15 essential brands that, by embracing crypto adoption, could eliminate the need for fiat money

Author: Chirag Sharma

Published On: Thu, 25 Jul 2024 13:17:47 GMT

Crypto has been steadily gaining traction, and 2024 has proven to be a pivotal year for the sector. As the world becomes more digitally oriented, the acceptance of Bitcoin and other crypto by major brands is transforming how we transact. This article explores 15 essential brands that, by embracing crypto adoption, could eliminate the need for fiat money, enhancing convenience and financial freedom for consumers.

Amazon, the e-commerce giant, accepting Bitcoin would revolutionize online shopping. Customers could use cryptocurrency to purchase a vast array of products, from electronics to groceries. The integration of crypto payments could streamline transactions, reduce fees, and offer an additional layer of financial privacy.

Walmart’s adoption of cryptocurrency would make everyday shopping more convenient. Customers could buy groceries, clothing, and household items with Bitcoin, eliminating the need for cash or cards. This would especially benefit unbanked populations, providing them with a modern payment method for essential goods.

If Apple were to accept crypto payments, it would significantly impact the tech world. Customers could use Bitcoin to purchase iPhones, MacBooks, and apps. This move would promote broader adoption of cryptocurrencies, integrating them into daily life and aligning with Apple’s innovative ethos.

Microsoft’s acceptance of crypto would benefit users of its software and cloud services. Customers could pay for Office 365, Azure, and Xbox services using Bitcoin. This would provide a seamless, global payment option, promoting digital currency use in both personal and professional settings.

Tesla accepting crypto would enhance the auto industry’s shift towards digital currencies. Customers could buy electric vehicles with Bitcoin, emphasizing sustainability and innovation. This move could attract crypto enthusiasts, aligning with Tesla’s forward-thinking brand image.

Starbucks allowing crypto payments would make buying coffee and snacks more convenient. Customers could use Bitcoin for quick, secure transactions at checkout, reducing the need for cash or cards. This integration would also attract tech-savvy customers, enhancing the brand’s modern appeal.

McDonald’s acceptance of crypto would simplify fast-food transactions. Customers could use Bitcoin to buy meals, making payments quicker and more secure. This move could also appeal to younger, tech-oriented demographics, aligning with McDonald’s strategy to stay current and accessible. This would make other QSRs feel the FOMO which can lead the industry level adoption for these chains

Visa integrating crypto payments would revolutionize the financial sector. People could use their crypto holdings for everyday purchases via Visa cards, combining the benefits of traditional and digital finance. This integration would enhance the accessibility and acceptance of cryptocurrencies globally. The amount of taxation on international payments is also a main concern which will be ensured with crypto or bitcoin payments

Mastercard’s acceptance of crypto would expand payment options for consumers. People could use Bitcoin and other digital currencies for purchases wherever Mastercard is accepted. This move would promote financial inclusion, providing more choices for secure and efficient transactions.

Netflix accepting crypto would offer a new way to pay for entertainment. Subscribers could use Bitcoin for their monthly payments, adding flexibility and security. This integration could attract a global audience, including those in regions with limited access to traditional banking. The problem of different prices in different countries will be countered as well with a unique standard for payments.

Uber’s acceptance of crypto would make ride-hailing and delivery services more accessible. Users could pay with Bitcoin, simplifying transactions and reducing the need for cash. This move would also support global adoption of crypto, especially in countries with volatile currencies. The amount used in transactions held by the governments could be used in tipping the drivers to further promote switching from cash.

Airbnb accepting crypto would enhance the travel experience. Guests could use Bitcoin to book accommodations worldwide, simplifying payments and reducing exchange rate issues. This integration would attract a broader audience, including crypto enthusiasts and international travelers.

X (formerly Twitter) accepting crypto would revolutionize the social media landscape. Users could use Bitcoin to pay for premium features, advertising, or tipping content creators. This integration would streamline transactions, promote financial inclusion, and attract tech-savvy users who are already engaged in the crypto space.

ExxonMobil accepting crypto would impact the energy sector. Since its the leading company for gasoline and petroleum in US, customers could use Bitcoin to pay for fuel and energy services, making transactions faster and more secure. This integration would also highlight the company’s commitment to innovation and adaptability in a changing financial landscape forcing a change on the entire industry.

Disney’s acceptance of crypto would enhance the entertainment industry. Guests could use Bitcoin to pay for park tickets, merchandise, and streaming services. This move would simplify transactions, attract tech-savvy visitors, and align with Disney’s forward-thinking approach to entertainment and finance.

