarios strengthens its position as the most committed institutional Bitcoin holder.

However, risks remain. A prolonged period of low Bitcoin prices would significantly reduce shareholder equity and could make refinancing more difficult. Even if debt remains covered, investor sentiment could weaken under sustained losses.

Overall, Strategy’s position highlights both the strength and risk of institutional Bitcoin treasury strategies. The company has structured its debt and reserves to survive extreme volatility.

Our Crypto Talk is committed to unbiased, transparent, and true reporting to the best of our knowledge. This news article aims to provide accurate information in a timely manner. However, we advise the readers to verify facts independently and consult a professional before making any decisions based on the content since our sources could be wrong too. Check our Terms and conditions for more info.

$68480.00