Features, strengths, and weaknesses of the best of crypto market trackers which can help you level up your crypto trading strategy

Author: Chirag Sharma

As a degen we love to dive deeper into on-chain data and metric. But trust me most of the times we just have a surface level look at the market since its more feasible and easy to comprehend. Having access to accurate and real-time market data is essential for both retail investors and institutions. With thousands of coins and tokens being traded across hundreds of exchanges, tracking price movements, market trends, and on-chain data can be overwhelming. This is where choosing the best from these crypto market trackers comes into play.

Platforms like CoinGecko, CoinMarketCap, and CryptoRank have emerged as the leading tools for monitoring crypto market performance. These platforms provide crucial data such as trading volume, market capitalization, historical charts, and sentiment analysis, helping traders make informed decisions.

While CoinMarketCap remains the most popular due to its early dominance and Binance acquisition, CoinGecko is praised for its transparency and community-driven approach. Meanwhile, CryptoRank is gaining traction for its in-depth analytics and focus on tokenomics.

In this article, we’ll dive deep into the features, strengths, and weaknesses of these three platforms to help you determine the best crypto market tracker for your trading strategy in 2025. Whether you’re a casual investor or a professional analyst, understanding which platform fits your needs can give you a significant edge in this highly competitive market.

These crypto market trackers essentially aggregates data from multiple exchanges and blockchains, providing users with a centralized dashboard to monitor price action, liquidity, and token performance. This data is critical for traders, investors, and analysts to identify trends, assess market sentiment, and make strategic moves.

Key factors that define a reliable market tracker include:

By understanding how these platforms differ in functionality and approach, users can make better choices based on their trading style and analytical needs.

Founded in 2014, CoinGecko has established itself as one of the most trusted and independent crypto market trackers, known for its transparency and wide-ranging data coverage. Unlike CoinMarketCap, which is owned by Binance, CoinGecko remains community-driven, allowing it to maintain neutrality and avoid exchange bias.

Launched in 2013 and later acquired by Binance in 2020, CoinMarketCap is the most visited crypto market tracker globally, often serving as the first point of reference for new traders and institutional players alike.

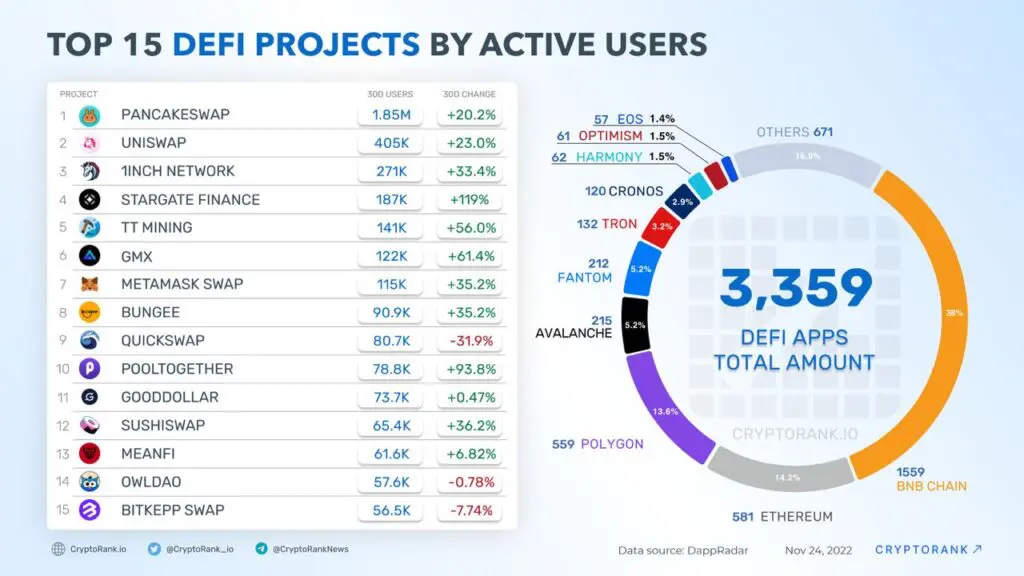

CryptoRank is an emerging market tracker that focuses heavily on advanced analytics and token fundraising data, making it a favorite among researchers and early-stage project investors. Unlike CoinMarketCap and CoinGecko, CryptoRank emphasizes detailed on-chain insights, IDO/ICO tracking, and market sentiment analysis, providing a more data-driven approach to crypto analysis.

When comparing CoinGecko, CoinMarketCap, and CryptoRank, each platform stands out in different areas, making them suitable for different types of crypto users. Here’s a direct comparison across key metrics:

While crypto market trackers provide valuable insights, users often make critical mistakes that lead to misinformed decisions. Here’s how to avoid these pitfalls:

Relying solely on CoinMarketCap or CoinGecko can give biased or incomplete data. Cross-check data on CryptoRank for on-chain metrics or Token Unlock platforms for vesting schedules.

Scammers often launch tokens with similar names and tickers to popular projects. For example, $PEPE or $SHIBA duplicates often appear on market trackers. Always verify the contract address before investing.

If a celebrity or influencer suddenly starts talking about crypto, they might be launching a token soon, leading to pump-and-dump scenarios like $JENNER $LIBRA $FAT etc. Track their on-chain wallets using platforms like Arkham Intelligence to spot insider moves early.