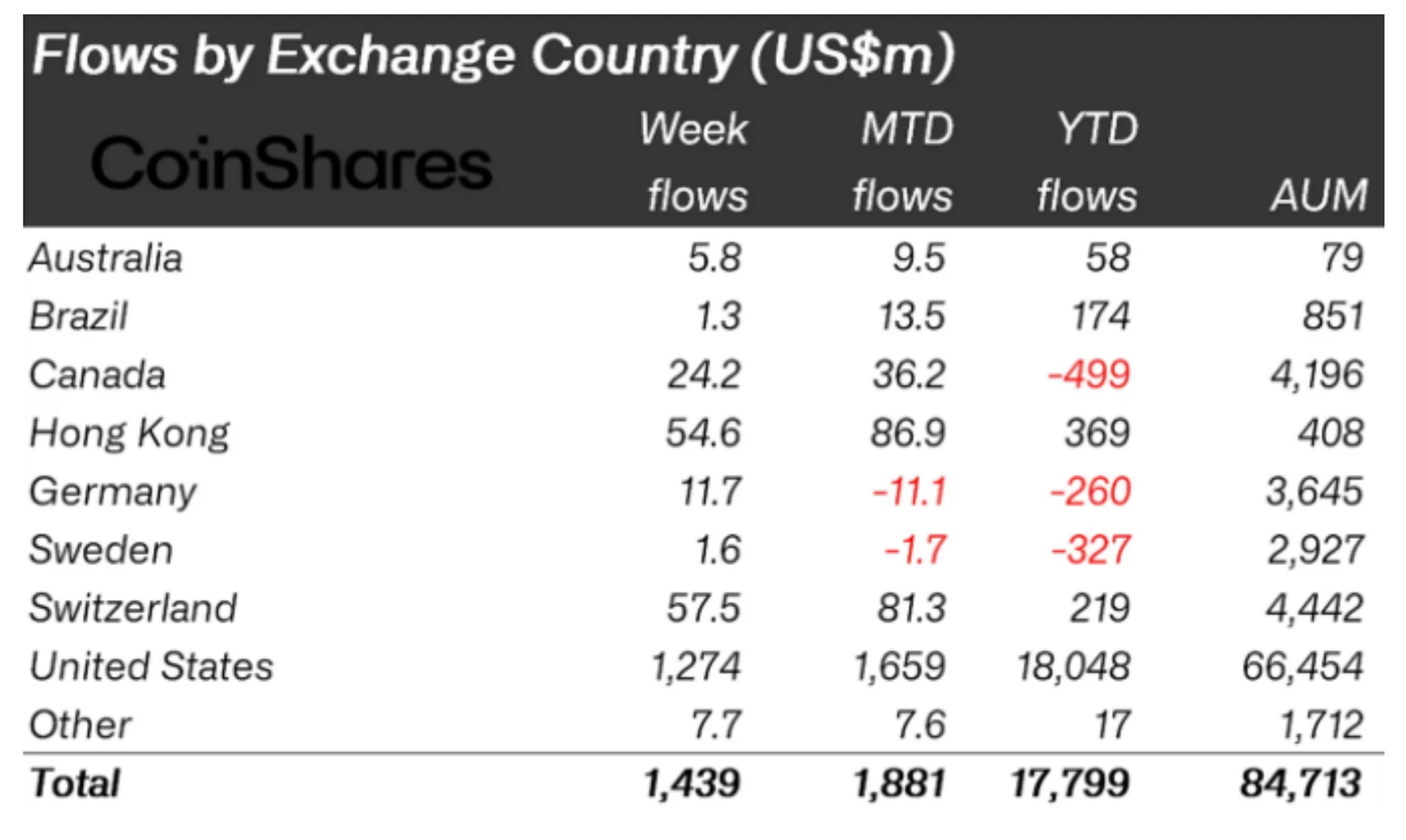

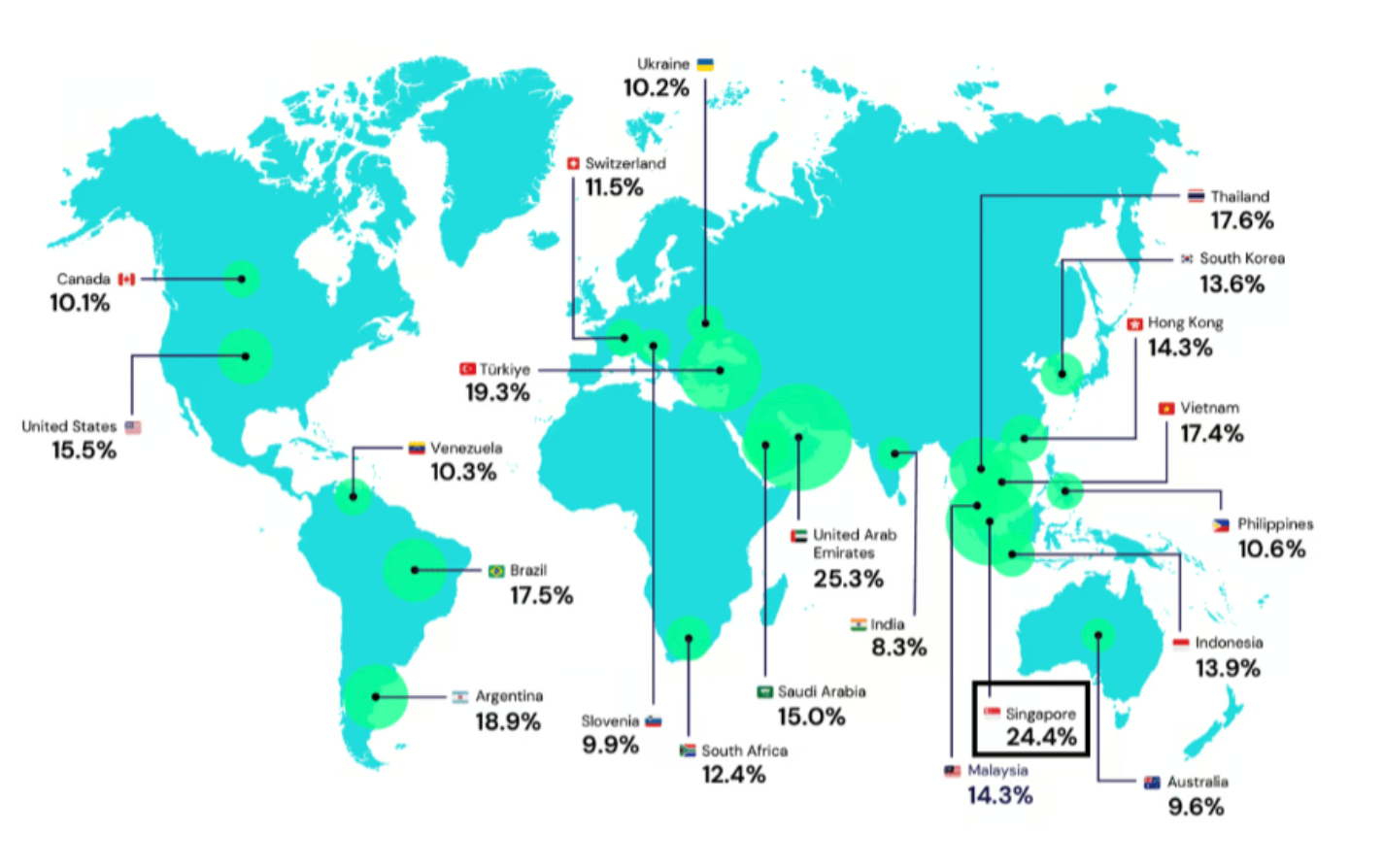

The year 2024 has been pivotal for crypto adoption, marked by several groundbreaking developments. Switzerland tops the index, followed by Singapore and the UAE, highlighting the global shift towards crypto adoption. The US and Asia have seen significant job growth in the crypto sector, while Europe, especially Germany, has faced declines.

Switzerland has emerged as the top-performing country in 2024, driven by its robust regulatory framework, favorable tax policies, and financial ecosystem. Key data points include a Regulation Score of 9.5, the highest globally, and a thriving crypto ecosystem with companies like Ethereum, Tezos, Cardano, and Bitcoin Swiss. Lugano has declared Bitcoin legal tender and started accepting Bitcoin and Tether for all municipal payments.

Singapore, a global leader in cryptocurrency ownership per capita, has 24.4% of its population involved in crypto. Supported by a robust regulatory framework and favorable tax policies, Singapore is an attractive destination for crypto enthusiasts and investors. The country also ranks highly in blockchain jobs, with 2,433 positions available as of June 2024.

El Salvador, Türkiye, and Lithuania have emerged as new players in the top 10 of the Web3 Index. Lithuania boasts a high concentration of registered Virtual Asset Service Providers (VASPs) and a structured legal system overseen by the Financial Crime Investigation Service (FCIS). Türkiye is driven by high adoption rates, a tech-savvy population, and progressive regulations. El Salvador continues to innovate with Bitcoin as legal tender, ranking first in Google searches for Bitcoin.

The US has experienced a decline in its ranking due to regulatory challenges. The SEC’s regulation by enforcement approach has created uncertainty, resulting in numerous lawsuits against various projects and exchanges. Despite a vast crypto ecosystem and significant profits, the sector remains a minor part of the American economy.

One of the major factors which is not leading to this increase in adoption is misuse of money. You can read more about it here

Germany has also faced economic struggles and significant job losses in the crypto sector. The broader economic stagnation in Europe, coupled with political instability and regulatory challenges, has impacted the growth of the crypto job market.

The implementation of the MiCA regulation in Europe and the launch of Bitcoin and Ethereum ETFs in the US represent significant milestones. These regulatory advancements are expected to provide a more secure and robust environment for crypto financial services, fostering greater investor confidence and market stability.

As the global landscape of crypto adoption continues to evolve, the acceptance of cryptocurrencies by these 15 essential brands could mark a significant turning point in the financial ecosystem. By embracing digital currencies, these companies would not only enhance convenience and security for consumers but also drive broader acceptance and integration of crypto into everyday transactions.

With 2024 being a pivotal year marked by regulatory advancements and increased adoption, the path forward is set for a world where fiat money may become increasingly obsolete. This shift promises to unlock new opportunities, promote financial inclusion, and pave the way for a more decentralized and innovative economic future.

All the opinions in this article are that of the author and in no way are financial advice. Our Crypto Talk and the author always suggest you do your own research in crypto and to never take anything as financial advice that you read on the internet. Check our Terms and conditions for more info.