Sei Network dominates blockchain fees with $374K in 24 hours, surpassing Ethereum and Solana as traders flock to its high-speed Layer 1.

Author: Chirag Sharma

Published On: Sat, 25 Oct 2025 19:10:26 GMT

October 25, 2025 – Sei Network has officially taken the spotlight in the crypto ecosystem after generating the highest blockchain fees among all major blockchains in the last 24 hours.

According to Artemis, a leading on-chain analytics firm, Sei recorded approximately $374,320 in blockchain fees. Sei outperformed long-time leaders like Ethereum, Solana, and BNB Chain. The surge reflects explosive activity across DeFi and trading applications that rely on Sei’s speed and efficiency.

The Artemis visualization makes the story crystal clear. Sei’s bar towers above every competitor, followed by Hyperliquid in second place at nearly 60% of Sei’s total. EdgeX, BNB Chain, and Tron follow in the $150,000 to $200,000 range. Solana and Ethereum, often the usual fee front-runners, came in mid-pack at roughly $120,000 and $100,000 respectively. Lower-tier chains like Arbitrum, Sui, and Polygon each remained below the $50,000 threshold.

The top ten chains collectively earned over $1.2 million in fees in the last 24 hours, representing a 15% daily increase in network usage. However, Sei alone contributed 31% of the total, an extraordinary share for a project just over two years old.

Ethereum’s fees dropped 8% week-over-week, while Solana stayed mostly flat. Bitcoin, despite generating $70,000 in fees, lags due to its slower throughput and higher operational costs.

Emerging players such as Hyperliquid ($220K) and BNB Chain ($180K) are showing resilience, but Sei’s focus on speed, liquidity, and decentralized trading continues to give it an edge. This data paints a clear picture: users are prioritizing performance and efficiency over legacy familiarity.

For investors and builders alike, fee dominance reflects more than network cost—it demonstrates genuine demand for blockspace, validator incentives, and developer activity.

Sei’s rise illustrates how real-world utility and optimized performance can redefine blockchain hierarchies. High fees, often criticized as barriers, actually indicate economic value. They show that users are willing to pay for fast, reliable execution—a metric that separates active ecosystems from idle ones.

Loading chart...

However, sustained success depends on balance. If fees climb too high, retail users may get priced out, concentrating usage among large players. Competitors like Ethereum and Solana must now accelerate Layer 2 scaling to remain competitive.

For Sei, the implications are huge. Its growth aligns with broader DeFi and RWA momentum, positioning it as both a trading hub and an innovation base for next-gen protocols. If the trend continues, Sei could lead a new wave of Layer 1 dominance built on speed, liquidity, and developer inclusivity.

Real voices. Real reactions.

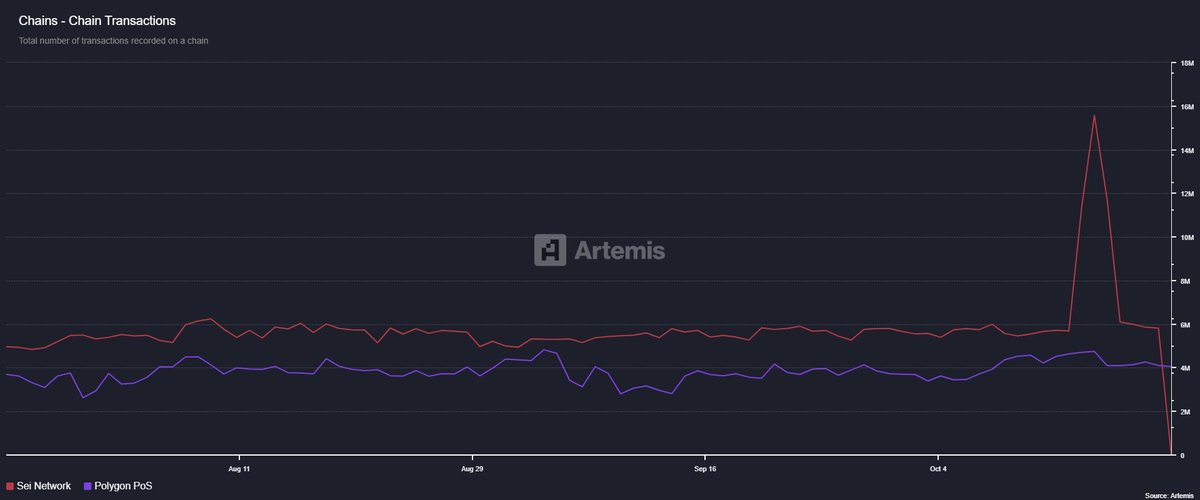

One of these chains is starting to look seriously undervalued. Both have shown consistent activity, but one quietly processed between 5M and 6M transactions daily and even hit 16M in mid October. The data speaks for itself. Markets move faster on Sei 👀 https://t.co/oLKWbzPXhI

@coinbureau That’s impressive... real usage always shows up in fees before it shows up in headlines.

Our Crypto Talk is committed to unbiased, transparent, and true reporting to the best of our knowledge. This news article aims to provide accurate information in a timely manner. However, we advise the readers to verify facts independently and consult a professional before making any decisions based on the content since our sources could be wrong too. Check our Terms and conditions for more info.