A legitimate project has utility, partnerships, and active development. Track developer activity on CoinGecko’s Github metrics and CryptoRank’s tokenomics section to avoid investing in empty hype coins and a Rug Pull

In the competitive landscape of crypto market trackers, each platform brings unique strengths to the table. Let’s break down the standout features that make CoinGecko, CoinMarketCap, and CryptoRank valuable for different types of users.

CryptoRank is widely recognized for its deep analytics on token launches and fundraising rounds. Its ICO/IDO tracker provides detailed insights into upcoming token sales, including launchpads, vesting schedules, and token unlock patterns. This feature is invaluable for early-stage investors and DeFi enthusiasts looking for new opportunities. Additionally, CryptoRank excels in monthly and quarterly token performance tracking, allowing users to assess how tokens have performed over specific timeframes and identify emerging narratives before they gain mainstream attention.

CoinMarketCap stands out for its comprehensive categorization of crypto narratives and ecosystems. Whether it’s tracking AI tokens, Layer 2 projects, Real World Assets (RWA), or DeFi protocols, CoinMarketCap offers an organized way to follow market trends. This feature is especially useful for identifying sector-specific pumps during bull markets and understanding capital rotation within different ecosystems. Moreover, CoinMarketCap’s “Trending” and “Recently Added” sections help users stay ahead of new projects and narratives gaining momentum.

CoinGecko goes beyond market data by focusing heavily on crypto education and research. Their YouTube channel, featuring interviews with top builders and analysts, is one of the most underrated resources for learning about emerging narratives and protocols. Additionally, CoinGecko’s Quarterly Reports and GeckoCon events provide valuable market insights and on-chain data analysis. For beginners and advanced traders alike, CoinGecko’s educational resources help users understand market trends and technical indicators, empowering them to make informed decisions.

GeckoCon 2024 Recap :

The crypto market is rapidly evolving, and so are the platforms that track its data. As the industry shifts toward on-chain transparency and decentralized finance, market trackers like CoinGecko, CoinMarketCap, and CryptoRank are adapting to meet the growing demand for more advanced tools and analytics.

One of the biggest trends is the integration of on-chain data analytics. Platforms like CryptoRank have already started providing token unlock data, vesting schedules, and whale tracking, allowing users to understand the real market impact of token movements. CoinGecko is also exploring on-chain metrics like DEX trading volume and active wallet data. This shift toward on-chain transparency is becoming crucial as centralized exchange data becomes less reliable due to wash trading and manipulation.

Another emerging trend is the use of Artificial Intelligence (AI) for market sentiment tracking. CoinMarketCap has begun experimenting with social sentiment analysis by tracking Twitter mentions and community engagement around specific tokens. CryptoRank is also integrating AI-based narrative tracking, helping users identify trending sectors like DePIN, RWA, and GameFi before they enter the mainstream.

With the rise of Real World Asset (RWA) tokenization, platforms like CoinGecko and CryptoRank are adding dedicated sections to track tokenized bonds, real estate assets, and stablecoin-backed securities. This allows institutional investors to analyze on-chain yield opportunities and track capital inflows from traditional finance (TradFi).

A major development in the space is the move toward decentralized data oracles. CoinGecko is already collaborating with Chainlink to provide verified market data directly to DeFi protocols. This will allow smart contracts to access real-time price feeds without relying on centralized APIs, enhancing security and transparency.

In the next few years, the best crypto market tracker will be the one that seamlessly combines on-chain analytics, AI-driven insights, and decentralized data feeds while catering to both retail and institutional investors.

Choosing the best crypto market tracker depends on your trading style and investment goals.

In reality, using all three platforms together provides the best edge. CoinGecko for in-depth data, CoinMarketCap for trend tracking, and CryptoRank for analytical insights.

In the rapidly evolving crypto landscape, having access to accurate and comprehensive market data is essential for making informed decisions. When it comes to the best crypto market tracker, there’s no one-size-fits-all solution, as CoinGecko, CoinMarketCap, and CryptoRank cater to different types of users with unique needs.

CoinGecko stands out for its altcoin coverage, on-chain metrics, and educational resources, making it the ideal platform for DeFi enthusiasts and early-stage investors looking to explore emerging narratives. With its transparent data approach and focus on community-driven metrics, CoinGecko remains the most unbiased alternative in the market.

On the other hand, CoinMarketCap dominates in terms of user experience, narrative classification, and market liquidity tracking, thanks to its Binance-backed infrastructure. It’s perfect for retail traders, narrative followers, and portfolio managers who want quick access to trending tokens and new market sectors.

Meanwhile, CryptoRank is the go-to platform for serious researchers, on-chain analysts, and those tracking fundraising rounds, ICO/IDO data, and token unlock schedules. Its advanced data analytics and quarterly performance tracking make it a powerful tool for identifying early-stage projects before they gain mainstream attention.

In reality, combining all three platforms is the smartest strategy for any crypto investor. By leveraging CoinGecko’s data depth, CoinMarketCap’s narrative tracking, and CryptoRank’s analytical tools, you can gain a 360-degree view of the market, helping you stay ahead in both bull and bear markets.

As the crypto space evolves with on-chain transparency, AI-driven analytics, and RWA tokenization, these platforms will continue to adapt and play a critical role in helping investors make informed decisions in 2025 and beyond.